UPDATED: S&P research finds 70% of vehicles on the road are over 6 years of age

By onMarket Trends

More than 110 million vehicles in the U.S. are between six and 14 years of age, reflecting nearly 38% of the fleet on the road, and that’s expected to continue growing to an estimated 40% through 2028, according to S&P Global Mobility.

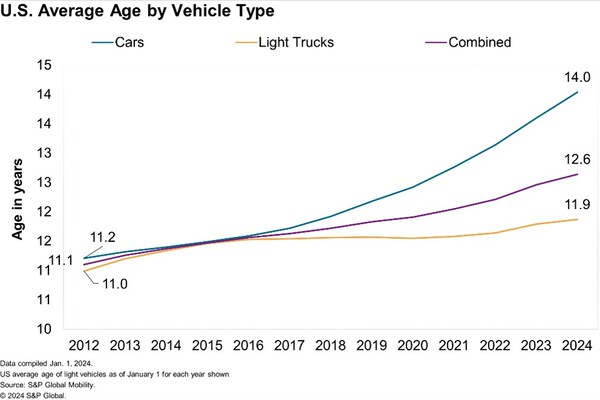

The average age of passenger cars and trucks on the road is still 12 years, up by two months to 12.6 from 2023.

S&P says the increase is showing signs of slowing as new registrations normalize, which continues to improve business opportunities for companies in the aftermarket and vehicle service sector in the U.S., as repair opportunities are expected to grow alongside vehicle age.

“With average age growth, more vehicles are entering the prime range for aftermarket service, typically from six to 14 years of age,” said Todd Campau, aftermarket practice lead at S&P Global Mobility, in a news release. “Consumers have continued to demonstrate a preference for utility vehicles and manufacturers have adjusted their portfolio accordingly, which continues to reshape the composition of the fleet of vehicles in operation in the market.”

Vehicle scrappage rates, S&P’s measure of vehicles exiting the active population, continue to hold steady at two passenger cars scrapped for every new passenger car registration. As of January, the scrappage rate was 4.6%, largely unchanged from 4.5% in January 2023.

Looking at the mix of the fleet, since 2020, more than 27 million passenger cars exited the U.S. vehicle population, while just over 13 million new ones were registered, according to S&P. More than 26 million light trucks, including utilities, were scrapped and nearly 45 million were registered.

The country’s vehicle fleet surged to 286 million vehicles in operation (VIO) in January, up 2 million over 2023.

Vehicles under the age of six accounted for 98 million vehicles in 2019, or about 35% of VIO. Today they represent less than 90 million vehicles and aren’t expected to reach that threshold again until 2028, when they will represent about 30% of VIO, according to S&P Global Mobility estimates. The estimates are driven by the impact of the COVID-19 pandemic and subsequent supply chain shortages that disrupted vehicle supply and registrations following historically high volumes from 2015-2019.

The primary driver of VIO growth will be vehicles in the aftermarket “sweet spot” — those that are six to 14 years old, and older, which are expected to represent about 70% or more of VIO for the next five years. S&P said that the estimate will serve as a tailwind to aftermarket service opportunities.

Electric vehicles on the road also continue to increase, with 3.2 million in operation as of January, according to S&P.

Last year, EV registrations surpassed 1 million for the first time and increased about 52% compared to 2022.

The rate of EV growth was slower than some automakers had anticipated, and there is potential for the average age of EVs to rise in the short term as consumer adoption slows, S&P says.

The average age of EVs in the U.S. is 3.5 years and has been holding largely steady since 2019 with new registrations representing a large share of overall EV VIO, S&P says.

“We started to see headwinds in EV sales growth in late 2023, and though there will be some challenges on the road to EV adoption that could drive EV average age up, we still expect significant growth in the share of electric vehicles in operation over the next decade,” said Campau.

Images

Featured image credit: peeterv/iStock