GEICO parent Berkshire has ‘no possibility of eye-popping performance’

By onInsurance

Berkshire Hathaway Board Chairman Warren Buffett has provided an unusually grim take on the company’s shareholder equity net worth compared to the rest of the S&P companies in a letter to shareholders as part of the company’s annual report.

“Berkshire now has, by far, the largest GAAP net worth recorded by any American business,” Buffett wrote. “Record operating income and a strong stock market led to a year-end figure of $561 billion. The total GAAP net worth for the other 499 S&P companies — a who’s who of American business — was $8.9 trillion in 2022. (The 2023 number for the S&P has not yet been tallied but is unlikely to materially exceed $9.5 trillion.)

“By this measure, Berkshire now occupies nearly 6% of the universe in which it operates… There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance… On the positive side, after 59 years of assemblage, the company now owns either a portion or 100% of various businesses that, on a weighted basis, have somewhat better prospects than exist at most large American companies.”

As Carrier Management noted:

-

- Pre-tax underwriting profit of $3.6 billion, reversing a $1.9 billion underwriting loss reported for GEICO in 2022, and “fueling a $5 billion pre-tax underwriting profit for all of Berkshire Hathaway’s insurance operations last year;”

- Underwriting profits for remaining 2023 primary operations were three times higher than in 2022 and more than double in 2021, with written premiums growing 24.1% to $3.5 billion; and

- P/C reinsurance operations added another $2 billion in pre-tax underwriting profit. “The last time P/C reinsurance came in even close to that figure was more than a decade ago in 2013 when P/C reinsurance underwriting profits reached $1 billion.”

“GEICO’s $3.6 billion pre-tax underwriting profit translates to a 90.7 combined ratio, more than 14 points below the 104.8 recorded in 2022,” Carrier Management wrote. “The only better year of underwriting performance at GEICO in the last 10 was 2020 when COVID shutdowns kept drivers off the roads. In 2020, GEICO’s combined ratio landed at 90.2, fueling a $3.4 billion pre-tax underwriting profit.

“GEICO’s combined ratio improvement in 2023 looks stunning against competitors Progressive and Allstate, which both posted double-digit premium jumps in 2023 but smaller improvements in their personal auto combined ratios. (Editor’s Note: State Farm has not reported earnings yet).”

According to Berkshire’s annual report, 2023 earnings benefited from relatively low losses from significant catastrophic events during the year and improved underwriting results compared to 2022, which reflect premium rate increases and lower claims frequencies.

Underwriting results in 2022 and 2021 included after-tax losses from significant catastrophe events of $2.4 billion and $2.3 billion, respectively.

Underwriting losses in 2022 also reflected accelerating claims costs at GEICO. Earnings from insurance underwriting increased $60 million in 2022 and $142 million in 2021.

“Our insurance business performed exceptionally well last year, setting records in sales, float, and underwriting profits. Property-casualty insurance provides the core of Berkshire’s well-being and growth. We have been in the business for 57 years and despite our nearly 5,000-fold increase in volume — from $17 million to $83 billion — we have much room to grow.”

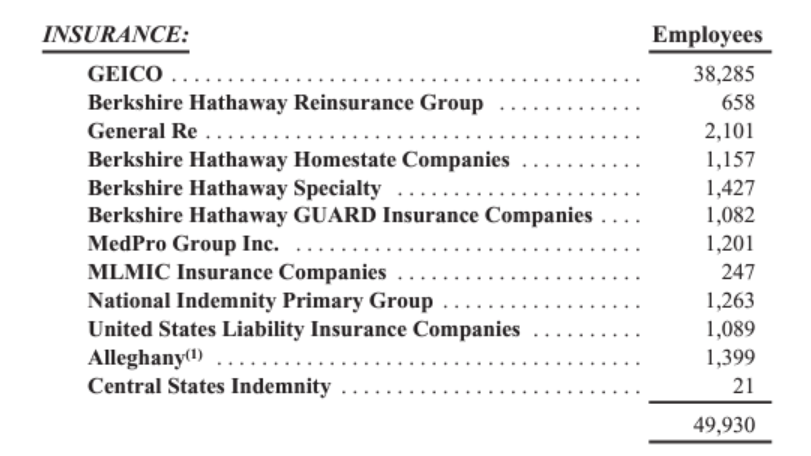

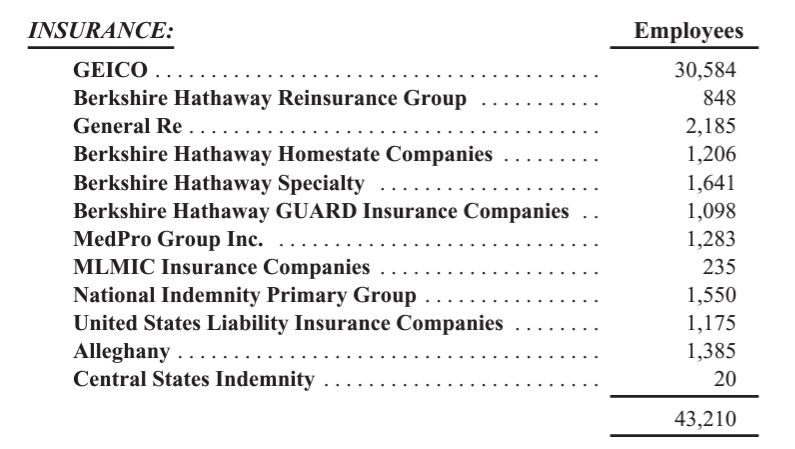

The report also shows that, compared to 2022, GEICO cut 7,700 employees last year.

GEICO had the second-highest number of layoffs last year after 2,000 workers lost their jobs in October. The company’s CEO said in an internal email shared with Repairer Driven News at the time that GEICO’s remaining staff was ordered to return to the office.

The results of a labor market survey given by Jacobson Group and Aon during Q3 2023 (released in August) found that 65% of P&C insurance companies planned to increase their staff over the next 12 months, while 10% planned to make cuts. In July 2022, 71% of P&C companies planned to increase staff, but only 62% of companies did, according to the Q3 2023 results.

All Berkshire Hathaway earnings and annual reports can be accessed here.

Images

Featured image credit: jetcityimage/iStock