CCC Trends: 2023 repair costs rise due to labor costs, UAW strike & theft

By onMarket Trends

The latest trends report from CCC Intelligent Solutions that looks back on 2023 found three trends have continued, and need to be improved upon in the new year, which “requires both shops and carriers to explore new ways of operating and delivering on customer expectations.”

Repair costs, the weekslong United Auto Workers (UAW) strike, and a rise in auto thefts took their toll on both industries over the past year, according to the report.

While the total cost of repairs saw “subtle fluctuations,” CCC says increases in new vehicle sales and a changing vehicle age mix could cause concern in the coming years, as early as 2024.

“As powertrain diversity and ADAS technology become more widespread across the car parc, complexity and the demand for specialization increase,” CCC Industry Analytics Director Kyle Krumlauf told Repairer Driven News. “This involves factors such as tooling, technical expertise, parts access, safety considerations, and shop configuration (notably for calibration operations). Shop owners, regardless of size, should be mindful of how the vehicle pool is evolving and the profound implications these changes have on their business.”

Citing research from S&P Global Mobility, Krumlauf wrote in the report that the average age for light vehicles still on the road was 12.5 years during a year with the lowest volume of new vehicle sales since the financial crisis felt nationwide from 2007-2011.

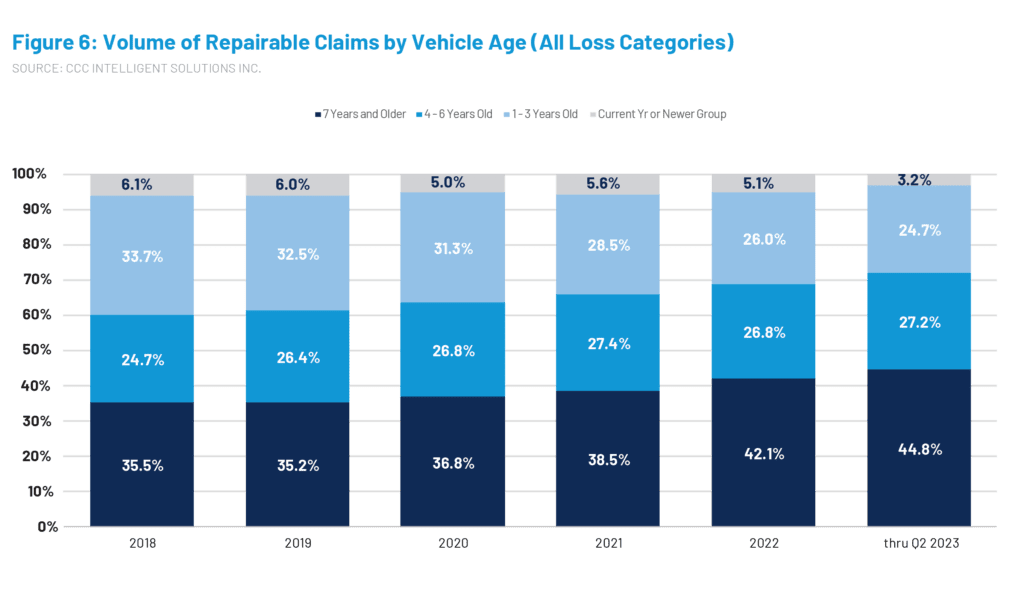

Since 2018, vehicles seven years or older have accounted for an increasing share of overall repairable claims from 35.5% in 2018 to 44.8% in 2023:

When asked about the continuing upward trend of crash frequency and damage severity paired with slowly decreasing inflationary pressures, Krumlauf responded that if trends continue, the average number of parts per appraisal will decrease slightly next year.

“Based on CCC’s estimate data, average total repair costs are up [around] 5% year-over-year with the key driver appearing to be labor,” he said. “While average labor hours per appraisal is flat year over year (27.3 per appraisal), the average blended labor rate based is +6.8%.

“It’s also important to note that the average number of parts per appraisal is currently +0.3 additional parts (13.5 parts per appraisal) and average parts prices are up +0.8% year-over-year… Despite the year-over-year increase, recent months indicate a potential reversal in this trend. In addition, the frequency of total losses (which is largely driven by vehicle values and loss severity) will continue to play a critical role [in] repairability metrics.”

Krumlauf told RDN that Q4 2022 and into Q1 2023 “appears to have been a very challenging time in terms of loss severity and cycle times” based on the repair cost difference between vehicles seven years or older and six years or newer, which was $1,774. That’s nearly the same average cost difference through the first two quarters of Q2 2023 ($3,516 compared to $5,211).

“In other words, the aging vehicle pool is temporarily containing the average TCOR [total cost of repairs] from ballooning even further,” Krumlauf. “Had the vehicle age mix remained consistent with 2018, the average TCOR would currently stand at $4,657 (an additional +4.6% greater than current).”

According to CCC’s current non-comprehensive loss repair cost data, changes this year compared to 2019 include, on average:

-

- An additional 3.4 hours of labor per appraisal;

- An additional 18.6% on the blend labor rate; and

- About three additional parts per appraisal with the price per part up 14.9%.

“2023 parts prices can be attributed to the recovery in the supply chain and improvements in inflationary conditions,” Krumlauf said. “Looking ahead, we’ll be closely monitoring parts suppliers and potential disruptions in the global supply chain, as these factors are likely to play a crucial role in any short-term changes in parts prices.

“Throughout the year, we have seen continued upward movement in shop labor rates. Current trends would imply that labor rates will continue to rise as we enter 2024 especially if market demand/capacity remains strong.”

Another factor that played a part in the increased total repair cost this year, though slight, was the UAW strike with the effects likely not over.

“Based on historical experience, the strikes could result in increased cycle times over the next few months and potential non-OEM part price increases,” Krumlauf wrote in the report.

“Beyond the short-term impacts, the recent strikes highlighted the importance of suppliers. Suppliers account for 900,000 jobs in the automotive industry (six times the number of UAW workers at Ford, GM, and Stellantis combined) and represent 2.5% of GDP [gross domestic product]. At the onset of the strike, concerns about the impact to suppliers and long-term effects on the supply chain were voiced… Suppliers accounted for almost a third of the economic losses from the strike; current estimates put the impact of strikes on suppliers of $3.3 billion.”

He noted as well that there is a need for a more resilient supply chain.

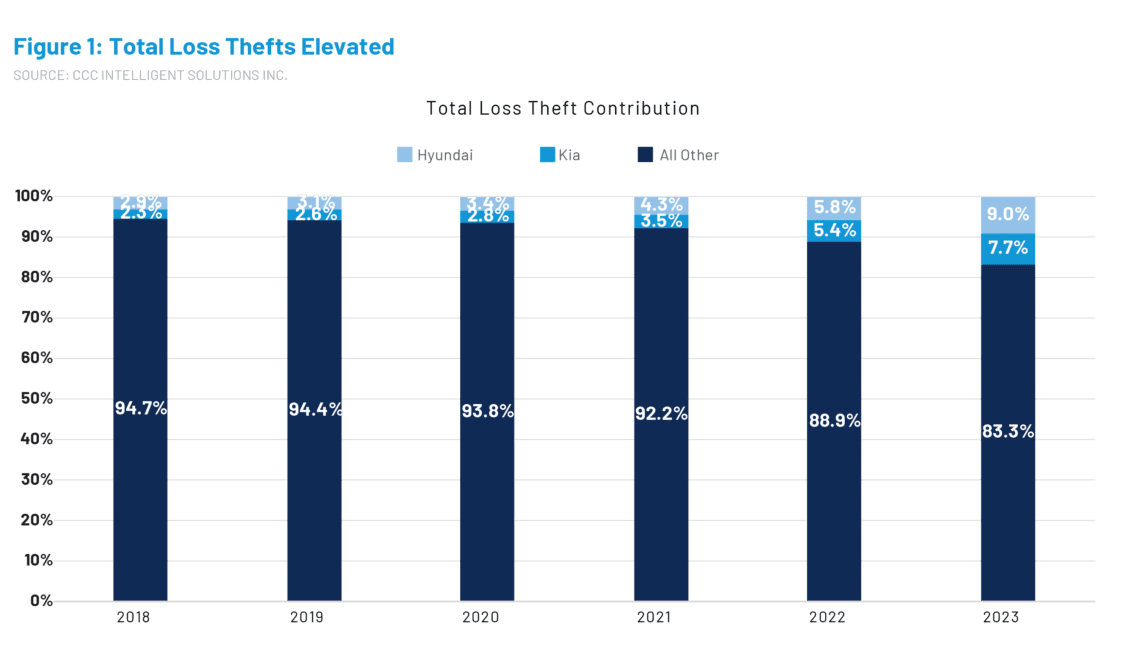

According to CCC data, total losses as a result of theft have exceeded 3% of all total losses since Q4 2021, peaking at over 4% in Q4 2022. Hyundai and Kia have faced scrutiny over a growing number of their vehicles being stolen but CCC found theft has been widespread regardless of vehicle type and origin.

CCC’s data shows that through Q3 2023, domestic pickup trucks have most often been totaled due to theft compared to other vehicle types at more than 6% for each of the past eight quarters.

Images

Featured image: A stock photo of a damage appraisal on a crashed vehicle. (Credit: varniccha kajai/iStock)

All graphs provided by CCC Intelligent Solutions