Class action price-fixing lawsuit filed against 6 tire manufacturers

By onBusiness Practices | Legal

Continental, Michelin, Nokian Tyres, Goodyear, Pirelli, Bridgestone, and up to 100 unnamed defendants have been accused of violating federal anti-trust law in an alleged price-fixing scheme.

California resident Rena Sampayan filed suit, seeking class action certification, in New York District Court Wednesday. Treble damages and injunctive relief are sought. The class action includes those who purchased tires directly from any of the defendants at “supracompetitive prices,” which the suit says could involve millions of people in the U.S.

The plaintiff alleges that manufactures agreed to artificially increase and fix the prices of new replacement tires for passenger cars, vans, trucks, and buses sold in the U.S.

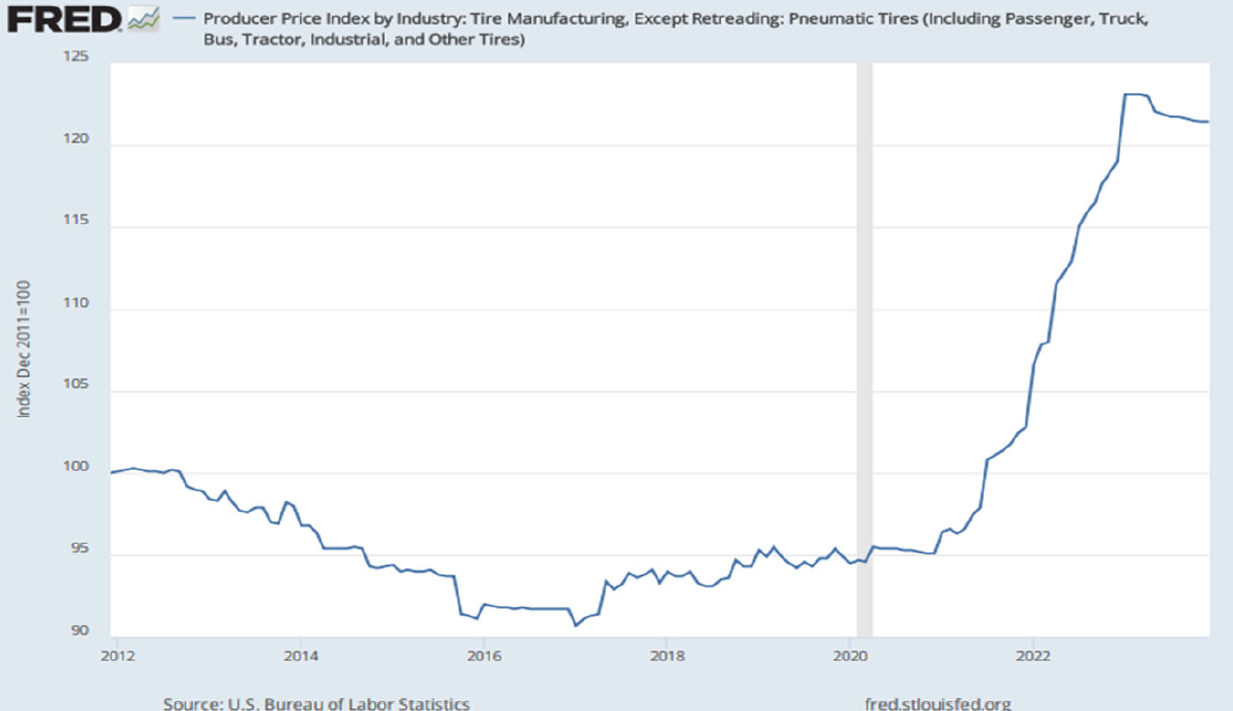

“Defendants coordinated price increases, including through public communications,” the complaint states. “…For most of the 2010s, the price level of tires was stable, changing only by small amounts slowly. Over the last four years, however, the prices of tires have seen dramatic

increases, driven by lock-step price increases from the major U.S. tire manufacturers.”

According to the complaint, between 2021 and 2023, the average price of tires rose 21.4%, which was more than 70% above core inflation.

“Prices for tires have remained high despite easing inflation and dissipating effects of the COVID-19 pandemic,” it states. “And defendants’ price increases are disproportionate to their increased costs during the pandemic. For example, in its Q1 2022 earnings call on May 6, 2022, Goodyear’s chief financial officer told investors, ‘[Goodyear’s] increase in the replacement tire prices more than offset [its] costs.’

“Sales volume also did not suffer due to price increases, which would normally be seen in a price-competitive market. For example, Continental’s sales volume rose by 19.3% in 2022.”

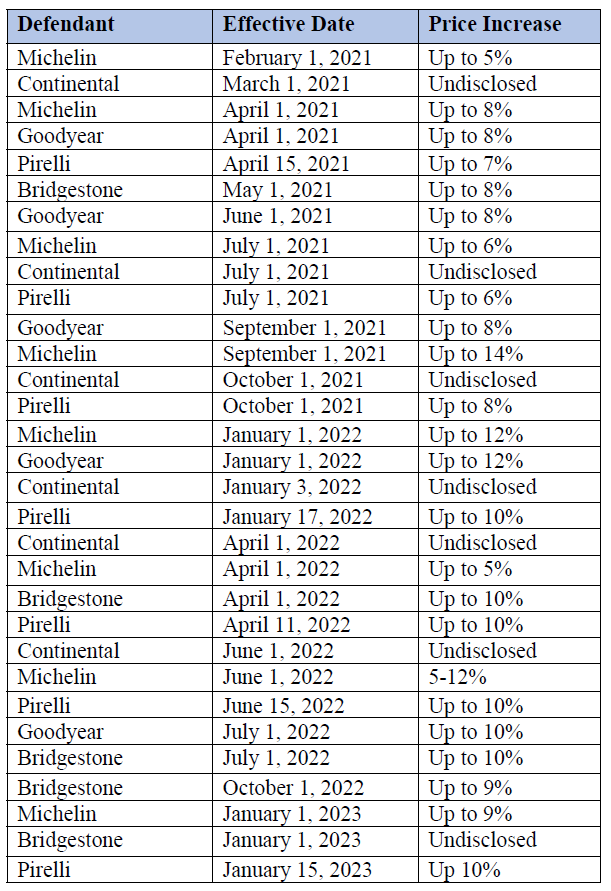

Defendants’ price increases on passenger and light truck replacement tires between 2021 and 2023, according to the complaint:

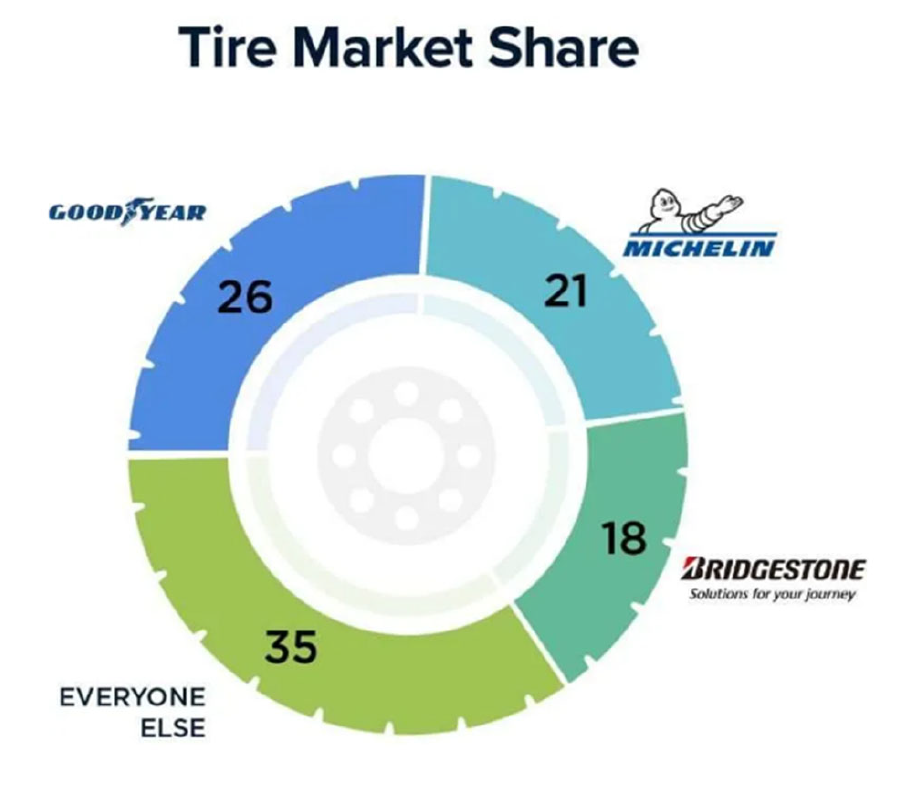

The plaintiff also argues that, in 2022, Bridgestone, Michelin, and Goodyear made up about 64% of the entire replacement tire market, including six subsidiary brands:

Despite inflation easing and supply chain logistics recovering last year, the defendants continued to pass inflated costs on to consumers even with excess supply, according to the complaint.

“A smaller number of negotiators makes it easier for the conspirators to agree on a cartel price, to allocate market shares, to conceal their

collusion, to develop enforcement mechanisms, and to detect and punish cheaters,” it states. “Tire manufacturers face significant entry and exit barriers that lead to market concentration which facilitates collusion.”

Those barriers include large upfront capital investments to build facilities near consumers and avoid high shipping costs, building a large labor force or automated processes, and patenting products; all of which make it cheaper for companies to consolidate than going out of business, the complaint states.

It also notes that manufacturers can increase selling prices without suffering a substantial reduction in demand because tires are always needed — similar to gas prices and demand. Consumers can also combine tire brands if they wish to not replace the entire set, making prices the primary way for companies to compete.

“The avoidance of price-based competition is the primary motivation for forming a cartel,” the complaint states. “Thus, cartels are more likely when the participants sell interchangeable products.”

To back up the plaintiff’s allegations, it’s also noted that Bridgestone and Continental have paid fines and reached settlements in the past over anti-trust law violations in South Africa and California.

On Jan. 30, the European Commission shared it had been carrying out unannounced inspections of tire company properties because of concerns that the companies “may have violated EU anti-trust rules that prohibit cartels and restrictive business practices (Article 101 of the Treaty on the Functioning of the European Union).”

“The Commission is concerned that price coordination took place amongst the inspected companies, including via public communications,” a news release from the commission states.

The commission didn’t disclose which companies had been inspected. Reuters reports Pirelli, Continental, Michelin, and Nokian Tyres were raided by EU anti-trust regulators on Jan. 30, causing shares for each company to drop.

Images

Featured image: Stock photo of tires. (Credit: Chonlatee Sangsawang/iStock)