SBA opening simplified online PPP forgiveness portal for loans up to $150K

By onAnnouncements | Business Practices | Education | Legal | Market Trends | Technology

The SBA on Wednesday announced small businesses who borrowed up to $150,000 through the Paycheck Protection Program could soon seek loan forgiveness with a “streamlined application portal” online.

The directforgiveness.sba.gov Small Business Administration portal will open Wednesday, Aug. 4, for borrowers whose lenders agreed to use the forgiveness tool.

“As one of the leading PPP lenders in the nation, Customers Bank is proud to partner with SBA to deliver responsive digital loan forgiveness service to the small business borrowers,” Customers Bank CEO Sam Sidhu said in a statement Wednesday. “The streamlined and efficient SBA PPP loan forgiveness portal will help borrowers and lenders move forward with economic growth and job creation following the pandemic. We encourage other lenders to join Customers Bank and opt-in to the SBA portal.”

The agency estimated that more than 600 banks collectively representing 30 percent of the eligible $150,000-and-under loans have opted in to the program.

This will allow more than 2.1 million borrowers to pursue what the SBA described as a simpler forgiveness process for the COVID-19 economic relief loans.

“The SBA’s new streamlined application portal will simplify forgiveness for millions of our smallest businesses — including many sole proprietors — who used funds from our Paycheck Protection Program loans to survive the pandemic,” SBA Administrator Isabel Casillas Guzman said in a statement. “The vast majority of businesses waiting for forgiveness have loans under $150,000. These entrepreneurs are busy running their businesses and are challenged by an overly complicated forgiveness process. We need to deliver forgiveness more efficiently so they can get back to enlivening our Main Streets, sustaining our neighborhoods and fueling our nation’s economy.”

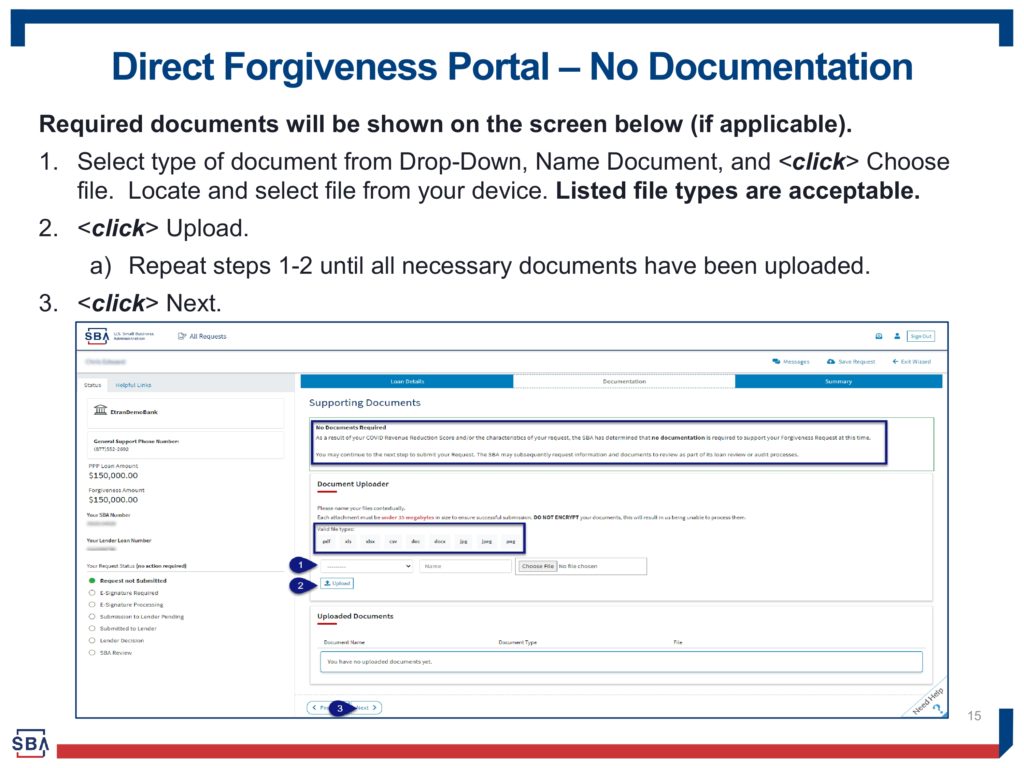

The online portal going live Wednesday asks few questions and might not require companies to submit documentation at all, based upon a presentation the SBA provides with the website. Body shops and other small businesses who need help with the PPP portal can call a PPP customer service team at 877-552-2692 between 8 a.m. and 8 p.m. Monday-Friday.

The COVID-19 economic relief Paycheck Protection Program initiative ran from April 3-Aug. 8, 2020 (with a brief hiatus), and again from Jan. 11-May 31, 2021. Many of 2020’s borrowers were eligible to apply for a “second draw” loan in 2021.

Altogether, the program saw more than $799.8 billion in government-backed, potentially completely forgivable loans approved for more than 11.8 billion small businesses — including many of the nation’s body shops.

The average national loan in 2021 was around $42,000, and the average loan in 2020 was $101,000, according to the SBA.

A Repairer Driven News analysis of Small Business Administration NAICS 811121 “Automotive Body, Paint, and Interior Repair and Maintenance” borrowing data indicates the collision repair industry is ripe for the easy forgiveness program. (While it does include some noncollision businesses like upholstery shops, the government’s NAICS 811121 data category excludes glass and mechanical shops and overall provides a pretty good way to analyze the industry.)

The SBA reports 27,256 “Automotive Body” companies received PPP first draw loans in 2020 or 2021, and 10,855 shops took advantage of second-draw lending in 2021. However, 1,078 first-or second-draw loans remain undisbursed.

Only 14,119 repairers have seen part or all of their first-draw loans forgiven, and just 573 shops have received second-draw loan forgiveness as of June 30, 2021.

The average first draw loan was about $58,202, and only 2,537 repairers — less than 10 percent — borrowed more than $150,000 in a first draw.

The average second draw loan was about $77,155. Only 1,407 out of the 10,855 “second draw” lenders received more than $150,000.

Simplifying forgiveness

PPP loans and their interest are completely forgivable so long as the business spends all or the bulk of the money on employee salaries and any remainder on authorized critical expenses, such as utilities. The idea was to help businesses suffering a pandemic-related loss of business keep employees on the job rather than using layoffs to make ends meet.

However, it’s been argued that the forgiveness process is a headache small businesses don’t need.

AQN Strategies in 2020 argued that the government’s original 11 pages of forgiveness forms and instructions in May 2020 put a counterproductive burden on small businesses. The research firm also pointed out that small-dollar loans could actually cause banks to lose money if the loans matured. They argued that automatically forgiving everything $150,000 and lower would be better for society net than going through the original process, even if a few unworthy parties slipped through the cracks.

However, the government attempted to simplify the forgiveness process throughout 2020, and Congress in December 2020 ultimately approved a COVID-19 relief measure mandating no more than a one-page forgiveness form for borrowers of up to $150,000.

That Economic Aid Act also reopened PPP “first draw” lending for businesses that hadn’t used the program yet and permitted “second draw” borrowing by businesses who had already received a PPP loan.

PPP “first draw” loans in 2021 lend up to $10 million to businesses with 500 or fewer employees who didn’t get a PPP loan last year. These completely forgivable loans mostly follow the same rules as the 2020 PPP run, including qualifying by attesting in good faith, “Current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.”

“Second draw” PPP loans maxed out at $2 million and were only available to companies with 300 or fewer employees. This time, the company must have experienced a 25 percent decline in gross receipts during at least one quarter in 2020. This could be proven at the time of the loan or now during the application for forgiveness.

“Despite the implementation of the streamlined loan forgiveness application for borrowers with loans of $150,000 or less, many smaller PPP lenders continue to express concerns to SBA that they do not have the technology or human resources to develop efficient electronic loan forgiveness platforms to process the new streamlined loan forgiveness application,” the SBA wrote in an interim final rule published July 23. “SBA has also become aware that because lenders are overwhelmed by the volume of PPP loans and are mindful of the statutory 60-day requirement for lenders to issue a forgiveness decision to SBA from receipt of the borrower’s loan forgiveness application, lenders are limiting when loan forgiveness applications are accepted from borrowers, creating uncertainty among borrowers that they are going to have to start making payments on their PPP loans while they are waiting for their lenders to accept and process their loan forgiveness applications.

“Additionally, SBA has heard concerns from PPP lenders of all sizes that the requirement for borrowers to submit and lenders to review at the time of forgiveness the revenue reduction documentation for Second Draw PPP Loans of $150,000 or less is delaying the forgiveness process for these borrowers.”

So the agency planned two additional steps to make life easier for these lower-dollar borrowers and their banks.

First, it invented the online direct forgiveness portal, freeing up banks from having to collect such a tool themselves and from the data collection scut work.

“When a PPP lender opts-in to the direct borrower forgiveness process, the Platform will provide a single secure location for all of its borrowers with loans of $150,000 or less to apply for loan forgiveness through the Platform using the electronic equivalent of SBA Form 3508S,” the SBA wrote in its interim final rule. “Upon receipt of notice that a borrower has applied for forgiveness through the Platform, lenders will review the loan forgiveness application in the Platform and issue a forgiveness decision to SBA inside the Platform. SBA believes that lenders that opt-in to using the direct borrower forgiveness process will benefit with reduced costs, increased efficiency, and more timely remittance of forgiveness payments from SBA, while borrowers will benefit from the ability to submit loan forgiveness applications directly through the Platform and reduce the wait time and uncertainty associated with submission through their lender.”

Second, the SBA will permit a “COVID Revenue Reduction Score” developed by an independent SBA contractor as an alternative to the revenue decline documentation.

“The score uses current data on economic recovery and return of businesses to operational status,” according to the SBA. It said it takes into account “industry, geography and business size.”

If a business received the “second draw” loan without documentation, the bank can just check the score tool and see if the government feels that borrower doesn’t need to bother providing proof.

“The independent third-party contractor will use a Consumer Demand Recovery Index that combines multiple data sources of the consumption of products and/or services (foot traffic, third party data, credit card spending, etc.) provided by businesses,” the SBA wrote. “Further, using the Business Operations Response Index, the score will measure the businesses’ return to operational status, which includes employment and unemployment data, business to business payment transactions, mobility and foot traffic on workplace and visitor frequency at physical locations. The resulting score will reflect declines in revenue. The contractor has advised SBA that this methodology will result in a score that will adequately document that the borrower met the revenue reduction standard as required by section 7(a)(37)(I)(i)(II) of the Small Business Act.”

As we read it, the government is basically playing the odds. Think about small businesses like gyms or bars in states that locked them down more severely than other businesses during the pandemic. Does the SBA or the bank really need proof of income to believe that such a small business was down 25 percent in a quarter last year? Even if a couple of outlier gyms or bars who did OK last year slip through the cracks, it’s probably a better use of the businesses, banks and agency’s time just to assume that local sector all deserved their “second draw” loans and move on. Remember, we’re only talking about $150,000 or less per undeserving company. That’s like a rounding error to the government and U.S. economy.

More information:

“SBA Announces Opening of Paycheck Protection Program Direct Forgiveness Portal”

Small Business Administration, July 28, 2021

Repairer Driven News collection of NAICS 811121 “Automotive Body” PPP usage data

SBA, data current through July 1, 2021

PPP direct forgiveness portal user guide

SBA Paycheck Protection Program webpage

SBA, July 28, 2021

Images:

Small Business Administration Administrator Isabella Guzman. (Provided by SBA)

This Small Business Administration slide demonstrates how the Paycheck Protection Program direct forgiveness portal might not require documentation from a borrower of less than $150,000. (Provided by SBA)