Insurers overstated projected losses during California rate hike request, nonprofit says

By onBusiness Practices | Insurance

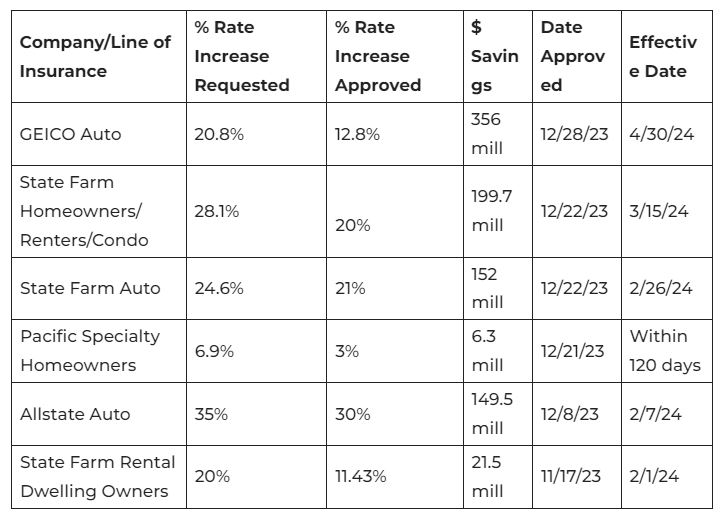

A Consumer Watchdog analysis found auto and home insurance companies overstated projected losses and inflation trends by millions of dollars when asking the California Insurance commissioner for double-digit rate increases late last year.

The nonprofit advocacy group says it challenged the rate hikes, which ultimately resulted in lower rates approved and a total savings of $884.8 million for California policyholders, according to a press release. Allstate and State Farm also agreed to lift restrictions on sales of new auto policies the companies implemented in 2022, the release said.

“California’s insurance market is in upheaval — insurance companies have created shortages by limiting sales of new policies across the state while at the same time pressing the insurance commissioner for massive premium increases,” said Pamela Pressley, Consumer Watchdog senior attorney, in a press release. “With mounting pressure on the commissioner by insurance companies to swiftly approve insurance companies’ requested rate hikes, close scrutiny of rate requests and consumer participation in a public, data-driven review process is more important than ever.”

Farmers Direct Property and Causality Insurance, a division of Farmers Insurance, stopped writing new policies in California in September.

California Insurance Commissioner Ricardo Lara said last month that the state is looking into consumer claims about difficulty in securing auto insurance.

Consumer Watchdog was able to challenge the proposals under California Proposition 103, the release said. The proposition requires insurers to publicly open finances to prove they need requested rate increases.

Challenges Consumer Watchdog made relative to auto policies after reviewing proposals included:

State Farm Auto

-

- Overstated projected claims payments

- Inflated projections for bodily injury and uninsured motorist claims

- Failed to meet state law by removing costs for institutional advertising or advertising designed to improve the company’s image.

Allstate Auto

-

- Overstated projected claims payments

- ailed to meet state law by removing costs for institutional advertising or advertising designed to improve the company’s image.

- Violated California Proposition 103 by limiting access to auto insurance products

GEICO Auto

-

- Overstated projected claims payments

- Failed to meet state law by removing costs for institutional advertising or advertising designed to improve the company’s image.

- Claimed 25% of expenses were attributable to sales through agents but the company closed sales offices in California in 2022. In-house employees make policy sales over the phone or on the Internet.

- Proposition 103 violations by using education and occupation as rating factors.

Similar challenges were made on homeowners relative to inconsistent net income for 2021 and inflated or unsupported projections for claims payments and rate calculations.

Through Consumer Watchdog’s challenges, Allstate will offer the same payment plan options for new and renewal policies to comply with Proposition 103, according to the release. Pacific Specialty Homeowners also will remove underwriting guidelines denying coverage for properties not showing pride of ownership or condemned dwellings.

Repairer Driven News previously reported that Allstate received the rate increase in California after CEO and President Tom Wilson made statements about dropping insurance consumers there if rates weren’t increased. He also threatened to drop costumers in New York and Jersey where he also received double-digit rate increases.

Two insurance companies recently requested double-digit increases in West Virginia, according to Insurance Journal. Progressive Classic Insurance Co. requested a 19.78% increase and Farmers Direct Property and Casualty Insurance Co. asked for a 19.9% increase.

A Value Penguin and Lending Tree report says auto insurance rates have increased by 29% nationwide since 2018. Rates increased 11.2% in 2023 and is expected to increase by 12.6% in 2024, it said.

Images

Featured image courtesy Bill Oxford/iStock

Graph courtesy of Consumer Watchdog