Calif. orders Allstate, Mercury, CSAA to refund excess profits to drivers

By onAnnouncements | Insurance

California’s insurance commissioner has ordered Allstate, Mercury and CSAA to return to drivers more of the excess profits collected from them during the pandemic, or face legal action.

Although insurance companies have returned more than $2.4 billion in premium relief to California drivers, an analysis by the California Department of Insurance (DOI) of new data shows these three companies “have the greatest gap between what they initially refunded drivers, and what they should have refunded, to provide proper premium relief to their policyholders since the start of the COVID-19 pandemic,” Insurance Commissioner Ricardo Lara said in a news release.

“On behalf of consumers, I am out of patience,” Lara said. “These insurance companies have 30 days to tell us once and for all how they are going to make it right before we take further action.”

The commissioner’s office did not say how much money each of the three insurers had already returned under a previous order, or how much it believes they should have returned. In general, the DOI has found that from March to September 2020, insurance company groups returned on average 9 percent of auto premiums, but should have refunded nearly double that amount — 17 percent — over the seven-month period.

Collectively, the three companies provide insurance to one in five California drivers.

Proposition 103, passed by California voters in 1988, gives the insurance commissioner broad authority to make sure premiums are fair, and based primarily on a driver’s safety record, miles driven and driving experience.

Any company that violates the law faces fines of as much as $10,000 per person overcharged.

Nationally, consumer groups analyzing insurers’ underwriting performance from 2020 have concluded that auto insurers reaped billions of dollars in excess profits due to reduced accidents during the lockdowns, and say consumers are still owed billions in additional refunds.

“Insurers selling personal auto insurance reaped windfall profits of at least $29 billion in 2020 as miles driven, vehicle crashes and auto insurance claims dropped because of the pandemic and related government actions,” the Consumer Federation of America and Center for Economic Justice said in early September.

The Consumer Federation of America and Center for Economic Justice have concluded that California drivers are owed an average of $3,541, in premium relief, by far the highest in the country. The groups called the figure “conservative.”

A separate analysis conducted by the non-profit group Consumer Watchdog found that insurers earned excess profits of about $5.5 billion in California.

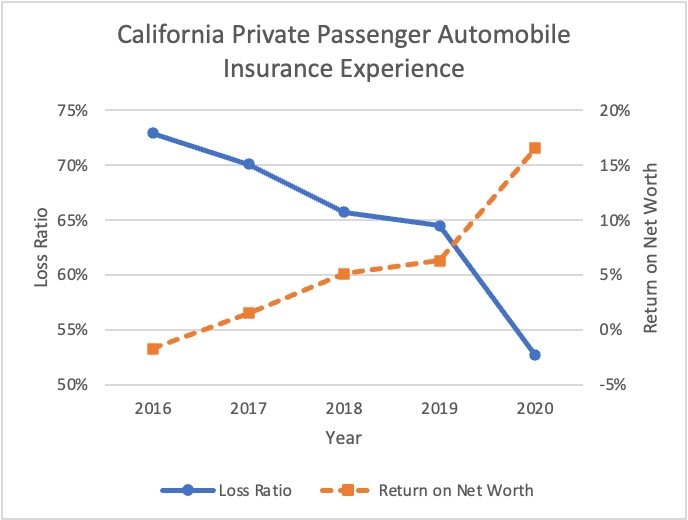

“Newly published 2020 data show that accident claims plummeted as cars idled in driveways, but insurance companies failed to reduce rates accordingly,” Consumer Watchdog said in a statement. “As a result, insurance companies’ average return on net worth – a measure of profitability that includes premiums and investment income – was more than twice what California law allows last year.”

Repairer Driven News reached out to Allstate, Mercury and CSAA for comment. CSAA responded, “We are in receipt of Commissioner Lara’s letter, are currently reviewing the request, and will respond within the time frame requested. In 2020, CSAA Insurance Group issued more than $137 million in total refunds to policyholders as part of our commitment to help AAA Members prevent, prepare for and recover from life’s uncertainties.”

“We were the first insurer to respond to decreased driving during the pandemic by returning $1 billion to drivers countrywide and always provide our customers affordable coverage,” Allstate said in a statement to RDN. “Not only did we lead to support drivers, but we’ve been there for Californians throughout the wildfires by paying thousands of insurance claims and extended our coverage offerings this year to help alleviate the homeowners’ insurance availability crisis.”

Mercury had not responded as of late Thursday afternoon.

In letters to to Allstate, Mercury and CSAA, Lara’s office puts forward its allegation, and asks the insurers to respond.

“Many Californians’ private passenger vehicles became misclassified or incorrectly rated and the projected loss costs became overstated as a result of policyholders driving significantly less to comply with the various state and local public health ‘stay-at-home’ orders. As a result, many insurers overcharged consumers for their private passenger automobile (PPA) coverage beginning in March 2020 through at least March 2021,” the letters, signed by Kenneth B. Schnoll, general council and deputy insurance commissioner, reads.

The letters ask each of the insurers to provide the following information:

- The amount of additional PPA premium refunds/credits the Company intends to provide to its California PPA policyholders for the time period of March 2020 through at least March 2021;

- A description of the methodology to be used to determine which policyholders will be provided additional refunds/credits, how much each will receive, and when they will receive it;

- Appropriate data and documentation, per the attached Appendix A, to assist the Department in determining any additional amount of PPA premium refunds or credits to be provided; and

- A description of all actions, if any, the Company took in response to the pandemic to determine policyholders’ annual miles driven from March 2020 through at least March 2021.

Images:

Featured image: One consumer advocacy group says that insurers owe California drivers $5.5 billion. (Kativ/iStockphoto)

The relationship between loss-ratio and return on net-worth for an insurance company. (Consumer Watchdog)

More information:

Letter from Kenneth B. Schnoll to CSAA

Letter from Kenneth B. Schnoll to Mercury Insurance

Letter from Kenneth B. Schnoll to Allstate Insurance

Auto insurers scored windfall profits from pandemic lockdowns