Correction: CCC, Mitchell, LKQ report aftermarket parts gains

By onBusiness Practices | Market Trends | Repair Operations | Technology

Recent Mitchell, CCC and LKQ data all point to a slight uptick in aftermarket parts usage.

LKQ

LKQ Chief Financial Officer Varun Laroyia said last week that much of the company’s impressive first-quarter 2017 organic growth stemmed in large part from sales of batteries — a demand created by the winter weather — and certified aftermarket parts.

“Both are lower-margin products, which diluted the overall margin profile,” he told analysts on a first-quarter 2017 earnings call last week. (Special thanks to Seeking Alpha, whose transcript of the call helped us quickly confirm what was said and check quotes.)

LKQ posted organic growth of 6.5 percent in North America, “well ahead of expectations,” CEO Dominick Zarcone said on the call. The company’s new deal to distribute batteries for FCA made up about 1 percentage point of that growth, he said.

CCC only found collision and liability claims up 0.8 percent nationwide between January and March, which means LKQ was doing far better than the market even excluding the new battery deal.

“Interestingly, the revenue growth was in our traditional crash parts,” Laroyia said, giving examples of bumpers and grilles.

Zarcone said the company’s core aftermarket products were “well north” of the 5.5 percent growth, while recycled parts were in the “lower single digits” of growth.

Unexpectedly severe winter weather left some areas’ body shops “full up” and “incredibly focused on cycle time,” according to Zarcone. He said this “no doubt” shifted demand from recycled parts to aftermarket options.

“Organic growth for the aftermarket parts outstripped that of salvage parts as the repair shops were looking to improve cycle times given the increased volume of work they were processing,” Zarcone said. He said LKQ typically can get an aftermarket part to a shop faster — even sometimes the same day as it was ordered.

Automotive glass posted double-digit growth “which was terrific,” Zarcone said. This was likely a reference at least in part to the aftermarket glass business LKQ retained from its PGW purchase.

“Paint was flat,” Zarcone said. Paint accessories like sandpaper and body filler were down, and cooling products were also negative, according to Zarcone.

Zarcone said LKQ felt alternative part usage was “trending up, just a little bit at a time, but every little bit helps.”

Overall, parts and service revenue in North America was up 8.6 percent for LKQ.

LKQ also has a larger number of parts for sale, Zarcone said.

“Importantly, we continue to see increases in our total aftermarket collision SKU offerings, as well as the total number of certified parts available, each growing 6.7 percent and 13.8 percent respectively in the first quarter,” he said.

Zarcone also noted that the first quarter saw LKQ buying a distributor of aftermarket radiators and related products.

“During this quarter, we tempered the volume of our acquisitions, primarily to digest what we had acquired in 2017, but not closing the door on attractive acquisition opportunities,” Zarcone said. He said the company saw “a robust pipeline of opportunities to acquire businesses that fit with our growth strategy.”

Mitchell

Earlier in April, Mitchell reported that the average number of aftermarket parts on Mitchell repairable estimates increased in the fourth quarter of 2017.

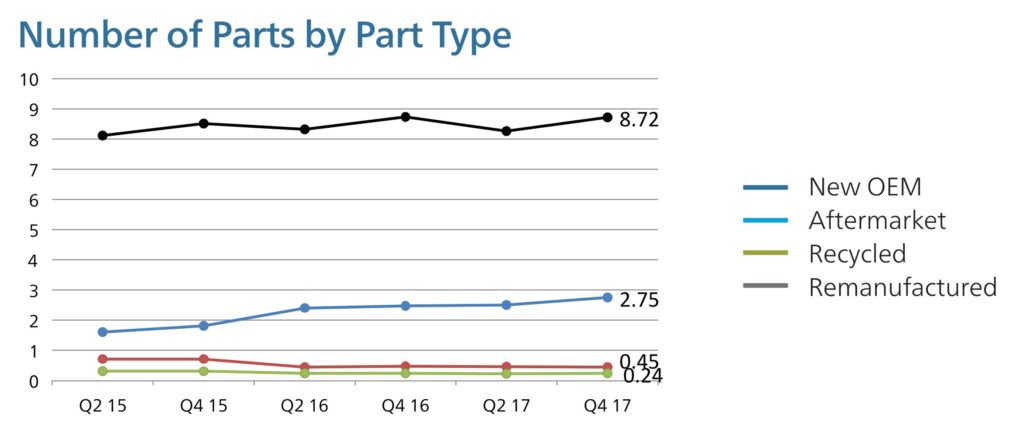

“In comparing Q4 2017 to the same quarter in 2016, aftermarket parts usage increased to an average 2.75 parts per estimate, while new OEM parts usage was flat,” Mitchell wrote in its first-quarter 2018 Industry Trends Report.

Mitchell found an average of 8.72 new OEM parts on each estimate, and barely any remanufactured or recycled parts in the fourth quarter. However, it pointed out ‘that a very large number of RECYCLED ‘parts’ are actually ‘parts-assemblies’ (such as doors, which in fact include numerous attached parts and pieces).”

“Thus, attempting to make discrete comparisons between the average number of RECYCLED and any other parts types used per estimate may be difficult and inaccurate,” Mitchell continued.

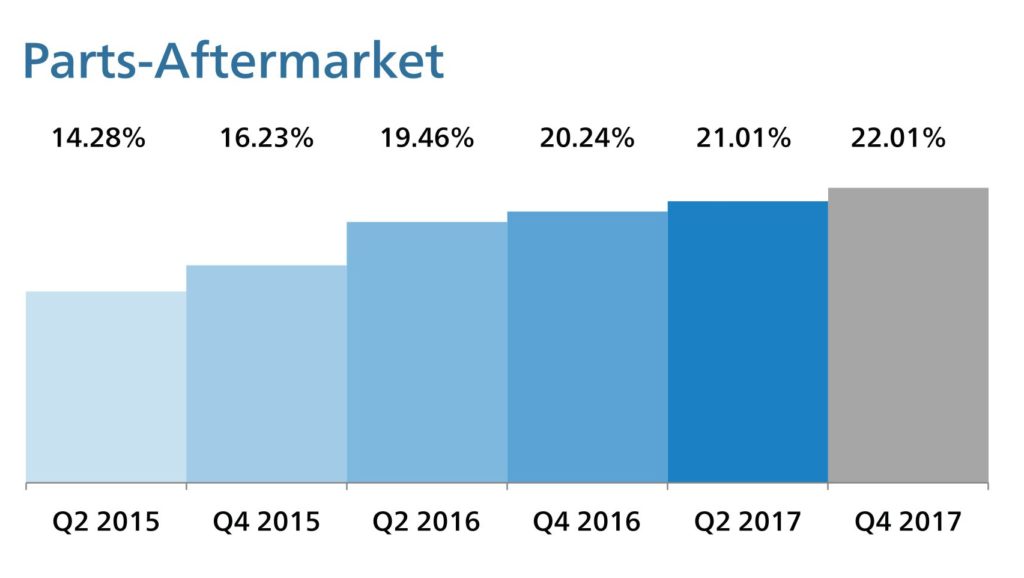

Mitchell also found the proportion of parts dollars tied to aftermarket parts grew 1.77 percentage points to 22.01 percent in the fourth quarter.

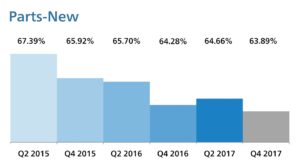

New OEM parts fell 0.39 percentage points to 63.89 percent of all parts dollars. Recycled parts dropped 1.1 percentage points to 10.27 percent of the overall parts spend.

CCC

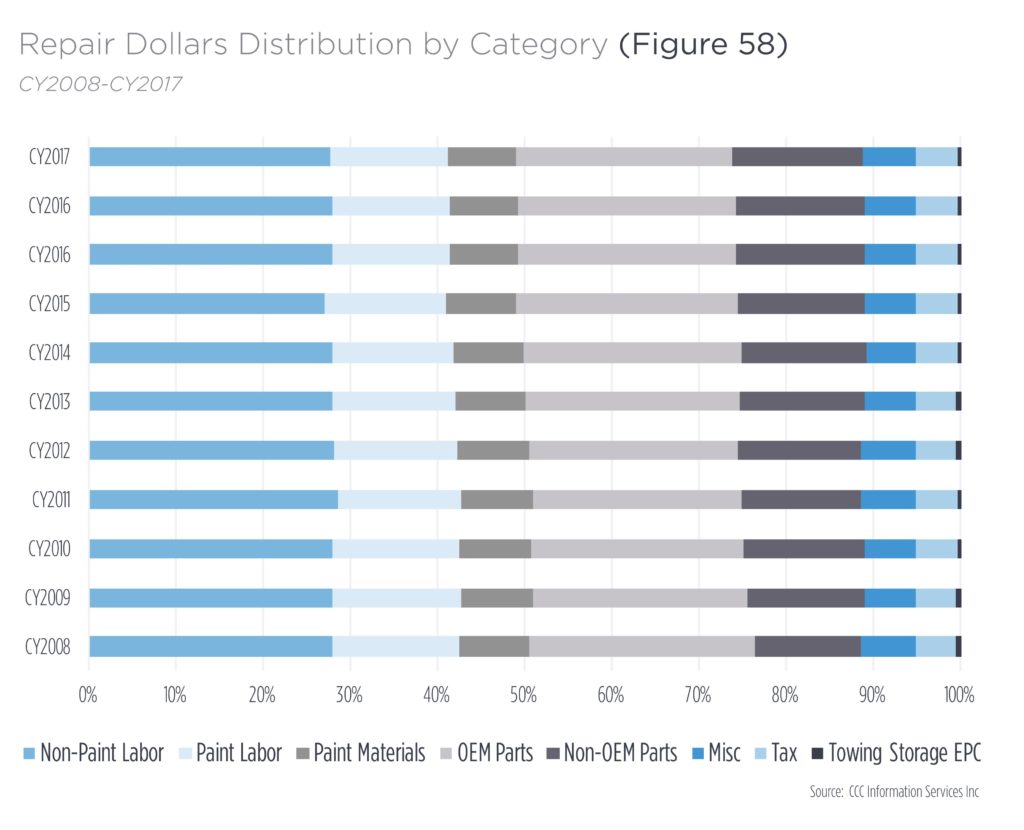

CCC appears to have tracked a similar overall parts spend breakdown of overall parts, based on its 2018 “Crash Course” released in March.

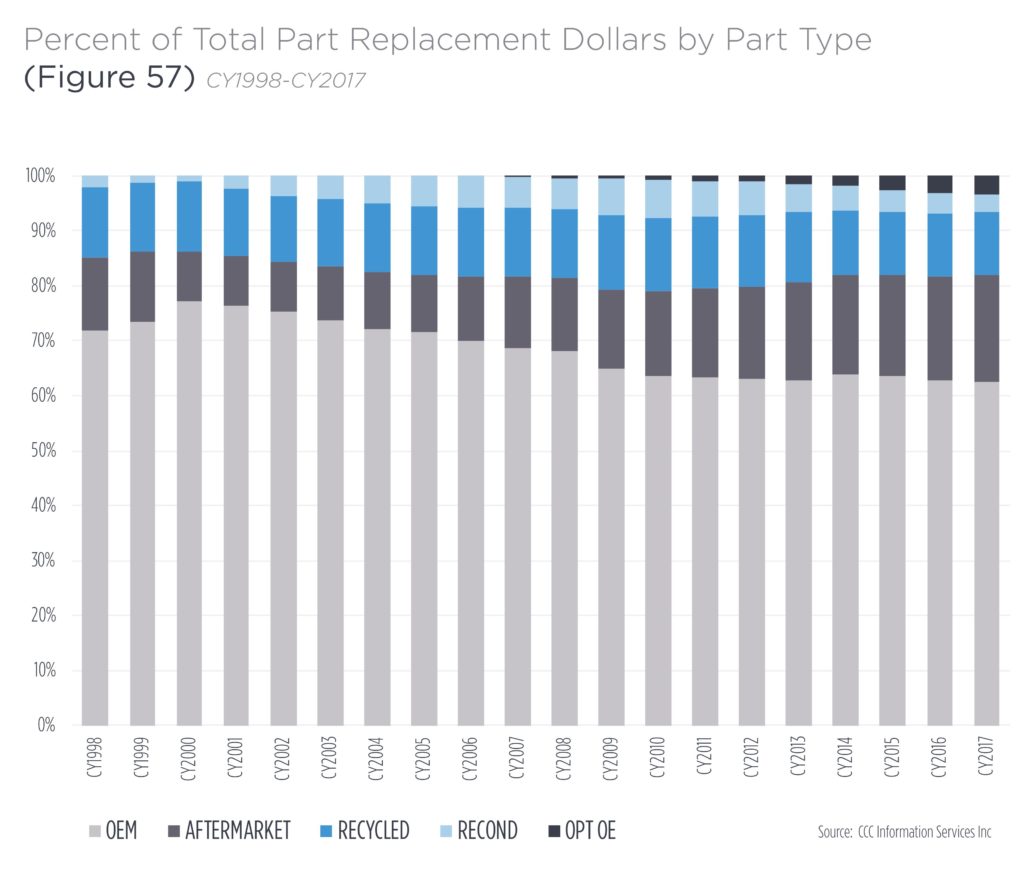

“Alternative parts utilization continued to grow in 2017 with slight increases in both aftermarket and recycled part utilization,” CCC wrote, referring readers to the chart below.

The number of parts replaced per repairable estimates in CCC rose to 9.52 per appraisal in 2017, up from 9.43 parts in 2016. About 62.5 percent of the parts spend went to OEM components versus 62.9 percent in 2016. The average number of OEM parts replaced per appraisal moved up from 6.51 in 2016 to 6.53 in 2017.

When a vehicle cracks 7 years old, OEM parts fall to a little more than 50 percent of the overall parts spend, according to CCC — reinforcing LKQ’s opinion of its sweet spot vehicle ages.

Correction: An earlier version of this report contained incorrect information regarding CCC’s 2018 “Crash Course” data. The number of parts replaced per repairable estimates in CCC rose to 9.52 per appraisal in 2017, up from 9.43 parts in 2016. About 62.5 percent of the parts spend went to OEM components versus 62.9 percent in 2016. The average number of OEM parts replaced per appraisal moved up from 6.51 in 2016 to 6.53 in 2017. The article has since been corrected to reflect this.

More information:

Mitchell first-quarter 2018 Industry Trends Report

LKQ first-quarter 2018 earnings call

LKQ, April 26, 2018

LKQ first-quarter 2018 earnings call slides

LKQ, April 26, 2018

Seeking Alpha transcript of April 25 Axalta earnings call

Seeking Alpha, April 25, 2018

Images:

Recent Mitchell, CCC and LKQ data all point to a slight uptick in aftermarket parts usage. (cosmin4000/iStock)

The average number of each type of part used in Mitchell collision repair estimates in the fourth quarter of 2017 is shown. (Provided by Mitchell)

The proportion of parts dollars spent on new OEM parts on Mitchell collision repair estimates in the fourth quarter of 2017 is shown in this Mitchell graphic. This is a different metric than the total number of each type of part used on a repair. (Provided by Mitchell)

The proportion of parts dollars spent on aftermarket parts on Mitchell collision repair estimates in the fourth quarter of 2017 is shown in this Mitchell graphic. This is a different metric than the total number of each type of part used on a repair. (Provided by Mitchell)

The proportion of parts spend allocated to each part type on CCC estimates is shown on data from CCC’s most recent “Crash Course.” (Provided by CCC)

The proportion of parts spend allocated to OEM and alternative parts on CCC estimates is shown on data from CCC’s most recent “Crash Course.” (Provided by CCC)