Experts expect inflation to drop, insurance rates to soar this year

By onInsurance | Market Trends

Experts expect U.S. inflation to lower this year with some goods prices, such as car prices, dropping but a study shows car insurance rates will move in the opposite direction.

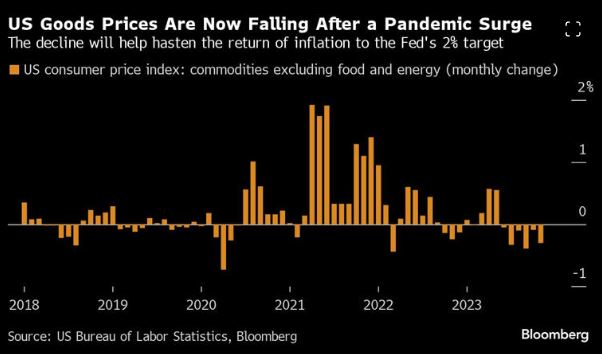

Inflation fell in recent months as supply disruptions from the pandemic faded, according to Bloomberg. The downward movement is expected to continue through the year, hitting near the Federal Reserve’s 2% target.

Bloomberg says goods prices have stopped rising overall, and the U.S. central bank could lower interest rates as soon as March.

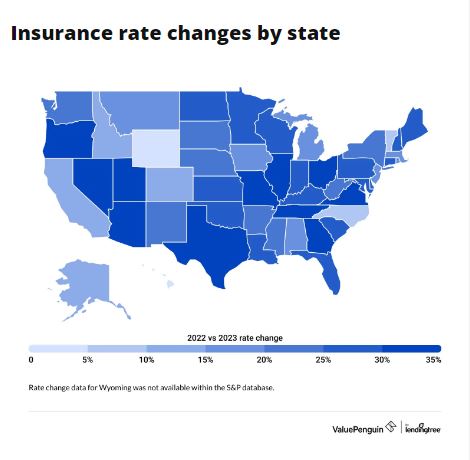

Yet, car insurance — which has increased 29% since 2018 — is expected to hike another 12.6% this year, according to a Value Penguin and Lending Tree study. It will be the most significant increase for car insurance since 2018, with 2023 seeing the second-largest increase at 11.2%.

“Insurers have continued raising rates because of an increase in car repair costs and claims,” the report said. “For insurance companies, one of the biggest causes for increased costs was natural disasters — these included severe hail in Texas, Colorado, and Missouri plus major windstorms in states like Georgia and Alabama.”

Allstate received double-digit increases in California, New York, and New Jersey last month following CEO and President Tom Wilson’s comments about dropping insurance customers in those states if rates weren’t increased.

Progressive Classic Insurance Co. recently requested a 19.78% increase to rates in West Virginia, according to Insurance Journal. It said the state is already considering a 19.9% rate increase request from Farmers Direct Property and Casualty Insurance Co.

The current average cost for full coverage car insurance in the U.S. is $1,984 per year or about $165 per month, the Value Penguin and Lending Tree study said. Michigan policyholders pay the highest average of $386 per month — 134% higher than the national average. Policyholders in Maine have the cheapest car insurance at $92 a month — about 41% more affordable than the national average.

Nevada is expected to see the highest insurance increase this year, of 28%, the report said. Every state is expected to see at least a 5% increase, except Colorado, Hawaii, Idaho, and North Carolina.

This year, drivers with a traffic violation or accident could see an average rate increase of 52%, and young drivers are expected to pay 188% more than experienced drivers, the report said.

This year, drivers with a traffic violation or accident could see an average rate increase of 52%, and young drivers are expected to pay 188% more than experienced drivers, the report said.

The Honda CR-V is the cheapest popular vehicle to insure at $219 per month, the report says. The Tesla Model Y is the most expensive popular vehicle to insure at $350 monthly.

Another Lending Tree study recently found that Tesla vehicles have the highest crash rate out of 30 brands reviewed.

As for vehicle body types, crossovers are the cheapest to insure at $219, and pickups the most expensive at $261.

The study reviewed more than 3.6 million quotes from 37 insurance companies.

Images

Photo courtesy of Torsten Asmus/iStock