Big will get bigger: MSO growth hot topic during SEMA

By onMarket Trends

The big will continue to get bigger. That’s the conclusion drawn from three presentations during SEMA Week on collision repair center consolidation.

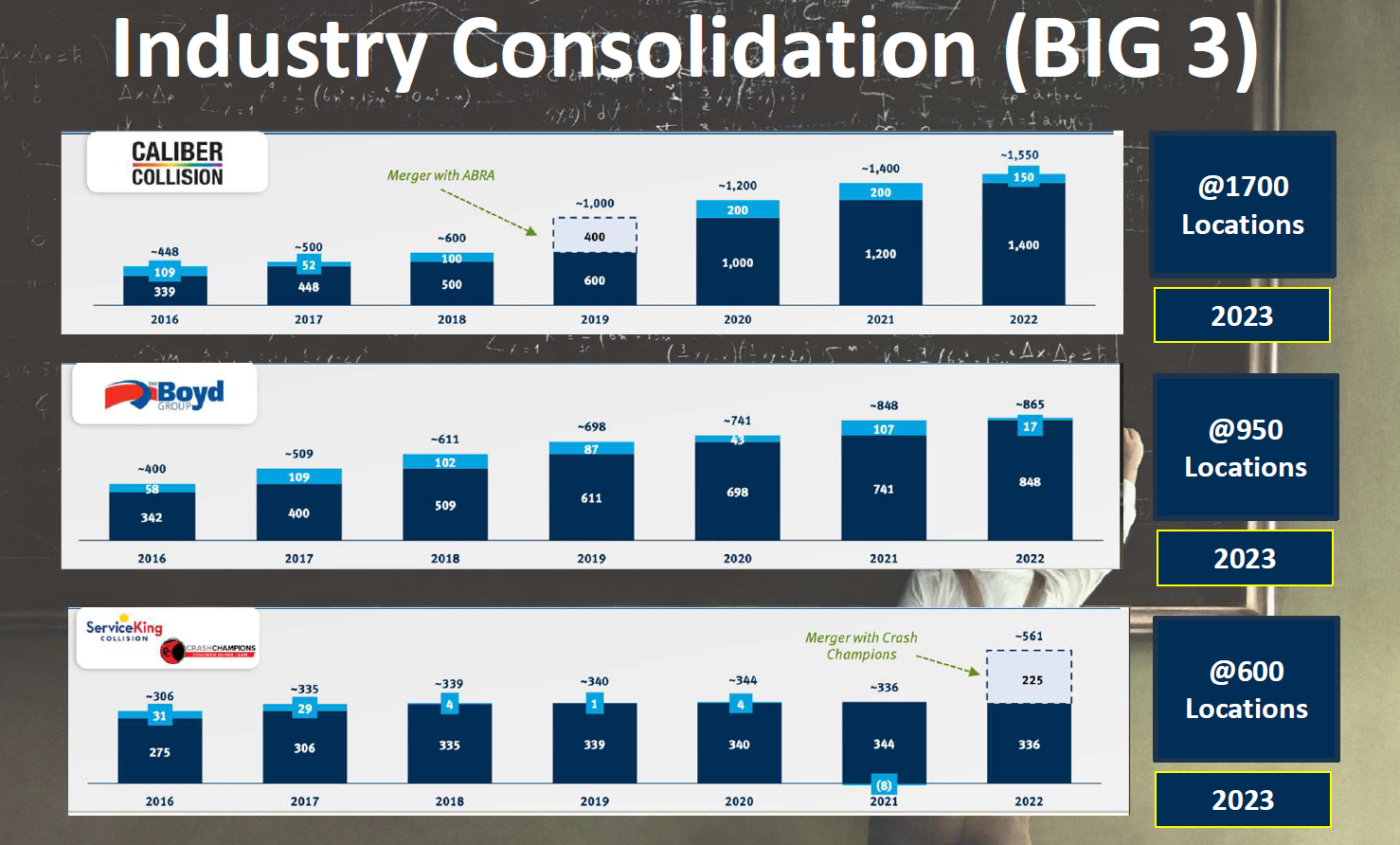

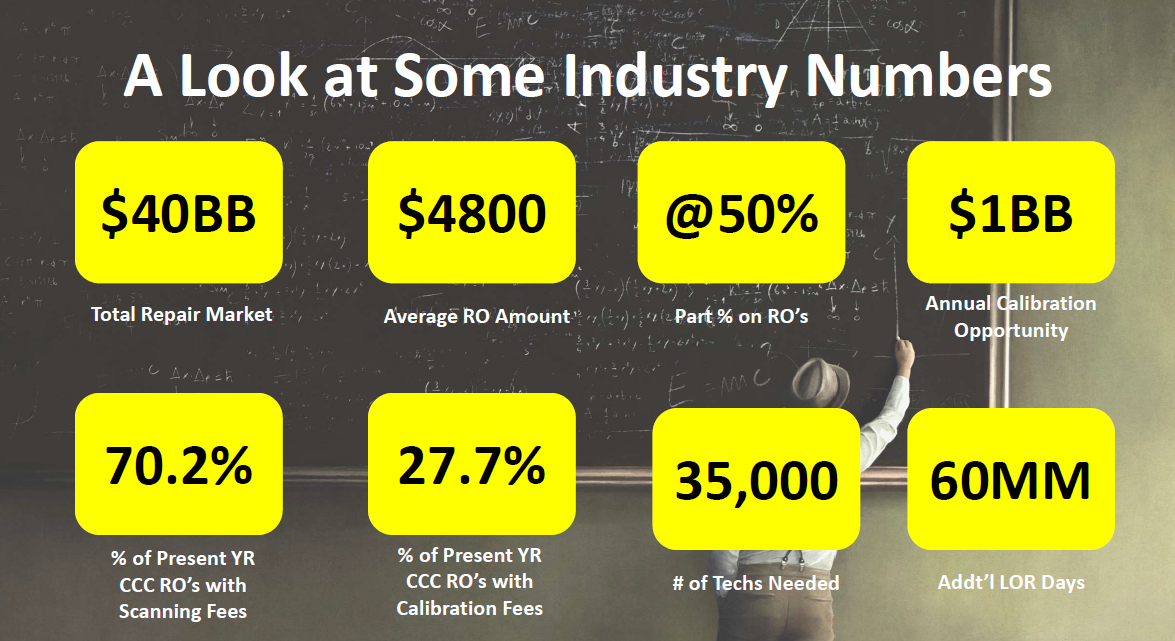

Opus IVS ADAS Solutions Vice President Frank Terlep shared his findings on the current state of consolidation during a Society of Collision Repair Specialists (SCRS) Repairer Driven Education (RDE) session.

In addition, there are also 17 private equity organizations and another 12-15 “waiting on the sidelines,” Terlep said. He also predicted that the bigger MSOs will continue to diversify their business operations and that a big tech company, such as Google, Apple, or Microsoft, will find its way into the collision industry — possibly through acquisition.

During this year’s MSO Symposium, held on Oct. 30, Focus Advisors Automotive CEO and Managing Director David Roberts shared that there are 803 MSOs and 14 consolidators including five big consolidator MSOs and nine fully launched MSOs with private equity sponsors. The 803 MSOs own 2,400 facilities and are making $7.5-7.6 billion in revenue, Roberts said.

Next are 40 independent shops that own seven or more repair facilities followed by 81 other independent MSOs that own four to six facilities. Aside from those, there are 679 MSOs that own two to three facilities leaving the rest of the industry encompassing 25,000 facilities.

Roberts noted as well that “the Four Horsemen of Consolidation” — ABRA Auto Body and Glass, Boyd Group, Caliber Collision, and Service King — have changed since the analogy was used in 2014 with only two of them left.

“The consolidators, they’ve got 32% market share,” Roberts said. “The independent MSOs, there’s 2,400 of them, they have about a 17% market share… Obviously, there are a lot more shops, they still have 50% market share… the consolidator growth over the last 10 years has been nothing short of phenomenal.”

Roberts shared that Caliber, for example, went from being very city-specific to the first widely distributed national chain. Roberts co-founded Caliber.

Gerber began with a regional focus and has branched out more while Crash Champions “went from almost nothing in Chicago” to absorbing Service King and buying several other facilities to become widely distributed across the U.S., Roberts said. Classic Collision was a privately held company in Atlanta, Georgia, and is now a private equity-sponsored company with facilities in specific geographic regions.

“What we’re looking at is this phenomenal growth fueled by the PE [private equity] folks for the ones that are going to get into the industry,” he said. “They start out looking at a platform-centric acquisition. The best example of that is Kinderhook a few years ago bought ProCare Automotive down in Texas… They expanded with some single shops and then they bought Austin Motor Mile Collision. Then, Classic Collision came knocking and they sold and they had an extraordinary return over a short period of time.”

Roberts was also one of a five-member panel hosted by the Collision Industry Conference (CIC) during its meeting on Oct. 31. The other panelists were John Walcher, Veritas Advisors president and chief M&A advisor; Cole Strandberg, Focus Investment Banking principal; Laura Gay, Collision Consultants of Florida owner/consultant, and Matt Di Francesco, HighLift Financial principal.

The panel mostly discussed things for collision repair facility owners to be mindful of if they’re thinking about selling.

“When you’re looking at selling, just be careful what you’re promising people because you can’t guarantee your employees what’s going to happen afterward and it’s not fair,” Roberts said. “We all want to do the best for the people that we represent and our clients want to do the best for their people. It’s the universal value of every seller.

“Will they take care of my people? If you’re honest with your client and your client is honest with his or her staff, the fact is there’s some things you can’t control and what you can do is send your employees to give it a shot. You can have retention bonuses. You can say, ‘Look, I know this may not be what you want but there will be more opportunities with a larger entity that owns you.'”

Di Francesco added, “I think even if you’re not right at this time even thinking about what that next transition is you need to be starting to put different systems and financial vehicles in place so that you’re in a better position when that time comes… starting to think about these things now, I think will put you in a much better position whether you’re doing an internal transfer or a third-party sale.”

Strandberg and Gay brought up the emotional side of selling as well.

“[I]f you have a team that has a strong culture and you care about their future, you’re going to want to make sure your values are shared with your next partner and your buyer,” Strandberg said. “The numbers are very, very important but so is that aspect… in my instance, my family sold their business. I grew up around the business [and] viewed it as my big brother so when you talk about it, in those terms, you realize the level of emotion that goes into that.”

Gay added that when she sold her facilities in Maryland in 2015 she “cried like a baby” for 10 days post-sale.

“I know there’s a lot of other buyers that go through that,” she said. “When I sold, I was 42 years old. I was not in a position where I thought I was even thinking about selling so it’s definitely something I wasn’t mentally prepared for. I didn’t have someone like me or one of the other folks on the stage here to help me through it. It was in the very early stage of consolidation. It’s an extremely emotional journey.”

Di Francesco called his tagline of “aligning families and businesses for generational wealth” his priority as a certified exit planner.

“The shop is typically their number one asset so we’ve got to get down to what their value-based goals are [and] what their universal goals are,” he said. “As we start to put together this plan, it’s really the starting point to all of it. I tell all these guys, ‘90% of my job is psychology, 10% of it is financial’ because the financial part is putting the puzzle together.”

Terlep, who was the panel moderator, asked the panelists for their thoughts on the concern in the industry that consolidation will turn collision repair businesses into chains, like hardware stores Home Depot and Lowe’s.

“I think the backbone of this country is the independent family-owned business and I think the collision industry is part of that,” Di Francesco said. “What I’m really passionate about is trying to help the independent shop owners to stay independent, to create a unique business within that market, and again, hope to align these families and their businesses for generational wealth.”

Walcher, Strandberg, and Gay likened the industry’s consolidation to fast food chains.

“I think there’ll be more choices but I think the harbinger, the thing to look for, as to just how much we will consolidate within this industry is consolidation within the referral sources,” Walcher said.

Strandberg added, “You have the national players, you have the regional players, and you have the local players who are typically really good at one thing and I think that’s an opportunity for smaller operations… there will be decisions to be made — whether to grow or sell — and I think that third bucket… is the specialization of local shops.

“I don’t think there has been a better time in history to be an owner in the collision repair industry. I think your options are incredible whether you want to sell now, whether you want to grow, whether you want to specialize — you only have great options.”

Gay agreed that right now is a great time to be an independent repairer.

“You do have so many options,” she said. “When I had my shops, it was easy to get my car fixed. Right now, if I want to get my car fixed, in my opinion, it’s hard. Where do you go? I think that’s a challenge… We need you independent repairers so you can fix our cars.”

Roberts added that he predicts a lot more referrals coming directly from dealers in the future because they don’t want to be in the body shop business.

“I think there are enormous possibilities for what are now single shops or small MSOs to closely align themselves with a particular brand or a particular dealer,” he said.

Roberts compared consolidation to the healthcare industry in that businesses become a smaller group of large national entities.

“I think they are going to be a lot of strong regionals and I think there are going to be more billion-dollar businesses out there,” he said.

During the Q&A portion of the panel discussion, Collision Advice President Mike Anderson said one thing he’s noticed the industry doesn’t talk about is helping independent facility owners buy.

“There are options for people to sell other than to a national MSO,” he said. “There are people in your town that maybe your employees might feel more comfortable working for.”

A lot of the dealerships are growing as well, he added.

“Over the last 30 months, about 276 of our clients have sold to a national chain,” Anderson said. “When I first heard about that, firsthand because of my clients, obviously it personally affected me… I kind of took it personally and then I kind of had to move past that emotional feeling and say, ‘You know what, it’s kind of like a high school football coach — when your senior class graduates and you have to find who the new freshmen are.'”

Images

Featured image credit: Pattanaphong Khuankaew/iStock

Slides courtesy of Frank Terlep and SCRS