Don’t forget to post COVID-19 sick leave notice; get a copy, see FAQs on law via the DOL

By onAnnouncements | Business Practices | Legal | Repair Operations

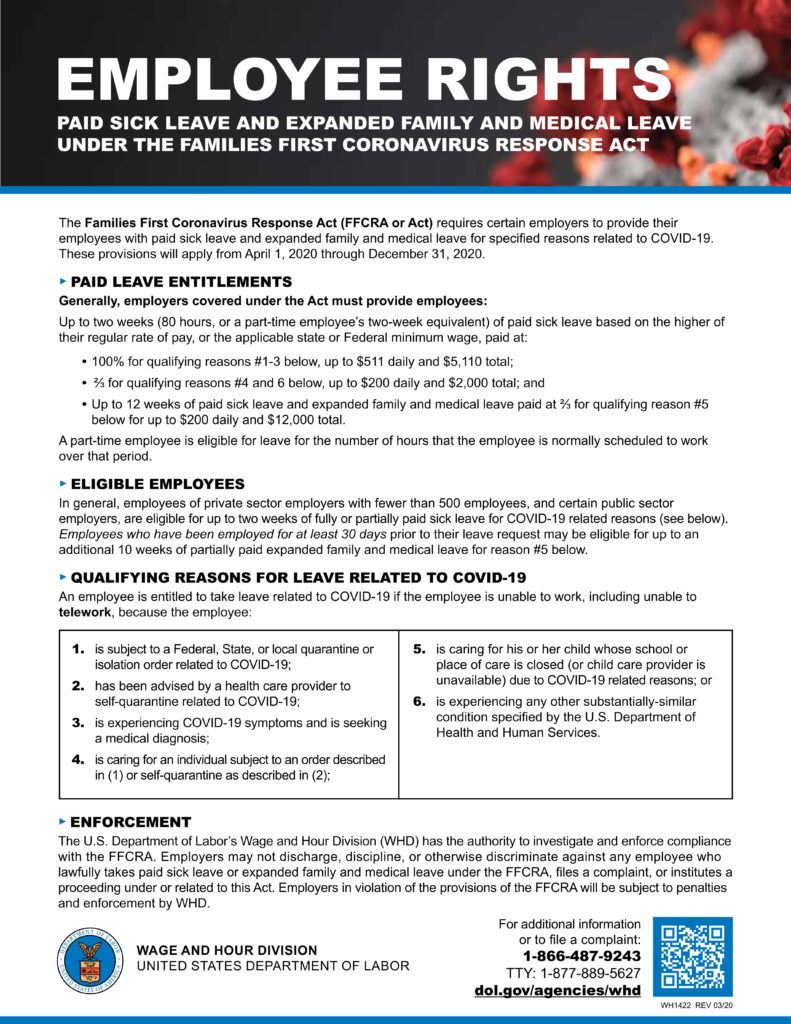

Collision repairers and other employers must by Wednesday post notice of the new COVID-19 paid sick and family medical leave rules taking effect the same day, according to the Department of Labor.

The agency on Thursday provided a free copy of the notice auto body shop owners can download, print and post to meet the April 1 deadline related to House Resolution 6201.

Congress passed and Republican President Donald Trump on March 18 signed the bill, known as the “Families First Coronavirus Response Act,” The measure requires companies with fewer than 500 workers to temporarily offer paid sick and family leave under certain conditions related to the COVID-19 coronavirus response. However, it also gives the employers immediate payroll tax breaks equal to the amounts paid under the new rules, according to the Department of Labor.

The law also takes effect Wednesday, according to the DOL.

The DOL has issued FAQs on both posting the notice and the heart of the law itself as well as fact sheets for employers and employees. It also has referred businesses to its Wage and Hour Division for updates and IRS’ COVID-19 website for more details on tax relief related to the bill.

According to HR 6201, employers must give “paid sick time to the extent that the employee is unable to work (or telework)” for reasons like:

(1) The employee is subject to a Federal, State, or local quarantine or isolation order related to COVID–19.

(2) The employee has been advised by a health care provider to self-quarantine due to concerns related to COVID–19.

(3) The employee is experiencing symptoms of COVID–19 and seeking a medical diagnosis.

(4) The employee is caring for an individual who is subject to an order as described in subparagraph (1) or has been advised as described in paragraph (2).

(5) The employee is caring for a son or daughter of such employee if the school or place of care of the son or daughter has been closed, or the child care provider of such son or daughter is unavailable, due to COVID–19 precautions.

(6) The employee is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor.

Full-time employees are limited to 80 hours. Part-time staffers get as many hours as they would on average work in two weeks.

“Employees who have been employed for at least 30 days prior to their leave request may be eligible for up to an additional 10 weeks of partially paid expanded family and medical leave for reason #5,” the DOL wrote on the new poster. (Emphasis DOL’s.)

For reasons 1-3 above, the employer must pay the staffer either their regular rate of pay or the applicable state or federal minimum wage, whichever is higher. This applies for up to $511 per day or $5,110 altogether.

For reasons 4-6, the employer must pay at least two-thirds of the regular pay/minimum wage, up to $200 a day or $2,000 altogether.

Exemptions might be possible for reason No. 5 (watching a child who isn’t sick but whose school, etc., was unavailable because of COVID-19 restrictions) if a business has fewer than 50 workers.

For more information about the law, consult the resources above, contact the DOL Wage and Hour Division at 866-4US-WAGE and consult with a qualified attorney.

“The response to the guidance we’ve published so far has illustrated the critical need that workers and employers have for this important information,” DOL Wage and Hour Division Administrator Cheryl Stanton said in a Saturday statement related to some new “Families First” guidance. “This round includes some of the most common questions we are receiving and will help ensure that the American workforce has all the tools and information needed in these very trying times. We encourage everyone to check the Wage and Hour Division website frequently, as we continue to add guidance to help everyone understand what they are entitled to as we prepare for these vital new benefits to go into effect on April 1, 2020.”

Here’s some excerpts from the FAQs and other DOL guidance:

Posting the document

Where do I post this notice? Since most of my workforce is teleworking, where do I electronically “post” this notice?

Each covered employer must post a notice of the Families First Coronavirus Response Act (FFCRA) requirements in a conspicuous place on its premises. An employer may satisfy this requirement by emailing or direct mailing this notice to employees, or posting this notice on an employee information internal or external website.

If my state provides greater protections than the FFCRA, do I still have to post this notice?

Yes, all covered employers must post this notice regardless of whether their state requires greater protections. The employer must comply with both federal and state law.

I am a small business owner. Do I have to post this notice?

Yes. All employers covered by the paid sick leave and expanded family and medical leave provisions of the FFCRA (i.e., certain public sector employers and private sector employers with fewer than 500 employees) are required to post this notice.

How do I know if I have the most up-to-date notice? Will there be updates to this notice in the future?

The most recent version of this notice was issued on March 25, 2020. Check the Wage and Hour Division’s website or sign up for Key News Alerts to ensure that you remain current with all notice requirements: www.dol.gov/agencies/whd.

Do I have to pay for notices?

No. To obtain notices free of charge, contact the Department’s Wage and Hour Division at 1-866-4-USWAGE (1-866-487-9243). Alternatively, you may download and print the notice yourself from https://www.dol.gov/agencies/whd/posters

I am running out of wall space. Can I put the required notices in a binder that I put on the wall?

No, you cannot put federal notices in a binder. Generally, employers must display federal notices in a conspicuous place where they are easily visible to all employees—the intended audience.

Exemptions

If providing child care-related paid sick leave and expanded family and medical leave at my business with fewer than 50 employees would jeopardize the viability of my business as a going concern, how do I take advantage of the small business exemption?

To elect this small business exemption, you should document why your business with fewer than 50 employees meets the criteria set forth by the Department, which will be addressed in more detail in forthcoming regulations.

You should not send any materials to the Department of Labor when seeking a small business exemption for paid sick leave and expanded family and medical leave.

When does the small business exemption apply to exclude a small business from the provisions of the Emergency Paid Sick Leave Act and Emergency Family and Medical Leave Expansion Act?

An employer, including a religious or nonprofit organization, with fewer than 50 employees (small business) is exempt from providing (a) paid sick leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons and (b) expanded family and medical leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons when doing so would jeopardize the viability of the small business as a going concern. A small business may claim this exemption if an authorized officer of the business has determined that:

- The provision of paid sick leave or expanded family and medical leave would result in the small business’s expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity;

- The absence of the employee or employees requesting paid sick leave or expanded family and medical leave would entail a substantial risk to the financial health or operational capabilities of the small business because of their specialized skills, knowledge of the business, or responsibilities; or

- There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting paid sick leave or expanded family and medical leave, and these labor or services are needed for the small business to operate at a minimal capacity.

If I am a small business with fewer than 50 employees, am I exempt from the requirements to provide paid sick leave or expanded family and medical leave?

A small business is exempt from certain paid sick leave and expanded family and medical leave requirements if providing an employee such leave would jeopardize the viability of the business as a going concern. This means a small business is exempt from mandated paid sick leave or expanded family and medical leave requirements only if the:

- employer employs fewer than 50 employees;

- leave is requested because the child’s school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons; and

- an authorized officer of the business has determined that at least one of the three conditions described in Question 58 is satisfied.

Documentation

What records do I need to keep when my employee takes paid sick leave or expanded family and medical leave?

Private sector employers that provide paid sick leave and expanded family and medical leave required by the FFCRA are eligible for reimbursement of the costs of that leave through refundable tax credits. If you intend to claim a tax credit under the FFCRA for your payment of the sick leave or expanded family and medical leave wages, you should retain appropriate documentation in your records. You should consult Internal Revenue Service (IRS) applicable forms, instructions, and information for the procedures that must be followed to claim a tax credit, including any needed substantiation to be retained to support the credit. You are not required to provide leave if materials sufficient to support the applicable tax credit have not been provided.

If one of your employees takes expanded family and medical leave to care for his or her child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19, you may also require your employee to provide you with any additional documentation in support of such leave, to the extent permitted under the certification rules for conventional FMLA leave requests. For example, this could include a notice that has been posted on a government, school, or day care website, or published in a newspaper, or an email from an employee or official of the school, place of care, or child care provider.

What documents do I need to give my employer to get paid sick leave or expanded family and medical leave?

You must provide to your employer documentation in support of your paid sick leave as specified in applicable IRS forms, instructions, and information.

Your employer may also require you to provide additional in support of your expanded family and medical leave taken to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19-related reasons. For example, this may include a notice of closure or unavailability from your child’s school, place of care, or child care provider, including a notice that may have been posted on a government, school, or day care website, published in a newspaper, or emailed to you from an employee or official of the school, place of care, or child care provider. Your employer must retain this notice or documentation in support of expanded family and medical leave, including while you may be taking unpaid leave that runs concurrently with paid sick leave if taken for the same reason.

Please also note that all existing certification requirements under the FMLA remain in effect if you are taking leave for one of the existing qualifying reasons under the FMLA. For example, if you are taking leave beyond the two weeks of emergency paid sick leave because your medical condition for COVID-19-related reasons rises to the level of a serious health condition, you must continue to provide medical certifications under the FMLA if required by your employer.

Payroll tax break

The following is from the Department of Labor on March 20:

To take immediate advantage of the paid leave credits, businesses can retain and access funds that they would otherwise pay to the IRS in payroll taxes. If those amounts are not sufficient to cover the cost of paid leave, employers can seek an expedited advance from the IRS by submitting a streamlined claim form. …

Prompt Payment for the Cost of Providing Leave

When employers pay their employees, they are required to withhold from their employees’ paychecks federal income taxes and the employees’ share of Social Security and Medicare taxes. The employers then are required to deposit these federal taxes, along with their share of Social Security and Medicare taxes, with the IRS and file quarterly payroll tax returns (Form 941 series) with the IRS.

… eligible employers who pay qualifying sick or child-care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child-care leave that they paid, rather than deposit them with the IRS.

The payroll taxes that are available for retention include withheld federal income taxes, the employee share of Social Security and Medicare taxes and the employer share of Social Security and Medicare taxes with respect to all employees.

If there are not sufficient payroll taxes to cover the cost of qualified sick and child care leave paid, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less. …

Examples

If an eligible employer paid $5,000 in sick leave and is otherwise required to deposit $8,000 in payroll taxes, including taxes withheld from all its employees, the employer could use up to $5,000 of the $8,000 of taxes it was going to deposit for making qualified leave payments. The employer would only be required under the law to deposit the remaining $3,000 on its next regular deposit date.

If an eligible employer paid $10,000 in sick leave and was required to deposit $8,000 in taxes, the employer could use the entire $8,000 of taxes in order to make qualified leave payments, and file a request for an accelerated credit for the remaining $2,000.

Equivalent child-care leave and sick leave credit amounts are available to self-employed individuals under similar circumstances. These credits will be claimed on their income tax return and will reduce estimated tax payments.

More information:

Mandatory “Families First Coronavirus Response Act” Notice (Must post/share with teleworking employees April 1)

U.S. Department of Labor, March 25, 2020

“Families First Coronavirus Response Act Notice – Frequently Asked Questions”

U.S. Department of Labor, March 2020

“Families First Coronavirus Response Act: Questions and Answers”

U.S. Department of Labor, March 2020

U.S. Department of Labor, March 28, 2020

DOL Wage and Hour Division “COVID-19 and the American Workplace” webpage

Internal Revenue Service COVID-19 coronavirus tax relief webpage

Centers for Disease Control COVID-19 coronavirus webpage

Images:

Collision repairers and other employers must by Wednesday post notice of the new COVID-19 paid sick and family medical leave rules taking effect the same day, according to the Department of Labor. The agency on March 26, 2020, provided a free copy of the notice auto body shop owners can download, print and post to meet the April 1, 2020, deadline related to House Resolution 6201. (Provided by Department of Labor)

This colorized scanning electron micrograph image shows an apoptotic cell heavily infected with COVID-19 coronavirus particles, yellow. (National Institute of Allergy and Infectious Diseases https://creativecommons.org/licenses/by/2.0/legalcode)

Transmission electron micrograph of Particles of SARS-CoV-2, the virus which causes COVID-19 coronavirus, are seen in a scanning electron micrograph image. The NIAID Fort Detrick, Md., Integrated Research Facility color-enhanced the image. (National Institute of Allergy and Infectious Diseases https://creativecommons.org/licenses/by/2.0/legalcode)