IIHS: Rear autobrake ‘standout feature’ in reducing liability, collision claims

By onAssociations | Insurance | Market Trends | Repair Operations

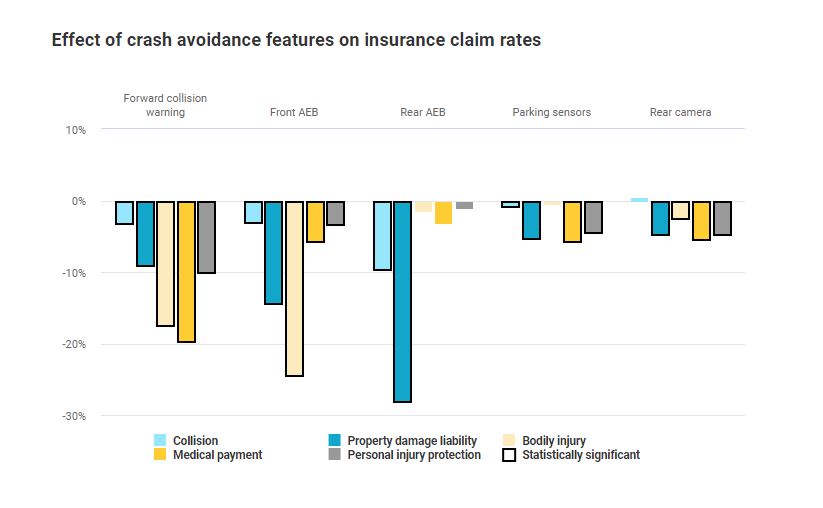

Updated Highway Loss Data Institute research into rear autobraking found the ADAS technology cut property damage liability claims 28 percent and collision claims 10 percent, the Insurance Institute for Highway Safety said Thursday.

The success of the technology recounted by the HLDI’s sister organization suggests a significant threat to auto body shop volume. It also represents another advanced driver assistance system which will need to be properly restored to deliver the same crash protection to your customer and the motorists around them. (The IIHS said the tech will leverage sensors like cameras and radar.)

Incidents of rear vehicle damage of less than $2,000 comprised 17 percent of all collision claims between 2010-17, according to HLDI research cited by the IIHS.

2018 crash data from the Indiana Criminal Justice Institute also confirm a large number of crashes arise while someone is backing up. Backing crashes represented 9.3 percent of all state crashes and 10.8 percent of Indiana crashes with property damage but no one killed or hurt.

The Indiana statistics also found that “(u)nsafe backing” accounted for about 10.4 percent of all crashes and 12.6 percent of property-damage-only crashes attributed in some way to the driver.

Backing crashes were among the least likely crashes to leave fatalities in Indiana.

“Backing crashes generally happen at lower speeds than front-to-rear crashes,” HLDI Senior Vice President Matt Moore said. “That means they’re less dangerous, but the costs from vehicle damage can add up.” One wonders if the lower speeds increase OEMs’ chances of further slashing such crashes with technology — there’s less velocity and perhaps more time for the AI to react.

The IIHS called rear autobraking the “standout feature” when HLDI conducted its annual roundup of its research. The HLDI had expanded its rear autobraking data set, adding statistics from 2015-18 Subarus to its earlier work involving 2013-15 Cadillacs, and analyzing the new results.

The Subarus with rear autobraking were involved in 28.9 percent fewer property damage liability claims, and the Cadillacs posted 26.3 percent fewer incidents. The Cadillacs yielded 13.1 percent fewer collision claims, and the Subarus saw an 8 percent decline.

Only front autobraking, rear autobraking and forward collision warnings to date have been shown to lead to double-digit claim frequency declines, regardless of coverage, according to the IIHS.

New vehicles already have backup cameras mandatory as of 2018, but the HLDI has found these aren’t nearly as effective at preventing crashes. Parking sensors aren’t as good either, according to the HLDI.

That said, both pieces of tech still work well enough that body shops should be prepared for an erosion of volume.

The HLDI said research spanning seven other OEMs’ vehicles found backup cameras and parking sensors each cut property damage liability claims by 5 percent on their own. Parking sensors also cut collision claims 1 percent. (Collision claims weirdly rose when backup cameras were present, but not enough to be statistically significant.)

“Claims data show that collision avoidance technologies that automatically intervene to prevent or mitigate crashes are more effective than warning-based systems,” Moore said in a statement. He also pointed out that forward collision warning wasn’t as effective as frontal autobraking.

More information:

“Evidence mounts for effectiveness of rear autobrake”

Insurance Institute for Highway Safety, Jan. 7, 2021

“Compendium of HLDI collision avoidance research” bulletin

Highway Loss Data Institute, December 2020

Images:

The Highway Loss Data Institute found 2015-18 Subarus with rear autobraking were able to reduce property damage and collision claims by a notable amount. (Provided by Insurance Institute for Highway Safety; redaction by Repairer Driven News)

Updated Highway Loss Data Institute research into the rear autobraking ADAS found the technology cut property damage liability claims 28 percent and collision claims 10 percent, the Insurance Institute for Highway Safety said Jan. 7, 2021. (Provided by IIHS)