Looking for collision repair job candidates? Here’s 3 insights into what they want

By onAnnouncements | Associations | Business Practices | Education

We know what auto body shops are looking for in job skills. But what do the candidates want?

That question grows more and more crucial as collision repair makes forays into regional and national job boards, most recently with the SCRS Career Center announced Thursday. (That board leverages a national job posting network that includes the Auto Care Association and SEMA; check it out here.)

We talked to Collision Repair Education Foundation director of development Brandon Eckenrode (whose organization is also piloting an auto body job board) to find out a little more about the job market from the perspective of a candidate.

Here’s three things we learned. Tips for crafting a job ad can also be found on SCRS’ site.

Relocation

A fledgling technician in Alaska can log on and see a job in Florida. But would he or she apply?

It’s not unprecedented in technical careers — see the boom in populations once a factory is established or an industry like fracking or mining has boom times — but is it feasible for collision repair? ABRA’s willing to pay room and board for out-of-state students willing to attend its academy in Minnesota, so they certainly haven’t ruled out that possibility.

Eckenrode estimated that college students and those with family connections would be more inclined to move, but as far as a general rule of thumb, “we don’t have specific numbers” on distance.

However, he noted that it’s been a “good conversation-starter” at CREF career events in colder climates to point out that jobs could be found somewhere warmer. A job seeker’s “eyes light up a little bit” sometimes.

“I wouldn’t say it’s the majority, by any means,” he said.

He estimated that candidates might be open to relocate within a state, but it probably varies.

Career path

CREF is working on a more rigorous study of candidate perceptions of the industry, but “from what I’ve kind of heard,” candidates like to see a “mapped out career path.”

They want to know that they’re not going to be sweeping for two years, that there’s room for advancement, he said.

“Obviously, they need to earn that right,” he said.

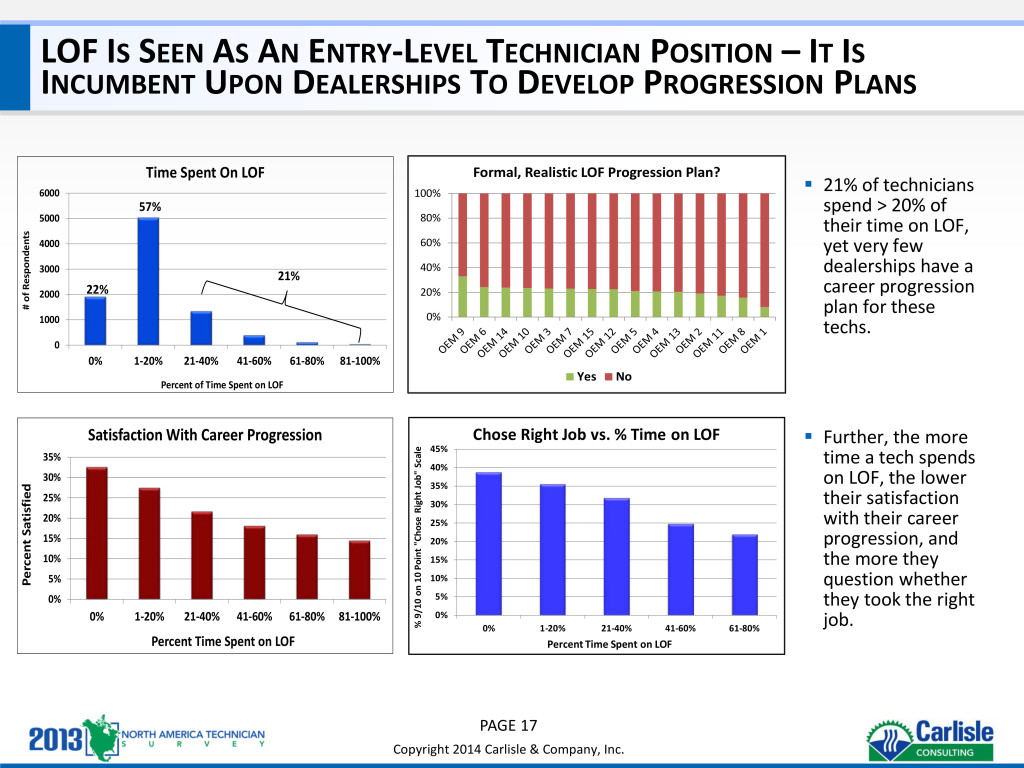

Carlisle & Co.’s 2013 survey of technicians raised the same point, and while it involved mechanical repairers, the lesson seems to be the same.

Carlisle founding partner Harry Hollenberg told Automotive News’ Fixed Ops Journal spinoff that dealerships don’t do enough to promote and develop techs who find themselves stuck in entry-level lube, oil and filter type jobs for years.

Carlisle found that 21 percent of technicians spent more than 20 percent of their time in that scut work,

“yet very few dealerships have a career progression plan for these techs.”

“Further, the more time a tech spends on LOF, the lower their satisfaction with their career progression, and the more they question whether they took the right job,” Carlisle also wrote.

Competitive pay

Not only could you lose such an uninspired prospective or existing employee to a competitor, but you could lose them to another industry altogether.

Eckenrode said that “constantly battling with other technical trades” was a big problem for recruitment.

He gave the example of a industry shown-and-tell type meeting at a national school counselors conference he attended.

About 90 percent of technical trades attended, and “a lot of those industries” pay more.

A welding department, for example, could pay $20 an hour. When a technically minded person weighs that against a collision job paying $10-12 an hour, the decision is easy. Even fast food pays more than body shops in some areas.

“We’re losing,” Eckenrode said, and the industry needed to take “a good hard look at” its pay.

The median salary for employees in the auto body and glass repair industry nationally was $19.17 per hour, or $39,880 per year, according to the Bureau of Labor Statistics’ Occupational Outlook Handbook. So on a national basis, it doesn’t sound so bad. (It’s unclear if this statistic includes concepts like piece rate.)

But if your shop falls in the bottom 50 percentiles of that bell curve and is in a market where other industries are paying more, it’s easy to see how you’d start running into the issues he’s describing. Plus, Eckenrode’s on the ground with these kids and other industries and can see market-to-market what’s occurring on a practical basis.

More information:

SCRS (also SEMA and Auto Care Association), Sept. 1, 2016

“2013 AUTOMOTIVE TECHNICIAN SURVEY SUMMARY OF FINDINGS”

Carlisle & Co., February 2014

Collision Repair Education Foundation Collision Repair Careers pilot job board

CREF, 2016

Automotive body and glass repairer forecast

Bureau of Labor Statistics Occupational Outlook Handbook, 2014-15

Images:

Students attend a Collision Repair Education Foundation job fair in Saint Louis, Mo. (Provided by CREF)

Staying in lower-tier work like lube, oil and filter without promotion chances can disillusion technicians, Carlisle found in 2013. (Provided by Carlisle & Co.)

Students attend a Collision Repair Education Foundation job fair in Seattle, Wash. (Provided by CREF)