Digital channels critical for insurance service and shopping, according to J.D. Power

By onInsurance

With auto insurance rates higher than ever and more consumers in the market shopping for policies than ever before, digital channels have become a critical component of the overall auto insurance shopping and service experience, according to J.D. Power.

J.D. Power found through its “2024 U.S. Insurance Digital Experience Study,” released May 21, that a strong majority of auto insurance websites and apps are doing a good job delivering on foundational functional capabilities, but far fewer are delivering the type of value-added services that set them apart from the pack, a news release states.

“When you consider the sharp declines in customer satisfaction we’ve been seeing across all aspects of the auto insurance industry during the past year, digital channels have been remarkably resilient when it comes to delivering a good user experience and helping to get customers and prospects the information they need,” said Stephen Crewdson, J.D. Power insurance business intelligence senior director, in a news release.

“However, many insurers still have work to do when it comes to keeping customers on their websites and apps to answer all questions and provide critical information. Customer satisfaction plummets when users of digital channels need to pick up the phone and contact the call center if they can’t find what they need online.”

J.D. Power’s study evaluates the digital consumer experiences of both property and casualty (P&C) insurance shoppers seeking quotes and existing customers conducting typical policy-servicing activities, according to the release. It examines the functional aspects of desktop, mobile web, and mobile apps based on four factors — navigation, speed, visual appeal, and information/content.

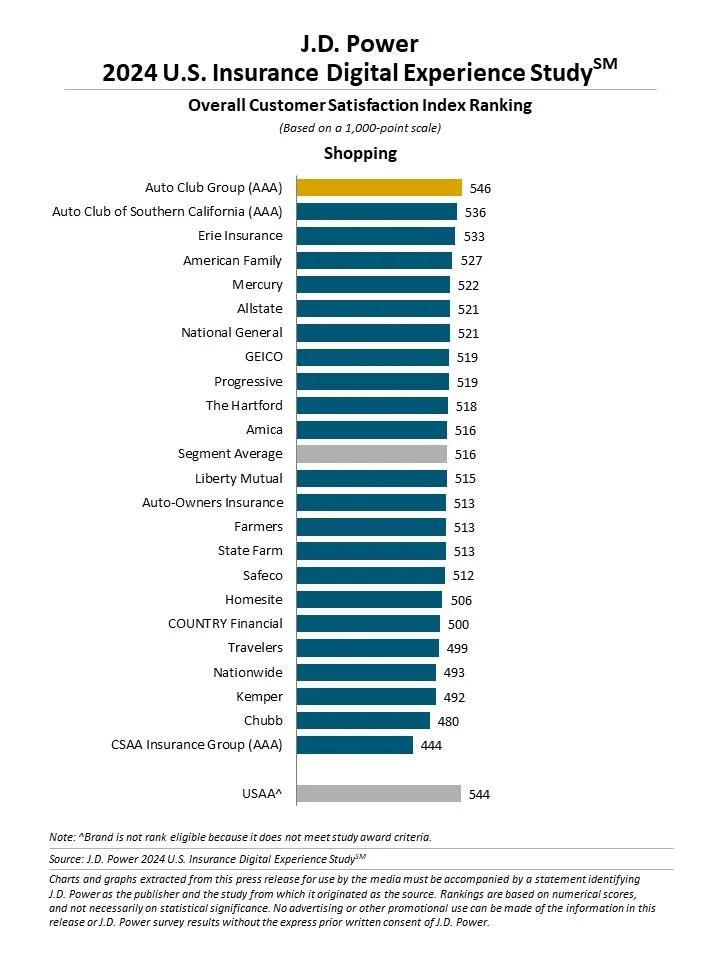

Overall digital shopping experience satisfaction holds strong despite industry headwinds at 516 on a 1,000-point scale, down five points from a year ago, according to the study.

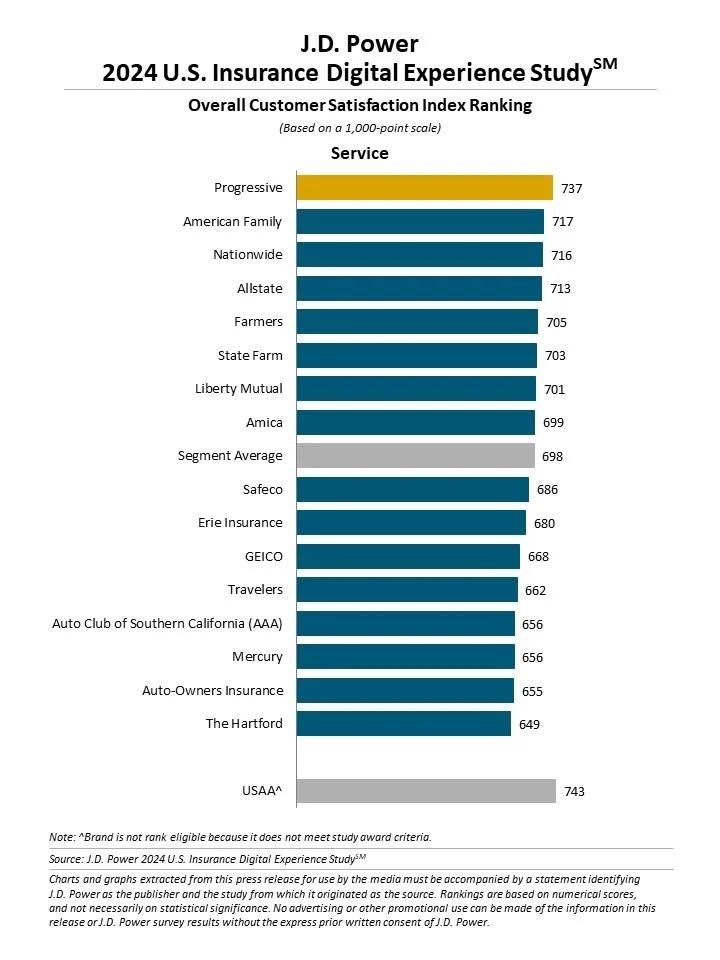

Overall customer satisfaction with the P&C service experience is 698, down four points from a year ago. Relative to overall customer satisfaction scores with auto insurers in general, which fell 12 points in 2023 from 2022, the digital channel is “performing admirably, despite soaring rates,” J.D. Power said.

Fifty-three percent of first-time buyers start their relationships with auto insurers through digital channels, compared with 29% who come in through agents, and 18% who come in through call centers. Similarly, digital is the first choice for 42% of those who switch insurance companies and 46% of those who stay with their current insurer. J.D. Power has found that all of these have grown significantly during the past four years.

Overall customer satisfaction scores are considerably higher when customers use their insurer’s website or assisted digital contact methods as a first line of interaction than when they use another contact method first, according to the study.

“While most insurer digital channels are delivering foundational tools and navigation capabilities, fewer are making it easy for customers to perform more advanced tasks,” J.D. Power said. “In the service category, 83% of customers said digital channels delivered foundational experiences, but only 30% said they found the channels were foundational, findable, and valuable.

“In the shopping category, 72% of customers said digital channels are delivering foundational experiences, but just 4% said they found the channels were foundational, findable, and valuable.”

Progressive ranks highest in the service segment with a score of 737. American Family (717) ranks second, and Nationwide (716) ranks third.

Auto Club Group (AAA) ranks highest in the shopping segment with a score of 546. Auto Club of Southern California (AAA) ranks second (536), and Erie Insurance (533) ranks third.

The 2024 U.S. Insurance Digital Experience Study was based on 11,086 evaluations and was fielded in January-March 2024.

Images

Featured image credit: Kameleon007/iStock