‘Who Pays’ survey: More shops billing and paid for feather, prime and block

By onCollision Repair | Repair Operations

Collision Advice and CRASH Network’s latest “Who Pays for What?” survey found that double the number of shops compared to 10 years ago are asking insurers to reimburse them for the not-included feather, prime, and block repair operation.

The survey is conducted quarterly. The last was conducted in January and focused on refinish operations.

Feather, prime, and block is an operation that repairers taking the surveys have been asked about every year since the first survey in 2015.

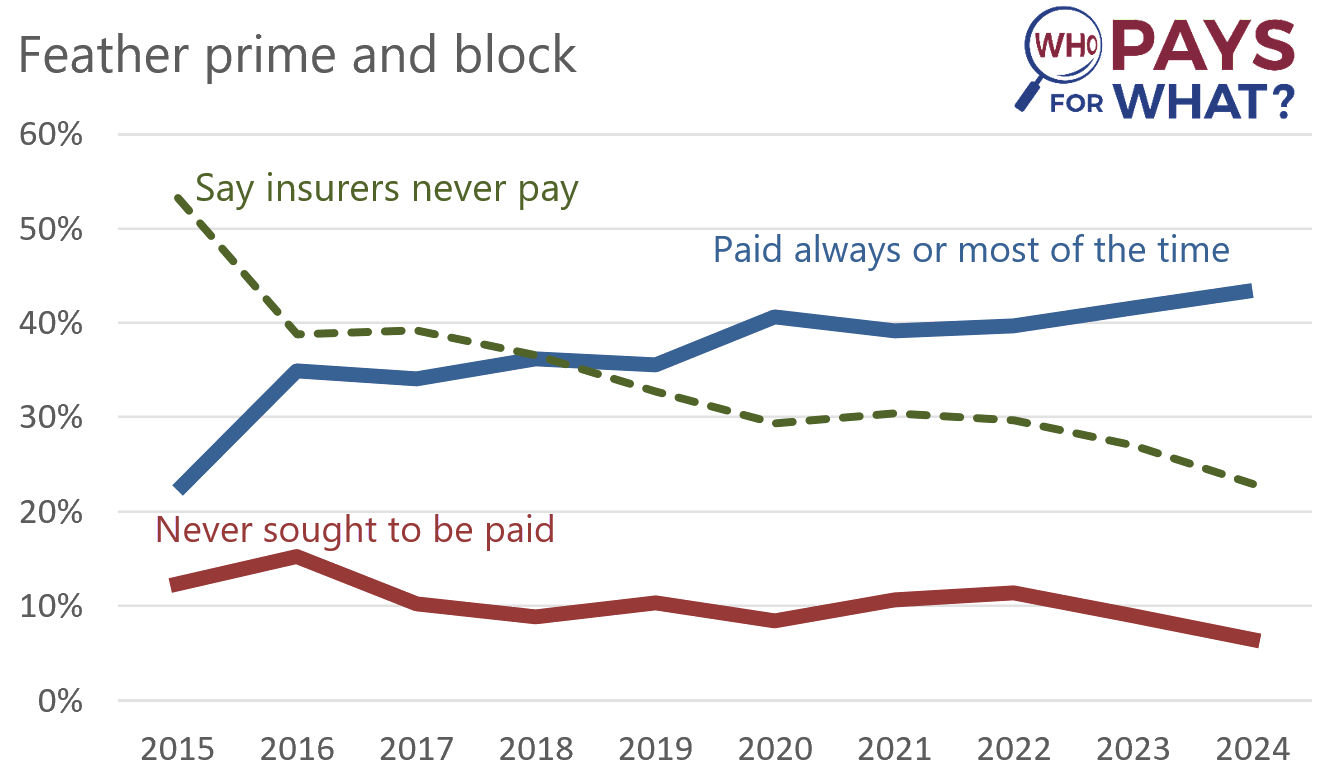

Ten years ago, just over 1 in 5 shops, or 22% of those billing for the procedure, said they were paid “always” or “most of the time” by the eight largest national insurers when it was necessary and performed as part of a repair. That nearly doubled to 44% of shops this year who said they are paid regularly for the procedure.

“In terms of actual numbers, these results indicate there are over 9,000 more shops regularly being paid for this in 2024 than there were in 2015,” said Mike Anderson, Collision Advice president, in a news release. “The surveys are important to keep raising shop awareness. Even today, about 1 in 20 shops still are not billing for this procedure when they perform it despite the fact that 77% of shops that do bill for it get paid at least some of the time by those same eight insurers.”

Ten years ago, 53% of shops that negotiated to be paid for feather, prime, and block said that the insurers “never” paid them for it. This year, 23% of shops said they “never” get paid for the procedure.

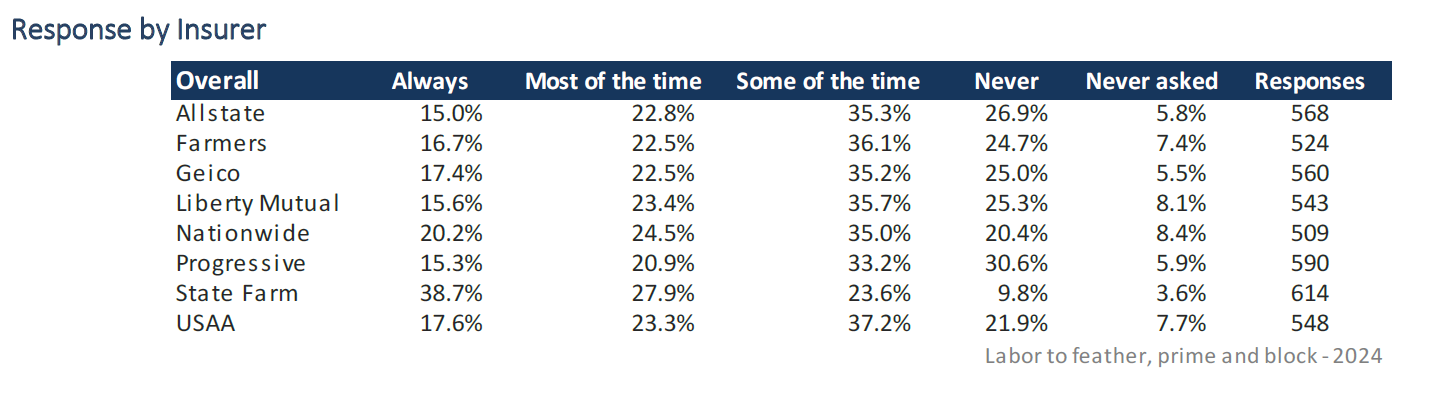

Shops said State Farm (38.7%), Nationwide (20.2%), and USAA (17.6%) were the top three insurers to “always” pay for feather, prime, and block.

Progressive, Allstate, and Liberty Mutual were the top three to never pay for the operation, according to the survey results.

“It is important to remember that most paint companies have had paint material price increases of late, making it critical that this operation takes into account the materials it requires,” Anderson wrote in the survey results. “All the estimating system refinish times are based on new, undamaged panels. But repair work on a welded-on panel, for example, ends with the technician finishing it off at 150 grit. A panel finished with 150 grit is not the equivalent to new and undamaged. To get to that level requires finishing the repaired panel to 320 grit.

“The paint and abrasives manufacturers concur that you should not jump more than two grit sizes. You can’t go from 150 right to 320 grit. It’s that process in between the two that’s essentially covered by this not-included labor time to feather, prime, and block. In some cases, a repair may require feather, prime, and block. In other cases, such as adjacent panels to the panel being welded on, blocking labor may not be required, just featheredge and prime.”

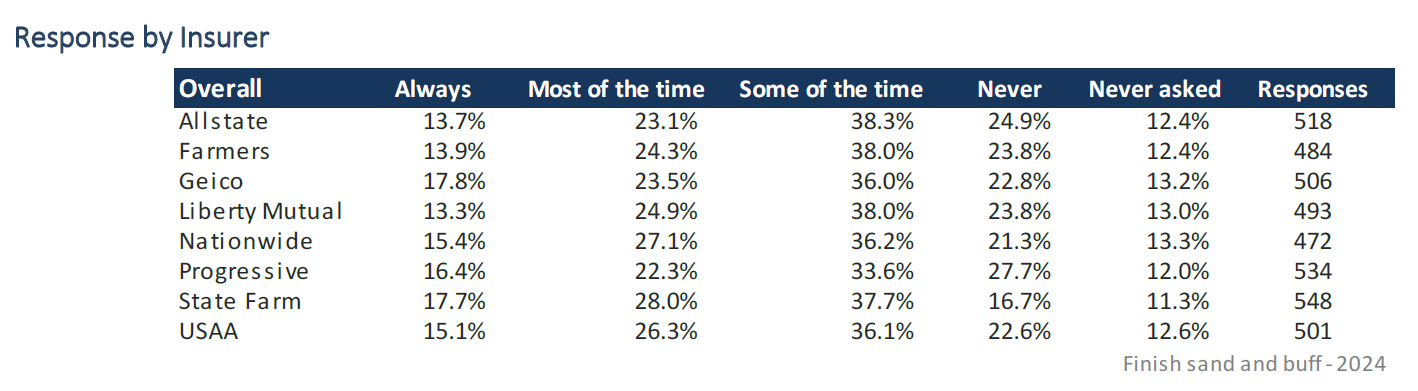

Another operation asked about in the survey that had a significant difference in the percentage of shops that are paid “always” or “most of the time” compared to last year (3.9%) was finish, sand, and buff. Of those who negotiate for payment, 40% said they are paid “always” or “most of the time.”

GEICO (17.8%), State Farm (17.7%), and Progressive (16.4%) are the top three to always pay for the operation while Progressive (27.7%), Allstate (24.9%), Farmers (23.8%), and Liberty Mutual (23.8%) are most likely to never pay for the operation, according to the survey results.

“All of the paint manufacturers have bulletins on the need to denib or finish sand or buff,” Anderson wrote.”Often noting (as the AkzoNobel statement reads) that, ‘It is not likely that a repair can be made that is completely free of surface defects,’ and that it is (as the Axalta statement reads) ‘a normal and necessary operation for both OEM manufacturers and collision repair shops.'”

He added paint company bulletins can be downloaded from the Society of Collision Repair Specialists’ (SCRS) website. Some automakers including Toyota, Lexus, Nissan, and Infiniti also have statements that state the processes are necessary at manufacturing plants and body shops, Anderson said.

Another significant change since last year was reimbursement for refinish adjacent/mating panels after structural panel replacement.

Of those who negotiate for payment, 70% said they’re paid “always” or “most of the time.” That’s a decrease of 4.5% compared to last year.

The latest quarterly “Who Pays for What?” survey is now open for repairers to take through the end of the month. It focuses on not-included frame and mechanical labor operations.

Survey participants receive a free report with complete survey findings, analysis, and resources to help shops better understand and use the information presented.

The survey can be completed in about 15 minutes by anyone familiar with their shop’s billing practices and the payment practices of at least some of the largest national insurers. Only aggregated data is released. The results of previous surveys are also available here.

Images

Featured image credit: anyaberkut/iStock