Progressive accused of denying appraisal clause and violating New Hampshire insurance code

By onInsurance

An actual cash value dispute between a New Hampshire resident and Progressive recently ended with policyholder Mike Hamel’s right to invoke the appraisal clause in his policy being trumped by state law.

The pickup truck was “pristine” before the collision and had only 30,000 miles on it, Hamel said. He was offered $32,955.35.

When Hamel disagreed with the settlement amount, he found out he could have an independent assessment done. Hamel sought assistance from independent appraiser Billy Walkowiak who confronted Progressive. He also reviewed Hamel’s policy and found that he had the right to appraisal. Hamel, like many other policyholders, didn’t know he had that option.

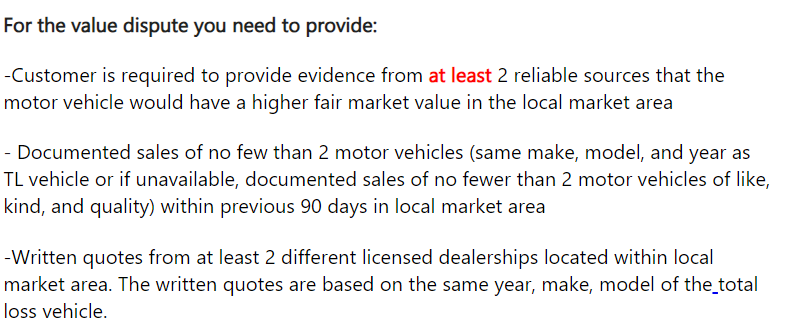

When Hamel attempted to do so, Progressive said in an email that the appraisal clause isn’t in its New Hampshire policy so per state law (Ins. 1002), the total loss dispute process includes:

“I went online and it was hard to find a vehicle like mine anywhere in this 50- to 60-mile radius that was like mine — same year with the same features in it… They kept saying, ‘That’s not comparable to what you have,’ including what my independent insurance agency gave them. They said, ‘No, no, it doesn’t fit the bill.’”

Progressive then allegedly denied the comparable vehicles Hamel found, he said.

“I ended up giving up because I couldn’t find anything online that matched or any dealership that was willing to help me out. They knew they had me over a barrel… I thought it was worth around $38,000 being in the shape that it was in.

“I relented and signed the title over because I got tired of arguing back and forth and emails. They wore you down and New Hampshire law doesn’t help.”

Walkowiak contends Progressive acted in bad faith and in violation of New Hampshire law by not honoring Hamel’s insurance contract.

Hamel also contacted the New Hampshire Department of Insurance. He was told to follow the same process under Ins. 1002.

Hamel said he considered filing a complaint about Progressive’s handling of the claim with the DOI but decided not to since he surmised they would provide the same response they had already given — what his option is under state law.

“If things could have been different as far as state law goes then I could have challenged them with another assessor,” Hamel said. “The two [appraisers] could agree that it would go before an arbitrator and he would make the final decision, but they take that all away from you.

“I just get tired of the insurance companies nickel and diming. I’m going to get right out of Progressive. I’m going to find somebody else. I’m going to drop all my insurances that I’ve had with them for years and move to somebody else.”

Repairer Driven News contacted Progressive and the DOI with questions about the claim and the state’s insurance code. Neither provided answers by the publication deadline.

New Hampshire shop owner Steven Piispanen told RDN he believes state law hinders policyholder rights. He has filed complaints with the DOI about dealings with insurers on his customer’s claims and was told the DOI doesn’t have jurisdiction to intervene in “contract disputes,” rather the courts do.

The department investigated at least one complaint filed by Piispanen about State Farm and no regulatory violations were found, according to email correspondence between Piispanen and the DOI.

“In New Hampshire, basically, the insurers can… break the insurance contract with no fear because they know that the NH DOI will not do a thing,” Piispanen told RDN. “It is up to the insured/claimant to take the insurer to court. The DOI has no jurisdiction over policy disputes, which appears to be the problem on your claim.

“The insurers know that they have the money and resources to battle and bury the claimant/insured that do test the court system which makes me wonder why the NH DOI even exists… the DOI and insurance practices, I feel, are unethical and need to be corrected. There is a lack of enforcement from the DOI.”

Washington Insurance Commissioner Mike Kreidler recently fined Allstate $25,000 for mishandling an auto insurance claim.

OIC said the fine was the result of a consumer complaint it received about a low estimate from the insurance company. The OIC also discovered Allstate incorrectly stated that a right to appraisal could not be invoked after repairs had been made, failing to conduct the appraisal in a timely manner.

In Texas, the Department of Insurance (TDI) called for the submission of vehicle appraisal data by July 12 from personal auto insurance companies to determine how often they’re used and their impact on claims.

TDI said it’s collecting this information because while appraisal is widely allowed in policy forms, they’ve found insurers don’t routinely collect and report appraisal data. The data call also includes residential property insurance. TDI plans to release a report in October.

Legislators and the Auto Body Association of Texas have tried for several years to mandate the right to appraisal, as recent as earlier this summer.

Images

Photos are of Mike Hamel’s Ram pickup truck post-collision (Provided by Mike Hamel)