Q3 2023: More EVs on the market & sales up, charging infrastructure still lacking

By onMarket Trends

A report from the Alliance for Automotive Innovation (Auto Innovators) on Q3 2023 state-by-state U.S. electric vehicle (EV) sales found that more EV models are on the market and sales are up compared to Q3 2022.

In addition to summarizing sales, the “Get Connected Electric Vehicle Report” highlights EV purchasing trends across all 50 states. More than 378,000 EVs were sold nationwide during Q3, which was a 63% increase over Q3 2022.

As of Q3, there are 111 EV cars, utility vehicles, pickup trucks, and vans on the market now. Light truck sales represented 74% of the EV market during Q3.

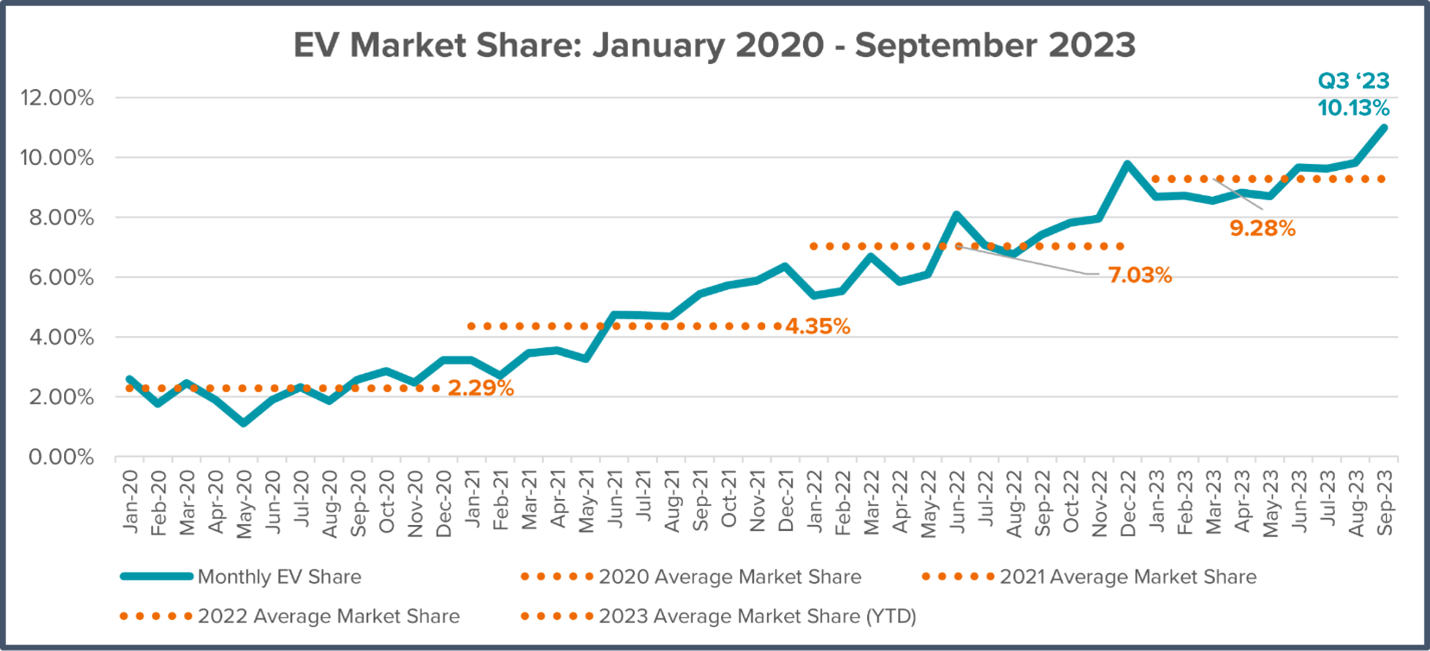

EVs represented 10.1% of new light-duty vehicle sales, up from 9.1% in Q2 2023 and 7.1% in Q3 2022.

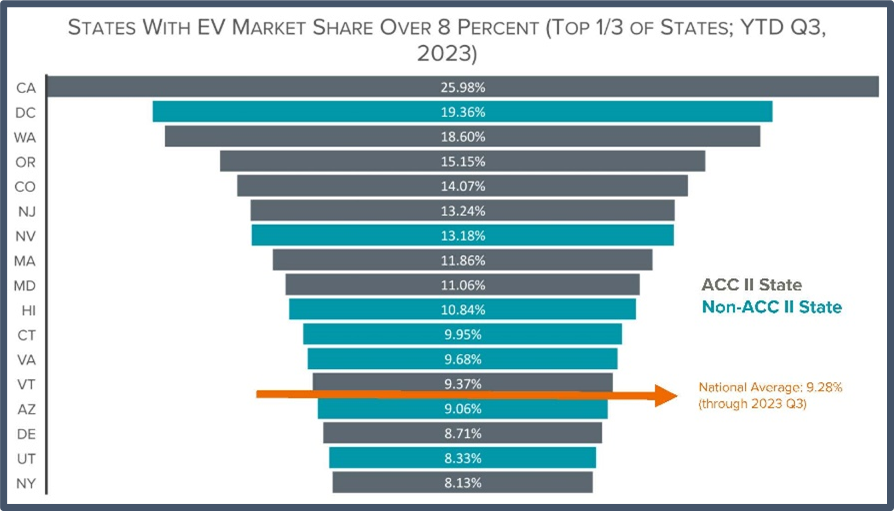

The top five states in EV sales for the quarter were: California (28.1%); Washington (21.7%); the District of Columbia (19.3%); Colorado (17.9%), and Oregon (16.3%).

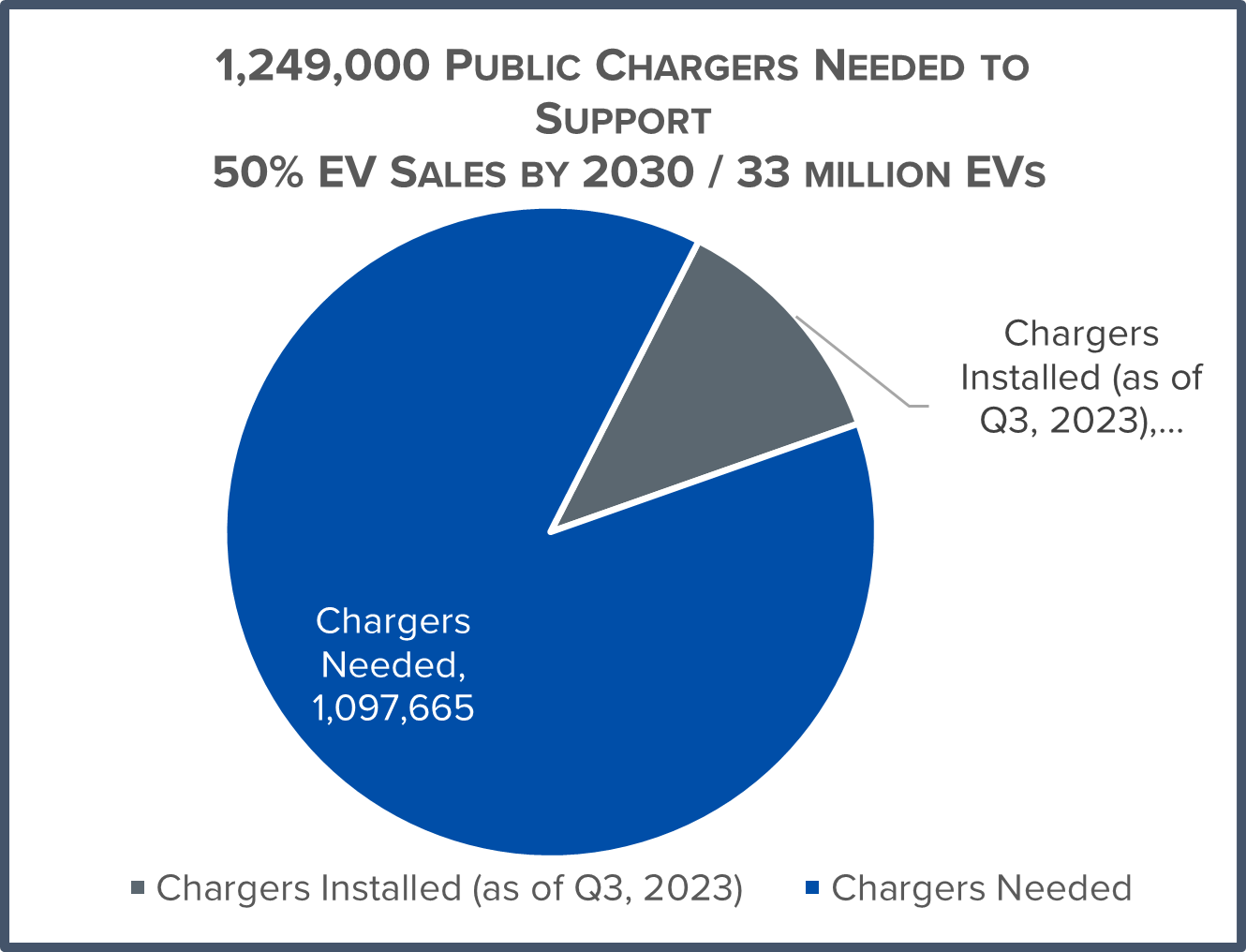

While EV sales are increasing, public EV charging infrastructure is still lacking, with the installation of public chargers not keeping up with current and projected sales, according to Auto Innovators.

During the first three quarters of 2023, the number of public EV chargers increased by 26% year-over-year while EV sales increased by 59%.

Nationwide, 378,097 EVs were registered in Q3 2023 but only 7,800 new public chargers were added, meaning there are 48 EVs for every new public port, Auto Innovators wrote.

There are 4 million EVs on the road and 151,303 public charging outlets, which is 26 EVs for every public port, according to the report.

Auto Innovators notes in its report that a 2023 assessment by the U.S. National Renewable Energy Laboratory (NREL) determined that 28 million charging ports would be necessary to support 50% EV sales by 2030, or 33 million EVs on the road. That adds up to an investment of $53 billion to $127 billion, mostly from consumers and commercial real estate owners who install home and workplace charging stations, according to NREL.

Four percent of the needed charging ports, or more than 1.2 million, would need to be public Level 2 or high-speed DC Fast ports. Level 2 would need to make up 85% of available public chargers.

“At the end of the third quarter of 2023, there were about 151,000 public charging ports across the country and 4 million EVs on the road,” the Auto Innovators report states. “Total installed public charging ports are about 12% of the needed estimate to support EV penetration by 2030.”

“Nearly 1.1 million more public chargers (950,000 Level 2 and 147,000 DC Fast) will need to be installed to satisfy the necessary infrastructure estimate. This means that between the end of the third quarter in 2023 and Dec. 31, 2030, 414 chargers need to be installed every day for the next 7.2 years, or nearly three chargers every 10 minutes through the end of 2030.”

A dozen states — Colorado, Delaware, Massachusetts, Maryland, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Washington, and the District of Columbia — have adopted California’s Advanced Clean Cars II (ACC II) regulation. It requires 35% of auto sales to be zero-emission in 2026, and 100% by 2035. Some of the states have adopted the rule to be reached by 2032.

However, Auto Innovators contends that mandates alone don’t move markets and no two states are the same.

“Each state will face its own challenges in increasing EV sales and other characteristics will ultimately play a role,” the report states. “Many factors contribute to a state’s EV adoption rate, including the availability of charging infrastructure and both financial and non-financial consumer incentives. Demographics also play a role with climate, median income, population density, and political leanings of the state making a difference.”

On Thursday, the Biden administration announced it will award $623 million in grants to help build a nationwide EV charging network.

The grants will fund 47 EV charging stations and related projects in 22 states and Puerto Rico, including 7,500 EV charging ports. The funding is the result of the Bipartisan Infrastructure Law’s $2.5 billion Charging and Fueling Infrastructure (CFI) Discretionary Grant Program. It complements the $5 billion National Electric Vehicle Infrastructure (NEVI) formula program to build the “backbone” of high-speed EV chargers along our nation’s highways, according to the U.S. Department of Transportation (USDOT).

Of the funds, the Federal Highway Administration will give $311 million to 36 community projects that invest in EV charging and hydrogen fueling infrastructure in urban and rural communities including at convenient and high-use locations like schools, parks, libraries, multi-family housing, and more, USDOT said.

The other $312 million will go to 11 corridor recipients whose projects are located along roadways designated as “Alternative Fuel Corridors.” The projects “will fill gaps in the core national charging and alternative-fueling network,” USDOT said.

Nationwide, EV market share through Q3 was 9.3%, according to Auto Innovators’ report. Among ACC II states, there was a wide range — from nearly 26% in California to five states that held under 10% of the market each, including New Mexico at under 5%, according to the report.

Auto Innovators found in its research that:

-

- One-third of ACC II states had an EV market share below the national average of 9.2% during the first three quarters of 2023;

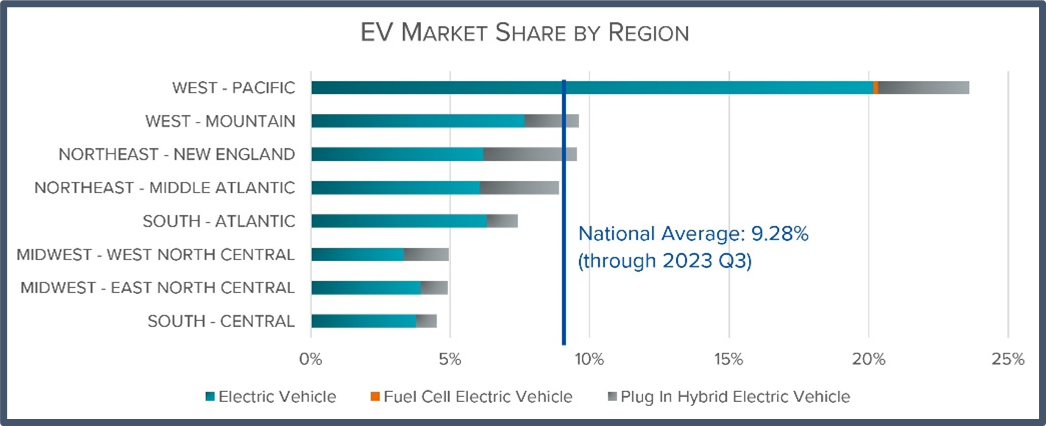

- Both east and west coastal regions have higher EV market share rates than regions in the country’s interior;

- States in the top third median income bracket have three times the EV market share of states in the lowest third income bracket;

- Of the states in the top third of EV sales (above 8% through Q3 2023), 13 states were in the top income bracket, four were in the middle bracket, and there were none in the lowest income bracket;

- States with a more urban population have 10.6% EV market share compared to rural states having 4.2%;

- Plug-in hybrid vehicles (PHEVs) make up 28% of EV sales in rural states compared to 18% in urban states;

- States that tend to vote Democratic (“blue states”) in presidential elections have more than three times the EV market share than states that tend to vote Republican (“red states”). Swing states hold half the market share of blue states.

Several OEMs reported in their Q4 2023 and full-year sales reports that EVs helped bring their sale volumes up.

Ford attributed its Q4 sales growth to its EV pickup truck, the F-150 Lightning, and the electric Mustang Mach-E. Sales of the Lightning were up 74% during the quarter. Mach-E sales increased by 3% for the year, which was the best year of sales since it came to market in 2021.

Ford hybrid sales also saw an increase, up 55% during Q4 and 25% for the year.

While GM scaled back on EV production and sales goals by Q3, it ended the year with record combined sales of Bolt EVs and Bolt EUVs, which were up 63%. Hummer EV sales also increased 74% between Q3 and Q4.

BMW saw combined sales of its four battery electric vehicle (BEV) models increase by 65.4% during Q4. Its BEVs made up 12.5% of its 2023 sales. Plug-in hybrid EVs (PHEVs) made up 19.5% of BMW’s sales for the year.

Honda reported that its electrified models set an all-time sales record with CR-V and Accord hybrids combined representing over one-quarter of Honda brand sales.

EV sales accounted for 29.2% of Toyota Motor North America’s total 2023 sales.

Volvo’s EV, the Recharge, accounted for 28% of the automaker’s 2023 sales.

Images

Featured image: Just_Super/iStock

All infographics provided by Auto Innovators for publication.