Update: Minimum wage among new Calif. laws regarding auto body repair staff, owners

By onAnnouncements | Associations | Education | Legal | Repair Operations

The California Autobody Association recently alerted members to a variety of laws which mostly took effect Jan. 1, and employees, managers and owners should take note.

Shops outside of the major national market might also wish to take a second and review the new measures. Laws which pop up in California might inspire copycat efforts in other states.

The trade group gave us permission to reprint its rundown of the new laws. See some of the highlights below per the CAA as well as some additional context we’ve added. Bolding and hyperlinks within the CAA quotes have been added.

None of this is meant as legal advice and is only presented for informational purposes. Consult a qualified employment attorney licensed in your state before taking action.

CAA labor and employment counsel Cory King of FordHarrison also can be a source of information for trade group members. Contact him at 858-214-3951 or cking@fordharrison.com.

Employment

Minimum wage rises to $12-$13

California Autobody Association: “Reminder that effective January 1, 2020, the minimum wage for employers with 26 or more employees will increase to $13.00 per hour. The minimum wage for employers with 25 or fewer employees will increase to $12.00. (SB 3 of 2017) Local minimum wage may be higher.”

The median pay in California for auto body repairers was $48,830 in May 2018, the last year with federal data available. That’s well above $12 or $13. However, 10 percent of repairers made $26,900, which works out a little more than $12.93 an hour. It’s possible other positions within the shop typically make less than what the Bureau of Labor Statistics classifies as auto body repairers. That means some folks in California shops ought to be seeing a raise — or demanding one now that pay that previously had been above minimum wage no longer is.

More time to start sexual harassment prevention training

CAA: “Extends the original compliance deadline associated with SB 1343 (passed in 2018), which requires all employers with five or more employees to provide two hours of sexual harassment training from January 1, 2020 to January 1, 2021. (SB 778)”

Supervisors need at least two hours of training, and nonsupervisors need at least an hour by Jan. 1, 2021. Any new hires must get that training within six months. Everyone trained must repeat the process every two years at least after that.

The training includes:

The training may be completed by employees individually or as part of a group presentation, and may be completed in shorter segments, as long as the applicable hourly total requirement is met. An employer who has provided this training and education to an employee in 2019 is not required to provide refresher training and education again until two years thereafter. The training and education required by this section shall include information and practical guidance regarding the federal and state statutory provisions concerning the prohibition against and the prevention and correction of sexual harassment and the remedies available to victims of sexual harassment in employment. The training and education shall also include practical examples aimed at instructing supervisors in the prevention of harassment, discrimination, and retaliation, and shall be presented by trainers or educators with knowledge and expertise in the prevention of harassment, discrimination, and retaliation. The department shall provide a method for employees who have completed the training to save electronically and print a certificate of completion.

(b) An employer shall also include prevention of abusive conduct as a component of the training and education specified in subdivision (a).

(c) An employer shall also provide training inclusive of harassment based on gender identity, gender expression, and sexual orientation as a component of the training and education specified in subdivision (a). The training and education shall include practical examples inclusive of harassment based on gender identity, gender expression, and sexual orientation, and shall be presented by trainers or educators with knowledge and expertise in those areas.

Are you an employee?

CAA: “This new law provides factors of the “ABC” test, as specified, to determine the status of workers as employee or independent contractor. The law also provides an exemption between business-to-business provided that vendor meets the specified independent contractor criteria. (AB 5)”

The law generally defines an employee as everyone who doesn’t meet all three of these criteria:

(A) The person is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

(B) The person performs work that is outside the usual course of the hiring entity’s business.

(C) The person is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

CAA had concerns, but noted, “The bill was amended to provide an exemption between business to business, which would include automotive repair shops conducting sublet repairs with third party vendors, provided that vendor meets the specified independent contractor criteria.”

More time to file workplace complaints

CAA: “This new law extends the deadline to file an allegation of unlawful workplace harassment, discrimination, or civil rights-related retaliation under the Fair Employment and Housing Act from one year to three years. (AB 9)”

Anti-forced arbitration law in place — but so is federal injunction.

CAA: “This new law, among other things, prohibits employers from requiring employees or applicants to waive any right, forum, or procedure for a violation of the Fair Employment and Housing Act or the Labor Code as a condition of employment. (AB 51). Also, SB 707 requires the employer (for an employment-related arbitration agreement) to pay for certain fees and costs before an arbitration may proceed.”

Other provisions of AB 51 include:

(b) An employer shall not threaten, retaliate or discriminate against, or terminate any applicant for employment or any employee because of the refusal to consent to the waiver of any right, forum, or procedure for a violation of the California Fair Employment and Housing Act or this code, including the right to file and pursue a civil action or a complaint with, or otherwise notify, any state agency, other public prosecutor, law enforcement agency, or any court or other governmental entity of any alleged violation.

(c) For purposes of this section, an agreement that requires an employee to opt out of a waiver or take any affirmative action in order to preserve their rights is deemed a condition of employment.

However, the law “does not apply to postdispute settlement agreements or negotiated severance agreements.”

The law is currently on hold. According to King:

On January 31, 2019 a Federal Court in Sacramento GRANTED the U.S. Chamber of Commerce’s Motion for Preliminary Injunction stopping California’s enforcement of AB51, it’s recently enacted anti-arbitration law. The court battle over this controversial law is expected to continue before the Ninth Circuit Court of Appeals in the coming months, and to eventually make its way to the United States Supreme Court. Until such time as one of those courts decides otherwise, the law will NOT TAKE EFFECT. Thus, at least for the foreseeable future, employers may continue implementation of binding arbitration agreements with their employees.

If your company does not have arbitration agreements in place with its employees, or has not updated its arbitration agreement for 2020, it is recommended you discuss the matter with competent employment counsel promptly. The Association’s employment counsel has prepared an updated arbitration agreement designed to withstand the challenges of recent court decisions that is available to current Association members as a free member benefit.

King encouraged members to contact him for more information and the CAA sample arbitration agreement.

Employee actions regarding unpaid wages

CAA: “In addition to existing penalties that an employee may recover for an employer’s failure to timely pay an employee’s wages, this new law authorizes the affected employee to bring action to recover statutory penalties against the employer to recover unpaid wages. It also authorizes an employee to either recover statutory penalties under these provisions or to enforce civil penalties under Labor Code section 2699(a), the Private Attorneys General Act of 2004 (‘PAGA’), but not both, for the same violation. (AB 673)”

Space requirements for nursing employees

CAA: “Expands existing law relating to lactation accommodation to add a number of new requirements for the lactation space itself, including access to running water and a refrigerator for storing milk, as well as employer policy requirements and document retention obligations. (SB 142)”

Smaller employees can petition for an exemption from some of the bill, but it sounds like they at least have to try and accommodate their employee partway.

(i) An employer that employs fewer than 50 employees may be exempt from a requirement of this section if it can demonstrate that a requirement would impose an undue hardship by causing the employer significant difficulty or expense when considered in relation to the size, financial resources, nature, or structure of the employer’s business. If that employer can demonstrate that the requirement to provide an employee with the use of a room or other location, other than a bathroom, would impose such undue hardship, the employer shall make reasonable efforts to provide the employee with the use of a room or other location, other than a toilet stall, in close proximity to the employee’s work area, for the employee to express milk in private.

Protecting hair

CAA: “This new law expands the Fair Employment and Housing Act’s definition of race to include traits historically associated with race, such as hair texture and protective hairstyles. It defines ‘protective hairstyles’ as ‘braids, locks, and twists.’ It also prohibits workplace dress code and grooming policies that prohibit natural hair, including afros, braids, twists and locks. (SB 188)”

Two weeks more paid family leave

CAA: “Amends exiting law and increases the maximum wage replacement benefits under the California Paid Family Leave program from six to eight weeks, beginning July 1, 2020. (SB 83)”

Parts and technology

Don’t unstall unsafe used tires

CAA: “Prohibits an automotive repair dealer from installing a used unsafe tire as specified. (AB 949)“

Battery fees rise

CAA: “Beginning, April 2022, the current $1.00 California battery fee imposed on a person who purchases a replacement lead-acid battery from a retail dealer (including auto repair dealer) will increase to $2.00. (AB 142)”

The CAA had concerns about the bill.

Permanent Diagnostic Trouble Codes fail smog check

CAA: “On July 1, 2019, the BAR incorporated Permanent Diagnostic Trouble Codes (PDTCs) as part of the Smog Check failure criteria for model-year 2010 and newer vehicles. 16 CCR 3340.42.2(c)(5).”

The Bureau of Automotive Repair’s explanation of those codes offers another interesting detail for the collision repair industry’s scanning education.

“Permanent Diagnostic Trouble Codes (PDTCs) are very similar to regular Diagnostic Trouble Codes (DTCs),” the BAR wrote. “However, unlike regular DTCs, they cannot be reset by disconnecting the vehicle’s battery or cleared using an On-Board Diagnostic (OBD) scan tool. The only way to clear a PDTC is to fix the underlying problem with the vehicle that originally caused the PDTC and its corresponding DTC to set, and then allow the vehicle sufficient drive time to re-run the monitor that identified the problem in the first place. When the monitor runs without identifying a problem, the PDTC will clear itself.”

Miscellaneous

Right to cash out if vehicle safe

CAA: “This law restates that an insured has the right to select the auto body shop of choice to repair a damaged vehicle, or decide not to have the vehicle repaired; however, an insurer may require that a damaged vehicle be repaired as a condition for payment if the damage is sufficiently serious that safety features of the vehicle’s operating systems are compromised. (AB 1538).”

Assembly Bill 1538 blocks unscrupulous insurers from using a demand for repair as a tactic to save money. If a low-income customers couldn’t pay the deductible triggered by a repair demand, the resulting stalemate could mean the carrier doesn’t have to pay anything under the status quo. The bill closes that loophole and lets those consumers cash out.

However, the bill does allow insurers to block a cash-out if they suspect fraud. (According to a June 14 Senate analysis, fear of scammers might have been a legitimate reason for a no-cash rule.) They can also block a cash-out and require repair if the vehicle would be unsafe.

The CAA supported the bill when we covered it back in July 2019. “The bill protects consumers and the CAA is supportive of the intent,”

Privacy law live, but adjusted

CAA: “California Consumer Privacy Act (CCPA). Beginning January 1, 2020, this new law, in part, would grant a consumer the right to request a business to disclose the categories and specific pieces of personal information that it collects about the consumer, the categories of sources from which that information is collected, the business purposes for collecting or selling information and the categories of third parties with which the information is shared. (AB 375-2018). Several new laws passed to clarify and to ease CCPA compliance including a narrow opt-out and deletion rights in order to facilitate prompt and effective recalls and warranty work. (AB 1146, AB 25, AB 874, AB 1355 and AB 1564)”

Under the California Consumer Privacy Act, businesses doing $25 million or more in sales are by law in 2020 held to higher standards regarding customer data. (Businesses that don’t make that kind of money but still handle 50,000 consumers a year also would qualify.)

The law has been tweaked since passing in 2018, as the CAA noted.

Rules for dealer warranty rates

CAA: “This new law, among other things, requires car manufacturers to reimburse franchised new car dealers for warranty repairs based on a specified formula instead of using the existing practice of determining a reasonable rate and recasts other exiting provisions of the relationship between manufacturers and dealerships. (AB 179).”

This one is interesting in light of similar debates between insurers and body shops over what amount a carrier ought to reimburse. Among the rules it establishes for dealers and OEMs seeking to hash out fair warranty rates:

(a) A franchisee seeking to establish or modify its retail labor rate, retail parts rate, or both, to determine a reasonable warranty reimbursement schedule shall, no more frequently than once per calendar year, complete the following requirements:

(1) The franchisee shall submit in writing to the franchisor whichever of the following is fewer in number:

(A) Any 100 consecutive qualified repair orders completed, including any nonqualified repair orders completed in the same period.

(B) All repair orders completed in any 90-consecutive-day period.

(2) The franchisee shall calculate its retail labor rate by determining the total charges for labor from the qualified repair orders submitted and dividing that amount by the total number of hours that generated those charges.

(3) The franchisee shall calculate its retail parts rate by determining the total charges for parts from the qualified repair orders submitted, dividing that amount by the franchisee’s total cost of the purchase of those parts, subtracting one, and multiplying by 100 to produce a percentage.

(b) For purposes of subdivision (a), qualified repair orders submitted under this subdivision shall be from a period occurring not more than 180 days before the submission.

More information:

Images:

The California and U.S. flags are shown. (franckreporter/iStock)

A bear statue sits Sept. 22, 2018, outside of the California governor’s office in the Capitol in Sacramento. (Andrei Stanescu/iStock)

The California Capitol is shown. (KingWu/iStock)

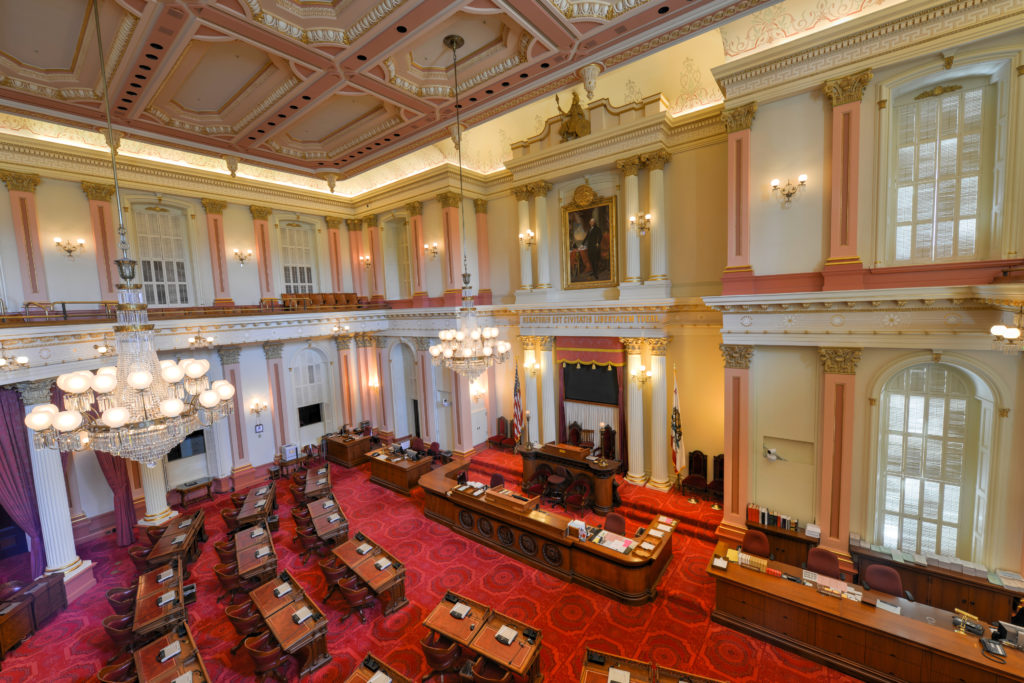

The California Senate Chamber is seen May 31, 2014. (demerzel21/iStock)