LOR continues downward trend but remains higher than pre-pandemic years

By onMarket Trends

The length of rental (LOR) continued the trend of decreasing in Q1 2024 but remains higher than pre-pandemic levels as market conditions remain challenging, Enterprise’s most recent U.S. Length of Rental report says.

Collision-related rentals were 17.6 days for the quarter, a 1.1-day decline from the first quarter last year.

“Traditionally, LOR decreases in the first quarter of each year, a trend that continued,” the report says. “LOR has shown steady decreases from the post-COVID highs, with Q1 2023’s 18.7 days and Q1 2022’s 18.2 days, but it is still higher than what we observed in Q1 2021 (13.3 days) and Q1 2020 (13.2 days),” the report says.

The decline aligns with repair shops’ backlog during the same timeframe, John Yoswick, Crash Network newsletter editor, says in the report.

“On a national basis, the average backlog reached a two-year low in January — just shy of four weeks,” Yoswick said. “That’s down by nearly two full weeks since the high of 5.8 weeks in the first quarter of 2023. But the average backlog remains significantly higher than the same period in January 2020 (2.1 weeks) and January 2021 (1.6 weeks).”

Work-in-process (WIP) is also declining, Yoswick said. He said this could be a sign that parts-related issues are easing. WIP is measured as the number of jobs a shop has in process compared to its typical job count.

On average, 550 shops in March had a WIP equal to 57% of their typical monthly volume, he said.

“That was down 11 points from the prior quarter, and 8 percentage points lower than a year earlier,” Yoswick reports.

The first quarter also saw a decrease in median delivery days for parts, according to Greg Horn, PartsTrader’s chief innovation officer.

PartsTrader uses the median delivery days plus two standard deviations to track delivery times and the impact of outliers, Horn says in the report.

“We compared the results of Q1 2024 median parts delivery data to the Q1 results for the preceding three years,” Horn says. “Q1 2024 median delivery days for all parts saw an overall decrease of 1.9 days compared to Q1 2023.”

He adds that median delivery days have not returned to 2021 levels.

“There isn’t a single factor, such as a single manufacturer, union strike, or port bottleneck; this is an industry struggling to reach pre-pandemic production and delivery levels, and we’re not there yet,” Horn says.

The LOR for drivable, non-drivable, and total loss claims all saw decreases during Q1, according to the report.

Drivable claims had the smallest drop with the rental length at 15.8 days in the first quarter, down 0.3 from the same time period last year.

Non-drivable claims had a LOR of 25 days in Q1 2024, down 2.5 days since Q1 2023.

Yoswick said that during January 33% of shops said they could schedule a job within two weeks. This is similar to the percentage tracked in the last quarter of 2023, he said. However, the percentage is 20 points higher than during the same time period in 2023 when 13% of shops were able to schedule new work in two weeks, he said.

“The first quarter is traditionally the busiest of the year, and in the eight-year history of backlog tracking through the ‘Who Pays for What?’ surveys, there had never been a decline in backlog between October and January,” Yoswick said. “That might suggest the drop in backlog is more dramatic than the 1.3-day decline (compared to Q4 of 2023) reflects.”

Ryan Mandell, Mitchell International’s director of claims performance, said calibration frequency in 2024 increased in January 2024 to 21.35% compared to 15.10% in January 2023. He added that calibration adds time to the repair process.

The LOR for total loss claims also dropped two days to 16.4 days in the first quarter of 2023.

Mandell said repairable claims volumes fell overall by 0.87% in Q1 2024 compared to Q1 2023. He said this is because of mild weather conditions during the first quarter along with a “cooling” in the used vehicle market.

The used vehicle market drove total loss frequency to 20.8% in Q1 2023 from 20.1% in Q1 2024. Overall total loss market values decreased by 1.95% in Q1 2024 compared to Q1 2023.

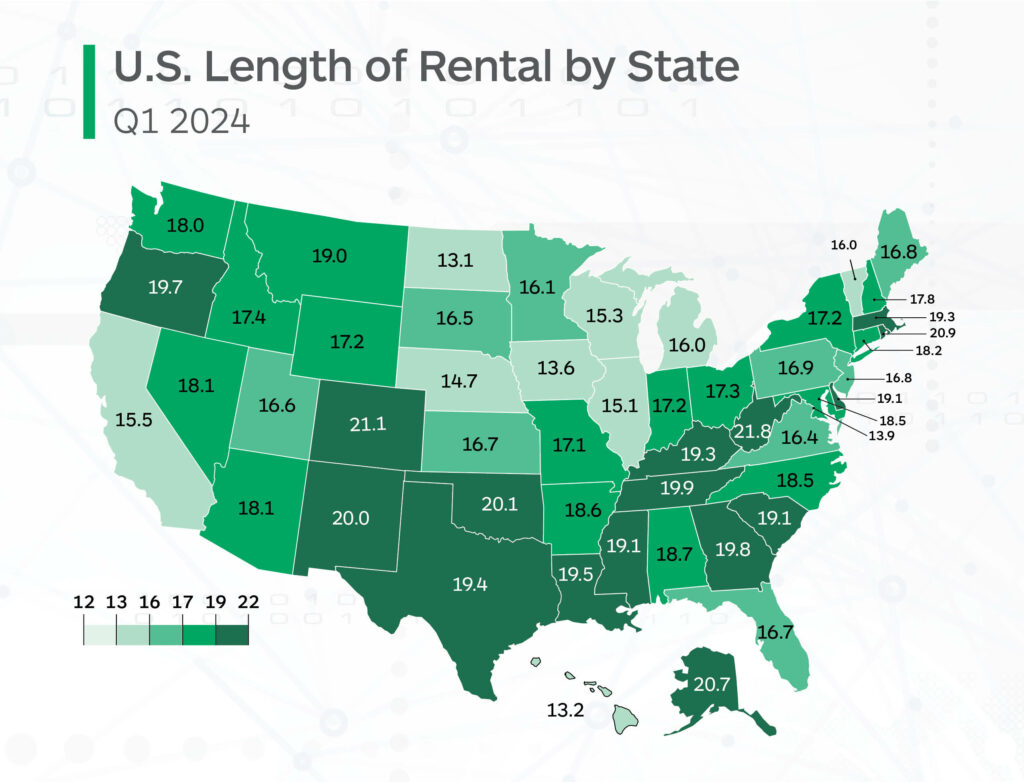

At a state level, West Virginia had the highest overall LOR at 21.8 days, a 0.6-day increase from Q1 2023. North Dakota had the lowest LOR with 13.1 days, a 1.5-day drop. Three states had increases including West Virginia (0.6), Maine (0.2), and New Mexico (0.2). Washington had the largest decrease of 2.3 days.

For drivable claims, Rhode Island had the highest LOR at 19.3 days. Twenty-two states had drivable increases, with West Virginia having the highest drivable increase, up 1.6 days to 17.6. The lowest drivable LOR was North Dakota with 10.4 days. California had the largest drivable decrease, down 1.2 days.

West Virginia also had the highest non-drivable LOR at 33.2 days. Vermont was the only state to see an increase. It rose 1.1 days to 27.5 days. D.C. had the lowest non-drivable LOR with 20.6 days. South Dakota had the largest decrease down 6 days to 24.7.

As for total loss LOR, West Virginia had the highest at 20.1 days. Vermont was the only state to see an increase, up 0.9 days to 18.8 days. North Dakota had the lowest LOR at 14.4 days and Montana had the largest decrease, down 8.1 days to 15.8 days.

High LOR can contribute to out-of-pocket expenses incurred by policyholders once policy limits are exceeded.

Colorado could be adding to that expense with a bill that would raise rental car fees by up to $3 per day.

The Colorado Senate passed SB 184 to the House on April 17. The House Transportation, Housing & Local Government Committee referred the bill to the House April 23 and the House referred the bill to the Committee on Appropriations April 25.

According to KKTV, the bill would collect $50 million or a 20% down payment for a Front Range passenger railway. The news station reports state officials plan to ask for U.S. grants to fund the rest of the project.

“The potential for the federal government to pay up to 80% of the project is incredibly exciting, kind of a game changer for financing large infrastructure projects like this,” Senate President Steve Fenberg told KKTV. “Colorado is only one of two projects that was not only accepted, but they were sort of fast-tracked to a more advanced state of the grant process, so we feel Colorado is very well positioned to get the grant from this pool of funds.”

KKTV said Sen. Kevin Van Winkle posted a video speaking against the bill.

“Senate bill 184 will expand government and impose a daily fee on rental cars in our state with the aim of using these funds to build a new multi-billion dollar train network across the front range,” KKTV says Van Winkle said. “While the idea of front range metro rail might seem attractive to some, the people of Colorado cannot afford to foot the bill for such a project, especially during the ongoing affordability crisis … Senate Bill 184 is just one of many bills Coloradans can expect that will levy costly fees on Coloradans to fund this project.”

IMAGES

Photo courtesy of IJzendoorn/iStock