See how your shop stacks up to industry with 2019 edition of CCC’s ‘Crash Course’

By onBusiness Practices | Education | Insurance | Market Trends | Repair Operations | Technology

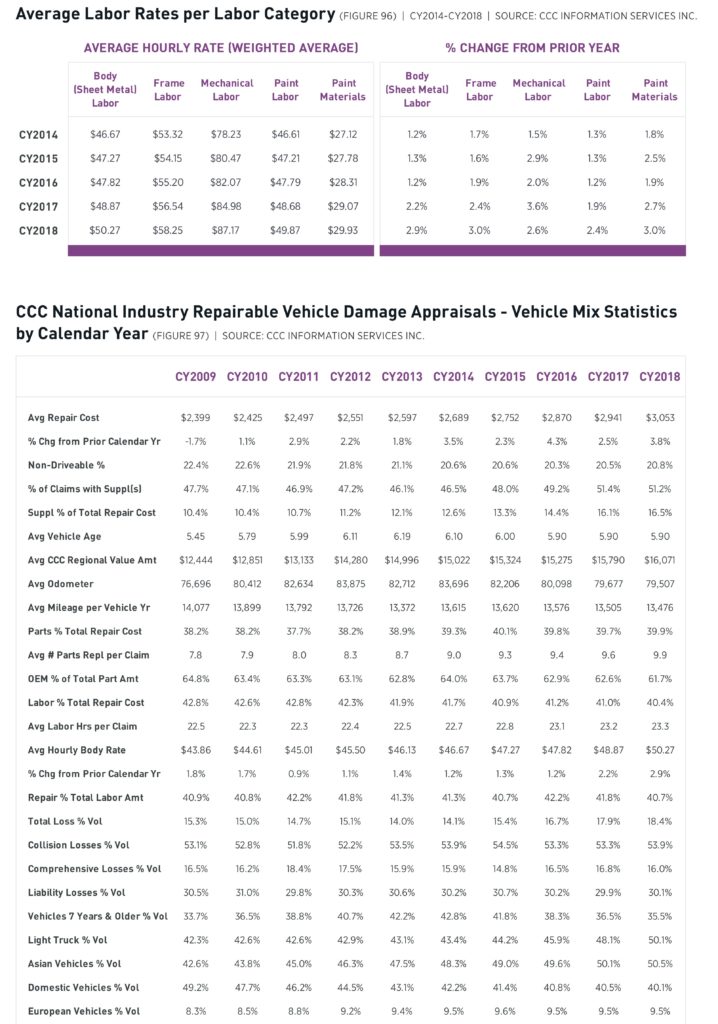

CCC estimate data revealed collision repair industry’s average body labor rate crossed the $50/hour threshold for what appears to be the first time last year.

The bump from $48.87 in 2017 to $50.27 in 2018 on CCC estimates related to repairable vehicles represented a 2.9 percent increase, second only proportionally to 3 percent increases in both frame and paint materials rates.

Those statistics are among many, many other valuable data points collision repairers can obtain for free by downloading the latest annual edition of CCC’s “Crash Course,” which was released Tuesday by the estimating service.

CCC attributed the increase to the technician shortage.

“Average labor rates per labor category also experienced some of their largest increases in CY 2018 as many shops struggle to find and keep qualified technicians,” CCC wrote.

CCC’s vast market share among U.S. body shops provides it with one of the industry’s better data sets — perhaps the best — for studying industrywide trends related to information captured on estimates. The ability to obtain statistics and expert analysis related to those trends for free shouldn’t be passed up by any repairer, be they a one-man operation or the 1,000-shop Caliber.

The information can help a business owner or manager strategize for the coming year, but it also holds value for estimators, painters and body technicians — more so perhaps at a piece-rate shop.

For example, the average repair cost also crossed a threshold in 2018, climbing 3.8 percent to $3,053 — breaking the $3,000 threshold for what appears to be the first time. That average repairable estimate saw 9.9 parts replaced by a staff that put in 23.3 hours of work. Odds also were greater than even money that the shop would need to submit at least one supplement.

“With each vehicle repair requiring more part replacements, at a higher cost, with more labor hours at a higher rate, it’s easy to understand why repair costs are increasing,” CCC wrote. “Combine that with a continuation of the shift of the vehicle fleet to newer, more expensive light trucks, and the industry will likely continue to see repair costs rise over the next several years until such time as ADAS-equipped vehicles account for a much larger share of the overall registered vehicle population in the U.S., and some of the anticipated reductions in both frequency and repair cost will have a broader impact.”

“Crash Course” has information on other topics with relevance to a body shop besides repairs: for example, mix of vehicles sold in the U.S. It also discusses where such trends could go in the future.

“Long-accepted tenets or established truths like ‘I own my car,’ ‘I drive my car,’ ‘I insure my car,’ ‘I contact my insurer in the case of an accident,’ and others will be challenged as ride-sharing, ride-hailing, vehicle autonomy, telematics, AI, 3D-printing and more bring dramatic change to personal mobility and the industries that have traditionally supported it,” CCC wrote in an executive summary.

“Some of these changes are happening rapidly, others more slowly, but the changes already are dramatic in terms of their impact to customer expectations, traditional business roles, accident frequency and accident loss costs. Companies must adapt, invest, and extend to ensure they can operate successfully now and in the future. …

“This year’s Crash Course will explore how technology has helped our industry evolve to where it is today, and how technology will transform it even further and faster in the future, disrupting personal mobility as we know it.”

Learn more by downloading the 2019 “Crash Course” for free here.

More information:

Images:

CCC’s 2019 “Crash Course.” (Provided by CCC)

Collision repair data from CCC’s 2019 “Crash Course.” (Provided by CCC)