Tech VP, repairer: AI may jeopardize auto body shops’ storage revenue stream

By onBusiness Practices | Education | Insurance | Market Trends | Technology

If your auto body shop’s business model relies heavily on income from total loss storage, you might wish to reconsider, a collision industry expert and a telematics provider recently suggested.

Technology allowing insurers to classify and redirect totals up front could cut off what Collision Advice CEO Mike Anderson described as a revenue stream for collision repairers.

“As we see artificial intelligence enter into our industry, you’re gonna see less total losses end up in your shop,” he told an Oct. 29, 2020, Collision Advice-CRASH Network webinar.

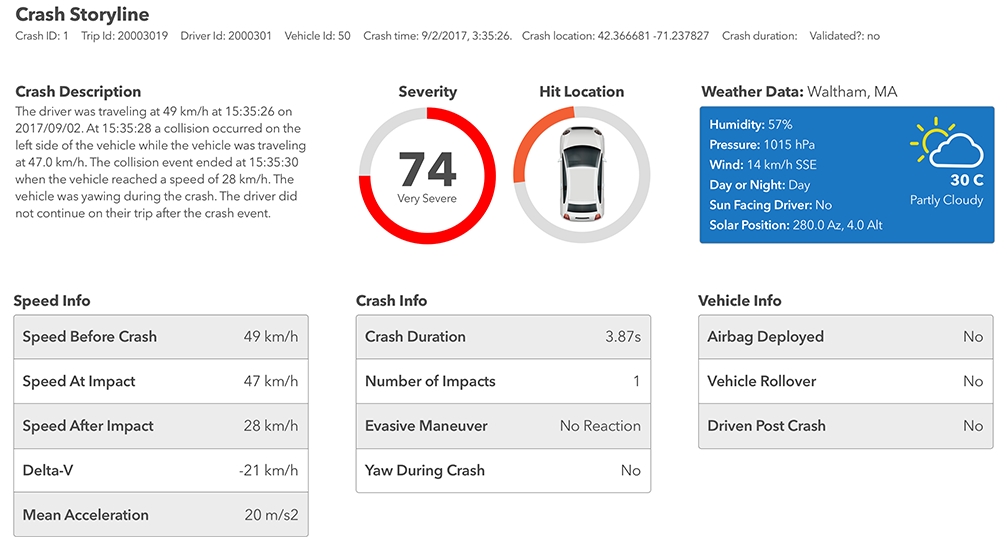

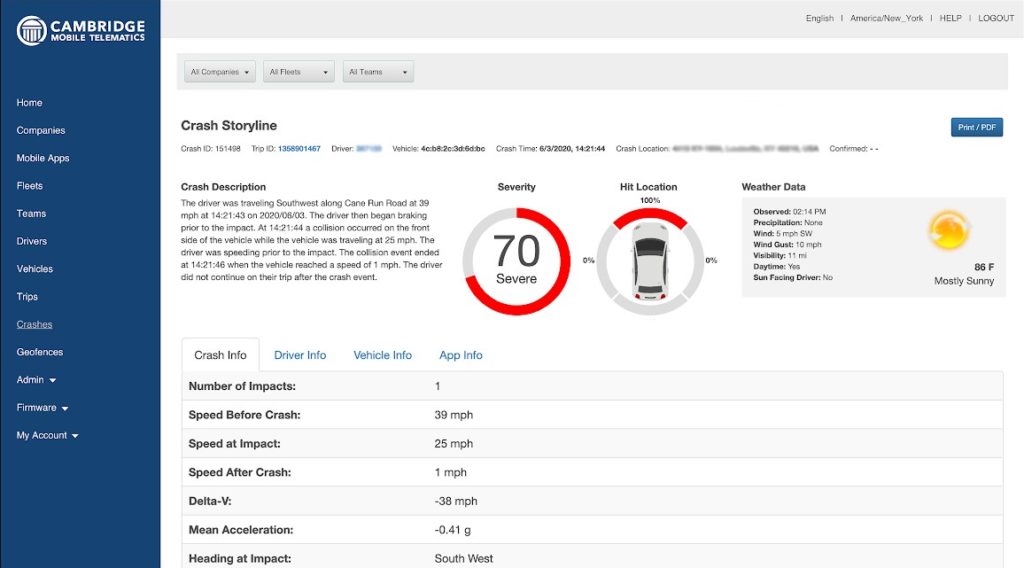

It’s possible for artificial intelligence to recognize a total loss now by analyzing photos or drawing upon on telematics data (for example, the “delta-V” change in velocity) generated by the crash circumstances themselves. Cambridge Mobile Telematics insurance Vice President Ryan McMahon, whose company operates in the latter space, told us Dec. 8, 2020, these two methods could be combined as well.

Anderson told the webinar that many non-direct repair program facilities draw a significant portion of their profitability from total loss storage fees. He recalled talking to one facility who made $200,000 in storage charges in a year. “That’s pure profit,” he said.

At a DRP facility, totals are a “hindrance,” Anderson said. They halt production, you “don’t get paid that much” for teardown, and the DRP contract probably requires storage fees to be waived, he said.

But at a non-DRP auto body shop, “you probably love total losses,” he said.

For an insurer, “it’s gonna save me money” to use AI and catch totals immediately, according to Anderson. Sending total losses to body shops first increases the expense of the loss by generating tow, teardown and storage charges. It also erodes the opportunity to recoup the loss if a vehicle is disassembled and therefore commands a lower price at salvage, he said.

If a body shop relies on total loss storage for gross profit, “you better start thinking about how you’re gonna replace that,” Anderson said.

McMahon agreed, noting in our interview Dec. 8, 2020, that if one’s business was based upon storage, “you may want to reconsider.”

CCC has said that 20.2 percent of all noncomprehensive appraisals between Oct. 1, 2019, and Sept. 30, 2020, involved nondriveable vehicles, and 21.2 percent wound up being totals.

COVID-19 has probably skewed these proportions upward by reducing congestion and letting us all drive faster and crash harder. However, CCC data for the same time in 2019 still saw 19.6 percent of vehicles flagged nondriveable and 19.6 percent of vehicles deemed totals.

We asked McMahon if Cambridge Mobile Telematics was at the point where it could assess the odds of a vehicle being nondriveable or a total based upon telematics data.

“It is,” he said.

Cambridge Mobile Telematics can collect driving data using a policyholder’s smartphone sensors alone or with an “App+Tag” setup that also affixes a sensory device to the vehicle as well. (McMahon said about half his company’s clients were smartphone-only and the other half App+Tag.)

CMT can predict delta-V, point of impact and degree of severity. McMahon said his company can also determine a rollover based upon the physics of a crash, and it can even use an iPhone barometer’s air pressure measurements to ascertain if airbags have blown.

“We can tell non-driveable immediately,” McMahon said, describing basing such a conclusion on the fact the vehicle hadn’t left a certain point or hadn’t moved in 10 minutes. If the vehicle didn’t proceed on its trip, it was “certainly part of the story” told by the data, he said.

However, McMahon said insurers were generally needed to convert a CMT severity score into a prediction of a total, for the carrier is the one with the make, model and year information necessary to assess if the vehicle was worth fixing.

“We don’t actually have the data ourselves,” he said. Sometimes it does, but mostly those details are with the insurer, he said.

For newer cars, such a determination is “a bit more tricky,” but CMT’s physics data combined with the insurer’s specific vehicle information allows carriers to build out toolsets to predict totals.

And while CMT has the technology to predict total losses based upon telematics, there’s still a matter of “tuning it” to individual insurers, according to McMahon. Each one has its own threshold of repairability. There’s not a universal standard, he said.

McMahon didn’t see photo AI total loss prediction as a threat to telematics AI total loss prediction. Instead, he described the market as offering a “great opportunity to combine the two.” Telematics data combined with photos “makes it even smarter.”

“It’s just information,” McMahon said of both methods. A former property damage adjuster himself, McMahon described collecting multiple forms of information and evaluating them against the policy as the job of insurance.

Images:

Artificial intelligence total loss assessment could jeopardize the storage revenue stream for auto body shops. (GoneWithTheWindStock/iStock)

An illustration of Cambridge Mobile Telematics’ Claims Studio crash reconstruction. (Provided by CMT via Business Wire)

An illustration of Cambridge Mobile Telematics’ Claims Studio crash reconstruction. (Provided by CMT)