CCC says repairable claims down 19.6% in October; auto insurers examine 3Q frequency

By onAnnouncements | Education | Insurance | Market Trends

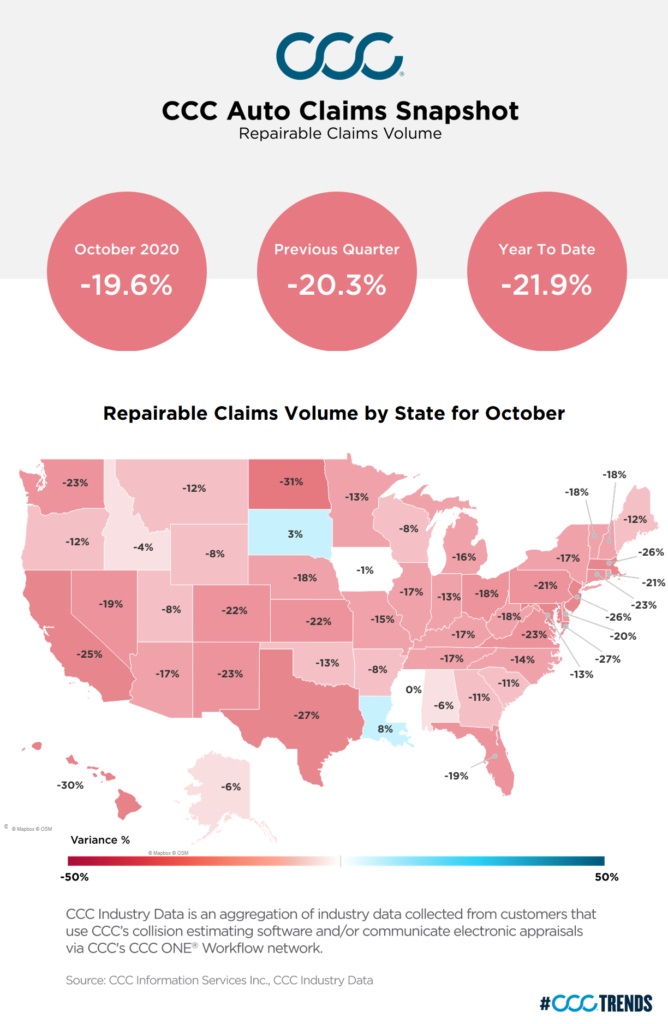

CCC on Wednesday estimated repairable auto appraisal counts were down nearly 20 percent in October.

The projections come amid November releases of third-quarter same-store sales data from Gerber Collision’s parent company and 3Q frequency data from Allstate and Progressive. This month also saw Liberty Mutual and State Farm representatives assess their loss rates and GEICO’s Berkshire Hathaway evaluate claims for the first nine months of the year.

The various statistics offer auto body shops mechanisms for evaluating their businesses and gauging the impact of future pandemic initiatives upon claims.

For example, states like Washington and Michigan this week tightened restrictions in response to significant COVID-19 resurgences — potentially curtailing road traffic and collisions even further. CCC reported that Washington’s repairable claims were already down 23 percent in October, and Michigan’s stood down 16 percent.

“With the U.S. reporting more than 100,000 new COVID-19 cases in a single day, predictions of a winter wave of the virus appear to be coming true; plans to bring more students back to school full-time or employees back to office will likely be stalled further,” CCC wrote Wednesday. “Additionally, U.S. unemployment claims have not improved significantly in the last several weeks. With many fewer drivers on the road each day driving to work, driving kids to school, or because they are unemployed, the likelihood of significant increases in accident and claims counts in Q4 are looking even more unlikely.”

CCC’s estimate of repairable appraisals found October at least looking better than September, which stood down 22.7 percent over 2019. Overall, the year ending Oct. 31 has seen 21.9 percent fewer repairable claims than Jan. 1-Oct. 31, 2019.

Without catastrophic claims, body shops would have experienced even lower volume this year, according to CCC. (Weather-battered Louisiana might have provided a symbol of this, with repairable appraisals up 8 percent in an October which saw Hurricanes Delta and Zeta.) Nationally, repairable non-comprehensive claims in the first 10 months of the year are down more than 25 percent, CCC wrote.

During the virtual MSO Symposium on Thursday, Liberty Mutual auto physical damage Vice President Scott Kohl also called 2020 a “pretty big cat year” for many insurers.

Total losses also remain elevated compared to 2019 — another contributor to the decline in repairable vehicles. CCC said totals reached 21 percent of losses in the third quarter compared to 18.7 percent in 2019.

“Higher total loss frequency with a higher share of claims that are non-driveable continue to underscore how COVID-19 has changed accident types,” CCC wrote.

Insurers describe current state

Kohl and State Farm property and casualty claim consultant Chris Evans told the MSO Symposium audience that auto frequency remained down but nowhere near as much as the heart of the pandemic in the spring.

Evans said his company’s losses at in late March and early April were “literally cut in half.”

He estimated that when considering a rolling 12-month period, State Farm was today experiencing a percentage decline in the “kind of negative teens, if you will.”

“… It is trending back up,” he said. “… It’s noticeable what’s happening.”

Kohl estimated that his insurer’s claims “certainly took a hit” at the end of the first quarter and beginning of 2Q but had rebounded — but not to 2019 levels. He said Liberty Mutual was likely in the “low teens” in terms of a claims decline.

Quarterly reports

CCC’s analysis Wednesday declared third-quarter repairable appraisals had fallen 20.3 percent from 2019, and quarterly reports from publicly traded companies reflect such trends.

Allstate earlier in the month reported its third-quarter gross auto frequency sat down 28.6 percent compared to July 1-Sept. 30, 2019. However, paid claim severity has risen 7.9 percent, the insurer said.

Progressive on Nov. 3 said its personal auto incurred frequency fell 19 percent in the third quarter and was down 25 percent for the first nine months of the year.

“Auto property damage decreased about 24% for the third quarter and 28% for the first nine months of 2020, respectively,” Progressive wrote.

“… Collision decreased about 15% for the quarter and 25% for the first nine months.”

GEICO parent Berkshire Hathaway didn’t report third-quarter frequencies and severity in its Nov. 7 10-Q, instead examining the first nine months of the year.

“Claims frequencies in the first nine months of 2020 were lower for property damage, bodily injury and personal injury protection coverages (twenty-nine to thirty-one percent range) and collision coverage (twenty-four to twenty-six percent range) compared to 2019,” Berkshire Hathaway wrote. “Average claims severities in the first nine months of 2020 were higher for property damage coverage (ten to twelve percent range), collision coverage (seven to nine percent range) and bodily injury coverage (ten to twelve percent range).”

More information:

“CCC Auto Claims Snapshot – October 2020”

CCC, Nov. 11, 2020

Allstate third-quarter earnings results

Allstate, Nov. 5, 2020

Berkshire Hathaway (GEICO) third-quarter earnings results

Berkshire Hathaway, Nov. 7, 2020

Progressive third-quarter earnings results

Progressive, Nov. 3, 2020

“Boyd Group Services Inc. Reports Third Quarter 2020 Results”

Boyd Group Services (Gerber), Nov. 11, 2020

Images:

Insurers estimated auto claim frequency was down in the third quarter of 2020, and CCC wrote that repairable vehicle appraisals were down 19.6 percent in October. (Liliboas/iStock)

CCC on Nov. 11, 2020, estimated repairable auto appraisal counts were down nearly 20 percent in October. (Provided by CCC)

Clockwise from top left, moderator Stephen Applebaum, managing partner of Insurance Solutions Group; Allstate auto line director Sandee Lindorfer; State Farm claim consultant Chris Evans; Liberty Mutual auto physical damage Vice President Scott Kohl; and USAA auto claims AVP and senior experience owner Patrick Burnett participate in a Nov. 12, 2020, virtual MSO Symposium panel. (Screenshot from MSO Symposium video)