Texas Watch digs into undervalued repairs & TLs, 3rd party appraisals 40% higher than carrier offer

By onCollision Repair | Insurance

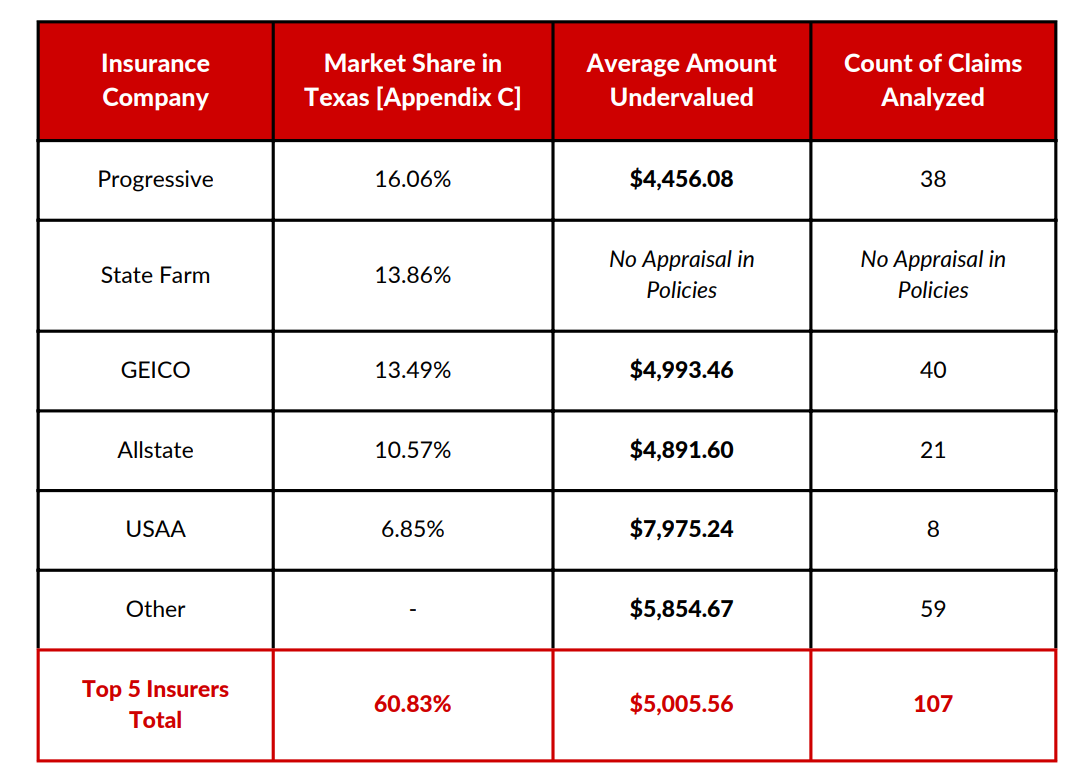

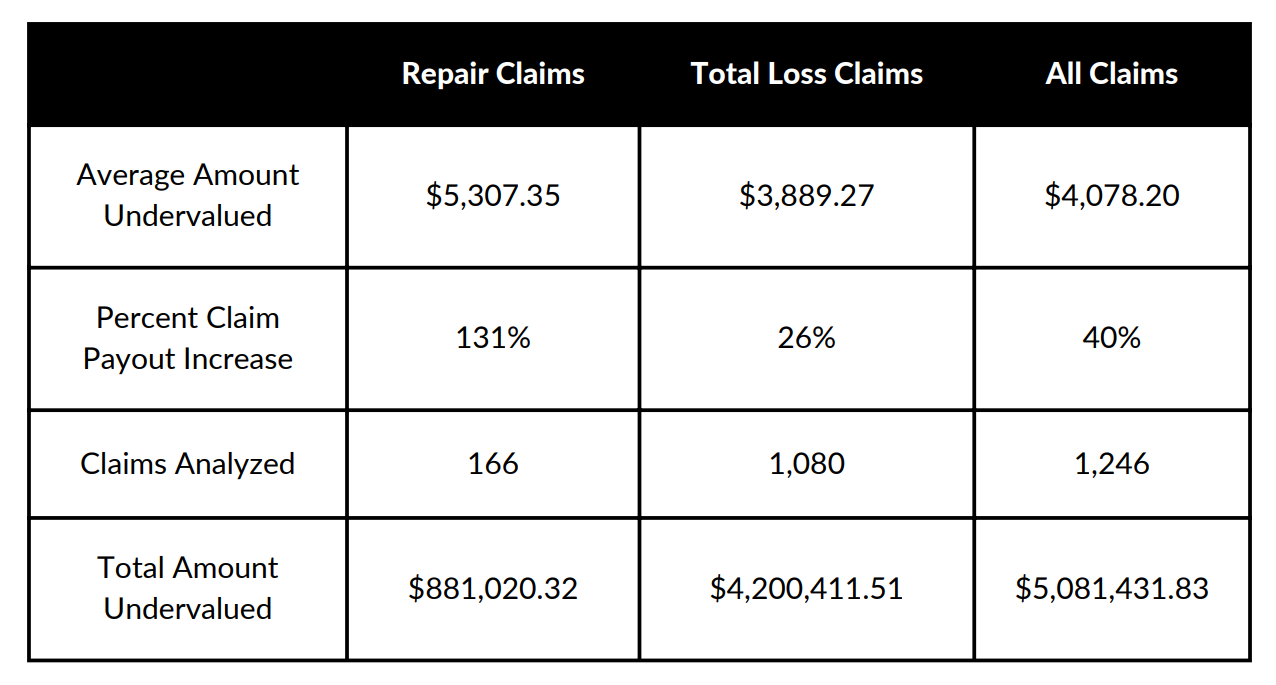

As part of its advocacy for the mandatory right to appraisal in Texas, consumer advocacy group Texas Watch analyzed 1,246 auto insurance claims settled through independent appraisers. They found that, across all auto insurance claims, the appraisal award was an average 40% higher than the insurance offer.

Many car insurance policies include an appraisal clause that policyholders can invoke to have a third-party appraisal done when they don’t agree with their carrier’s valuation of their vehicle or damages. Low valuations often lead to improper indemnification for loss, and in some cases can lead to total loss determinations on vehicles that could otherwise be fixed. Both the carrier and the policyholder hire an independent appraiser and if the appraisers can’t agree, an umpire is selected to make the final decision.

The claims analyzed by Texas Watch were gathered from five Texas auto appraisers and 28 collision repair facilities.

On average, the appraisal award for repair claims was $5,307.35 higher than the carrier’s offer and total loss claims were $3,889.27 more. Appraisals increased settlement amounts by 131% on repair claims and 26% on TLs, on average.

“Too often, insurance companies undervalue repair or total loss claims,” Texas Watch wrote in its 14-page report. “The right to a fair auto insurance appraisal allows consumers to hire an independent, third-party appraiser if there is a dispute about the amount it will take to repair the car or the value of the total loss. However, some insurance companies are trying to remove the right to a fair appraisal from policies.

“Too often, insurance companies undervalue repair or total loss claims,” Texas Watch wrote in its 14-page report. “The right to a fair auto insurance appraisal allows consumers to hire an independent, third-party appraiser if there is a dispute about the amount it will take to repair the car or the value of the total loss. However, some insurance companies are trying to remove the right to a fair appraisal from policies.

“Without the right to a fair auto insurance appraisal, Texans will be forced to pay out of pocket to repair their vehicle safely, or corners will be cut on repairs, resulting in unsafe vehicles on our roads. …For the everyday Texan who needs a safe car to go to work or take their kids to school, paying thousands of dollars because the insurance company lowballed the offer to repair the vehicle is devastating.”

In January, the Texas Office of Public Insurance Council (OPIC) noted in its recommendations report to the legislature that the appraisal clause should be mandated because it is “increasingly concerned with restrictions on appraisal in policy forms filed by top insurers.”

In the current legislative session, HB 1437, sponsored by Rep. Travis Clardy (R-District 11), has been introduced in the House along with its companion bill SB 554 sponsored by Sen. Bryan Hughes (R-District 1) to amend the state’s insurance code to ensure the accuracy of repair estimates within Texas auto policies, which is consistent with OPIC’s recommendation. Both bills are in committee.

Bills were considered in the state House and Senate during the 2021 legislative session that Texas Watch says “would have streamlined the appraisal process and made it fair” but after passing in the House, the companion bill stalled in the Senate.

It was the general standard in Texas for auto insurance policies to include an appraisal clause until 2014 when State Farm sought approval from TDI to remove the clause from its policies. Approval was granted in 2015. Only one other insurer, GEICO, has sought approval to remove the clause since then, in 2021, to which the Texas Office of Public Insurance Council (OPIC) filed an objection with TDI. The insurer’s request was denied in July for failure to address TDI’s questions.

According to the claims analyzed by Texas Watch, claims have been undervalued by the highest amount, over $8,000, in West Texas. Next is South Texas by more than $7,000 then North and East, both by more than $5,000. Central Texas claims are undervalued by more than $2,000. Appraisal awards were more than carriers’ offers across the state by $3,300 to more than $4,100.

Specific to repair claims across the state, undervalued amounts from carriers varied from $2,000 or less to more than $10,000. Forty of the 160 claims that Texas Watch looked at were undervalued by $4,000-$6,000 and another 50 were undervalued by $2,000-$4,000. Around 15 of the 160 were undervalued by $10,000 or more.

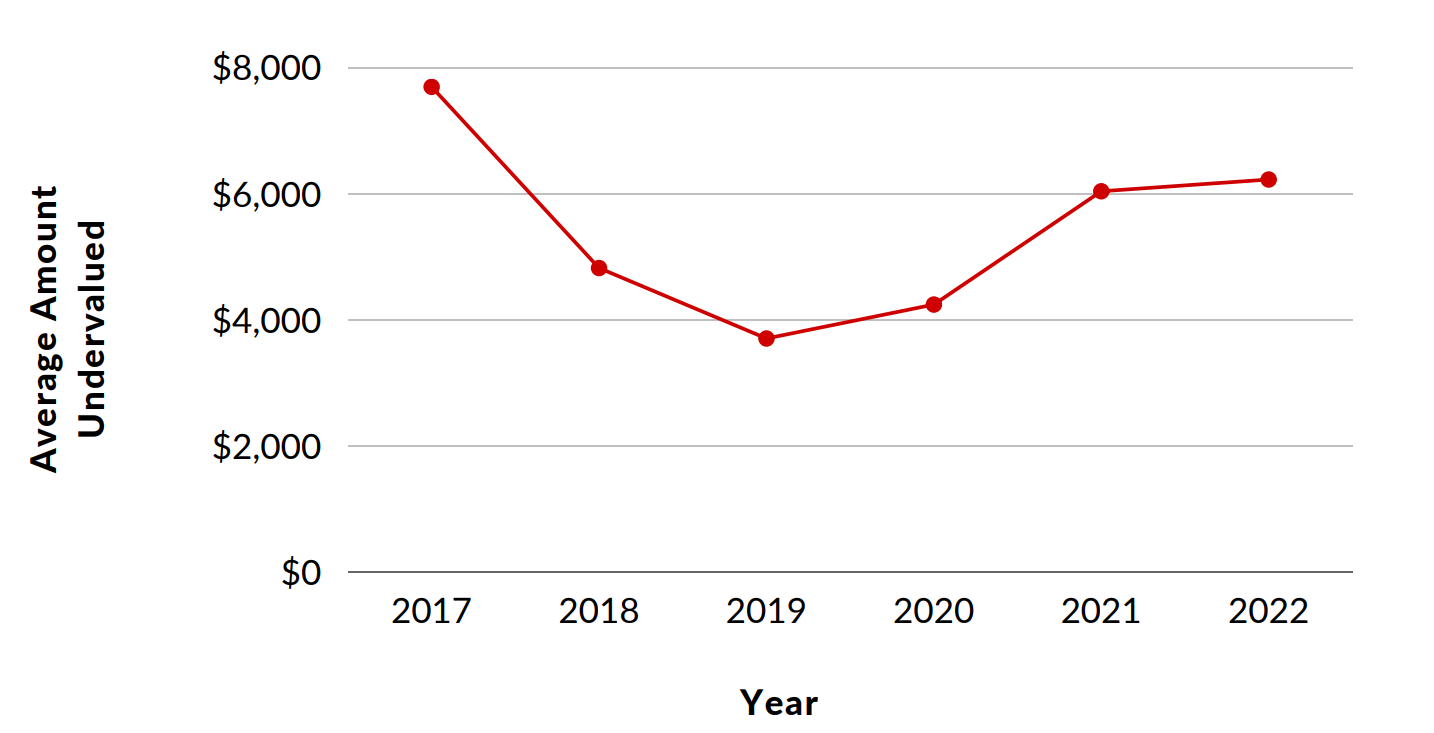

While claims aren’t undervalued by as much as they were in 2017, Texas Watch found that the average has been steadily increasing since 2020 after dipping in 2018 and 2019. The difference between insurance offers and appraisal awards also decreased in the same years and began rising again in 2020, hovering around $5,000 in 2022.

Texas Watch is also advocating for widespread education about the existence and use of the appraisal clause. Texas Watch’s Director of Organizing Kelly Taft called dozens of policyholders who experienced an issue with their carriers during vehicle repairs or assessing their total loss valuations.

Only four people told Taft that their carrier told them about their policy right to appraisal Thirty-four said their carriers didn’t tell them about the appraisal process. Some were upset that their longtime insurer didn’t educate them about the appraisal process to resolve their dispute, according to Taft.

Images

Featured image credit: Leonid Eremeychuk/iStock

All graphs and charts courtesy of Texas Watch