As insurers increase rates, more policyholders shop for new plans

By onAnnouncements | Insurance

About 41% of all insured households shopped for insurance at least once in 2023, as consumers carried the weight of insurers’ rate increases, according to data found in a LexisNexis Insurance Demand Meter report.

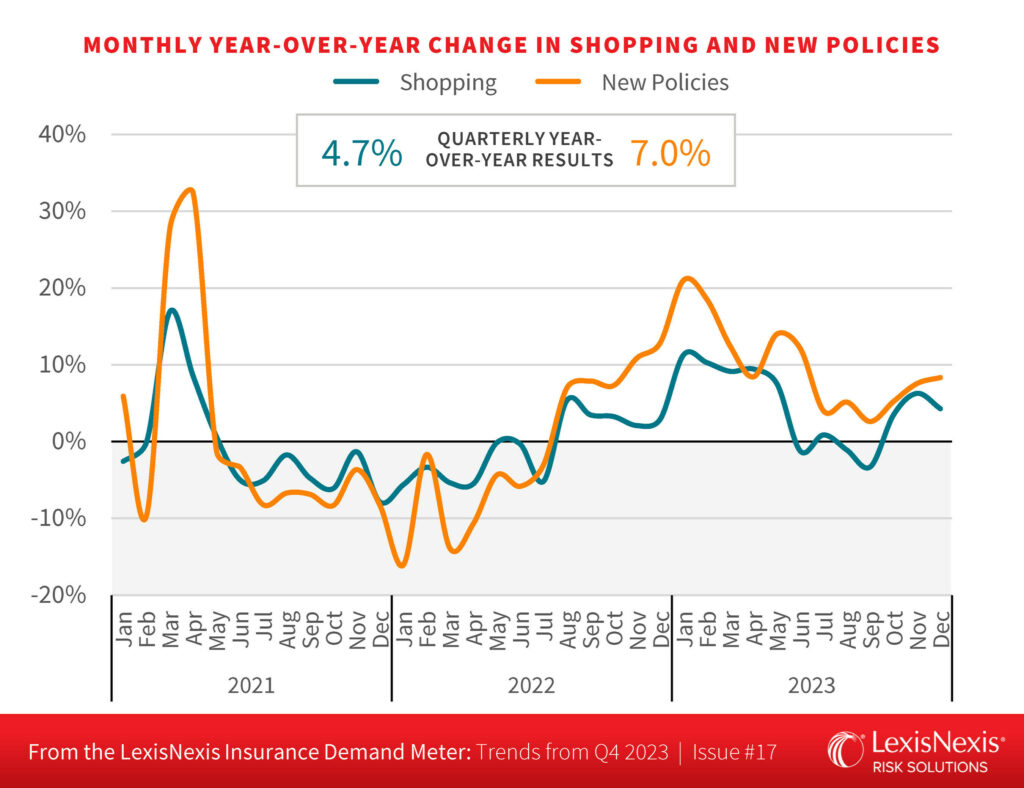

“Driven by a combination of continued rate increases for many and the growth aspirations of carriers with improved combined ratios, consumer shopping rebounded from a relatively sluggish Q3 to post growth in each month of the quarter,” the report says. “Year-over-year shopper growth climbed in Q4 from -1.2% to 4.7%. This was the strongest Q4 growth since 2020.”

Policyholders weren’t just shopping more, they were also buying new plans more, the report says.

“New policy growth also experienced a jump in the final quarter, rising from 3.9% to 7.0%,” according to the report. “Growth in new policies continued to outpace shopper growth for the sixth consecutive quarter.”

The report says new policy growth has increased for insurers for six quarters, while retention of consumers has dropped three percentage points since Q1 2022.

“With such a significant drop in a very short time, insurers may want to take heed of retention strategies, including more proactive and selective monitoring of their renewal book to identify and retain the most profitable policyholders,” the report said. “While retention will likely stabilize, the industry hasn’t witnessed a drop this significant in recent years.”

A Q1 2024 Insurance Personal Lines Trends and Perspectives report from TransUnion predicts shopping trends will continue to remain high in 2024.

“The December 2023 consumer price index for motor vehicle insurance increased 20% over December 2022 — an annual increase not seen in over four decades,” the report said. “Combine this record level of price adjustment with moderating loss costs, and a path towards rate adequacy becomes clearer. In fact, some insurers have reported near-target profitability performance and are signaling intent on selectively resuming marketing effort.”

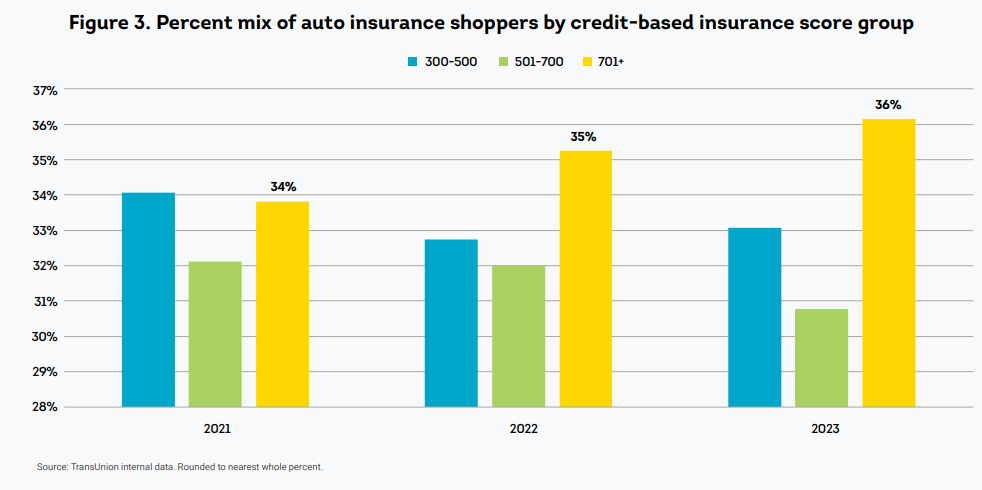

The TransUnion report says auto policyholders with a higher credit score saw the largest increase in shopping in 2023, with a 14% increase.

“Throughout the reporting timeframe, the year-over-year percent change in the number of high credit-based insurance shoppers posted nearly consistent double-digit increases,” the report says.

Allstate plans to continue increasing auto insurance rates in at least 10 states in 2024, including New Jersey and New York, where the company received double-digit rate increases late last year, according to the company’s Q4 earnings call.

The insurer netted $1.5 billion in Q4, a 496% increase from the $303 million loss the insurer in Q4 2022.

While Allstate had a profitable Q4, the company ended the year in the red with a $316 million loss. Yet, the company ended with a 77% increase from the $1.4 billion loss in 2022.

Executives said a reduction in marketing investment directly impacted a decline in new auto-issued applications by 20% in 2023. They also said improving auto insurance profitability negatively impacted policies in force.

Progressive netted $1.9 billion in Q4 2023, a 141% increase from the $826.4 million the company netted in Q4 2022, according to the company’s December earnings release.

The company’s net income for 2023 is $3.9 billion, more than a 400% increase from 2022. The company recorded $721.4 million of net income earned in 2022. The 2023 annual amount is unaudited.

Last year, the company announced a plan for “aggressive” rate increases, increasing by 4% companywide during the first quarter. It raised rates by 13% in 2022.

Most major insurers haven’t released Q4 earnings.

Insurers claim pandemic losses from part delays, rising labor costs, and used car values are why they’ve hiked rates in recent years. The rate hikes continually receive criticism from consumer advocacy groups who’ve claimed insurers are overstating needs and overburdening the consumer.

IMAGES

Photo courtesy of Natee Meepian/iStock