CCC 2023 Crash Course report explores AI effects on collision claims processes

By onMarket Trends | Technology

CCC Intelligent Solutions’ 2023 Crash Course report has been released and, in part, covers how continuing labor shortages impact collision repairs and how to reduce cycle times with CCC by leveraging artificial intelligence (AI) platforms.

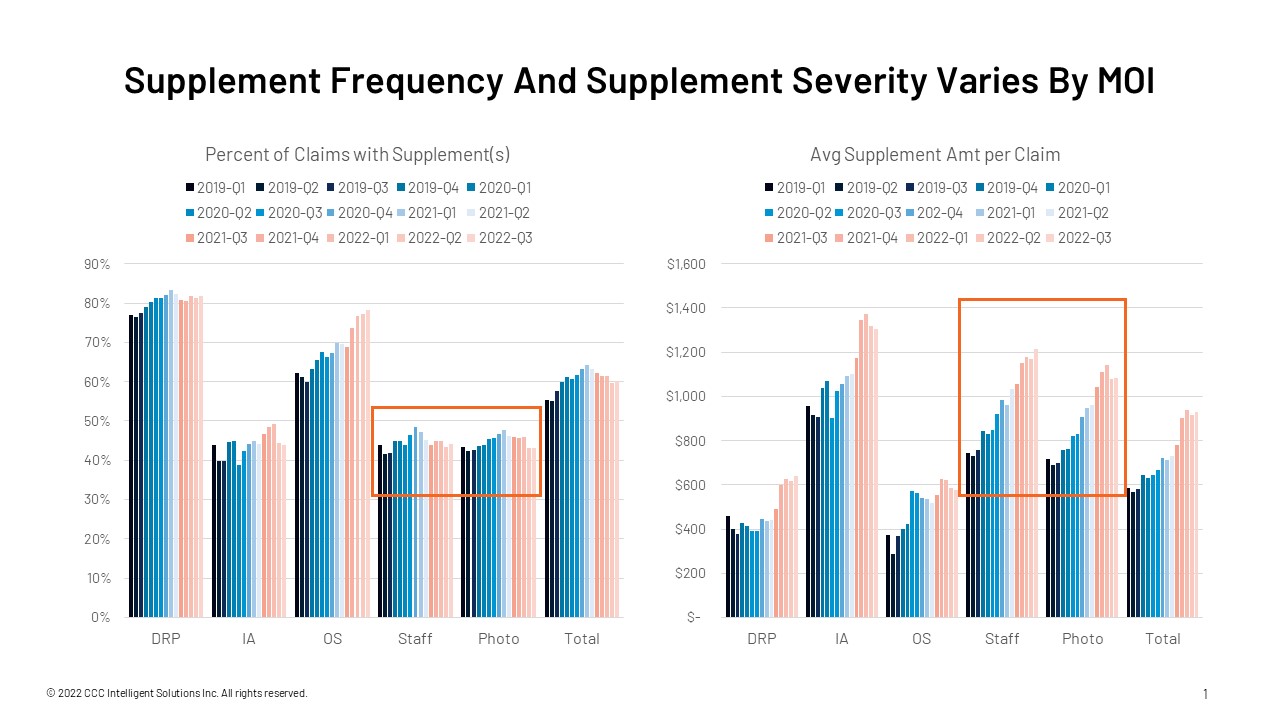

While the report states that the insurance industry has “accelerated its adoption of technologies like machine learning, digitization, AI, and insurtech solutions,” some in the collision repair industry remain skeptical of the accuracy and say their use, including photo estimating, actually increases cycle times. They say delays are caused by having to wait for insurance supplements when large differences in actual costs based on OEM repair procedures are discovered during the disassembly and repair planning process compared to virtual estimates.

Product Marketing Vice President Jason Verlen spoke to Repairer Driven News on that topic as well as the Crash Course report. When asked about cycle time concerns from repairers, he said there are more supplements now, and will continue to be, because of the increasing complexity of vehicles and their necessary repairs.

“The AI is, in a sense, helping [carrier] labor get up to speed but that labor doesn’t necessarily have the same experience in some cases as the labor that was there previously,” he said. “In those cases, they might have more supplements that they might not have had if more experienced labor was there writing the estimate or looking over what had been written.

“There are commingled elements here that are very hard to separate out. We believe the AI both by itself in certain cases for Estimate-STP and in conjunction with the human gives, in general, estimates that perform similarly to humans, similar supplement rates, similar supplement amounts and we monitor that stuff pretty closely.”

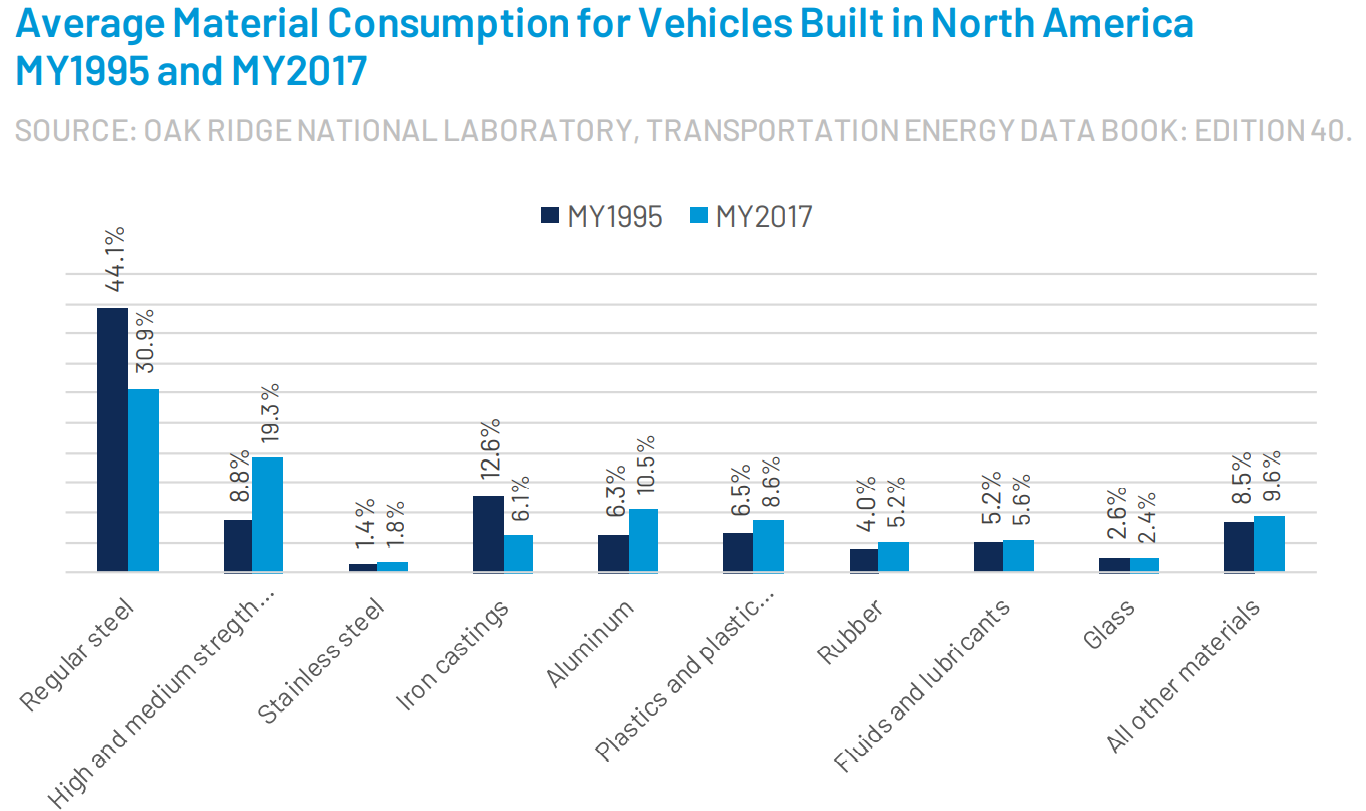

In the report, he wrote that materials used to manufacture vehicles have shifted as automakers look to counter the growing weight of larger vehicles and meet stricter fuel economy standards.

“The automobile industry has been moving at a steady pace to integrate electronics into cars that augment safety and autonomy, support infotainment and navigation, and provide system monitoring, onboard computers, and more. The average vehicle today has between 1,400 and 1,500 semiconductor chips, and electric vehicles have nearly double that amount.”

While CCC’s data finds that AI use by insurers is increasing, Verlen says the technology isn’t there yet and advances so far are only “the end of the beginning.”

“There are a lot of AIs — there are AIs to produce estimates to determine if a vehicle is a total loss or repairable. There’s AIs that help audit estimates written by external sources. There’s AIs that show you visually the damage of the car and I can keep going and going,” Verlen said. “AI to predict repair or replace. AI to predict labor. I mean, it’s incredible. …the obvious question that people might ask is, are we done yet?

“I think where we’re at is kind of a proof point of the transformative nature of this technology and it’s quite impressive in and of itself. But if you look at number one, the state of the industry and how fast it’s changing. And then number two, what the market really demands or, in terms of the challenges they are having like if you look at insurance, the results, the nature of vehicle repair with the costs going way, way up and the labor challenges, et cetera.”

He added there is tremendous market demand for faster AI advances but the technology doesn’t exist yet to meet what’s needed. However, “there is a lot of new AI-type capability that is becoming available now to drive a step change.”

When RDN asked Verlen what could be next in advancing AI, he noted that it’s simpler to write estimates than to repair them but as insurance adjusters begin to interact live with AI more while inspecting vehicles and taking photos, the adjusters will become more efficient and AI will learn more about how to write more accurate estimates.

“The beauty of it is the same exact photos that tip off this APD [auto physical damage] sequence that we’ve been discussing where you can have an interaction with the consumer on the phone, he takes photos and he gets an estimate, those photos will now be used in the casualty realm as well to figure out the likelihood of what kinds of injuries might have occurred and how severe they are so that the insurance company and the injured party can work towards getting an efficient treatment process mapped out to get him back to health.”

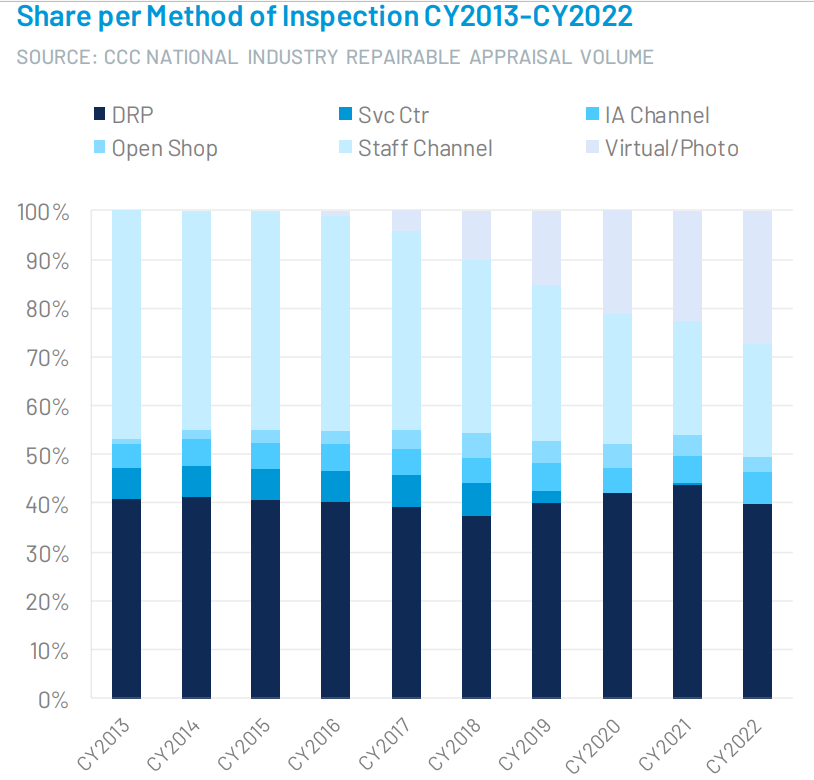

According to CCC data, 27% of repairable vehicles are being processed via consumer-driven mobile AI but if direct repair program (DRP)-assigned vehicles are taken out of the equation, that goes up to nearly 50%. Verlen said that’s because DRP vehicles “tend to be heavier hits,” as far as collision impact.

“It makes sense to remove them from that process because what’s this photo process best for? It’s more the lower end of the hits on the trajectory,” Verlen said. “If it’s a really bad accident, the photo doesn’t really add much. That should go through a different MOI and DRP is very good for that.”

Verlen added that DRPs save insurers from writing the full estimate on their own. “They have an agreement with the DRP participant repair facility that the DRP participant will examine the vehicle and write estimates that comply with the carrier rules that the two of them have agreed to. And so it behooves the insurance company, in that case, to just get the vehicle to the repair facility and let them build the estimate.”

Verlen added that DRPs save insurers from writing the full estimate on their own. “They have an agreement with the DRP participant repair facility that the DRP participant will examine the vehicle and write estimates that comply with the carrier rules that the two of them have agreed to. And so it behooves the insurance company, in that case, to just get the vehicle to the repair facility and let them build the estimate.”

He wrote in Crash Course that, “Adoption is not concentrated within a small number of select carriers but is instead broad-based across the industry. In fact, more than 150 carriers now enable policyholders to send collision damage photos, and roughly 100 carriers apply AI to determine next steps for repair. Benefits from this process have been measurable. According to a CCC survey, 84% of consumers prefer this new digital process because it’s user-friendly and it’s cutting their claims cycle time, from crash to keys, by as much as one-third.”

Verlen explained that when vehicle telematics detects a collision the occupant is asked if they want to digitally process the repairs.

“When someone is in an accident, sometimes they don’t report it immediately,” he said. If it’s telematics-detected, it’ll start to be processed within a few minutes. I think where you get a lot of advantages when you drive the artificial intelligence and the estimate-building into the actual consumer experience — the consumer takes the photos, presses the button, they go to the carrier, the carrier through AI (in some cases 100% and in other cases a combination with a person), they build an estimate, they press a button when they’ve looked at those photos, and they send the estimate back to the consumer.

“What the consumer does is he looks at the estimate and he assesses if he thinks it’s accurate or not. Now, he doesn’t have a lot of knowledge about that. He’s not an expert in fixing cars but what we send with the estimate is what we call a heat map. And a heat map is a visualization on the actual vehicle of where the deep learning artificial intelligence detected the damage.”

That piece saves a lot of cycle time, he added, because of the visualization. On the shop side, the benefit is AI suggests parts that will be needed to fix the vehicle and supplies choices of parts suppliers to buy them from, according to CCC.

“For example, the repair shop had to bail out of the process and send emails or text or call various suppliers to find the parts — that’s very time-consuming,” Verlen said. “It’s what I would call very actionable AI and it’s designed to get immediate decision-making to drive the process forward.”

While cycle times can also be increased due to short-staffed shops and insurance companies because of labor shortages across both industries, CCC has found that AI helps make the process, at least on the carrier side, more efficient, according to Crash Course. Verlen described AI for carrier employees as a “self training mechanism.”

“You start the estimate, or the AI starts the estimate, and immediately it shows you things that maybe you were unaware of. It lists certain parts and certain labor that you’re going to need to fix this vehicle, puts it on the estimate, gets the taxes right, and gets the labor charges right. But it all suggests things to you. It’s interactive… do you concur, do you not concur?”

However, he noted that of course AI can’t repair vehicles.

“Somebody has to get underneath that car and repair it,” Verlen said. “The way that we think of AI there is we have a situation where if the carriers send photos to the shop, we allow a jumpstart at the shop that uses AI to help that person build an estimate.”

To download the full Crash Course report, visit CCC’s website.

Images

All photos provided by CCC Intelligent Solutions

More information

CCC: AI claims processing up 60%, how that benefits claim cycle times