Guest column: Employee Retention Tax Credit cheat sheet

By onBusiness Practices | Education | Legal | Repair Operations

Editor’s note: George Crowell, principal of Harris, Hardy & Johnstone, on Feb. 12, 2021, shared the following summary of the Employee Retention Tax Credit — which last year was expanded to permit usage by Paycheck Protection Program recipients — and has graciously permitted us to reprint it as a guest column.

Last week’s House Resolution 1319, the “American Rescue Plan,” preserves the credit through the end of the year, and we’ve added the new dates. HR 1319 also creates ERTC rules for companies it classifies as “severely financially distressed employers” or “recovery startup businesses,” but we’re not going to get into those here.

Nothing in this article is meant as formal tax advice. It’s for informational purposes only. Consult with a qualified financial professional before taking any action.

By George Crowell

2020 ERTC (Applies to wages paid starting after March 12, 2020 through Dec. 31, 2020)

How to Qualify:

- Full or partial suspension of the operation of the company’s trade or business during any calendar quarter because of governmental orders limiting commerce, travel, or group meetings due to COVID-19, or

- a significant decline in gross receipts

A significant decline in gross receipts begins:

- on the first day of the first calendar quarter of 2020

- for which an employer’s gross receipts are less than 50 percent of its gross receipts

- for the same calendar quarter in 2019.

The significant decline in gross receipts ends:

- on the first day of the first calendar quarter following the calendar quarter

- in which gross receipts are more than of 80 percent of its gross receipts

- for the same calendar quarter in 2019.

The credit applies to qualified wages (including certain health plan expenses) paid during this period or any calendar quarter in which operations were suspended.

Amount of the Credit:

For small business (100 or fewer employees), it is a 50 percent credit for wages paid to any employee during the qualified period. (Larger employers are also eligible, but not all their workers might count.) Qualifying wages (including certain health plan costs) up to $10,000 are counted toward the $10,000. This means that, in any quarter you qualify, you can get a credit of up to $5,000 for that quarter. For example: For any employee being paid $40,000 or more per year, that was employed throughout the entire qualifying quarter, the company would receive a full $5,000 credit.

Claiming the Credit:

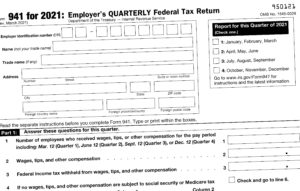

- You can reduce the amount of your federal tax deposits during the quarter, up to the amount of the credit, without penalty, or receive a refund on Form 941 for overpaid payroll taxes. The refund would reduce the expense for employer payroll taxes (FICA and Medicare) recognized by the company.

- File Form 7200 to request an advance of the ERTC.

2021 ERTC (Applies to wages paid starting after Jan. 1, 2021 through Dec. 31, 2021)

How to Qualify:

- Full or partial suspension of the operation of the company’s trade or business during any calendar quarter because of governmental orders limiting commerce, travel, or group meetings due to COVID-19, or

- a significant decline in gross receipts

A significant decline in gross receipts begins:

- on the first day of the first calendar quarter of 2021

- for which an employer’s gross receipts are less than 80 percent of its gross receipts

- for the same calendar quarter in 2019.

The significant decline in gross receipts ends:

- on the first day of the first calendar quarter following the calendar quarter

- in which gross receipts are more than of 80 percent of its gross receipts

- for the same calendar quarter in 2019.

The credit applies to qualified wages (including certain health plan expenses) paid during this period or any calendar quarter in which operations were suspended.

Amount of the Credit:

For small business (500 or fewer employees), it is a 70 percent credit for wages paid to any employee during the qualified period. (Larger employers are also eligible, but not all their workers might count.) Qualifying wages (including certain health plan costs) up to $10,000 are counted toward the $10,000. This means that, in any quarter you qualify, you can get a credit of up to $7,000 for that quarter. For example: For any employee being paid $40,000 or more per year, that was employed throughout the entire qualifying quarter, the company would receive a full $7,000 credit.

This credit is available for a potential total credit per employee of $28,000. You must meet the qualifications for each quarter to get the credit for that quarter.

Claiming the Credit:

- You can reduce the amount of your federal tax deposits during the quarter, up to the amount of the credit, without penalty, or receive a refund on Form 941 for overpaid payroll taxes. The refund would reduce the expense for employer payroll taxes (FICA and Medicare) recognized by the company.

- File Form 7200 to request an advance of the ERTC.

Footnote 2020 and 2021 ERTC:

Wages that were used as part of forgiveness of a PPP loan do not qualify for inclusion in calculating the amount of ERTC credit the company qualifies to receive.

George Crowell, CPA, CITP is principal of Harris, Hardy & Johnstone.

More information:

IRS Notice 2021-20: “Guidance on the Employee Retention Credit under Section 2301 of the Coronavirus Aid, Relief, and Economic Security Act.” (Note: Applies only to 2020 ERC)

Internal Revenue Service, March 1, 2021

“IRS provides guidance for employers claiming the Employee Retention Credit for 2020, including eligibility rules for PPP borrowers” (Note: Predates March 2021 passage of House Resolution 1319)

IRS, March 1, 2021

“New law extends COVID tax credit for employers who keep workers on payroll” (Note: Predates March 2021 passage of House Resolution 1319)

IRS, Jan. 26, 2021

Images:

An Internal Revenue Service payroll tax Form 941 is shown as of March 2021. (Provided by IRS)

The Internal Revenue Service building on Constitution Avenue in Washington, D.C., is shown. (drnadig/iStock)