The Composites Institute and Toray Composites on Tuesday called for industry partners to suggest research into how to cut the cost of structural automotive carbon fiber by 15 percent.

This could hasten the shift of mainstream cars — or at least luxury/sports ones — into carbon fiber, which some experts have called an inevitability. (See coverage here and here.)

Carbon fiber comes in as stronger and lighter than steel and aluminum — but more expensive.

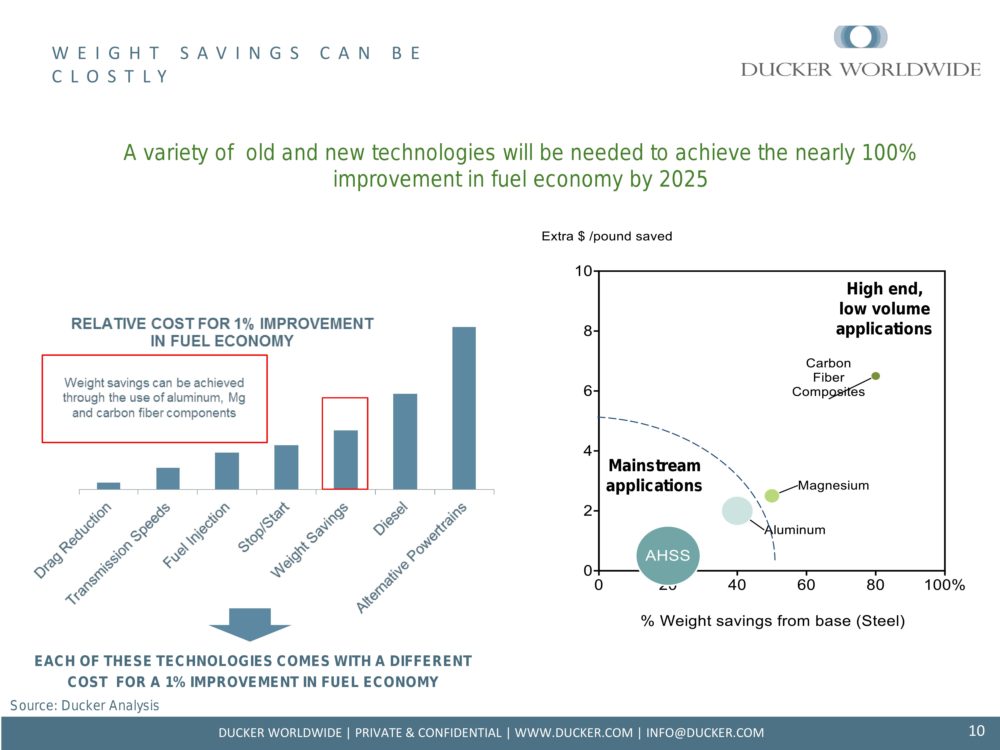

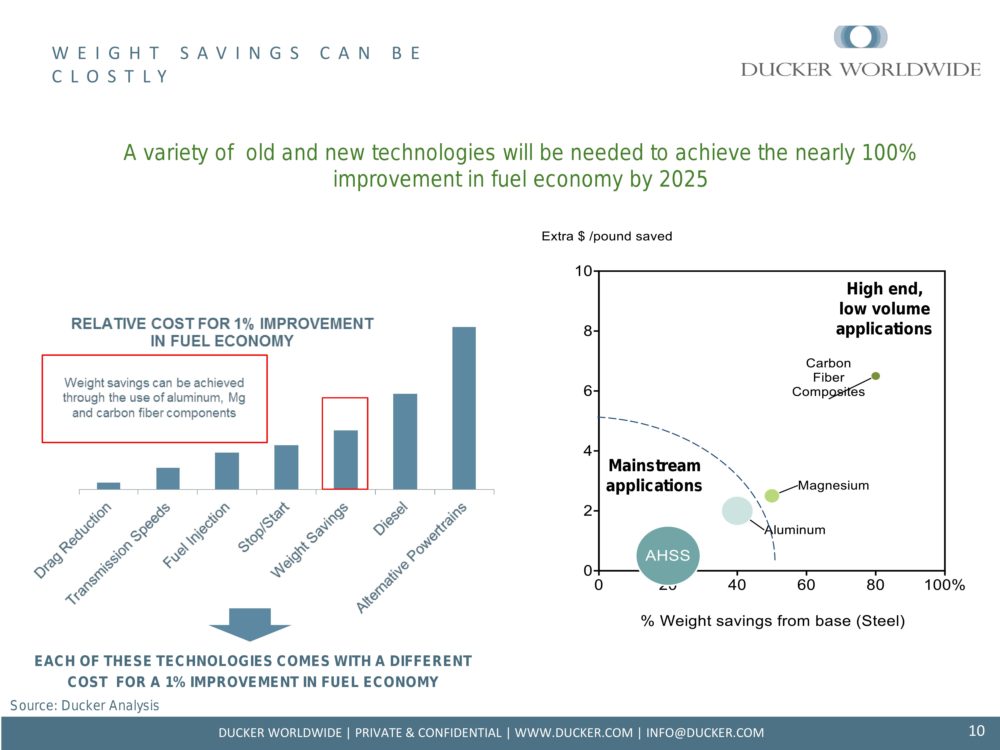

The cost factor has kept the competitor structural and exterior substrates the materials of choice for meeting CAFE fuel economy (demanding light cars) and crash test standards (demanding strong vehicles).

“By partnering with industry to solve composite materials manufacturing challenges, we’re advancing clean energy innovations that will help United States vehicles to meet energy saving CAFÉ standards required in 2025,” institute CEO Craig Blue said in a statement Tuesday.

Production time is another barrier to automotive carbon fiber usage, and the project will work on both issues.

“Project conclusions are expected to positively impact automotive manufacturing by optimizing high speed processing and advancing (recycling) of automotive parts,” the institute wrote in a news release.

On Friday, the institute announced it would team up with Peninsula College to create the Composite Recycling Technology Center in Port Angeles, Wash. The facility, which has the goal of growing aerospace carbon-fiber recycling, will collaborate on the automotive composite project as well.

Other collaborators include the American Composites Manufacturers Association, Globe Machine Manufacturing, Janicki Industries, Michigan State University, Reichhold and Zoltek.

Any ideas suggested by the research will be tested on a flat carbon-fiber panel (different from an automotive panel). The study will seek a “supply chain, ecosystem-based approach to integrate material selection, molding methods, and preform design patterns with waste stream utilization,” according to the institute.

The institute called companies “eager to submit project proposals to leverage IACMI resources and collaborate with members on the deployment of high impact advanced composites,” since the organization was created in 2015 by the Department of Energy, University of Tennessee and 121 other colleges, nonprofits and businesses. The feds put in $70 million; everyone else put in another $180 million to create the new hub in the government’s National Network for Manufacturing Innovation.

Industry partner Toray is the world’s largest carbon fiber producer, says it can replace all kinds of car parts with composites and has worked with OEMs before. In February, it announced it would collaborate with Toyota on carbon fiber recycling, and the two companies teamed up on what Toray boasted in 2014 was the first carbon-fiber structural automotive part, on the Toyota Mirai.

Last year, it bought 55 percent of Italian automotive carbon fiber producer Delta and announced it would double production of large-tow carbon fiber with automotive and wind applications.

In January, Toray broke ground on a $1 billion Spartanburg, S.C., facility to supply Boeing with carbon fiber. The location was announced in February 2014.

Now, if Spartanburg, S.C., sounds familiar, it’s because BMW’s 5 million-square-foot manufacturing plant producing the X3-X6 vehicles sits there.

And BMW, you might recall, really likes carbon fiber and according to the Nikkei Asian Review in late 2014 tapped Toray and subsidiary Zoltek for more of the material.

So it would seem like a convenient pair of neighbors — in fact, it’d be more convenient proximity than the Spartanburg Toray plant has with its actual primary customer: the Boeing plant in North Charleston, located on the other side of the small state.

More information:

“IACMI Announces Project to Reduce Cost of Carbon Fiber Automobile Structural Parts”

Composites Institute, July 5, 2016

Toray automotive carbon fiber interactive

Toray

Images:

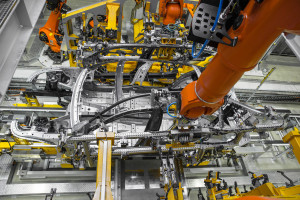

Carbon fiber can be found in the 7 Series’ B- and C-pillars, rocker panels, roof bows and rails, transmission tunnel and rear deck of the 7 Series, which will be built in Dingolfing, Germany. (Provided by BMW)

This Ducker Worldwide analysis (slightly distorted) shown in an SAE webinar indicates the various costs of different lightweighting materials. (Provided by Ducker Worldwide)

Share This:

Related