Driven Brands stock plummets, 2 firms allege violation of federal securities laws

By onMarket Trends

At least two investigations have been launched against Driven Brands over alleged violation of federal securities laws while its stock reached an all-time low of $16.05 when shares plummeted 37.55%.

Wolf Popper and Holzer & Holzer announced their investigations shortly after Driven Brands’ Aug. 2 Q2 2023 earnings call during which CEO Jonathan Fitzpatrick said Auto Glass Now (AGN) acquisitions have caused the company to fall behind monetarily by several quarters.

Fitzpatrick assured concerned investors that a dip in sales and delays in Auto Glass Now (AGN) acquisitions are a “temporary slowdown.” Driven Brands is currently working on converting 12 AGN locations.

Fitzpatrick also told investors the integration of numerous acquisitions simultaneously was a known risk “to become the clear No. 2 in the industry.”

“As a result, we are currently a few quarters behind where we anticipated,” he said. “This is also contributing to our updated fiscal guidance for 2023. The benefit of our strategy was we paid attractive multiples and significantly reduced the opportunity for other potential consolidators to enter this space. This was a calculated decision that we believe was the right strategy.

“Approximately 25% of our stores have completed the Auto Glass Now rebranding process, aligning them with our one national brand strategy. In 2023, we have opened 39 greenfield stores at an average capital investment of $150,000 and sales are in line with our underwriting.”

Both Holzer & Holzer and Wolf Popper noted Fitzpatrick’s comments that the company had fallen behind due to slowing car wash consumer demand and acquisition delays in the glass segment.

Holzer & Holzer encourages anyone that has Driven stock and has experienced a loss to reach out to them.

Wolf Popper wrote, “Before the market opened on August 2, 2023, Driven announced weak second quarter 2023 results and issued weaker than expected third quarter 2023 guidance and lowered full year 2023 guidance. During the earnings call, management blamed increased competition in the car wash business over the prior two years. In addition, management said it is now ‘a few quarters behind’ integrating the two auto glass acquisitions. On this news, Driven’s stock price collapsed $10.63 per share to $15.20, a drop of 41.2% on very heavy volume.”

The firm wants to represent investors who have lost more than $25,000 trading in Driven’s common stock.

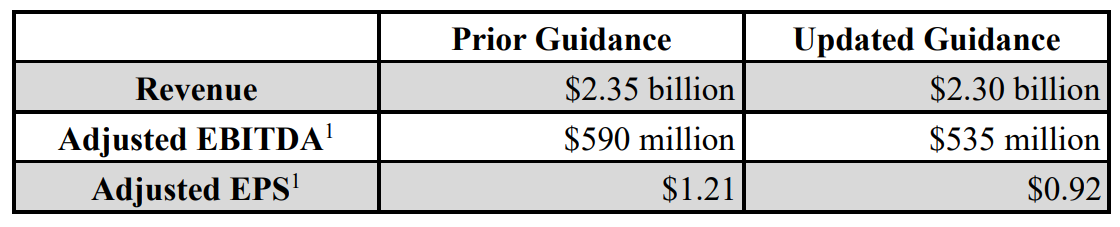

Based on “weaker than anticipated performance” in its car wash and U.S. glass business, Driven Brands updated its FY 2023 guidance to:

Underperforming locations are being evaluated, according to Fitzpatrick.

In the glass segment, he said the company’s mobile units had reached 780 and that demand from commercial, insurance, and retail customers remain strong.

“We are now averaging more than 10,000 inbound calls a week,” Fitzpatrick said. “Our calibration rates continue to grow, which is a long-term tailwind.”

When asked at what point Driven realized it was behind on its timeline, Fitzpatrick said the realization became obvious around two months ago when Gary Ferrera, executive vice president and CFO, began working at Driven “with a fresh sets of eyes to look at the business.”

Driven’s average capital investment on glass locations is $150,000, which isn’t spent unless the company believes it can generate cash-on-cash returns of 30-40%.

The slowdown has been caused by transitioning AGN shops to the Driven Brands culture as well as its processes and systems, he said.

Ferrera said part of the underperformance in the glass segment during Q2 was caused by investments in that side of the business, including personnel costs while the car wash and needs-based services, like oil changes, have been impacted by less consumer demand, nominal inflation, and supply chain delays.

Images

Featured image courtesy of Auto Glass Now

Driven Brands CEO Jonathan Fitzpatrick is shown. (Provided by Driven Brands)

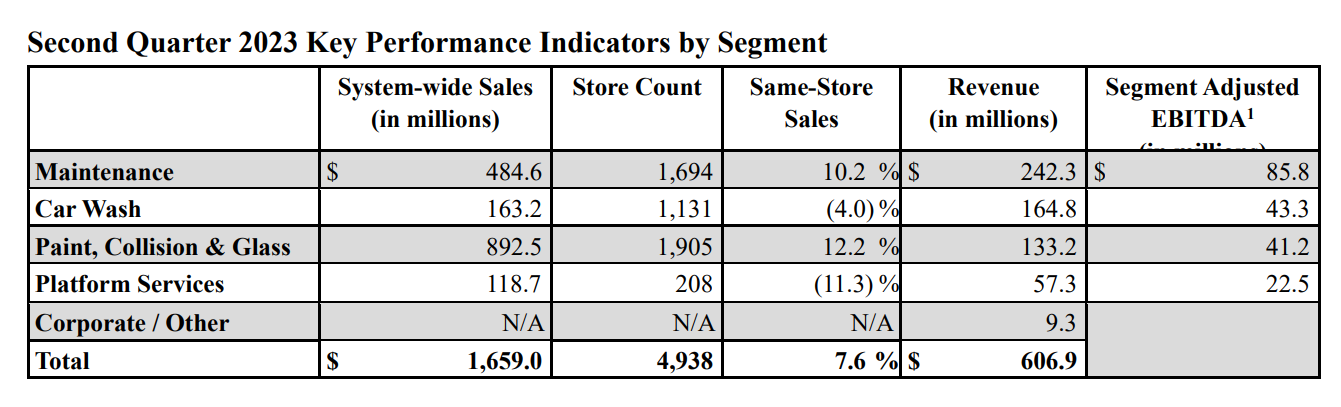

Charts provided by Driven Brands