Fla. court: Glass shop meets burden of proof for ‘prevailing competitive price’ win over GEICO

By onBusiness Practices | Insurance | Legal | Market Trends

Hillsborough County, Fla., Judge Miriam Valkenburg ruled earlier this year that GEICO had breached its contractual obligation to reimburse 11 claimants for a “prevailing competitive price” on auto glass repair.

She ordered the insurer to pay a few thousand dollars the insurer refused to cover on 11 windshield replacement bills from Kissimmee, Fla.-based auto glass shop Glassco.

GEICO has since appealed the Aug. 20 ruling in Glassco (assignee of J. Bazan et al) v. GEICO to the state’s 13th Circuit.

Glassco, which had obtained assignments of benefits from each of the policyholders, had filed a breach of contract lawsuit against GEICO.

According to one of the policies filed as an exhibit, GEICO has stated that the physical damage liability to the insurer “Will not exceed at the time of loss the prevailing competitive price, which is the price we can secure from a competent and conveniently located repair facility, to repair or replace the property, or any of its parts, including damaged glass, and including parts from non-original equipment manufacturers, with other of like kind and quality and will not include compensation for any diminution of value that is claimed to result from the loss. Although you have the right to choose any repair facility or location, the limit of liability for repair or replacement of such property is the prevailing competitive price which is the price we can secure from a competent and conveniently located repair facility. At your request, we will identify a repair facility that will perform the repairs or replacement at the prevailing competitive price.”

Both GEICO and Glassco had argued the other side carried the burden of proof on the “prevailing competitive price” issue. Valkenburg said they raised this issue too late to get a pretrial ruling and agreed to lay out their cases knowing she could apply it either way post-trial.

Valkenburg ultimately agreed with GEICO that the glass shop held the burden of proof — but she said based on the evidence, Glassco would have won either way.

Presuming the outcome isn’t overturned on appeal, the case seems to offer some valuable lessons for auto body shops and consumers considering breach of contract litigation on similar insurer short-pay scenarios. It suggests the policyholder/shop assignee will face a burden of proof threshold and provides an example of how to meet this burden.

GEICO cited Auto Glass America (Nielson Cordero) v. GEICO, which saw the Hillsborough County Court ruling in 2018 that Auto Glass America to have the burden of proof. In other words, it’d fall upon the shop to prove its bills fell within the “prevailing competitive price.” If it can’t make a strong enough case, GEICO wins.

“In all breach of contract actions, the burden of proof is on the Plaintiff to prove by the greater weight of the evidence, all of the elements of a breach of contract, and an indispensable element of such a claim is the element of damages,” Hillsborough County Judge Herbert Berkowitz wrote in the Cordero case.

Meanwhile, Glassco unsuccessfully cited cases including 2014’s State Farm v. Curran and 2002’s St. Paul Mercury Insurance v. Coucher, to try and stick GEICO with the burden of proof on the grounds of it using an affirmative defense. An affirmative defense involves a situation where a defendant agreed it has done the cause of action but was justified or had an excuse in doing so. As noted above, Valkenburg didn’t agree with that argument but said GEICO wouldn’t have met that burden if she did.

“Defendant did not present any evidence to either establish the ‘prevailing competitive price’ or to rebut the Plaintiff’s establishment of same,” Valkenburg wrote.

The Glassco victory largely hinged on the 2018 13th Circuit appellate ruling in GEICO v. Superior Auto Glass (Matthew Dick et al) and Certified Windshield (George Hart) — a potentially landmark 2018 decision for collision repairers, auto glass shops and consumers in Florida.

The 13th Circuit of Florida ruled in 2018 that “prevailing competitive price” truly had to be competitive. The amount an insurer and network shop had negotiated in a closed market didn’t count. The 3-0 decision also held that a shop’s price alone didn’t automatically count as “prevailing competitive.”

Meeting the burden of proof: Glassco

Glassco brought witnesses including its owner John Bailey, Bond Auto Glass co-owner Michael Slaman and Lloyd’s of Shelton Auto Glass owner Shelton Radebaugh. They testified how they established prices.

“Mr. Slaman, Mr. Radebaugh, and Mr. Bailey all testified that in determining pricing, they consider: a) cost of the material/glass (b) labor and (c) the cost of kits (urethane adhesive, clips, molding). All of these costs vary depending upon the make, model, year of the vehicle, and the number of kits used during the replacement of the windshield,” Valkenburg wrote. “The established prices for windshield services are also based on their experience in the glass industry, the market, and their competitors. Their testimony reflects that the prices invoiced are also set by considering the amount that the majority of insurance carriers will accept and pay without dispute.”

Slaman and Radebaugh said Glassco’s pricing was similar to others in the market.

“Mr. Bailey, Mr. Slaman, and Mr. Radebaugh also testified regarding the acceptance of their invoiced pricing by the majority of insurance carriers in the market. Mr. Slaman and Mr. Radebaugh testified that, considering the 50-60 insurance carriers they invoiced, in 2016 90-95% of the invoiced prices were accepted by the carrier(s) and were paid in full. Mr. Bailey also testified that in 2016, of all of the invoices his company submitted to its customers, (approximately 100 insurance carriers it billed), 95% of the invoiced prices were accepted and paid in full without dispute. Further Mr. Bailey testified that the pricing is negotiated in that the invoices are submitted to the customer and the company accepts the invoiced price and pays the bill in full or rejects the invoiced pricing.”

Valkenburg also added an eyebrow-raising footnote: “The Court notes the term ‘customer’ as used by the witness in this context is a reference to the insurance carriers not the insureds. The witnesses’ testimony reflects that cash transactions for these services are virtually non-existent. The transactions almost always involve insurance carriers and the insured is not shown the pricing that will be billed to the insurance company.”

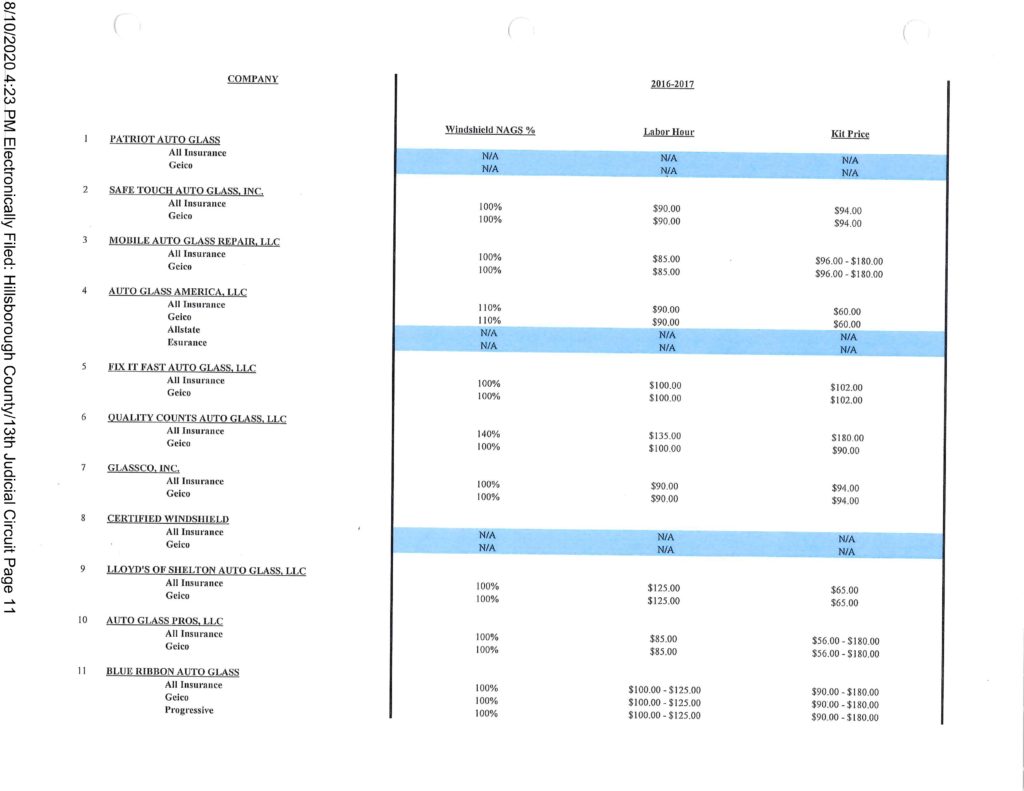

Glassco also called Auto Damage Experts owner Barrett Smith as an expert witness. Smith offered an expert opinion that Glassco’s prices were competitive and prevailing, citing his experience and a survey of 24 glass shops’ pricing. “His findings also revealed that Glassco’s prices were at the lower range in the market,” Valkenburg wrote.

For its part, GEICO called continuing unit examiner Susana Eberling.

“Ms. Eberling concluded that GEICO paid according to the ‘prevailing competitive price;’ however, she did not provide any testimony relative to the establishment of the ‘prevailing competitive price’ or to rebut Plaintiff’s evidence with regard to establishment of the ‘prevailing competitive price,'” Valkenburg wrote. “Much of Ms. Eberling’s testimony related to GEICO’s relationship and glass pricing agreement with its affiliate SGC/Safelite.”

Geico counsel also argued that the glass market wasn’t a normal arms-length transaction because there was no true customer-facing price competition.

“All three fact witnesses testified that the insured isn’t shown the prices on the invoices but they are submitted — that they are submitted to the insurance company,” GEICO attorney Joseph Nall said in closing arguments, according to a transcript.

“… Competition is not pulling the price in these cases. None of the prices, either those witness here today or those in Mr. Smith’s survey, can be said to be born from competition. Nothing about Bond Auto Glass’ prices would cause and insured to say, “oh, maybe not,” and go now the road to call Glassco, because the insured pays zero. So there’s simply nothing competitive about price.”

Not meeting the burden of proof: Cordero

The Glassco litigation provides an example of how a shop or policyholder would successfully present the repairer’s price as a “prevailing” one able to meet the burden of proof.

The Cordero case GEICO used demonstrates an argument insufficient to meet this goal. (The shop had originally appealed the decision, but it and GEICO ultimately settled the case.) For that reason, it’s worth reviewing as well.

According to Berkowitz, Auto Glass America only brought one witness, owner Charles Isaly.

“Mr. lsaly testified in detail how the Plaintiff set its prices,” Berkowitz wrote.

However, the judge found that the shop only presented evidence of its own prices and success in having its bills reimbursed by insurers — including the defendant GEICO. But that alone isn’t enough, according to Berkowitz.

“These summaries address only what the Plaintiff has charged for certain jobs and what it has been paid for certain jobs by various insurance companies, including this Defendant,” the judge wrote. “These summaries, as presented in this case, provide no explanation as to why any of these bills were paid. Although some notations indicate that they were paid after litigation began, We do not know why those particular bills or claims were paid. We cannot tell from these summaries whether these payments were made as a result of unrelated business decisions by any of the various carriers, or whether these carriers had the same or different limits of liability provisions. We do not know whether other claims went unpaid, nor can we tell what percentage of the relevant market is represented by these summaries.”

Auto Glass America needed to demonstrate what others in the market were charging, Berkowitz said.

“These summaries do not establish whether the Plaintiffs charge for the services rendered in this case was competitive in the relevant market,” the judge wrote. “These two exhibits provide only a picture of Plaintiffs success in having his bills paid, but do not establish what his competitors charge for similar services. …

“Plaintiff offered no other evidence of what the service at issue in this case would cost in such a market. Plaintiff offered no competitive or prevailing market price evidence at all, and no evidence of what the services at issue would cost in an arms’ length transaction as contemplated by the Matthew Dick opinion. Rather, the only evidence offered by Plaintiff is what Plaintiff itself chooses to charge in insurance transactions.”

Images:

Hillsborough County, Fla., Judge Miriam Valkenburg. (Provided by 13th Judicial Circuit of Florida)

GEICO is highlighted at the November 2016 Miami International Book Fair. (David Alexander Arnavat/iStock)

Glassco in Glassco (assignee of J. Bazan et al) v. GEICO called Auto Damage Experts owner Barrett Smith as an expert witness. Smith offered an expert opinion that Glassco’s prices were competitive and prevailing, citing his experience and a survey of 24 glass shops’ pricing. Part of this survey is shown here. (Provided by Hillsborough County, Fla., Court)