Inflation playing role in paint and material costs, up by average 7.4% during Q1

By onCollision Repair | Market Trends

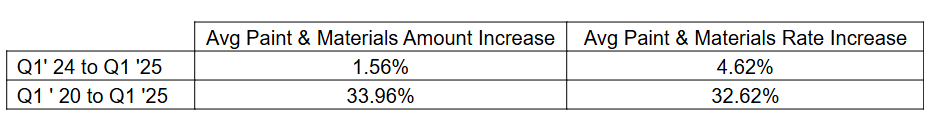

So far this year, collision repair customers have seen weighted average paint and material (P&M) costs increase by an average of 7.4%, according to company announcements from the five major refinish brands.

Paint material increase announcements tracked since Q1 2020 have resulted in an additional average cumulative increase of 59.6%. During a July 2022 Collision Industry Conference (CIC) meeting, a committee report indicated that material costs had risen 43.9% from 2017-2022. The committee additionally reported that paint and material reimbursements were only 18.5% higher than in 2017, at the time, remarking on the glaring distortion between cost and reimbursement.

Letters sent out by industry P&M companies between October and December 2024 and in March of this year attribute the cost increases to the challenging economic climate, sustained cost increases, inflationary pressures, and labor, operating, and shipping costs.

Effective Q1 2025, individual company refinish increases ranged between 6.1% and 9.4%.

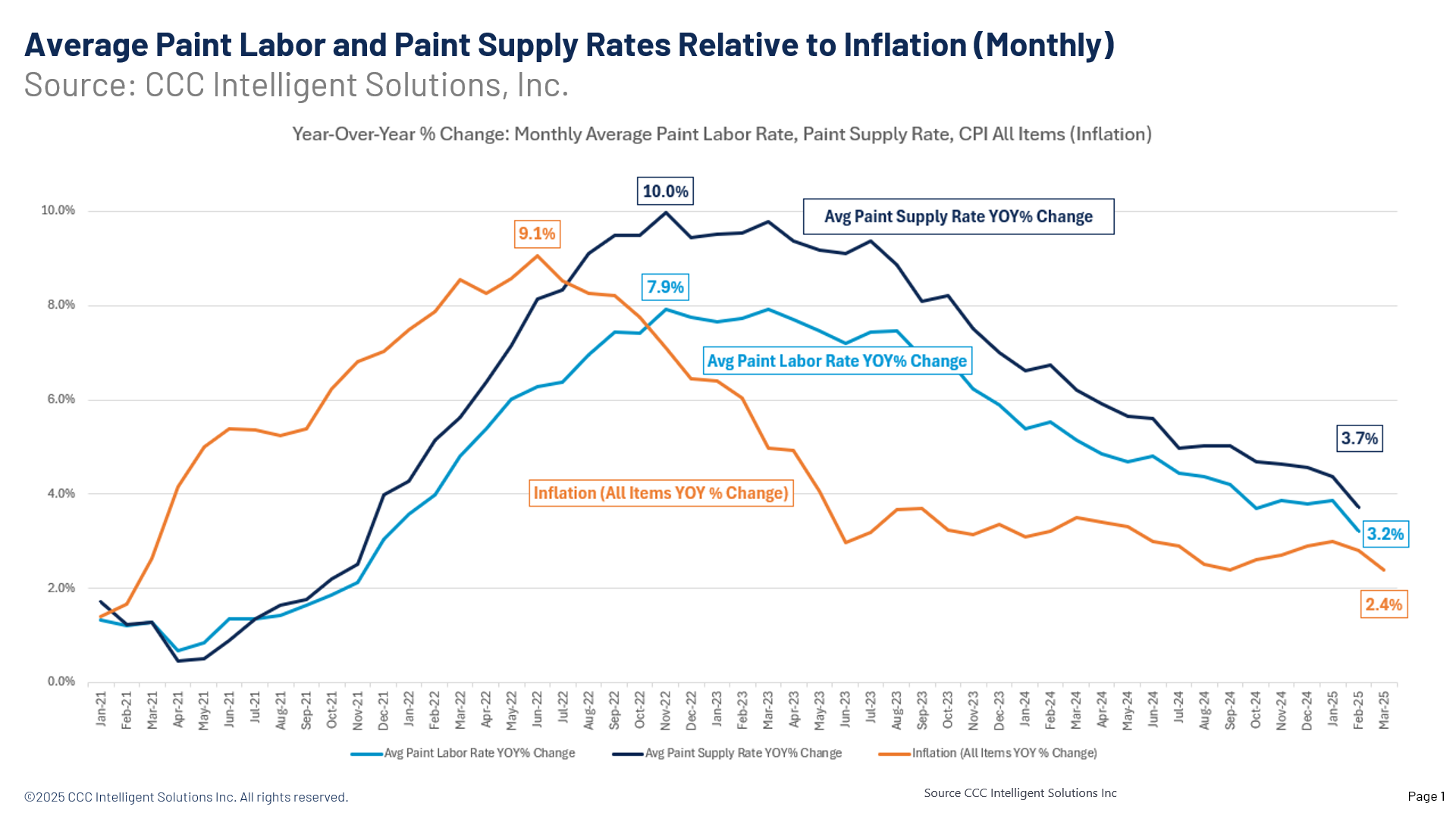

According to Kyle Krumlauf, CCC director of industry analytics, the paint supply rate increased by 5.4% in 2024, following an 8.7% increase in 2023. And paint supplies represented 7.8% of repair costs last year, up from 7.7% in 2023.

Paint labor accounted for 11.9% of repair costs in 2024, up from 11.8% in 2023, according to Krumlauf’s data. Both average labor rates and paint labor rates were up 4.5% in 2024. Average labor also increased 7.5% in 2023, and paint labor increased 7.1% that year.

Ryan Mandell, Mitchell International’s Auto Physical Damage Solutions claims performance director, said that while inflation currently contributes to P&M increases, it’s not a new trend.

“I think there’s definitely an inflationary aspect to this, and I think it’s been at play for some time,” he said. “When you look at the supply chains, most of these companies are using, at least to some degree, a large amount of chemicals from China. That means that those are going to be subject to not only inflation that we’ve seen in the past, because you’ve got shipping that has to take place, but they’re going to be more subject to future inflation.

“Many of the isocyanides that are used in those paint formulations come from China, so with the heavy tariffs that are being placed on Chinese imports, that’s a huge concern.”

Mandell shared with RDN that costs also depend on where paint is formulated; something he predicts paint manufacturers will look at very heavily.

As newer vehicles come to market, three-stage refinishes become more likely, which adds more labor and material costs, he said.

“One of the biggest shifts this year was inflation, which drove the cost of motor vehicle insurance up by 51% (since 2022), causing consumers to become more selective about filing claims for minor damages,” the report says.

Mandell said cycle times have steadily improved over the last couple of years, primarily from working through shop backlogs from a year ago.

“That’s steadily improved as claims volumes have declined,” he said. “Total loss frequency has been a lot higher these last few quarters as vehicle values have come down.”

And the potential for more supply chain disruptions could cause shops to lean more heavily into repairing parts, he said.

According to Mandell’s data, there hasn’t been a marked shift in P&M reimbursement practices.

Results from the latest “Who Pays for What?” refinish survey show a large increase in a mix of materials calculator and multiplier method to calculate charges for refinish materials.

Mike Anderson, Collision Advice president, said he thinks the mixed use of methods is due to multiple paint price increases in recent years.

“I think the invoicing method for materials is going to become increasingly important as we start to see more three-stage and four-stage finishes, as well as more LUTs (limited use toners) that shops may not stock because they are only infrequently used and/or have limited shelf life.

“I believe the shift toward invoicing will continue, and that the trend toward using the paint scale to create invoices will continue as more paint companies integrate their scales and systems with the shop management systems.”

Twenty-six percent of shops said in the survey that they always use a materials calculator, while 20% of those who use both methods said they usually use their materials calculator.

Thirty-seven percent use only the multiplier method. Eighty-four percent of those who use this method said they charge $40-$60 per refinish hour. The national average is $50.

Images

Featured image credit: Ruslan malysh/iStock

Graphs provided by CCC and Mitchell International