Length of rental continues to decline for collision-related rentals

By onAnnouncements

The overall length of rental (LOR) for collision-related rentals has declined by a day for the same time last year but remains higher than in 2021, according to an Enterprise Q4 report.

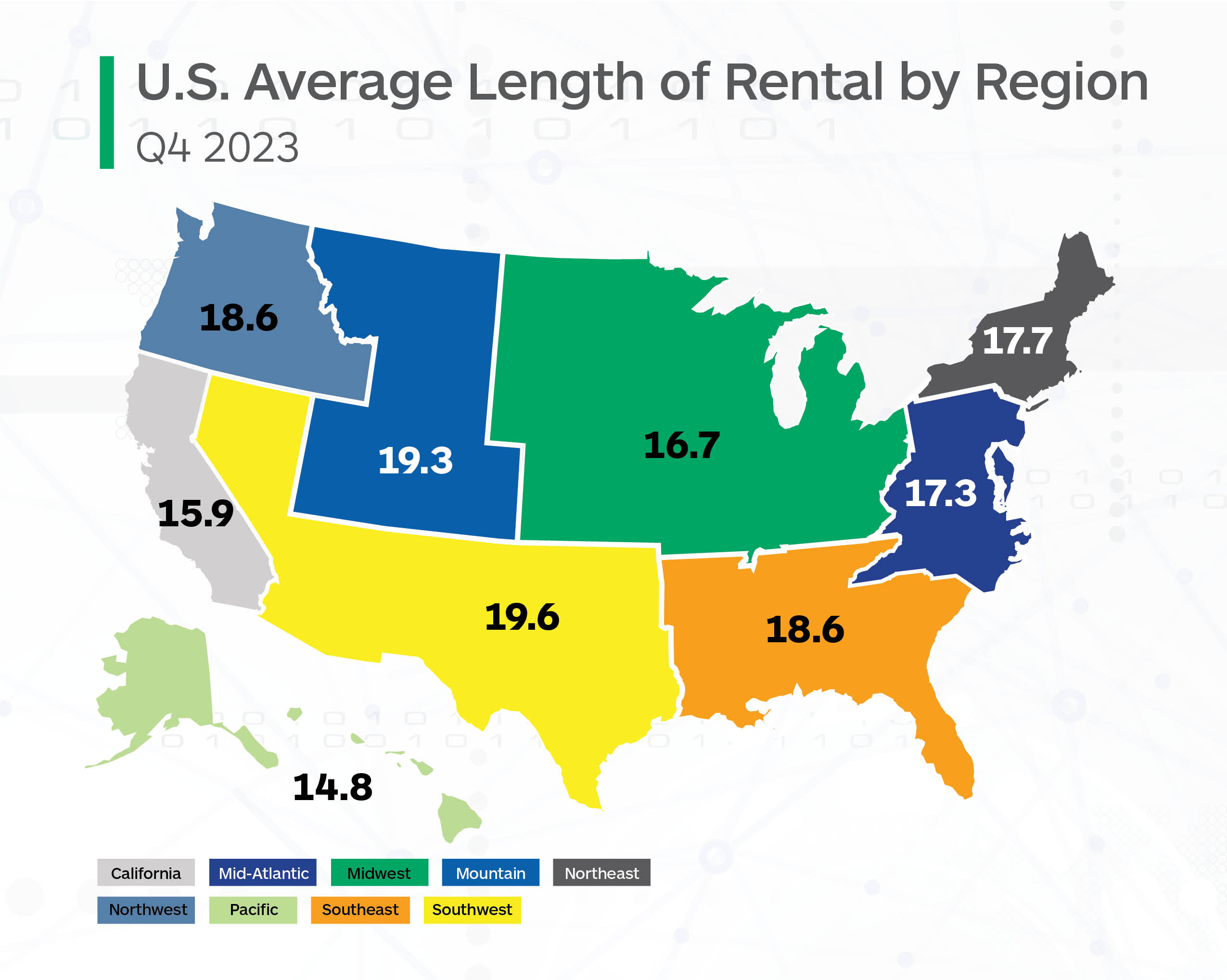

The rental time for Q4 2023 was 17.7, the report said. This compares to 18.7 in Q4 2022.

“The trend of declining year-over-year LOR we’ve been tracking since Q2 2023 continues,” the report said. “Compared to Q4 2021, LOR is up 0.7 days.”

The report calls the trend “positive” and shows “many repairers are finding ways to anticipate and operate in the new normal”.

“However, challenging market conditions remain, and overall LOR remains significantly higher than it was pre-pandemic,” the report said.

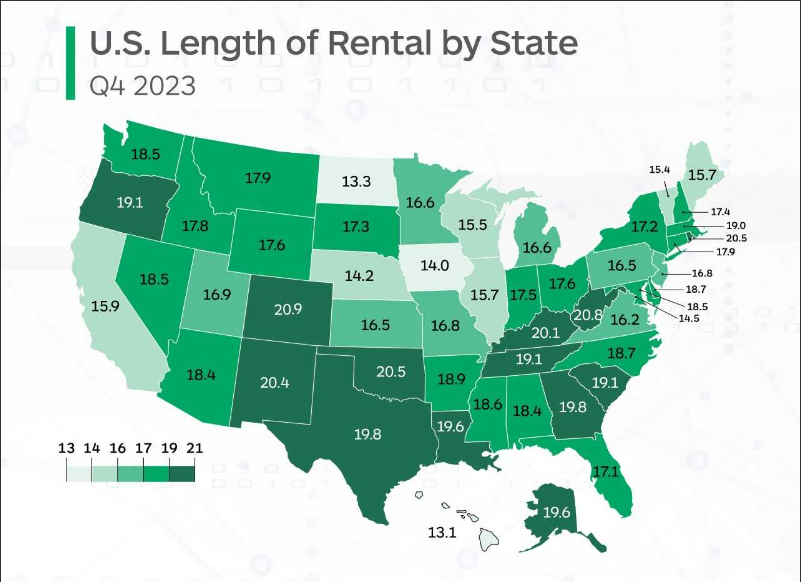

Colorado had the highest Q4 rental time at 20.9 days, which is a 0.3 day increase from last year. Hawaii had the lowest Q4 time at 13.1 days, the report said.

West Virginia, Oklahoma, Rhode Island, New Mexico and Kentucky were states with the highest LOR at 20 days or higher. North Dakota, Iowa, Nebraska, Washington D.C. were states with the lowest length at 15 days or lower.

Wyoming, Colorado and New Mexico saw the highest increases of LOR in the past year. Louisiana recorded the largest decline in rental time of 2.7 days, but remains as one of the state’s with the highest length.

The report said 19 states saw an LOR drop greater than a day and 20 states saw the rental time reduce by more than half a day.

“Some decline in LOR in Q4 2023 lines up with some easing we saw in shops’ backlog of work during that period,” John Yoswick, editor of CRASH Network said in the report. “The national average backlog in October dropped slightly to 4.1 weeks, down from 4.3 weeks in July. After drops the prior two quarters as well, shop backlog by last fall had fallen by a total of 1.7 weeks over nine months and was about 1.1 weeks lower in Q4 than the same period in 2022.”

Greg Horn, PartsTrader’s chief innovation officer, said a United Auto Workers strike delayed some deliveries in Q4.

“We see a slight decrease in the average number of parts ordered per repair as a result of a mild 4th quarter winter compared to last year’s early and heavier winter,” Horn said. “Parts are still a major factor in length of rental, but the decreases appear to be a result of a milder winter. Now that we are seeing significant weather in Q1 2024, we can expect a corresponding increase in non-drives with increased number of parts per repair.”

The LOR for drivable claims was at 16 for Q4 2023, down 0.2 days from Q4 2022. Non-drivable claims was 24.7 days for Q4 2023, down 2.4 from Q4 2022.

Total Loss claims saw an LOR of 16.3 days in Q4 2023, a drop of 1.9 from Q4 2022.

In May, a Collision Industry Conference panel identified rising supplements to claims as being one factor increasing repair times in recent years.

Images

Feature photo courtesy of djedzura/istock.

Maps courtesy of Enterprise.