TDI shares timeline for appraisal data report, hearing shows continued support for mandatory right to appraisal

By onInsurance | Legal

The Texas Department of Information plans to release a report in October on its recent call for appraisal data from the state’s top 10 insurance companies.

By July 12, insurance companies must submit both aggregate and claim-level data of each completed appraisal for July 2020-June 2021, July 2021-June 2022, and July 2022-June 2023.

A hearing held June 11 by the House Committee on Insurance included testimony regarding the right to appraisal.

Many car insurance policies include an appraisal clause that policyholders can invoke to have a third-party appraisal done when they don’t agree with their carrier’s valuation of their vehicle or damages. Low valuations often lead to improper indemnification for loss, and in some cases can lead to total loss determinations on vehicles that could otherwise be fixed. Both the carrier and the policyholder hire an independent appraiser and if the appraisers can’t agree, an umpire is selected to make the final decision.

TDI Property & Casualty Deputy Commissioner Mark Worman told the committee that nearly every residential property and personal auto insurance policy in Texas includes an appraisal clause but a few companies have, in recent years, asked for TDI’s approval to restrict or eliminate it from their policies.

“Unfortunately for us, there’s not a lot of publicly available data to help us understand what all is going on in the process and how the process works so in April of this year, we sent out an appraisal data call to gather some information,” Worman said.

Associations, lawmakers, and lobbyists have attempted to pass legislation to make the right to appraisal mandatory for several years, including during the last legislative session when a bill supporting the move died in the Senate.

David Bolduc, Office of Public Insurance Counsel (OPIC) public counsel, testified last week that OPIC views an appraisal as the status quo. In January 2023, OPIC recommended to the state’s legislature that the right to appraisal on insurance claims be a mandatory part of policies.

“During the [2023] session, we recommended that you mandate appraisal in personal auto and residential property policies,” he said. “Since the last session, we’ve had six insurers filing provisions that would restrict the right to appraisal. We objected to all of them. They’ve all been withdrawn… We’re going to keep pushing on it. It will be in our legislative recommendation again.”

Committee member Rep. Mary Ann Perez (D-District 144), who has authored at least one bill that supports the right to appraisal, said it’s typically unheard of for claimants to have an independent appraisal done until around the past seven years.

“It’s catching on and people are like, ‘No, this is not fair,'” she said.

However, Perez added, insurers aren’t required to pay the award within a certain timeframe.

Ches Bostick, vice president of the Texas Association of Public Insurance Adjusters (TAPIA), said the right to appraisal being used on auto claims is increasing. He estimated they make up 40% of independent appraisals in the state.

“Appraisal today is anything but fast and inexpensive,” Vostick said. “It’s not uncommon for an appraisal to take a year or more to resolve. And to make matters worse, the associated fees to the appraisers and umpires often range into the tens of thousands of dollars. As a result, some carriers are beginning to exclude the process from their policies and/or make it optional for themselves.

“In those cases, policyholders are left with no other option but to hire an attorney, and most won’t, and often end up settling their claim for less than they may be entitled to… TAPIA believes that appraisal should be part of the insurance policies covering real and personal property in Texas. Rather than doing away with it, we believe that it can be salvaged by adding some guardrails and timeframes.”

Texas Watch Executive Director Ware Wendell said the advocacy organization continues to see the biggest need for third-party appraisal in auto insurance.

“Auto is twice the size of the homeowners market, and we have very limited remedies as policyholders,” he said. “Cars are very complicated. It’s very hard to get an attorney to take a property damage claim. You’re left with either taking what the insurance company offers, which oftentimes is too little to do that repair safely, or taking it through appraisal. If companies are allowed to take that out of the policy, we eat the cost, repairs are not made safely, and our roads become more dangerous.”

Last year, Texas Watch analyzed 1,246 auto insurance claims settled through independent appraisers. They found that, across all auto insurance claims, the appraisal award was an average 40% higher than the insurance offer.

On average, the appraisal award for repair claims was $5,307.35 higher than the carrier’s offer and total loss claims were $3,889.27 more. Appraisals increased settlement amounts by 131% on repair claims and 26% on TLs, on average.

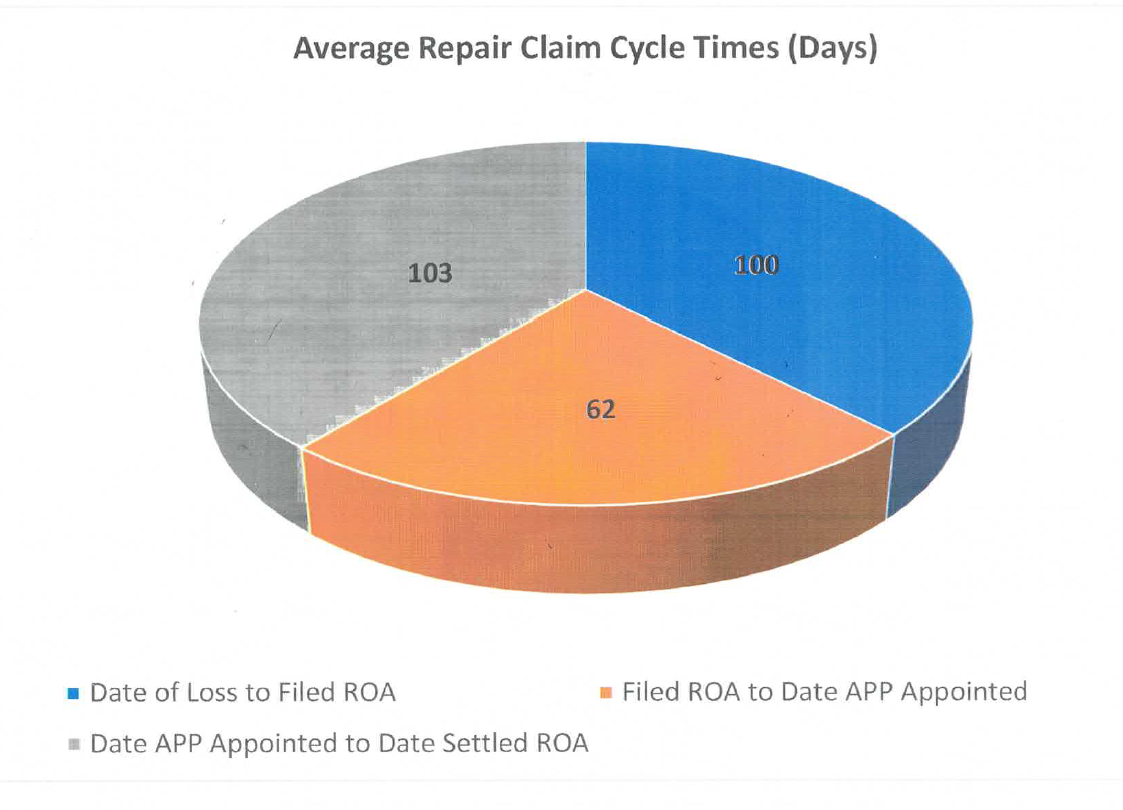

Robert McDorman, public insurance adjuster and general manager of Auto Claim Specialists, shared some of his claims data with Repairer Driven News. The data shows it takes, on average, 62 days from when an appraisal is requested to when an appraiser is appointed.

Once an appraiser is appointed, it takes an average of 103 days from the date an appraiser is hired to the date of settlement under the third-party appraisal process.

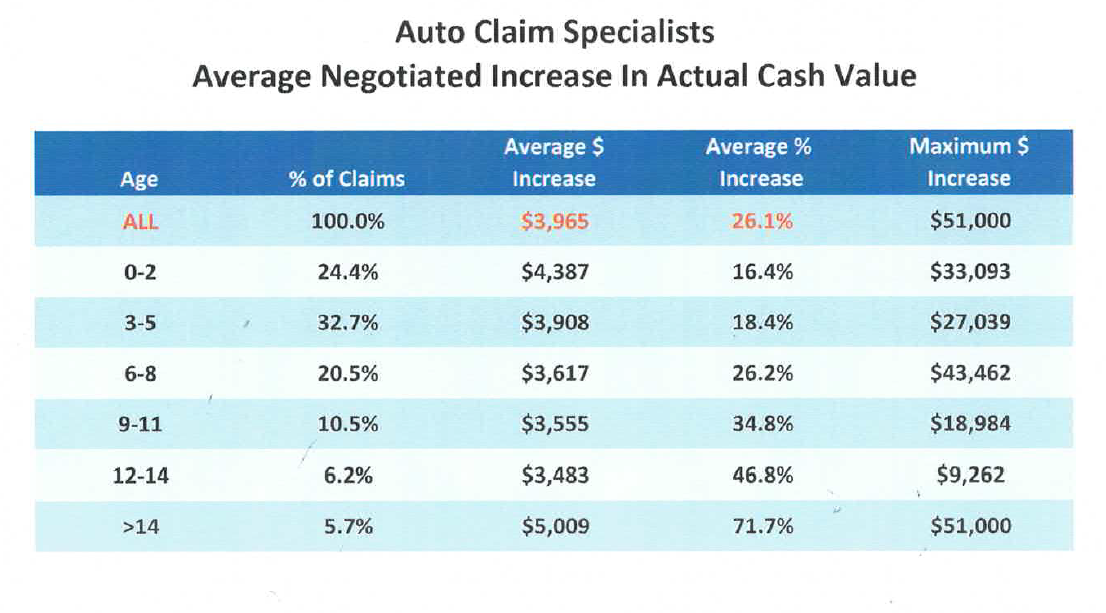

Auto Claim Specialists recover 26.1% more than what insurance companies offer, according to data McDorman shared with RDN:

The data also shows that it typically takes 42 days to settle a total loss claim.

McDorman said Auto Claim Specialists will give its data to TDI for its requested data call.

“Our industry must understand this pervasive activity,” McDorman said. “The limiting or removing of the right to appraisal in a repair procedure claim is the nail in the coffin for safe roadways. It has become apparent both sides see the need for appraisal and just need to bang out the right deal.”

John Wud, vice president of the American Adjuster Association, testified during the June 11 hearing that TDI should stop approving insurance policies that include “self-serving” appraisal clauses.

“Improper appraisal of claims is like a ‘get out of jail free’ card that eviscerates the rights policyholders have under the common law of Texas, the insurance code, and the laws of Texas,” he said. “It is too easy to put a self-serving appraisal clause in the policy that gets approved by TDI, and the insured is deemed to know what’s in their policy even if they never got a certified copy from their agent.

“The carrier could intentionally delay a claim for years, force the insured to litigate, and then invoke appraisal in response to the lawsuit. A lot of courts will say the case is abated until you go through this appraisal process. And then by merely complying with the appraisal clause that they wrote and paying the appraisal award, case dismissed. There’s no dispute anymore. The carriers escape liability under the consumer protection laws of Texas for everything they did wrong.”

Jon Schnautz, state affairs vice president for the National Association of Mutual Insurance Companies, was the only person to provide testimony against the right to appraisal.

“I’m not sure it’s very good public policy to be mandating that appraisal be present in all policies for all types of disputes,” he said. “What we tried very hard to get comfortable with at the end of last session was something like what was in the final Senate version of your bill [HB 4194] that really just got to what started this whole conversation in the first place which is, is appraisal available or not? Hard stop. Settle that issue.

“Frankly, we don’t like that either… But if you’re going to do something here, we feel like that’s the part that would be the easiest to do and the most justified by what we know right now.”

Images

Stock photo credit: sefa ozel/iStock