Calif. BAR offers guidance on how shops should handle storage, liens

By onBusiness Practices | Education | Legal | Repair Operations

Storage fee and lien issues arise most frequently with the California collision repair industry compared to other auto repairers, a Bureau of Automotive Repair enforcer told the agency’s board last week.

BAR often finds collision repairers “attempting to charge storage fees like a storage yard” when they’re really acting in the context of an auto repair dealer, BAR enforcement operations branch program manager Matthew Gibson said Thursday.

The presentation and discussion before the BAR Advisory Group gives one of the country’s largest collision repair communities some guidance on how to properly handle a lien sale — and a reminder of what can get you in trouble with the BAR. It should also serve as a reminder to the rest of the country’s auto body shops to check their state’s storage and lien requirements to avoid getting tripped up.

Towing/storage fees and lien sales tend to be treated as the same topic. However, California mostly governs towing and storage fees with the vehicle code, while lien sales — a right enshrined in the California Constitution — primarily fall under the civil code, according to Gibson’s presentation.

According to Gibson’s presentation, any facility that “obtained authorization, provided an estimate, or performed repairs” automatically becomes an auto repair dealer, not a storage yard.

Learn more about protecting your shop legally during Repairer Driven Education

Seeking more insight on complying with consumer protection rules? Learn more during the SEMA Show in Las Vegas at “More than Just a Hand Shake: The Professional Administrative (legal) Documents You Really Need to Operate a Successful Shop” with Erica L. Eversman of the Auto Education Policy Institute and Wade Ebert of American Auto Body. The session is part of the Society of Collision Repair Specialists’ Repairer Driven Education Series Oct. 29-Nov. 2. Register here for individual RDE classes or the series pass package deal.

Gibson said the best example he could provide of body shops falling afoul of the state’s rules involved a shop that contracts with a vehicle owner to perform a teardown when the car arrives.

The shop just entered into an “automotive repair transaction,” according to Gibson. However, they don’t tear down the car and just let the vehicle sit while awaiting an adjuster arrival.

While waiting for the adjuster, learning the car is totaled or engaging in a dispute with the insurer, the shop charges the consumer storage fees “retroactively” to when the vehicle arrived, Gibson said. But the shop had “never performed the contracted repairs, which was the teardown estimate,” he said.

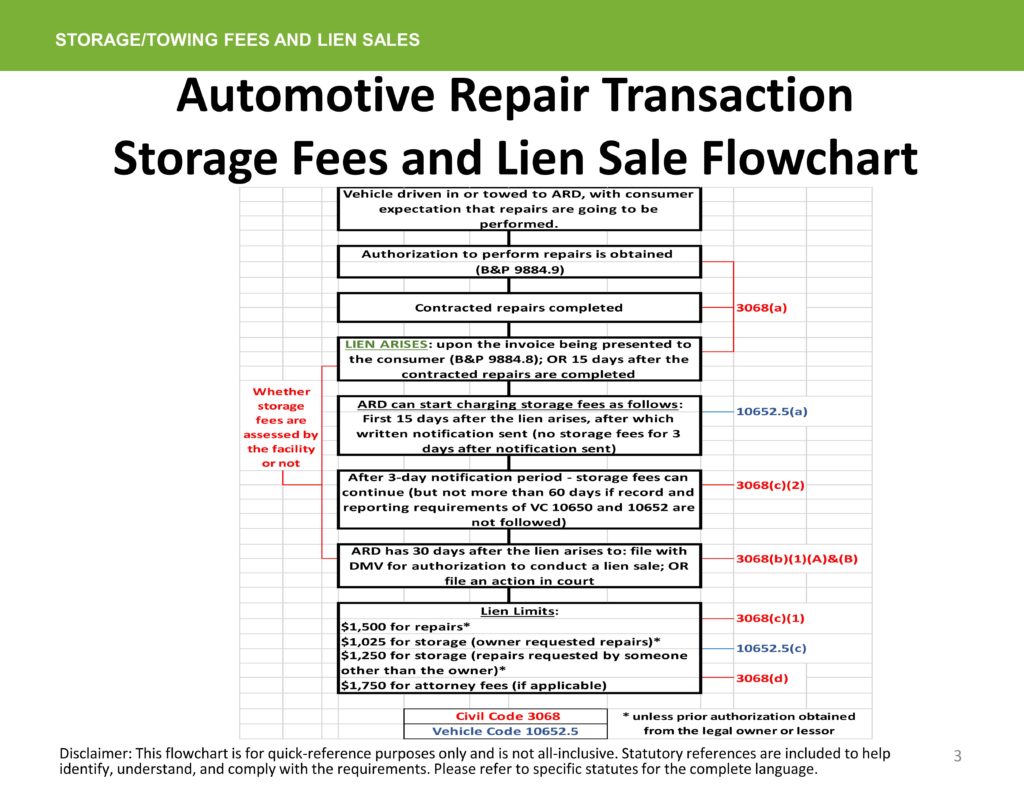

According to a flowchart provided by Gibson, an auto repair transaction lien arises once the invoice for the completed repairs is offered to the customer or 15 days after the repairs are done (in a situation where you can’t find the customer, for example).

A shop can start charging storage fees for the first 15 days after the lien begins.

At this point, the shop must halt storage fees until “three days after written notice is sent by the person in possession to the legal owner by certified mail, return receipt requested, and continuing for a period not to exceed any applicable time limit set forth in Section 3068 or 3068.1 of the Civil Code.”

Within 30 days after the lien, the shop must either file with the Department of Motor Vehicles for permission to do a lien sale or start court proceedings.

These are important considerations for California shops to recognize and wrap their brains around. They reinforce the reality that a shop’s customer is the customer, and its contract is with them, not the insurer.

Based on Gibson’s interpretation and the flowchart, it seems as though a shop needs to secure the full repair authorization from the customer, perform the work and bill the consumer once the work is done. Only then are storage charges possible, just as was the case in the completed and invoiced teardown example Gibson provided.

There’s nothing stopping that shop from waiting to perform repairs until it received insurer approval — but it doesn’t seem as though the repairer can recoup storage for that time. The repairer would basically be wasting its time and facility space. The issue of securing payment quickly from the insurer appears to be the California customer’s battle, not the shop’s. The shop’s battle is collecting from its customer.

Gibson said that sometimes a repairer will contract with an outside vendor to handle lien sale documents. However, those vendors don’t typically verify that the shop met its contractual obligations.

In his experience, those shops are typically “the most insistent” they were cleared to do a lien sale, assuming that the vendor wouldn’t have processed the documents if things weren’t kosher, Gibson said.

That incorrect assumption can lead to the BAR discovering the shop hadn’t followed the proper process during an investigation.

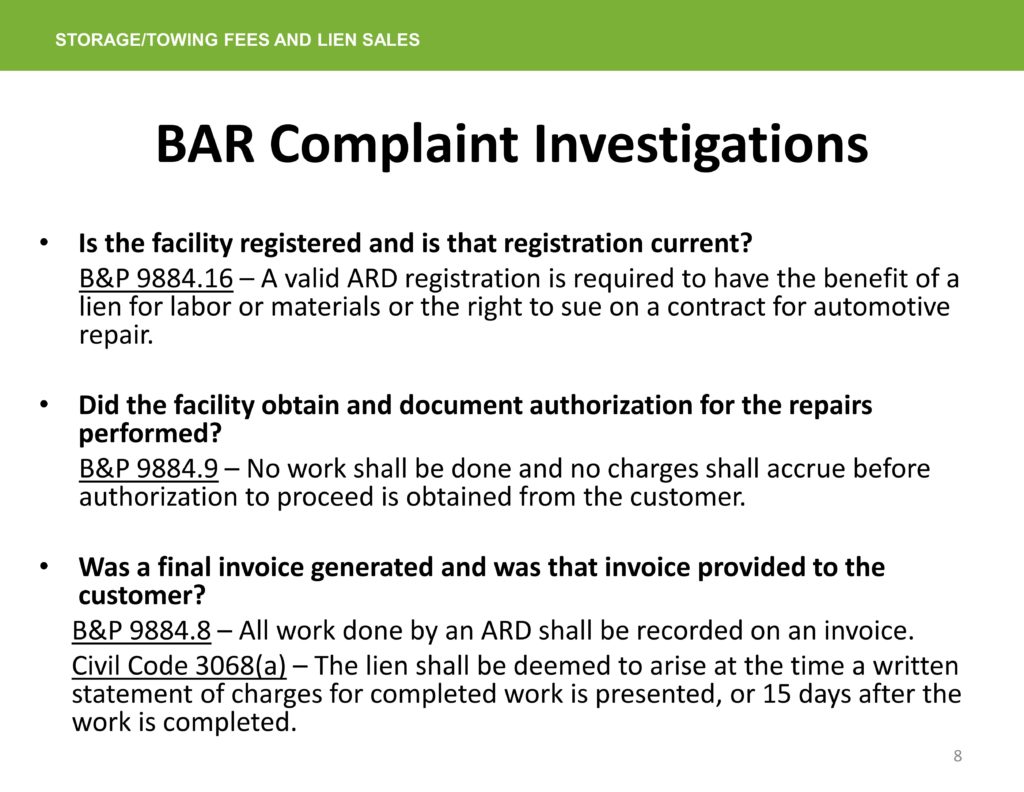

The BAR will investigate complaints on behalf of customers, notify consumers of their right to file an opposition, verify the shop’s registration, see if the shop met its obligation and try to resolve the issue, according to Gibson. BAR lien investigation reports can be subpoenaed by either party, he said.

A lien can only be for up to $1,500 for repairs unless the legal owner or lessor authorizes more. This also can trip up a shop.

According to BAR Advisory Group member Jack Molodanof (Molodanof Government Partners, California Autobody Association), the limit has to do with situations like a car being financed through a bank. If the customer stiffs the bank as well as the shop and the bank repos the car, the financier only has to pay the shop up to $1,500 plus storage capped at between $1,025 to $1,250.

“Those situations occur,” Molodanof said. A five-figure collision repair bill can be a “windfall” for a bank, for it only will owe the shop a fraction of that amount, he said.

Gibson said he had received calls about this topic as well. “It’s not uncommon,” he said.

Molodanof asked if the DMV — which California requires contact vehicle owners about lien sales — was notifying the owners of their ability to seek help from the BAR. He said he didn’t even know the BAR had that role and that others might not be aware either.

Gibson said he didn’t think the DMV mentioned the BAR, but he noted that the DMV notification requirement only applied for vehicles worth $4,000 or more. The person filing the lien sale request with the DMV is responsible for the notification when the car value is less than $4,000, he said.

Molodanof said it might be good to require that BAR reminder in the DMV notice, and BAR Chief Patrick Dorias said his agency would follow up on that idea to the DMV.

It’s probably a good idea if both the DMV and lienholder’s notifications remind consumers of their right to seek help from the BAR, even if that extra layer of scrutiny drags out the process for a shop. A consumer with a sub-$4,000 car probably is lower-income and possibly even less aware of their rights and the BAR than the owner of a pricier vehicle getting the DMV notification. They also might suffer a harder fiscal and logistical hit if a shop conducts an improper lien sale of their vehicle.

More information:

California Bureau of Automotive Repair storage/towing and liens presentation

BAR, Oct. 18, 2018

“Bureau of Automotive Repair Advisory Group Meeting – October 19, 2018”

California Department of Consumer Affairs YouTube channel, Oct. 22, 2018

Images:

California Bureau of Automotive Repair enforcement operations branch program manager Matthew Gibson appears Oct. 18, 2018, before the BAR Advisory Group. (Screenshot from California Department of Consumer Affairs video)

According to a flowchart provided by the California Bureau of Automotive Repair, an auto repair transaction lien arises once the invoice for the completed repairs is offered to the customer or 15 days after the repairs are done (in a situation where you can’t find the customer, for example). (Provided by California BAR)

The California Bureau of Automotive Repair investigates consumer complaints about auto repairer lien sales. Part of the investigation process is detailed in this slide from an Oct. 18, 2018, BAR Advisory Group meeting. (Provided by California BAR)