Focus Advisors: Investors continue to flock to collision industry, many with deeper pockets

By onBusiness Practices | Market Trends

A newly released Focus Advisors report outlines how acquisitions in the collision repair industry are evolving from smaller equity firms that previously faced higher risks, to larger investment firms with deeper pockets.

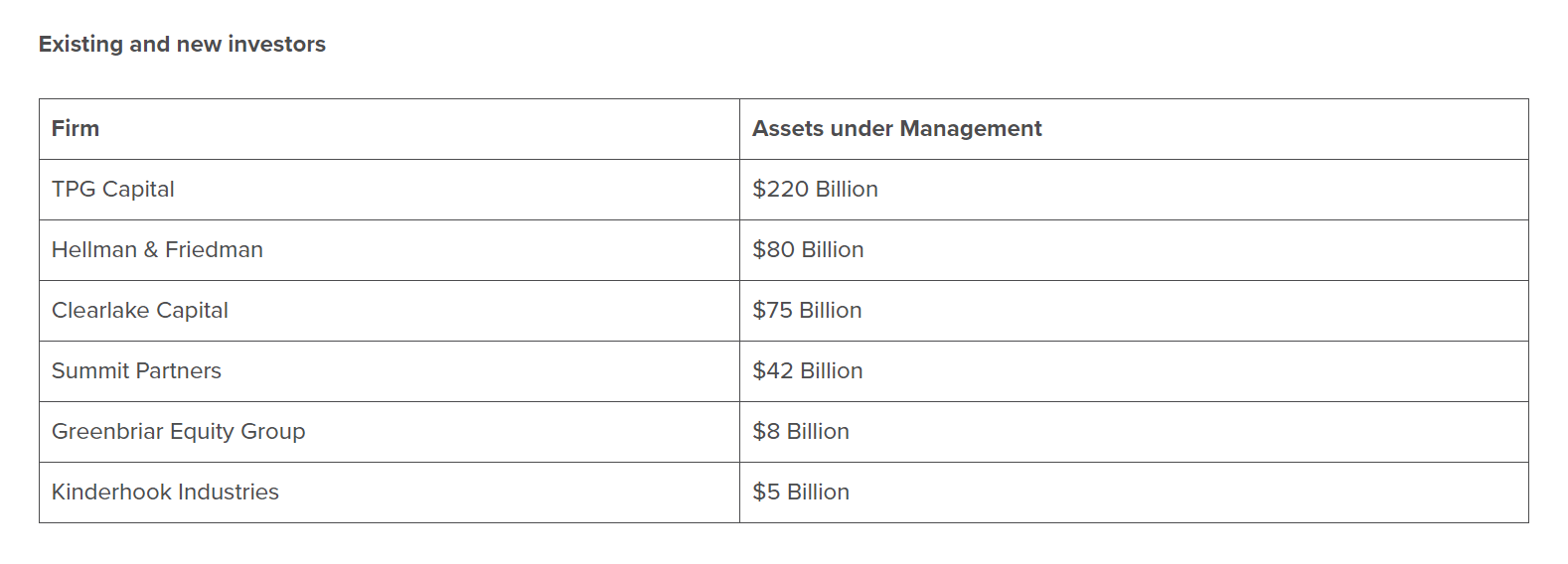

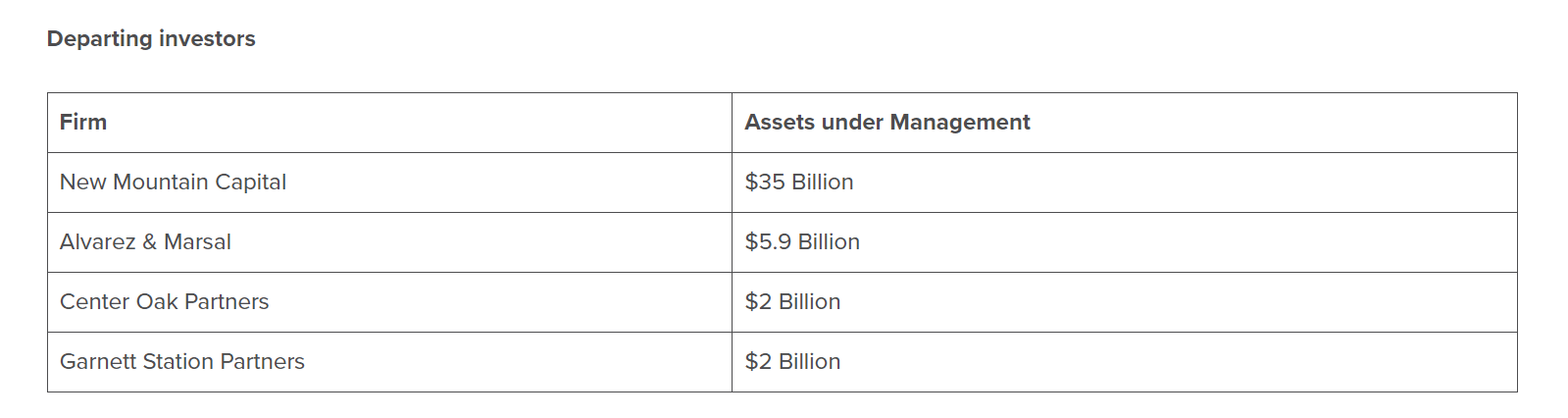

Departing investors held assets ranging from $2 billion to $35 billion, according to the report. In comparison, existing and new investors have assets from $5 billion to $220 billion.

For larger firms entering the market, they likely see a stable model that will continue to bring profits for years to come. This model, built on 25 years of acquisitions, has smoothed out some of the larger risks early investors faced.

“Today the acquisition model is proven.” said David Roberts, Focus Advisors CEO. Twenty-five years ago it was a big question on whether it was going to work. Many of the initial investors bailed out early but the ones who stuck around did really well. Out of those early failures came a much more disciplined model, management, and investors.”

Roberts expects these ownership and investor transitions will continue to prove profitable for investors well into the future.

“Technology is making the industry more complex, not more simple,” Roberts said. “The number of vehicles on the roads continues to increase. While we will have fewer accidents per mile driven, the damage to the vehicle and cost to repair will continue to be high and grow. These investments are not going to disappear. We are a mobile society and there is nothing that is going to displace the industry.”

The large consolidators are likely to transition into entities that are more conventionally valued because of their more predictable revenues and earnings, Roberts said.

“You will see one or more of these players eventually go public,” he said. The smaller MSOs will continue to grow with the help of new investors and eventually combine or sell out to the largest players in the industry.

Data in Roberts’s report supports that bigger investors are taking a seat at the table.

The report says interest rates haven’t slowed down these larger firms from investing in the industry, with $9 billion spent in just the past few months.

Yet the report says the “biggest chunk” of this new capital was $4.6 billion in debt financing by Caliber Collision. Crash Champions also had $1.9 million of debt refinancing and additional raised equity.

New sponsors were needed for other investors, such as Classic Collision, CollisionRight, VIVE Collision, and Kaizen, according to the report.

“Caliber issued new debt to refinance existing debt and fund a significant dividend for the current shareholders,” the report says. “Crash Champions refinanced some short-term debt and raised some additional equity which it is deploying into more acquisitions. The original private equity sponsors of VIVE Collision, Garnett Station Partners, sold to a larger private equity firm, Greenbriar Equity Group, which has significant holdings in the automotive aftermarket sector.”

CollisionRight was sold by CenterOak Partners to larger Summit Partners in January. Since its founding in 2022, CollisionRight has acquired 89 collision repair shops throughout the Central and Mid-Atlantic regions in the U.S.

Summit’s release said it is a global alternative investment firm that’s invested in more than 550 companies.

A few months later, Kinderhook Industries acquired Kaizen Auto Care in partnership with Jacob Tilzer and LNC Partners. Kaizen had 48 locations throughout Arizona, Colorado, Southern California, Iowa, Nebraska, and Nevada at the time of the sale.

It was Kinderhook’s 30th automotive/light manufacturing platform investment, according to a release at the time.

Last Month, TPG, a global alternative asset management firm, announced that it had signed a definitive agreement to acquire Classic Collision, a national multi-store operation (MSO).

TPG, the private equity arm of the $220 billion AUM asset management firm TPG, acquired the business from New Mountain Capital. Classic Collision had 262 locations in 16 states by the time of the sale.

“To put all of this in perspective, the private equity sponsors in the collision repair industry today — both those exiting sponsors and the incoming ones — collectively manage more than $400 billion in managed assets,” the report says. “The private equity sponsors that have recently entered the industry or increased their positions have largely supplanted smaller private equity firms. The most recent transaction, TPG Capital’s acquisition of Classic Collision, introduced one of the world’s largest alternative investment funds to the industry.”

The report says there are multiple reasons why new capital continues to come into the industry even as interest rates remain higher.

“Large private equity firms see an opportunity to accelerate their growth as the availability and cost of their capital vastly exceeds smaller players and independent shops,” the report says. “Another reason is that the increased revenues — driven by higher labor rates and calibration — have positively impacted EBITDA margins, making them more attractive to lenders and new investors. And there’s also the ongoing attractiveness of arbitraging acquisitions. Buying strong single shops and small MSOs at five to seven times EBITDA while raising capital at valuations of 12 to 14 times allows this new capital to effectively leverage their superior capital into faster growth.”

Early private equity investors in the industry have more risks, the report says.

“They are supporting management teams that may not have proven themselves in operating at a much larger scale or buying and integrating multiple targets in a shorter span of time,” the report says. “The playbook for these earlier investors is pretty much the same with a few variations.”

For example, industry veteran Vartan Jerian Jr. honed his executive talents after selling his independent MSO to Caliber, according to the report. He later left Caliber and joined two private equity sponsors and two alumni of other private equity firms.

CollisionRight, sponsored by Center Oak Partners, looked to Rich Harrison who already had experience executing a platform and roll-up strategy at TrueRoad Holdings, according to the report. The company grew to more than $300 million in revenues.

New Mountain Capital grew to $1 billion in revenue within four years under an experienced management team of former ABRA Auto Body Repair executives led by Toan Nguyen.

The early investors who succeed are then able to sell the platforms with less risk and a higher price tag.

“The predictability of cash flows has increased,” the report says. “The management teams are more proven. The costs of acquisitions and greenfields are more stable and the entire direction of consolidation is more clear. And the very large private equity firms are able to write much larger checks – in fact, they need to write larger checks given the size of their funds.”

Focus Advisors says more private equity investors are looking at the industry.

“Focus Advisors tracks more than 120 private equity firms that have examined the collision repair industry,” the report says. “Our team has had direct conversations with more than 100 of them over the past 12 months. Some are already well-informed; others are rapidly coming down the learning curve.”

The success of other private equity firms is attracting others, the report says.

“At the recent MSO Summit, sponsored by Focus Advisors, a large PE firm in attendance queried us, ‘Is it too late to initiate an entry,'” the report says.

Focus Advisors says the industry isn’t without its challenges for prospective investors.

“There are substantially different challenges in collision repair from the more conventional platform/add-on strategies that have worked so well in other industries,” the report says. “In many of these successful roll-up strategies, individual consumers make purchase decisions. But in the collision repair industry, third-party intermediaries — insurance companies — heavily impact the flows of business through Direct Repair Programs. In addition, the technical skill sets required to create superior gross.”

Boyd Group Services Inc. faced a tough Q1 with its net earnings decreasing to $8.4 million compared with $20.8 million in the same period last year.

Timothy O’Day, Boyd’s president and CEO, called the results “disappointing” in the company’s earnings call. He blamed mild winter weather and appraisal volumes declining as used car pricing returned to normal levels, which increased the frequency of total losses.

Repairable claims were down 8% during the first quarter with a greater share of the decline in March, he said.

O’Day followed with a statement that felt hesitantly optimistic about the future.

“While the company expects claims volume and demand for services to normalize as the year progresses, Boyd is prepared to take steps to address the challenges the business is currently facing should the current softer demand continue,” O’Day said. “Boyd has made meaningful progress towards our goal of internalizing scanning and calibration services to drive down cost to our customers and to convert a sublet operation to an internal operation.”

While the Focus Advisors report does mention some struggles investors might face in the industry, it provides a strongly positive future outlook overall.

The report says the company has identified 80 MSOs with five or more shops in its proprietary database. This includes a few $30 million revenue platforms and many in the $15 million-plus range, it says.

“The true scarcity is management teams that are capable of rapid unit growth and attracting the skilled technicians required to staff their platforms,” the report says.

When investors are looking to enter the industry, they need to evaluate the quality of their initial platform investment. Roberts said. Three important criteria are technicians, management and footprint.

Number one is the platform’s workforce. Qualified technicians are in short supply in the industry. Larger firms are able to create apprentice programs that bring more technicians into the workforce, Roberts said.

“Right behind that shortage is experienced management — executives who understand the dynamics of the industry,” Roberts said. “The third, if you have the management and you’ve got the technicians, is the quality of your platform. If an investor wants to reduce its risk, find a well-managed platform with a technician workforce that is really stable and shops that are large enough to allow for growth within an attractive market.”

The report concludes that “many new private equity firms” will enter the market in the next five years. It expects some will invest to build and flip and others will buy and build for the longer term.

Independent MSOs with strong management teams and a stable and growing base of technicians will attract more attention and higher values, according to the report.

Large acquirers will continue to consolidate private equity-sponsored platforms, it says.

Roberts says the ideal client for his firm is a well-disciplined, well-prepared management team.

“The ones who are disciplined tend to have larger shops, 15,000 square feet or larger,” Roberts said. “They create a footprint that is attractive to insurance companies that want to send them vehicles to repair.”

Investors should look for management teams that have excellent financial controls or are willing to take advice on how to improve their operations and financial controls, Roberts said. He said they also should be looking at ways to expand within their own market.

“There are really bright people that are more impulsive in the way they make acquisitions,” Roberts said. “They might acquire one and then go 400 miles away and acquire another one and it makes it difficult to manage. Contiguous markets are the best way to grow in control.”

IMAGES

Photo courtesy of SmileStudioAP/iStock