CMT announces ‘Claims Studio’ to help insurers reconstruct crashes from smartphones

By onAnnouncements | Insurance | Market Trends | Technology

Cambridge Mobile Telematics earlier this month announced its Claims Studio product could both detect a collision and reconstruct what happened before and during the impact using a smartphone.

“A claims adjuster needs information to do their job,” CMT insurance and government affairs Vice President Ryan McMahon said in a statement Jan. 9. “When information is incomplete or inaccurate, the process takes longer and costs increase. Claims Studio enables insurers to settle claims earlier and more accurately, offering better customer experience.”

The company had sold a product permitting crash detection since 2015. Packaging that capability with a solution to reconstruct claims details might tip “on the fence” insurers into adoption. It also might be a logical addition to smartphone usage-based insurance products basing premiums on how well a policyholder drives or coaching customers to drive better.

“Many auto insurers are already using mobile telematics to assess risk and promote safer driving behaviors, but the benefits of mobile telematics in auto insurance don’t start and end there,” CMT Chief Technology Officer Hari Balakrishnan said in a statement. “Claims Studio offers a proactive approach to how insurers handle claims and provide additional peace of mind to their customers that they have protection in the event of a crash.”

Auto body shops should care about CMT’s new product for two reasons.

First, any insurer with the ability to detect a collision with Claims Studio’s “Crash Detector” probably has a better shot of recommending a direct repair program facility immediately after the crash.

“Providing critical details like GPS location, time, and driver identification, Crash Detector enables insurers to save valuable time in emergency situations and improve customer experience with added services,” CMT wrote of Crash Detector. (Emphasis ours.)

Second, the ability to obtain such precise crash data from a customer via CMT’s “Claims Reporter” might help shops determine the necessity of certain repairs or inspections and explain them to the customer or adjuster.

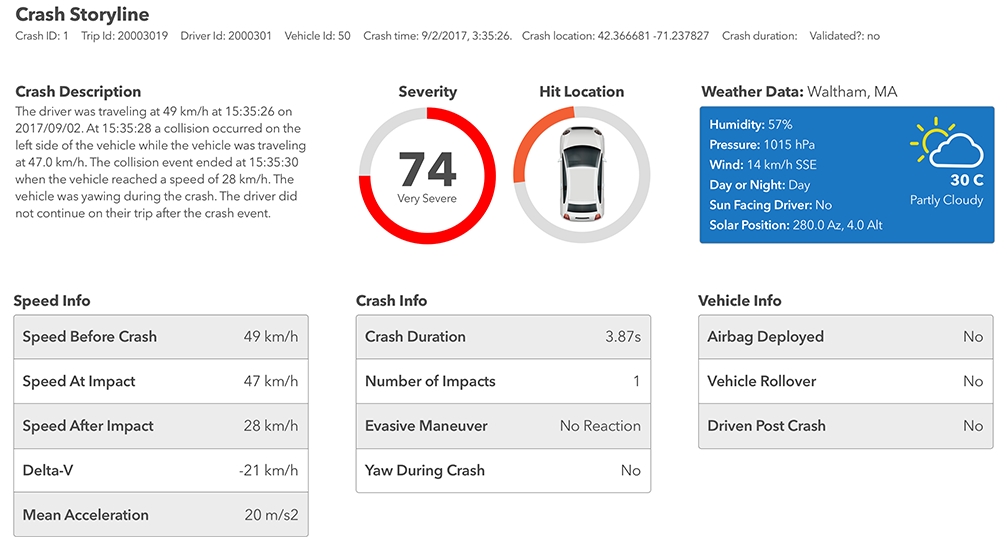

Look at CMT’s example provided with its news release. The vehicle had been traveling 29.2 mph at the crash and experienced a change in velocity (delta-V) of nearly 13.05 mph after an impact predicted to have occurred somewhere on the front driver’s side of the vehicle. Even though the airbag didn’t fire, CMT predicted the impact was “Very Severe” (The company says it has a “proprietary severity indicator.”). CMT even can determine if the vehicle yawed (moved along the horizontal plane).

You can use these sorts of details to research how energy was likely to have flowed through the vehicle from that point of impact, confirm that the crash was significant enough to merit potentially controversial items like supplemental restraint system inspections, and realize that the yawing might suggest a need to check the suspension for damage. Such data might be useful in situations where the insurer or customer insists a vehicle “doesn’t look that bad,” though hopefully the insurer and customer have already reviewed the same CMT output and already agree with the shop.

“Claims Studio uses telematics and artificial intelligence to reproduce the true story of a crash, creating a data-driven narrative to accelerate the claims process,” CMT wrote in a news release. “By accessing key details like speed, severity, and vehicle impact location early in the process, insurers can spend less time collecting information from drivers and third parties, and more time confirming facts and accurately assessing loss.”

Any insurers using Duck Creek’s insurance software would have access to Claims Studio, according to CMT. Duck Creek calls itself “a leading provider of core system solutions” for property and casualty carriers, and it’s planning an initial public offering.

“The Duck Creek Platform is the technical foundation of best-in-class policy, billing, rating, claims, data insights, digital engagement, and other solutions for the P&C space,” CMT wrote in November 2019. “CMT uses mobile sensing, IoT, artificial intelligence, and behavioral science to build solutions for top personal and commercial insurers, ride-sharing companies, and mobility providers worldwide. This partnership allows Duck Creek’s customers to rapidly deploy mobile telematics-based business strategies into their business.”

More information:

“Auto Insurers Can Now Use Smartphones to Reconstruct Crashes”

Cambridge Mobile Telematics via Business Wire, Jan. 9, 2020

Cambridge Mobile Telematics Claims Studio webpage

Images:

Cambridge Mobile Telematics in January 2020 announced its Claims Studio product could both detect a collision and reconstruct what happened before and during the impact using a smartphone. (m-gucci/iStock)

An illustration of Cambridge Mobile Telematics’ Claims Studio crash reconstruction. (Provided by CMT via Business Wire)