Not all aftermarket scan tools give OEM results in all situations, Repairify study finds

By Dave LaChance onAnnouncements | Technology

A field study by Repairify has shown that not all aftermarket scan tools perform like OEM tools on every year, make, model, and trim (YMMT) vehicle, and there’s no way for a technician to know which do and which don’t, Chris Chesney, the company’s vice president of training and organizational development, told an audience at an OEM Collision Repair Technology Summit session on Thursday.

During the summit, part of the Repairer Driven Education agenda offered by the Society of Collision Repair Specialists (SCRS) during the SEMA show, Chesney revealed some of the findings of Repairify’s research into aftermarket tools.

Repairify’s teams gathered information by conducting a field study of more than 70,000 model year 2014-2022 vehicles located in a dozen Copart yards. The study connected multiple aftermarket tools to thousands of different YMMT vehicles and compiled a comparative analysis of the scan results, Diagnostic Trouble Codes (DTCs), and the ability to clear DTCs in the same manner as the factory tool.

Chesney did not provide full details of the results, saying that Repairify invested millions of dollars in creating the database to help identify for its customers when an aftermarket tool might be an appropriate choice. But he did present five use cases that identified some troubling failures by aftermarket tools.

“At the end of the day, aren’t [the tools] all the same? Well, no, they aren’t. And so what’s the difference? Well, the difference is completeness and accuracy. And it’s not just saying that, well, this brand C tool is really good on Asian vehicles, but not so good on Euro and domestic. You can’t be that broad. And we didn’t look at it that way.”

He emphasized that the OEM tool is “the gold standard — always is, always will be, that will never change. That is the foundation.” But he suggested that an aftermarket tool that functions like an OEM tool for a specific YMMT vehicle might present an acceptable, and less costly, option for a body shop.

“With respect to accuracy, are they returning exactly what the OEM factory tool returns in the way of all the modules that are communicated with and all the DTCs that are returned in exactly the same way the DTCs were served up by the factory tool? … [S]urely some of them work on certain vehicles? And the answer is yes, but it’s not every year make model trim, it’s not every module, it’s not every DTC, it’s not every pin.”

Chesney provided details of five specific use cases:

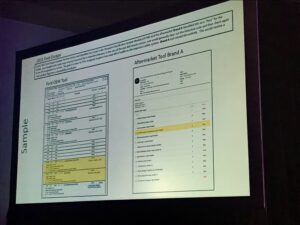

- On a 2021 Ford Escape, the OEM tool identified two DTCs in the occupant classification system module (OCSM), while the aftermarket tool gave it a pass. “That’s a safety system. We’re not going to call that a validation — it wasn’t even close…. In the context of this scan on this vehicle year make model trim, that aftermarket Tool A should not be used on that vehicle.”

- On a 2017 Toyota Camry, the OEM tool identified two DTCs for the ABS module, while the aftermarket tool showed none. “The aftermarket tool missed that. It missed it totally. So can we call that a validation? No. We’re going to never say that you can use that tool to scan the vehicle, a 2017 Camry with that VIN, we’re going to always serve up and recommend that you use the factory tool.”

- On a 2017 Kia Rio, the OEM tool identified three total DTCs with two active DTCs associated with the airbag module, requiring replacement of the module, “whereas the aftermarket tool came back and said, okay, no problem. That’s certainly not a pass. Because we’re dealing with safety systems we’ve got to be exact.”

- On a 2016 Honda Civic, the OEM tool identified two DTCs in the ABS system, while the aftermarket tool, in this case Repairify’s own asTech tool, only identified one DTC.

- Finally, on a 2021 Jeep Gladiator, the OEM and the aftermarket tool returned the very same results. “So in that case, we’d serve up an opportunity to the shopper.”

Chesney said his assumption that aftermarket tools might be made more accurate over time by their manufacturers turned out to be false. “I will tell you that the aftermarket scan tool manufacturers, when they release a tool to you, have other things to do besides updating their software every year to make sure it covers more vehicles,” he said. “They will listen to their hotline and they will react and when they react they’ll fix the problem and they’ll wait for the phone to ring again.

“They don’t have enough people. Consider they’re trying to consolidate 26 manufacturers into one box. They’re making concessions to begin with. But some of the content, some of the software that they’re providing works well. So the idea of this is to try to find where those cases are and expose those to you so you can make a decision.”

Customers will be able to set their criteria for tool selection through Repairify’s patented rules engine, Chesney said. Those aftermarket tools that did not perform like an OEM tool for a particular YMMT will be flagged as “not verified,” but can still be chosen by customers at their own risk.

Joining Chesney on the stage to talk about scan tool selection were representatives of three OEMs: Dan Dent, Manager, Collision, Certified Repair Network at Nissan Motor Corporation; Devin Wilcox, Program Manager and Strategist, Collision Network at Subaru of America; and Jake Rodenroth, North American Body Repair Program Operations Manager at Lucid Motors.

Rodenroth explained that Lucid is not typical, since its vehicles do not have OBD-II ports, relying on an Ethernet cable to connect the vehicle. But he said the OEM is committed to protecting its vehicles from hackers anytime they’re connected to the internet.

“So we have to have that layer of security for the diagnostic tool, but it’s also our umbilical cord to our car,” he said. “As we make changes to the car, and we make changes to the scan tool, we can push those in real time, and as we turn on other controllers in the car, then diagnostic tools set up those routines to service those components.”

Chesney raised the issue of payment, and those shops that have reported difficulty in getting insurers to pay for scans. “Is the data that we have presented at the beginning of this, where we talked about our testing of thousands of vehicles and the 100,000 diagnostic sessions and a data set that identifies the opportunity where on this VIN, with this tool, that it will return the same result as the factory tool, if that system is used and the documentation is applied, do you think that helps support the collision center in the way of getting paid?”

Both Wilcox and Dent said their primary concern is that repairs are being done properly, and that they can help repairers substantiate why they should be paid for following OEM recommendations.

“One thing I note in all the seminars I’m part of, I’m not here to argue nickels and dimes,” Wilcox said. “I’m here to make sure that the work that needs to be done to our vehicles is being done. I can help explain the why, I can help qualify the why… I’m here to support the shops, regardless of if you’re on our network or not.”

He cited a recent discussion he had, justifying Subaru’s requirement for a “lengthy, invasive” visual inspection to be done after one of its vehicles is in a collision. The inspection is necessary because it may turn up problems, such as a frayed wire or an incorrectly installed airbag component, that a pre- or post-scan will not find.

“So back to the question of nickels and dimes, that’s not really my place to be. But when a question is asked, I can help with the substantiating information to get that payment,” he said.

Dent said it’s up to shop owners and operators to decide what’s best for them. “We can only tell you what’s best for our brand and our owners and where our opinion is. So you have to decide what kind of business model you want to go after.

“We’re gonna throw a blanket over the top of it and say it has to be our scan tool,” he said. “It’s the gold standard… We don’t test 30 alternative brands out there, we don’t know what they do or how bad it’s gonna mess it up or if they’re gonna mess it up at all. But we’re not going to take that risk.

“We’re invested in you, as shop owners, shop operators, just as much as we want you guys to do the right thing,” he said.

Rodenroth said it’s important that shops understand the whys behind the OEM procedures. For instance, he said, refilling a Lucid’s cooling system requires seven gallons of coolant, unlike most gas-engine vehicles, which typically require about two gallons.

An insurer is likely to balk at paying for so much coolant because they don’t understand how a Lucid differs from other vehicles. “What they don’t realize is that we have a water-cooled control unit in the car that is the autonomous driving unit. And if you starve that unit of coolant to keep it cool, it will actually burn the most expensive computer in the car.

“As repairers, we have to continue that product knowledge, and the three of us can give it to you all day. But the reality is, you’ve got to want it.”

Images

Featured image: Reports on a 2021 Ford Escape made by using an OEM scan tool, left, and an unidentified aftermarket tool. The OEM identified two DTCs in the occupant classification system module (OCSM), while the aftermarket tool gave it a pass. (Dave LaChance/Repairer Driven News)

Panel members, from left, Chris Chesney, Vice President of Training and Organizational Development for Repairify; Devin Wilcox, Program Manager and Strategist, Collision Network at Subaru of America; Jake Rodenroth, North American Body Repair Program Operations Manager at Lucid Motors; and Dan Dent, Manager, Collision, Certified Repair Network at Nissan Motor Corporation. (Dave LaChance/Repairer Driven News)