Employee tenure nearly doubles when easy, affordable health plan offered

By onInsurance

A recent whitepaper from Decisely, a benefits, human resources, and compliance management services company, focuses on the importance of health benefits in employee retention noting that the investment also builds employee morale and workplace culture.

“Investing in benefits can help cultivate a loyal and committed workforce which, in turn, can contribute to the long-term success and growth of the organization,” Decisely wrote. “However, attractive health benefits packages are increasingly unaffordable for small businesses, limiting their capacity to compete for talent.”

Decisely has also found that insurers are hesitant to provide coverage for small businesses because of the risk they take with a small population of policyholders.

The average tenure of employees at a job that offers easy-to-use and affordable benefits is 29 months compared to 15 months at companies that don’t, according to Decisely’s research.

Keeping an employee tends to be cheaper than replacing them while the latter costs triple, sometimes up to four times, the amount of an employee’s annual salary, according to Decisely, which says there are also “soft costs” associated with turnover. Soft costs include a negative impact on employee morale, productivity, and culture if tasks of the departing employee are placed on others until the new employee is fully onboarded and a loss of institutional knowledge. The lack of knowledge and experience compared to what the former employee held could affect long-term efficiency and effectiveness as well as cause potential errors and delays.

During this year’s SEMA Show, Society of Collision Repair Specialists (SCRS) Board members and repair center owners shared their thoughts on the impact of providing benefits, from health insurance to retirement plans, mental health care support, and team-building activities, for their employees.

“Aside from just the cost savings, the plan itself has been a really good plan for us and has worked for us,” said Kris Burton, owner of Rosslyn Auto Body. “We also do a 401(k)… We had health insurance for many years and then we stopped it because we fell below our carrier’s quota for active participants.”

Richie Seaberry, with Decisely, added that many independent repair facilities often face the same issue of not meeting carriers’ threshold of participants.

“When you’re building a culture and a team, you want to do what’s right for your team and you want to give them stuff that they should have,” Burton said, adding that it’s helped with employee retention at his facility.

Andrew Batenhorst, Pacific BMW body shop manager, said it’s important to know what’s going on with your team.

“We all get bogged down with customer issues, dealing with vendors and problems with billpayers or whatever that might be that takes up time during your day but you have to remember they’re [employees] the ones driving the customer experience at the end of all this and without that, you’re going to get real lost,” he said.

Seaberry said a survey conducted by Decisely found that 33% of respondents said their benefits package was equal in importance to salary, if not more important.

Other surveys have echoed that opinion. According to a Glassdoor survey, nearly 80% of employees prefer additional benefits over a pay raise and cited health benefits as one of their most sought-after perks.

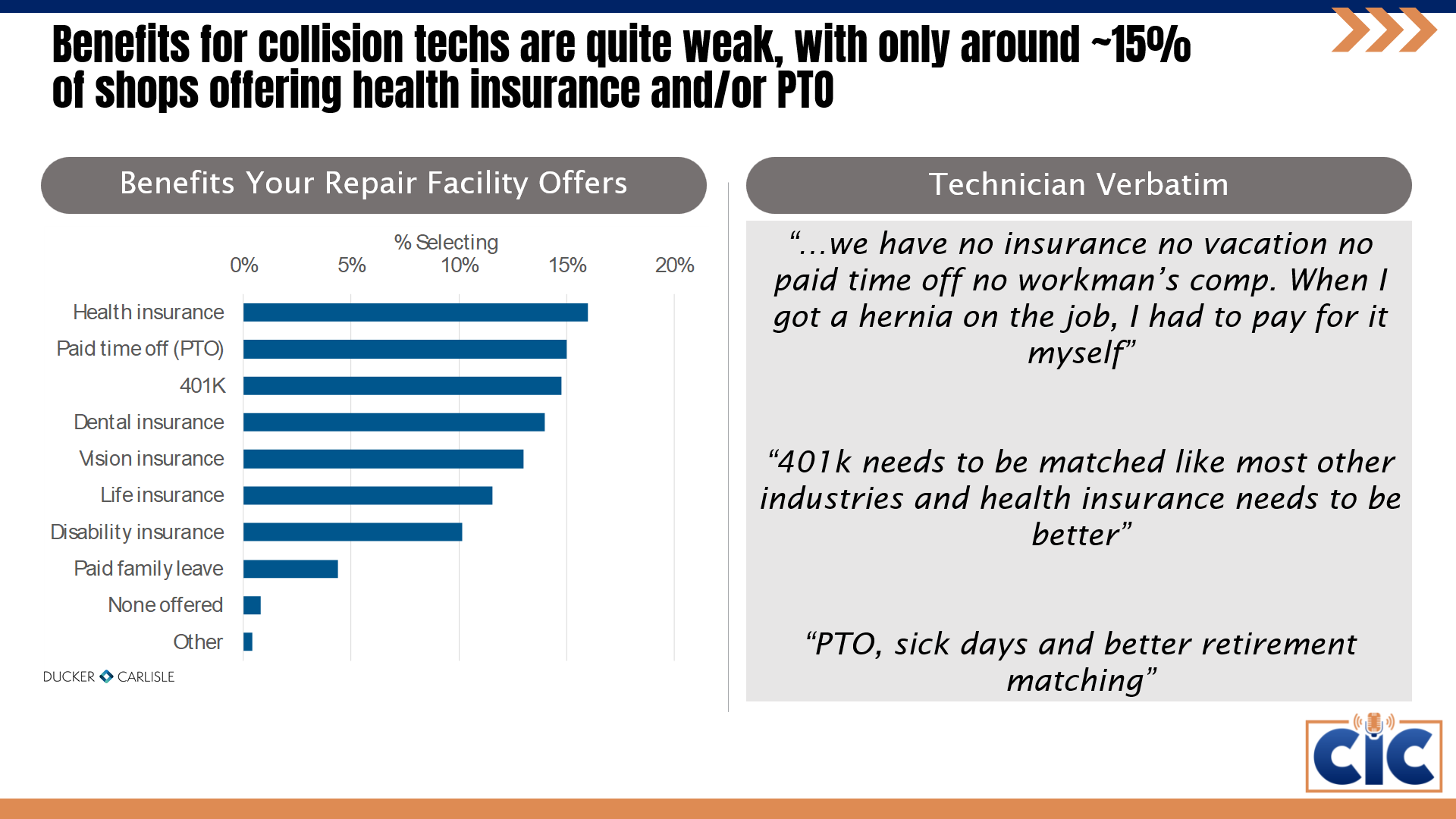

However, a survey of collision repair technicians conducted by SCRS and I-CAR earlier this year found that benefits aren’t often offered by repair centers, or aren’t satisfactory to employees:

Respondents to the survey valued benefits far below pay, convenience, getting along with co-workers, workplace culture and management, and work/life balance:

Decisely has found that small businesses face rising benefits costs and employees often can’t pay soaring deductibles and copays.

Other issues include, according to Decisely:

-

- “Limited benefit reach: 90% of benefit expenditures reach less than 10% of covered employees;

- “Perceived low value: Complex coverage and high-deductible plans often leave employees feeling like they have no benefits at all, resulting in reduced satisfaction with the healthcare system;

- “Escalating medical debt: Nearly half of U.S. adults lack the funds to cover a $500 healthcare bill, putting their living situation at risk;

- “Insurers and payors: Insurers find it challenging to gather sufficient data from smaller groups, making it hard to accurately assess risk profiles. This can lead to less favorable terms and higher premiums.”

Decisely’s solution, along with its insurer partners, to the issues it found leverages data from association or franchise organizations of small businesses to portray a more comprehensive view of risk factors within businesses.

“The amalgamation of data facilitates a deeper understanding of industry trends, risk behaviors, and potential cost drivers,” Decisely wrote in its white paper. “This, in turn, results in greater carrier confidence in their pricing strategies. As a result, small businesses and franchisees gain access to individual group level-funded plans grounded in accurate industry information.”

Decisely noted some of the automotive industry’s challenges — faced by the collision repair industry as well — including technician shortages, skill gaps, an aging workforce, favor of college over vocational education, and increased automation. All of which Decisely says has an impact on its long-term health.

“Businesses that prioritize the well-being of their employees not only attract top talent but also nurture a loyal and motivated workforce, leading to sustainable business success,” Decisely wrote. “Decisely is playing a crucial role in making this a reality for small business.”

For example, plans offered specifically to the collision repair industry through Decisely and the SCRS can save businesses up to 20% versus renewals. Plans are offered through Aetna and Cigna networks.

Participant employees also:

-

- Have $0 deductibles

- Choose their out-of-pocket maximums from $3,000-$7,900

- Have no hidden costs and surprise bills

- No-cost services including:

- Primary Care Physician (PCP) visits

- Specialist visits

- Urgent care visits

- Labs, imaging, and X-Rays

- Generic prescriptions

- Mental health care

- High-deductible health plan/health savings account option

- Rolling effective dates on the first of each month — enroll when it suits you

Amid rising inflation, annual family premiums for employer-sponsored health insurance climbed 7% on average during the first seven months of this year, reaching $23,968 — “a sharp departure from virtually no growth in premiums last year,” according to an employer health benefits survey conducted by nonprofit health policy research firm, KFF.

On average, workers said they contributed $6,575 annually toward the cost of family premiums, up nearly $500 from 2022, with employers paying the rest.

“Future increases may be on the horizon, as nearly a quarter (23%) of employers say they will increase workers’ contributions in the next two years,” KFF wrote. “Workers at firms with fewer than 200 workers on average contribute nearly $2,500 more toward family premiums than those at larger firms ($8,334 vs. $5,889). In fact, a quarter of covered workers at small firms pay at least $12,000 annually in premiums for family coverage.

“This year’s 7% increase in average premiums is similar to the year-over-year rise in workers’ wages, at 5.2%, and inflation, 5.8%. Over the past five years, premiums have risen 22% in line with wages and inflation at 27% and 21%, respectively.

“Among workers who face an annual deductible for single coverage, the average this year stands at $1,735, similar to last year,” KFF wrote. “The average deductible amount has increased 10% over the last five years and 53% over the last ten years. Workers at small firms (under 200 workers) on average face much larger deductibles than workers at larger firms ($2,434 vs. $1,478).”Fifty-eight percent of employers say that their workers have at least a moderate level of concern about the affordability of their plan’s cost-sharing requirements, according to KFF.

“Rising employer health care premiums have resumed their nasty ways, a reminder that while the nation has made great progress expanding coverage, people continue to struggle with medical bills, and overall — the nation has no strategy on health costs,” said KFF President and CEO Drew Altman.

Images

Featured image credit: Maudib/iStock