Romans guest column: Macro collision industry trends to watch in 2021

By onBusiness Practices | Market Trends

Editor’s note: This is the first part in a two-part series. See Part 2 on Thursday.

By Vincent Romans

I am confident that there is unanimous agreement that our futures are overshadowed by some degree of uncertainty, yet I also believe with unlimited opportunity.

The global pandemic year of 2020 can be seen as a year with significant disruption and structural change for the U.S. and the world with far-reaching economic, social, political, and medical implications.

According to the Chinese Zodiac, 2020 was the year of the Rat. Coincidently, on a global scale it was also the year of the COVID-19 pandemic. Feb. 12, 2021, began the year of the Ox. The Ox last appeared in 2009, the year that started the recovery after the 2007-08 recession. This time around, could this new year of the Ox also be the beginning of the start of a U.S. and global recovery from this persistent pandemic?

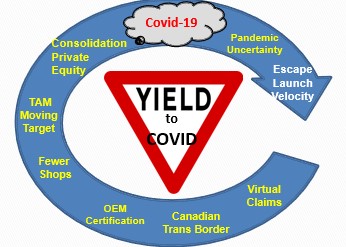

As we are all reminded more frequently than we would like, we don’t operate our personal lives or businesses in a vacuum. Much that happens outside and independent of the collision repair industry impacts not only the industry, but the entire auto physical damage ecosystem. As we move through 2021, there are a number of macro constructs/events that are out of our control. Individually, they can and do have an influence on our personal and business futures. In combination, the impact can quickly create obstacles or ignite unforeseen opportunities to our planned and intended direction that can be difficult to manage and navigate.

Our near and longer-term visibility is affected by continued uncertainty caused by the potential impact of some or all of the following macro constructs:

- COVID-19 pandemic continuum.

- Medical crisis.

- Second wave of cases, third wave surfacing; risk of fourth wave due to citizen complacency.

- Business lockdowns exacting both economic and human toll.

- Early-stage FDA approvals of safe, effective vaccines.

- Initial logistical distribution challenges.

- Improved distribution and inoculation acceleration across age and medical conditions is critical for economic recovery.

- Uneven/uncertain economic rebound and healing.

- Social unrest in the U.S.

- Tensions between the U.S., China, Russia, North Korea, and Iran.

- Presidential election results and congressional changes.

- Pandemic’s new virus strain’s uncertainty.

- $1.9 trillion economic recovery stimulus bill passed.

Moving from these broader, universal, macro events to specifically collision repair industry constructs, we see:

- COVID-19 has caused some repairers to exit the business, sell to a consolidator or accept private equity capital to expand.

- Collision repair designation as an essential business has been favorable for the collision repair industry and has helped with a faster recovery for many repairers, but not all.

- Private equity’s continued involvement, disruption and consolidation influence.

- Insurtech’s onslaught of the property and casualty insurance industry, especially through virtual appraising and estimating, digitization, and artificial intelligence (AI).

- OEM certification programs continue to make progress. This nascent and newest existing and potential business partner for many with scale continues to morph into an influential segment.

- Canada continues to competitively proact with two trans-border surprises as CSN enters the U.S. by merging with 1Collision early in 2020 and Mondofix’s announcement that it has entered the U.S. through its ProColor brand.

While we have these universal and collision repair industry constructs/events impacting and clouding our future visibility, we also have a number of dynamic, simultaneous, prevailing conditions that impact collision repairers on a more intimate basis. The key insight here is that this confluence and convergence of prevailing conditions and trends create a compelling economic and strategic case for the need to adapt, adopt and change to the new evolving environment.

Some of the more influential prevailing conditions in 2021 as we come to the end of the first quarter include:

- 1st quarter 2021 revenue down to flat from Q1 2020.

- Decrease in miles driven, accidents and claims processed.

- Increased vehicle repair complexity.

- Increased competitive segmentation and differentiation strategies.

- Shrinking collision repair industry target addressable market (TAM) in 2020.

- Increased acceptance and adoption of OEM certification and aggressive parts programs

- Expanded use of machine learning, computer vision, and AI for estimating.

- Accelerated digital transformation: virtual claims photo and video processing, and digital financial payments.

Another way to visualize these macro constructs is on a COVID-19 continuum, where despite our best efforts and intentions, we expect to continue to yield to COVID-19 in some unforeseen ways in the foreseeable future.

The foundation for change, opportunity and uncertainty in 2021 is firmly in place today. We believe that the stronger emerging and legacy leading businesses:

- Are well capitalized,

- Have a strong balance sheet,

- Can quickly manage expenses,

- Will maintain and nourish strong customer relationships,

- And will create differentiated product and service options.

Furthermore, scale continues to matter as a way to leverage an organization’s competitive advantage in the new frontier. We see that leaders in the auto physical damage, auto insurance and OEM dealer segments continue to grow their scale and market share. Forming, norming, and leveraging strategic and other partnership alliances will help accelerate scale and market share growth.

The following are some U.S. 2019 fast facts from our recently published 2019 paper on the “Evolving North American Collision Repair Industry.”

- Target addressable market for collision repair market size based on revenue was $38.3 billion.

- Our initial estimate for the collision repair industry TAM for 2020 is $34 billion, down 11.3 percent from 2019.

- Total U.S. addressable collision repair locations 31,800.

- Average revenue per location $1,204,402.

- Revenue for multiple-location operations/banners/franchise networks with greater than $10 million in revenue was $16.1 billion, representing 42 percent of 2019 TAM.

- Top 10 auto insurers’ market share was 73 percent.

- Top 10 Canadian insurers’ market share was 77 percent.

- Top 10 OEMs’ market share was 90.2 percent.

Changing industry structures will continue to be impacted by the malingering COVID-19, government interference and intervention, and private equity’s consolidation influence. Consumer and business behavior will continue to morph as social distancing as the new norm supports a more contact-free economy. For collision repair, this involves significant changes in scheduling appointments, virtual estimating/online photo estimates, contact-free curbside estimating, and home pick-up and delivery where provided. Measuring performance and maintaining strong customer metrics will continue to be paramount.

Having a current and post-COVID-19 transition plan is mandatory. Success today depends on how quickly an organization reacts to the dynamic operating environment as well as the universal and industry constructs mentioned earlier. A successful current and post-COVID-19 transition/migration will be led by resilient companies and resilient leaders striving to achieve their optimal business launch velocity.

As you begin to determine your launch velocity and speed of action, your plan for the pace and place to be in 2021 and beyond should be planned with a clear vision, a delicate balance of recovery and growth, carefully managed expenses and margins, and, of critical importance, continual flexibility and creativity in creating optionality and meeting the ever-changing collision repair industry environment.

Vincent Romans is the founding partner of the Romans Group.

More information:

“A 2019 Profile of the Evolving U.S. and Canada Collision Repair Marketplace”

Romans Group, Nov. 29, 2020

Images:

Romans Group founding partner Vincent Romans appears at the 2020 virtual MSO Symposium. (Screenshot from virtual MSO Symposium)

Romans Group founding partner Vincent Romans produced this graphic of trends affecting the collision repair industry. (Provided by the Romans Group)