Solera: New version of Qapter allows AI photo estimating

By onAnnouncements | Business Practices | Insurance | International | Market Trends | Repair Operations | Technology

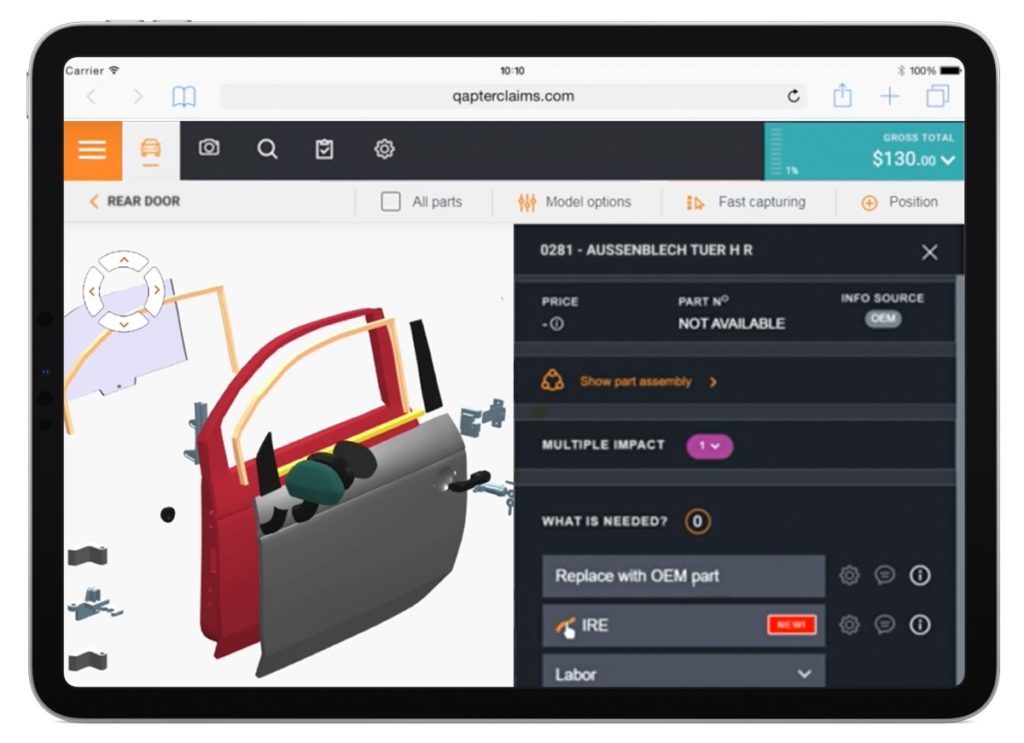

Solera last month announced its new generation of the claims system Qapter could identify damaged parts and create an estimate for the vehicle automatically.

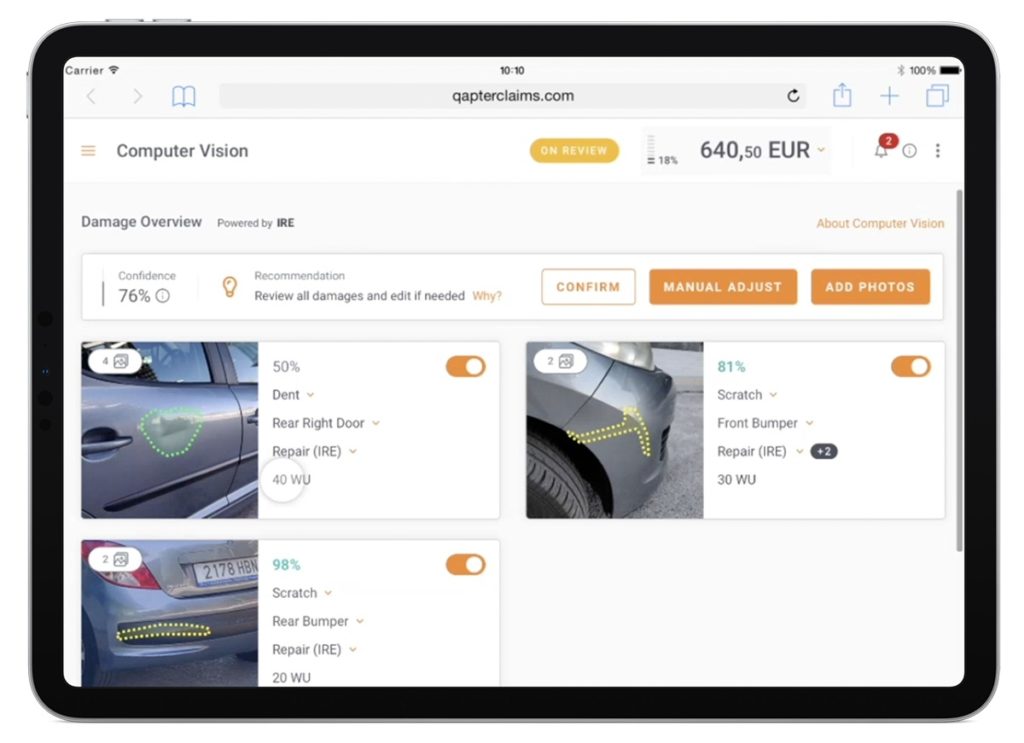

“The company’s AI has the capability to detect damaged parts, determine the type and severity of damage, define appropriate vehicle manufacturer repair operations and create an estimate based on these pre-defined repair operations,” the Audatex parent company wrote in a news release June 30. “Automation tools improve the process of triage claims workflow, speed up reviews of damage photos, rapidly improve identification of total loss vehicles, and support identification of the next best action for repairable vehicles. These capabilities all save time, speed up the claims process and shorten the lifecycle of a claim for insurers, body repair centers, assessors and vehicle owners.”

Solera public and analyst relations global director Olivia Logan confirmed last week that these capabilities were all new to the latest generation of Qapter. She said the company also “added AI capabilities to automate damage capturing from photos” to what she said was a largely pre-existing Qapter capability for customers to send images to repairers and insurers.

Solera’s Qapter website says the system can permit 50 percent of claims to automatically be authorized and reduce estimating costs by up to 50 percent. It said the system’s results can be shared in real-time with a body shop, assessor and insurer.

Solera said Qapter’s artificial intelligence was now also able to learn from “the company’s proven repair science technology with over 300 million historical claims, one billion historical images (and growing), and 50 years of experience.”

“Implementing AI will drive huge efficiency gains, but above all, the extent of such gains are determined by accuracy,” Solera CEO Darko Dejanovic said in a statement. “This accuracy depends on the quality, not just the quantity, of the data and images that are used to train the algorithms, as well as the supporting historical damage estimate. This historical data more thoroughly trains the algorithms, not simply on the repair itself, but also on the broader context of the damage.”

Machine learning based upon prior estimate data might alleviate issues like a human adjuster who asserts “you’re the only one” performing such an operation, a part needing replacement should be repaired or an obvious total is repairable. However, the technology also would seem to make it imperative that body shops and insurers write complete estimates that reflect the OEM procedures and work actually being conducted — even if the repairer never charges for those operations.

For example, let’s say no repairers bill for test welds but all of them still perform that best practice. If the shops leave that pro bono work off the estimate entirely rather than list it as a line item with a $0 charge, software seeking to detect patterns in and learn lessons from zillions of such estimates might conclude test welds aren’t needed ever.

Of course, the AI doesn’t work in a vacuum. Solera says Qapter offers a “‘human in the loop’ feature” which can help the AI get better.

“In addition to the AI pre-estimation, the ‘human in the loop’ feature allows for changes to be made at any stage for any job,” Solera wrote.” Any changes are sent back to the AI as part of the continuous learning cycle, to improve performance.

“In instances where the AI confidence level is lower, the software automatically flags the job for a manual check. This flag is available instantly to ensure unnecessary delays to the workflow are avoided.”

The system also can keep track of at least some pre-existing damage. As Solera described it, the customer would submit photos of their car when buying the policy. Qapter can compare the new collision damage to the old images.

In terms of total loss decisions and other triage, Solera says Qapter’s “AI empowers insurers to automate the decision process following FNOL (First Notification of Loss) and route the damaged vehicle to the most appropriate repair center or salvage yard.”

Solera said the upgraded Qapter delivered “the industry’s only globally available end-to-end solution for full digitalization of the modern claims workflow.”

“With leading claims platforms currently available throughout North America, Europe, Latin America and Asia Pacific, we are excited to provide even more value to our customers by making current platforms ‘smarter’ through the use of AI and supporting a seamless transition from existing solutions to the new platform,” Dejanovic said in a statement. “We’ll be working closely with our customers to deliver this functionality over the coming months and provide regular releases across markets.”

The company says it has partnerships with 60 percent of the world’s insurers and receives data from 73 countries.

More information:

“INTRODUCING SOLERA’S NEXT GENERATION OF QAPTER”

Solera, June 30, 2020

Featured images: A screenshot of Solera’s AI photo estimating within Qapter is shown. Note: Parts and labor costs are based on European standards and for illustrative purpose only. (Provided by Solera)