Pricing, battery range still among top EV concerns

By onMarket Trends

Survey results released by AAA earlier this month indicate more than half of respondents aren’t convinced electric vehicles (EVs) are worth purchasing when battery range and cost are considered while S&P Global Mobility found nearly half of global respondents to its similar survey consider EV prices to be too high.

AAA found that 1 in 4 U.S adults would be “very likely” or “likely” to buy an EV the next time they buy a vehicle. However, cost (59%), lack of charging stations (56%), cost to replace or repair the battery (55%), and range anxiety (53%) remain the primary barriers to purchasing an EV for those undecided or unlikely to buy an EV.

AAA conducted its survey in March with a probability-based panel of about 1,200 U.S. adults, designed to represent the overall U.S. household population.

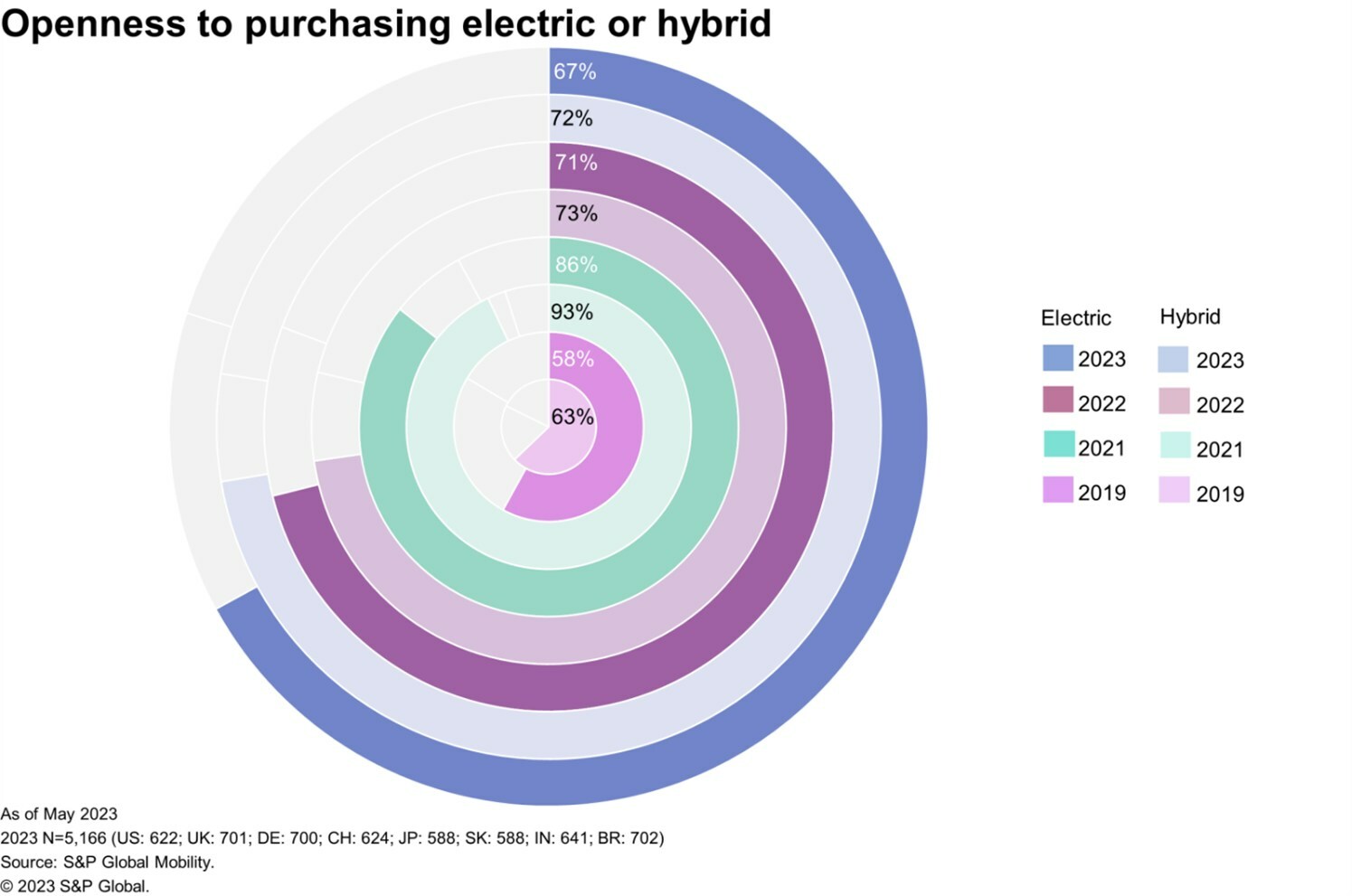

S&P’s findings echoed AAA’s. Its survey was answered by about 7,500 global respondents in May from the U.S., UK, Germany, Brazil, India, Thailand, Japan, and China:

“Pricing is still very much the biggest barrier to electric vehicles,” said Yanina Mills, S&P Global Mobility senior technical research analyst.

Consumer sentiment toward buying an EV has “cooled considerably” over the last two years, which Mills attributed to an immature market segment.

However, S&P says improved battery range and more model choices are lower on consumers’ list of reasons to avoid purchasing an EV.

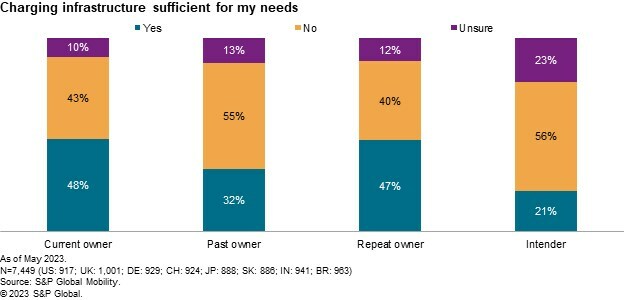

“Consumers know (charging) will not be the standard gas station in-and-out experience,” Mills said. “But they don’t want to delay for much more time than what would be a lunch break.”

Survey respondents said they’re willing to wait between 30 minutes and an hour to recharge.

Most S&P survey respondents said they would accept a minimum EV range below 300 miles. Nineteen percent said a range of 251-300 miles would be acceptable while 21% said they’d be fine with a range of 201-250 miles. Twenty-nine percent said they prefer a minimum range above 300 miles.

Forty-two percent of respondents said they’re considering an EV for their next vehicle purchase and 62% said they’re waiting until the technology improves before purchasing a new vehicle, the S&P Global Mobility survey found.

“There’s always that little bit of ‘What if…’ that continues to hold consumers back, even if for the most part they know they’re probably going to be OK with the capability of their new EV,” Mills said.

AAA also found:

-

- Seventy-six percent of those interested in purchasing an EV cite a desire to save on the cost of fuel as one of their reasons, followed by concern for the environment (60%);

- Millennials are more likely to consider buying a fully electric vehicle for their next vehicle (31%) than Generation X (21%) and Baby Boomers (18%); and

- Fifty-eight percent of respondents who said they’re interested in buying an EV said they’ll likely purchase new while 26% said they would purchase used and 16% said they’re unsure.

- Four in 10 respondents said they’re concerned about the impact cold weather has on an EV range, which can be reduced substantially.

More information

Nearly 50% of EV owners chose ICE vehicle for subsequent purchase, S&P Global Mobility study shows

Images

Featured image credit: Just_Super/iStock