Suit seeks release of CDI meeting records in California ‘pay to play’ lawsuit

By onInsurance | Legal

A California consumer rights organization is asking a court to order Insurance Commissioner Ricardo Lara’s office to disclose records of all meetings with representatives of insurance companies involved in what it calls the office’s “pay-to-play scandal.”

Consumer Watchdog has filed a suit in California Superior Court for the County of Los Angeles, alleging that Lara and the California Department of Insurance (CDI) failed to search for and produce records related to the scandal involving insurance companies with business pending before the agency.

Under the California Public Records Act (CPRA), Consumer Watchdog said it had sought records of meetings and communications with 13 individuals as “relevant to the pay-to-play scandal,” as well as those of “any individuals employed by or representing” the involved companies.

“The Department ultimately produced some responsive records, but indicated it was withholding others for which it refused to provide any information regarding their quantity or general nature, despite repeated requests,” the organization said in its opening brief, filed on July 5.

Two companies, Applied Underwriters and IHC, contributed $53,400 to Lara’s 2022 re-election campaign fund, with some contributions made in the names of relatives of insurance company executives, “apparently to hide their true source,” according to the brief.

Applied’s president, Steven Menzies, then asked Lara to intervene in proceedings at CDI involving Applied. Lara did so, overriding administrative law judge orders in at least four proceedings, Consumer Watchdog said. It also alleged that Menzies also stood to gain if Lara approved his purchase of Applied’s subsidiary, California Insurance Company (CIC).

During the discovery process, CDI admitted that it had done nothing to determine who was employed by or representing Applied or the other companies, the complaint alleges.

Consumer Watchdog said it found evidence that the department knew of other individuals who represented the companies, but failed, “perhaps intentionally,” to include their names as search terms. “As a result, the universe of responsive documents remains unknown,” it said.

Further, the “master calendar” produced by CDI shows related meetings for which no records were produced.

Through discovery, Consumer Watchdog learned that CDI had “not only refused to search for responsive documents, but Respondents also withheld 96 communications and redacted six others, claiming they are ‘absolutely protected’” under state law and the California insurance code. “Yet, Respondents failed to meet their burden to establish that those provisions apply to the records,” the brief says.

Consumer Watchdog said it offered to drop its lawsuit if CDI would “simply conduct the required search,” but that the office refused.

“The Petition cannot be resolved by simply filing a new CPRA request. To this day, there is no way for Consumer Watchdog to know all the individuals ’employed by or representing’ the companies involved in the pay-to-play scandal,” the brief says.

A spokesman for CDI told Repairer Driven News that the office cannot comment on pending litigation matters.

The trial is to begin Sept. 2.

In a Sept. 29, 2019 open letter to constituents, Lara apologized for unspecified meetings and pledged reforms.

“I believe effective public service demands constant adherence to the highest ethical standards,” Lara wrote. “But during my campaign and first six months in office, my campaign operation scheduled meetings and solicited campaign contributions that did not fall in line with commitments I made to refuse contributions from the insurance industry. I take full responsibility for that and am deeply sorry.”

Lara, a Democrat, will face off against Republican Robert Howell on the fall ballot. With Democrats holding an overwhelming electoral advantage in the state, Lara is widely favored to win re-election.

Washington commissioner faces calls to resign

Lara is not the only state insurance commissioner under scrutiny. In Washington, Gov. Jay Inslee and leaders of both parties in the legislature have called on longtime Insurance Commissioner Mike Kreidler to resign after he fired an aide who went public with complaints that Kreidler bullied him and was “antagonizing staff.”

According to The Seattle Times, “In recent months, a half-dozen potential and former employees disclosed instances when Kreidler was demeaning or rude, overly focused on race and used derogatory terms for transgender people and people of Mexican, Chinese, Italian or Spanish descent, as well as asking some employees of color for unusual favors.”

It said the instances date from 2017 to 2022.

“Commissioner Kreidler assured his employees and the public he would work to improve his relationship with staff, but instead he terminated an employee who spoke out about these issues,” Inslee said in a public statement. “All staff deserve respect regardless of their at-will status. Therefore it’s my belief we need different leadership in this position and I believe he should resign.”

So far, Kriedler, a Democrat who is serving his sixth elected term as commissioner, has rejected calls for his resignation and has disputed the reasons for his aide’s departure.

“I cannot comment on the details of an individual personnel matter but the conclusion that an important and valued employee’s departure was because he filed a complaint against me is not true and does not reflect the full context of the story,” Kreidler said.

More information:

Petitioner’s Opening Brief and Exhibits, Consumer Watchdog v. Lara et. al.

“State Insurance Commissioner Defends Intervening in Cases Involving His Donors”‘

KQED, July 25, 2019

Images

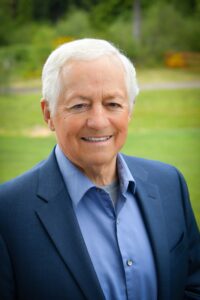

Featured image: California Insurance Commissioner Ricardo Lara. (Provided by the California Department of Insurance)