“It’s a long journey, but the journey has started and the initial results are promising,” Jain said, according to the article.

Berkshire chairman notes Progressive ahead of GEICO with telematics; GEICO sees Q1 underwriting loss

By onInsurance | Market Trends

Berkshire Hathaway Vice Chairman of Insurance Operations Ajit Jain said during the company’s annual shareholders meeting on April 30 that Progressive is far ahead of GEICO in using telematics.

“There’s no question that recently Progressive has done a much better job than GEICO …both in terms of margins and in terms of growth,” Jain said, according to an Investopedia article. “There are a number of causes for that, but I think the biggest culprit is as far as GEICO is concerned …is telematics.”

Forbes reports that Jain “expects to catch up with Progressive in a year or two.” And the Insurance Journal quoted Jain as saying, “Progressive has been on the telematics bandwagon for, I don’t know, more than 10 years, 20 years. GEICO until recently wasn’t involved in telematics. It’s been only the last two years that we made a very serious effort in terms of using telematics for segmentation and trying to match rate and risk.”

The same question was asked at last year’s meeting, according to Yahoo Finance, to which Jain said Progressive is “very good” at what it does.

“However, Jain also explained that GEICO had made some significant changes recently that have helped the business catch up with its close peer,” Yahoo Finance reported. “One of these was catching on to the potential of telematics. As Jain explained: ‘GEICO had clearly missed the business, and were late in terms of appreciating the value of telematics. They have woken up to the fact that telematics plays a big role in matching rate to risk. They have a number of initiatives, and, hopefully, they will see the light of day before, not too long, and that’ll allow them to catch up with their competitors, in terms of the issue of matching rate to risk.'”

In its report on this year’s shareholder meeting, the Fremont Tribune reports Jain “expressed confidence that results will improve.”

“If they had not done it, lives would be a whole lot worse,” Buffet said, according to the article.

Buffett also, as he has at past meetings, acknowledged State Farm’s “continued dominance,” according to the Insurance Journal.

“In terms of presence, of size, they still are the largest company,” Buffett said, according to the article. “If you leave out Berkshire, they have the largest net worth by far. They’ve got $140 billion or something like that in net worth. We spend $2 billion a year telling people the same thing we’ve been telling them for 70 or 80 years. …State Farm is still doing more business than anybody, and it shouldn’t exist under capitalism. If you [had] a plan to start a State Farm today and had to compete with Progressive, who would put up the capital [for] a mutual company that you’re not going get the profits from? It doesn’t make any sense at all.”

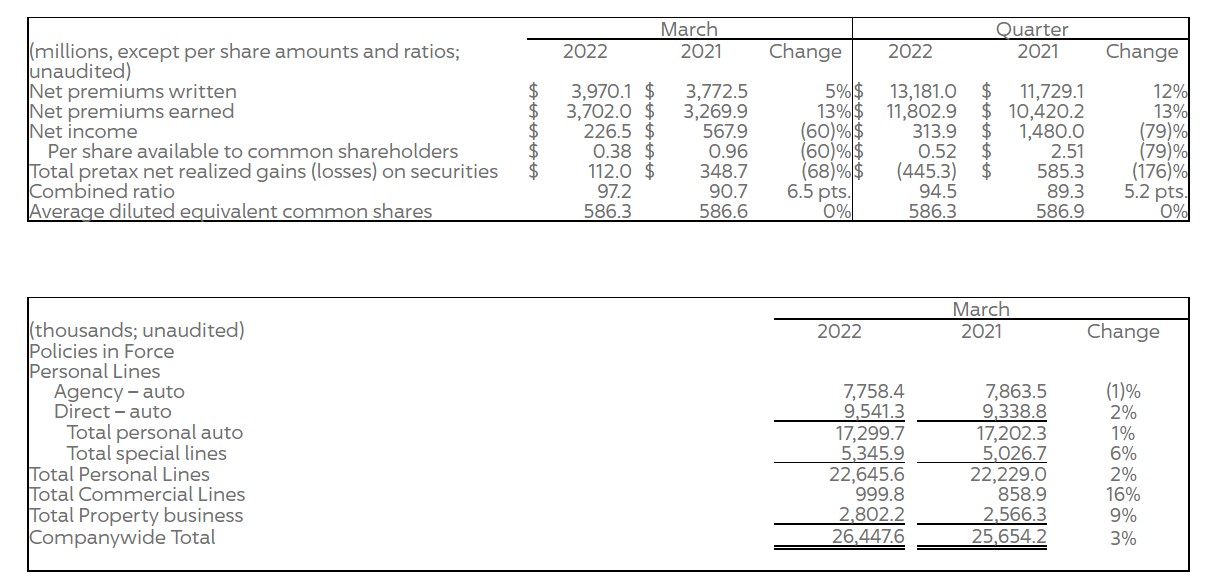

Progressive “outdistanced” GEICO on growth and profitability measures in the first quarter with Progressive reporting a 12% increase in written premiums and a combined ratio of 94.5, up 5.2 points from first-quarter 2021, GEICO’s combined ratio decreased by more than 13 points with premiums growing less than 3%, according to the Insurance Journal.

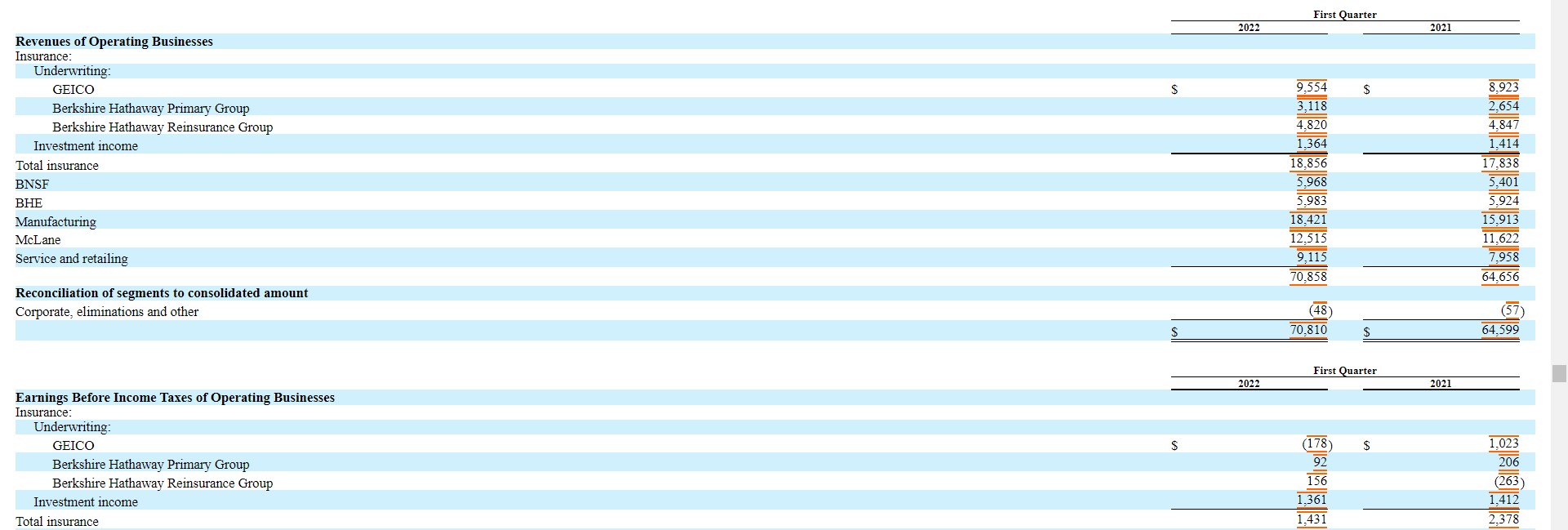

GEICO revenue in Q1 was $9.554 billion, up from $8.923 billion in 2021 Q1, according to Berkshire’s 10-Q. Berkshire’s auto service and retailing segment brought in $2.527 billion, up from $2.312 in 2021 Q1.

“The COVID-19 pandemic continues to affect most of our operating businesses,” Berkshire stated in its 10-Q. “Significant government and private sector actions have been taken since 2020 and likely will continue to be taken to control the spread and mitigate the economic effects of the virus. Actions in the latter part of 2021 and early 2022 included periodic temporary business closures or restrictions of business activities in various parts of the world in response to the emergence of variants of the virus. Notwithstanding these efforts, significant disruptions of supply chains and higher costs have persisted.

“Further, the development of geopolitical conflicts in 2022 have contributed to the disruptions of supply chains, resulting in cost increases for goods and services in many parts of the world. We cannot reliably predict future economic effects of these events on our businesses or when our operations will normalize. Nor can we reliably predict how these events will alter the future consumption patterns of consumers and businesses we serve.”

As for insurance specifically, GEICO saw a pre-tax underwriting earnings loss of $178 million in the first quarter.

“Insurance underwriting produced after-tax earnings of $47 million in the first quarter of 2022 versus $764 million in 2021,” the 10-Q states. “Underwriting earnings in the first quarter of 2022 were negatively impacted by ongoing increases in claims severities at GEICO. Underwriting earnings in 2021 reflected the effects of the premium reductions from the GEICO Giveback program and the favorable impact of lower claims frequencies for private passenger automobile coverages, which were partially offset by higher claims severities. After-tax earnings from insurance investment income decreased 3.1% in the first quarter of 2022 compared to 2021, attributable to lower dividend income.”

IMAGES

Featured article credit: jetcityimage/iStock

Progressive March 2022 and Q1 earnings graphic (Provided by Progressive)

GEICO Revenues of Operating Businesses and Earnings Before Income Taxes of Operating Businesses (From Berkshire Hathaway’s 10-Q filed on the U.S. Securities and Exchanges Commission website)