COVID-19 law requires paid sick, FMLA time at auto body shops, offsets it with tax breaks

By onBusiness Practices | Education | Legal | Market Trends

President Donald Trump on Wednesday signed a bill requiring companies with less than 500 workers to temporarily offer paid sick and family leave under certain conditions related to the COVID-19 coronavirus response.

But House Resolution 6201 would also give the employers tax breaks equal to the amounts paid under these new rules.

“We reached an agreement yesterday on a new legislative package that will provide strong support for American families and communities in dealing with the coronavirus,” Trump said in a statement.

The bill passed the House on March 14 in a 363-40 vote and cleared the Senate on Wednesday in a 90-8 decision.

“Today, the Senate has joined the House to pass our Families First Coronavirus Response Act: strong, bipartisan legislation that protects the health, economic security and well-being of the American people while stimulating the economy,” House Speaker Nancy Pelosi, D-Calif., said in a statement Wednesday.

“It is a well-intentioned bipartisan product, assembled by House Democrats and President Trump’s team, that tries to stand up and expand some new relief measures for American workers,” Senate Majority Leader Mitch McConnell, R-Ky., said on the Senate floor, according to a transcript provided by his office.

“I will vote to pass their bill. This is a time for urgent bipartisan action, and in this case, I do not believe we should let perfection be the enemy of something that will help even a subset of workers.”

He said the Senate was working on more coronavirus-related legislation.

“So — while I will support the House bill in order to secure some emergency relief for some American workers — I will not adjourn the Senate until we have passed a far bolder package that must include significant relief for small businesses across our nation,” McConnell said, according to the transcript.

The Society of Collision Repair Specialists and other trade groups on Wednesday asked Trump, Pelosi and McConnell for business relief including unsecured credit and postponed taxes. Find out more here.

Many collision industry businesses could be subject to HR 6201’s rules — though exemptions are a possibility for smaller operations — so it’s a bill you want to review.

Note: This article’s content and analysis — even the parts citing actual lawyers — is for informational purposes only and should not be construed as legal advice. Talk to a qualified attorney licensed for your state or states before taking any action.

Emergency paid sick time

According to HR 6201, employers must give “paid sick time to the extent that the employee is unable to work (or telework)” for reasons like:

(1) The employee is subject to a Federal, State, or local quarantine or isolation order related to COVID–19.

(2) The employee has been advised by a health care provider to self-quarantine due to concerns related to COVID–19.

(3) The employee is experiencing symptoms of COVID–19 and seeking a medical diagnosis.

(4) The employee is caring for an individual who is subject to an order as described in subparagraph (1) or has been advised as described in paragraph (2).

(5) The employee is caring for a son or daughter of such employee if the school or place of care of the son or daughter has been closed, or the child care provider of such son or daughter is unavailable, due to COVID–19 precautions.

(6) The employee is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor.

Full-time employees are limited to 80 hours. Part-time staffers get as many hours as they would on average work in two weeks. Any employee may request this leave, according to a summary of the legislation released Thursday by attorneys Rachel Ullrich, Sarah Wimberly and Jeffrey Ashendorf of employment law firm FordHarrison.

Workers using the sick time for reasons 1-3 above will see the employer requirement max out at $511 a day or $5,110 in the aggregate; reasons 4-6 have an employer ceiling of of $200 a day or $2,000 altogether.

There’s also a floor. Employers must pay at least local minimum wage in sick time for reasons 1-3. Reasons 4-6 only require at least two-thirds of that amount.

The boss can’t require the employee to find someone to cover their shift during the sick time hours. The employee also can’t be forced to use their existing paid sick time hours before using this new sick time.

However auto body shops with fewer than 50 workers can request an exemption to the mandate they pay sick leave to employees “caring for a son or daughter of such employee if the school or place of care of the son or daughter has been closed, or the child care provider of such son or daughter is unavailable, due to COVID–19 precautions.” The Department of Labor can grant that exemption “when the imposition of such requirements would jeopardize the viability of the business as a going concern.”

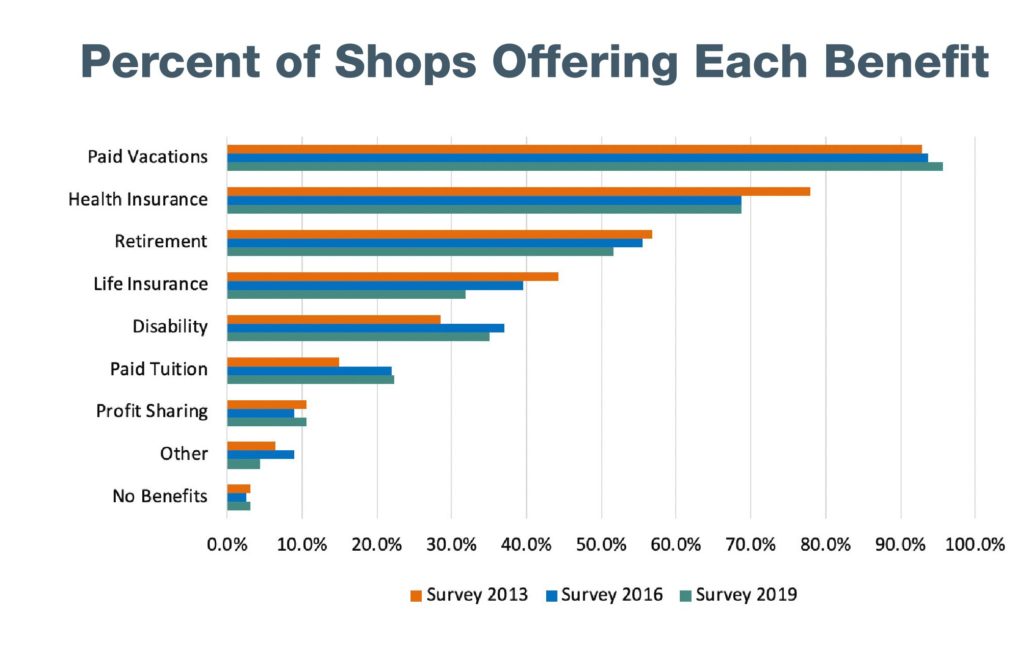

The number of auto body shops offering paid sick leave is unclear. A 2019 Collision Repair Education Foundation and I-CAR study with responses from more than 675 shops on at least one question found nearly all of them offering paid vacation, though.

Family and Medical Leave Act changes

Workers at businesses with less than 500 employees are also eligible for certain COVID-19 coronavirus-related Family and Medical Leave Act leave.

However, the Department of Labor can still exempt companies with less than 50 employers “when the imposition of such requirements would jeopardize the viability of the business as a going concern.”

The employee has to have had the job for 30 calendar days prior to the leave. He or she may take the new FMLA leave if they can’t “work (or telework) due to a need for leave to care for the son or daughter under 18 years of age of such employee if the school or place of care has been closed, or the child care provider of such son or daughter is unavailable, due to a public health emergency.” Public health emergency is only defined as “an emergency with respect to COVID–19 declared by a Federal, State, or local authority.”

The first 10 days of this leave are unpaid, though the worker can overlap other medical, sick, personal or vacation leave during that time. Then, the employer must pay no less than two-thirds of regular pay, with the requirement capped at $200 per day or $10,000 overall.

The FordHarrison attorneys noted that employees would probably overlap their paid sick leave under HR 6201 with the unpaid first 10 days of “E-FMLA.”

“The Act provides for a combination of unpaid and paid leave,” Ullrich, Wimberly and Ashendorf wrote. “The first 10 days of E-FMLA may be unpaid, but an employee may elect (and an employer may require an employee) to substitute any accrued vacation, personal leave, or medical or sick leave for unpaid leave. For many employees, that leave period will be paid as a result of the Emergency Paid Sick Time Act. After 10 days, employers shall provide partial paid leave for each additional day of leave at an amount that is not less than two-thirds of an employee’s regular rate of pay for the number of hours the employee would otherwise be scheduled to work. For employees who have weekly working hours that fluctuate, the employer is allowed to take an average over a six-month period.”

An employee’s job must be retained for them as in the traditional FMLA leave, according to the FordHarrison attorneys.

However, companies with less than 25 employees don’t have to restore the worker’s job following an E-FMLA leave if certain conditions arise, according to FordHarrison.

If the E-FMLA-taking employee’s job no longer exists “due to economic conditions or other changes in operating conditions of the employer … that affect employment; and … are caused by a public health emergency during the period of leave,” that small business doesn’t have to restore the post, HR 6201 states.

However, that company must also have made “reasonable efforts to restore the employee to a position equivalent to the position the employee held when the leave commenced, with equivalent employment benefits, pay, and other terms and conditions of employment,” according to HR 6201.

“If no equivalent positions are available at the time the employee tries to return from leave, the employer must attempt to contact the employee if an equivalent position becomes available in the next year,” Ullrich, Wimberly and Ashendorf wrote.

Both the emergency paid sick leave and E-FMLA leave rules will take effect no later than 15 days after HR 6201 became law and expire on Dec. 31, 2020, according to the FordHarrison attorneys.

Tax breaks

New emergency paid sick leave: Employers who paid out sick leave receive a tax credit “equal to 100 percent of the qualified sick leave wages paid by such employer with respect to such calendar quarter,” according to HR 6201.

This is limited per individual to $200 or $511 per day (based on the breakdown described above), and can’t for a calendar quarter “exceed the excess (if any) of … 10, over … the aggregate number of days so taken into account for all preceding calendar quarters.”

“Those amounts are increased by the amount of nontaxable health insurance premiums paid by the employer for employees who are out on Emergency Paid Sick Leave, for the days of leave, and further increased by the amount of Medicare tax owed by the employer with respect to the Emergency Paid Sick Time payments (generally 1.45%),” Ullrich, Wimberly and Ashendorf wrote. “The total credit amount is then also included in the employer’s income for income tax purposes.”

E-FMLA: The new E-FMLA rules also offer a tax credit back to employers. They’ll receive a credit “for each calendar quarter an amount equal to 100 percent of the qualified family leave wages paid by such employer with respect to such calendar quarter.”

This is limited per individual to $200 “for any day (or portion thereof) for which the individual is paid qualified family leave wages … and … in the aggregate with respect to all calendar quarters, $10,000.”

“Also like the credit for Emergency Paid Sick Time benefits, those amounts are increased by the amount of nontaxable health insurance premiums paid by the employer for employees who are out on E-FMLA Leave, for the days of leave, and further increased by the amount of Medicare tax owed by the employer with respect to the E-FMLA leave payments,” Ullrich, Wimberly and Ashendorf wrote. “The employer’s total available credit amount is also added to its income for the year. Unlike the credit for Paid Sick Time, however, there is already a general business credit available to certain employers who provide paid FMLA leave, and the new E-FMLA credit is not allowed with respect to any wages for which the general business credit is allowed (that is, ‘double dipping’ is not permitted).”

Webinar Friday

FordHarrison also has already hosted two webinars for employers, replays of which are available. See the March 6 “Is Your Business Ready to Deal with Coronavirus (COVID-19)?” here and the March 13 “Home Care and the Employment Impact of Coronavirus (COVID-19)” here.

On Friday, employers are welcome to tune in at 2 p.m. ET for another webinar, “Coronavirus (COVID-19) Update – Is Your Business Ready for the Employment and Employee Benefit Changes?”

“Businesses in the U.S. need to be prepared to deal with COVID-19 in the workplace,” FordHarrison described the webinar. “Multiple employment laws are implicated, including the Americans With Disabilities Act, the Family and Medical Leave Act, the Occupational Safety and Health Act, the National Labor Relations Act, the Health Insurance Portability and Accountability Act, as well as Employee Assistance Programs, onsite clinics, and Telemedicine. We will also discuss the Family First Coronavirus Response Act and its impact on employers.”

Be heard: Contact information for Trump can be found here. Contact information for representatives and senators can be found here.

More information:

“It’s Official – President Signs Coronavirus Paid Leave Act”

FordHarrison, March 19, 2020

Centers for Disease Control COVID-19 coronavirus webpage

FordHarrison COVID-19 coronavirus task force links for employers

Images:

Republican President Donald Trump, center, signs House Resolution 6201 on Wednesday. Treasury Secretary Steven Mnuchin is at left; Republican Vice President Mike Pence is at right. (Shealah Craighead/Official White House photo)

A smaller percentage of shops reported offering life insurance and retirement in 2019 than in 2016, according to a Collision Repair Education Foundation and I-CAR study that got a response to at least one question from more than 675 shops. (Provided by CREF)