Washington OIC hears trade group, shop, insurance & consumer views on increased complaints

By onInsurance

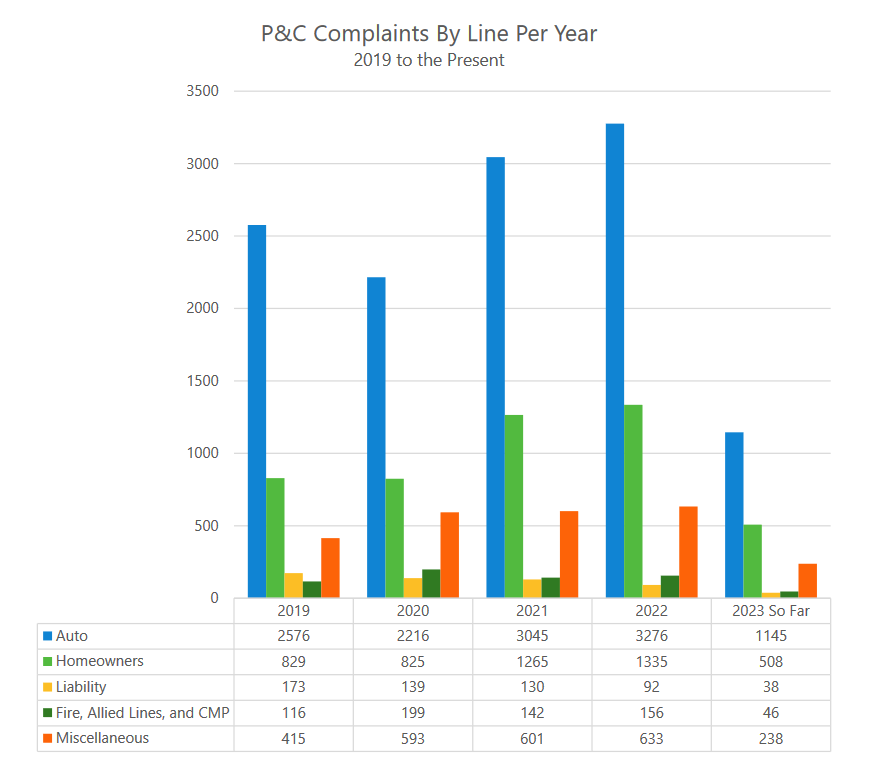

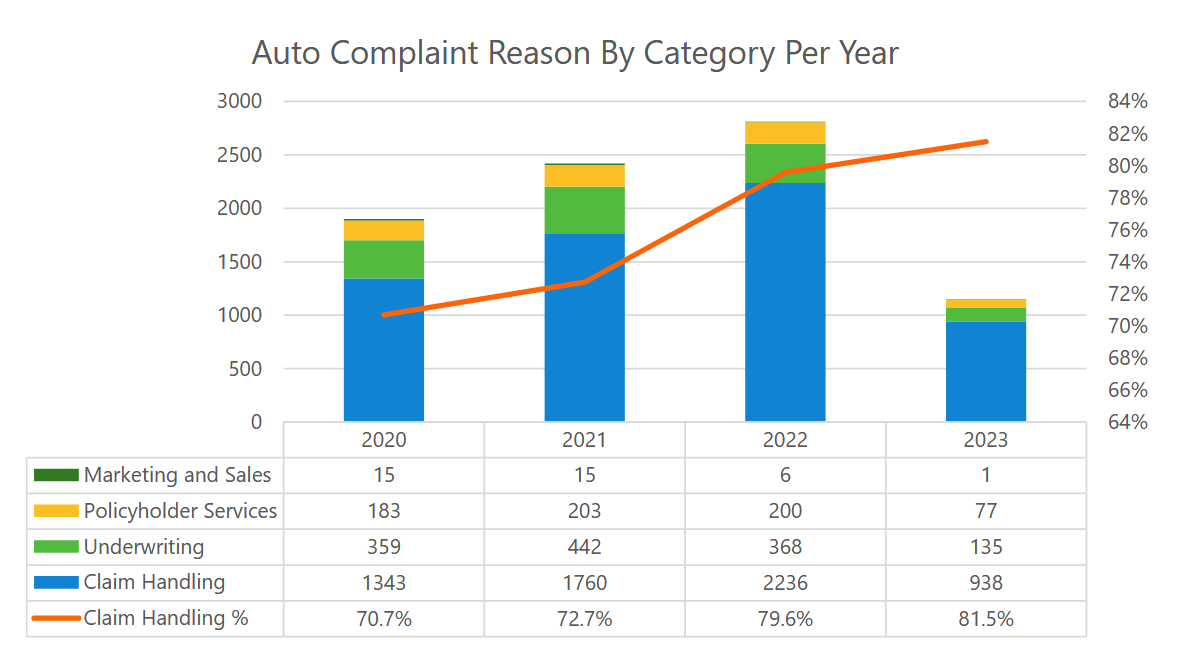

A workshop held Monday by the Washington State Office of the Insurance Commissioner (OIC) shed some light on the state of the P&C industry in auto and home insurance claim experiences and complaints, which have seen an increase, mostly in auto.

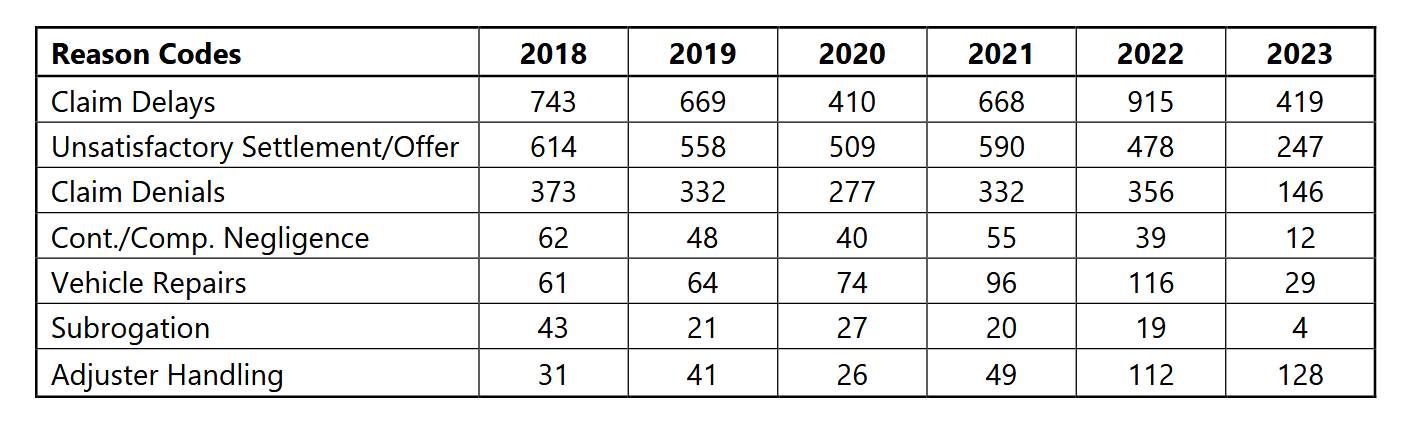

The OIC has reported a historic volume of complaints since 2021 according to its latest historic trends report.

The OIC’s Consumer Advocacy Program received 467 complaints in April 2023, up from the historic average of 287 a month, which was a 63% increase.

Collision repair trade groups, insurer-member associations, appraisers, consumer advocates, and consumers testified during the workshop.

OIC said the documents filed as part of the workshop record and testimonies during the workshop will “help the OIC determine how to move forward in addressing the rising number of auto and homeowners insurance claim issues.”

No questions were answered by OIC or questions asked of those that testified. The OIC also made no comments in response to the testimonies and consumer issues that were brought up.

Kreidler started off the workshop by saying that he believes the insurance industry is always appropriately looking for ways to improve claims process efficiency and accuracy.

“When the process works, most consumers are made whole,” he said. “I believe we have some serious issues right now. We’ve seen a 63% jump in complaints about claims issues, on average… I know supply chain issues have caused some repair delays but I’m especially concerned with the increase in consumers with complaints about the claims experience that do not involve supply chain problems.

“Some of the most concerning issues we’re hearing involve the issue of the use of photo that can produce very little repair estimates. Actual human adjusters are not inspecting the damage and insurers are not thoroughly explaining why they disagree with a consumer’s repair estimates.”

OIC said it asked multiple insurance company vendors that develop and use photo software and artificial intelligence (AI) to create repair estimates to participate in the workshop. None of them responded to the request.

Society of Collision Repair Specialists (SCRS) Executive Director Aaron Schulenburg testified that the issues discussed by the Washington OIC not only impact collision repair shops in the state but nationwide.

“Consumers’ peace of mind through the promise of indemnification benefit when consumers choose not to have a vehicle repaired, when the consumer otherwise becomes responsible for costs that should have been covered under a loss, and when consumer protection mechanisms are either weak or absent providing very little recourse for those that the policies were supposed to protect.”

With the SCRS board seated around him, which includes collision repair shop owners and managers, Schulenburg added, “There is not a business here who isn’t routinely asked to perform repairs in a manner that conflict with their professional expertise and commitment to the vehicle owner. There also isn’t a business sitting around me today who hasn’t had consumers address these shortcomings through policy protections, such as the appraisal clause.”

An appraisal clause can be included in insurance policies so policyholders can seek out an independent appraisal when they don’t agree with what the carrier offers, whether on total loss or repairable vehicles. Both parties hire an independent appraiser and if the appraisers can’t agree, an umpire is selected to make the final, binding decision.

Appraisal clauses aren’t required in Washington policies.

John Walker Jr., COO of MAS Solutions, an independent adjuster company, said the underlying issue of claims disputes comes down to consumers, public adjusters, carriers, and carrier adjusters not being educated about insurance policies and claims processes. They know very little about appraisal cost that’s built into policies, he said.

“I’d be curious to see if the complaints came before or after they use this appraisal procedure that is built into their policy,” Walker said, referring to the appraisal clause. “They knew this policy, they knew that there would be disputes and there, there should be a simple way to resolve it. That’s where I would advocate for education to help the consumers but also the appraisers and umpires that are participating in the process.”

That education should be offered through training by the state’s OIC, he added, “so that we can all speak the same language” and “play by the same rules.”

Testimonies given showed that playing fair also comes down to fair payment, including carriers paying shops adequate labor rates.

Erica Eversman, National Association of Insurance Commissioners (NAIC) consumer liaison and Automotive Education & Policy Institute founder, testified that the labor rate surveys carriers use to determine how much they’ll pay for labor by geographic area aren’t accurate.

First, she said, survey respondents aren’t limited to independent repair shops. Direct repair program (DRP) shops also agree to take the surveys. DRPs agree to abide by specific activities and limitations that carriers set.

“The surveys are routinely cited or talked about but understand that there are very few insurers who actually engage in a survey of body shops to determine what the true market rates are for repair services,” Eversman said. “Insurers are inherently unreliable. Insurers do not necessarily always allow all of the body shops to participate [in the surveys].

“There is also activity that insurers have engaged in to hide the true amount that they pay for labor rates and for procedures. This has occurred by providing lump sum amounts in a line item rather than actually increasing the labor rate field when there has been some concession by the insurer to truly increase that rate, or by including a particular repair procedure on their own estimates.”

Eversman added that she recommends shops document all of the repair procedures they do on each vehicle whether they charge for it or not just in case liability is ever questioned in any future collisions or problems with the cars.

“There’s an overall failure by auto insurers to provide adequate explanations to insureds and to third parties about what it is that they’re paying for, what they’re not paying for, and how they justify refusing to pay for any particular procedure or increasing the labor rate,” she said.

When speaking on the inaccuracy of the surveys, she quoted Judge James G. Bertoli who ruled on two Sonoma City, California companion cases regarding labor rates (Wilkins v. Delross and Mason v. Ellis) in 2009.

“I strongly question the intellectual honesty of the labor market survey that’s done by the insurance companies and their methodology,” Bertoli said.

Since State Farm was a party to the case part of what he said was aimed directly at that particular carrier: “If State Farm chose to determine their price by reading chicken entrails and – consulting with the three witches from McBeth (sic), that’s fine. I think that’s just about as accurate as the survey itself is. I think that survey from a statistical standpoint would get a first-year college student a flunking grade.”

Three insurance carrier associations — the Northwest Insurance Council (NWIC), American Property Casualty Insurance Association (APCIA), and National Association of Mutual Insurance Companies (NAMIC) — said they disagree with OIC’s trends report from the methodology to the results and the office’s reaction.

NAMIC Regional Vice President Christian Rataj said that while the association agrees with the OIC that an increasing number of complaints is an important issue, he called the conclusions made in the office’s report “misplaced, methodologically unfounded, and unsubstantiated by the data sets,” noting that it was based on a limited data set comparison.

“The number of insurance claims filed should naturally lead to an increase in consumer complaints,” he said. “Why hasn’t the OIC evaluated the historic percentage of consumer complaints submitted as compared to insurance claims filed? We are talking about a very small historic trend change; a fractional percentage point change for consumer complaints.”

Population growth of 1 million during the data set timeframe also contributed to an increase in complaints and a shortage of resources, he added.

“One would naturally and reasonably expect that as the population increases and resources, especially auto body repair shops, are now challenged that this number would increase,” Rataj said.

NWIC President Kenton Brine said “nearly all of the time” the council’s insurance company members in Washington are acting responsibly in the claims process. The number of complaints filed in Washington is typically less than 1% per year, he said.

“Regardless of having a low percentage of claims that result in complaints to the OIC and having an overall claim satisfaction score of 871 out of 1,000 from auto insurance consumers as measured by J.D. Power & Associates in 2022, insurers are keenly aware that those numbers mean nothing to an insured claimant whose auto repair is taking longer than they expected or who has not had a timely response to their email or a call from their claims adjuster as such,” Brine said. “The OIC’s report is concerning to companies that strive to provide good service to their policyholders.”

The number of claims is rising dramatically for many insurers, particularly auto insurance claims, with one company reporting a 44% increase in claims involving serious injuries between 2020 and 2022, he added. And, during the same timeframe, the average number of labor hours in auto repair increased by nearly 4%, according to Brine.

APCIA Vice President Mark Sektnan noted in his testimony that supply chain issues and worker shortages caused by the COVID-19 pandemic have led to longer auto repair times.

“Insurers do not benefit from delays in getting their customers’ cars repaired,” he said. “It is in the best interest of the insurance company to ensure that their customers receive a quality repair as promptly as possible. The fact is a consumer may only use that repair facility or home repair contractor once but they’ll be reminded of that experience every time they pay their insurance premium.”

In Washington, APCIA member insurers are “seeing claims against repair shops for negligence with supply chain issues often present preventing case resolution,” Sektnan said.

Mike Harber, a former shop owner and current Harber Appraisal president, said insurance industry representatives deny there are problems in claims processing is nothing new — he’s been hearing the same comments from the industry for the last 10-15 years.

“I can tell you that the number of people that we’re working with, it just seems to be increasing all the time so there is a problem and I think we should just try to keep it simple,” he said. “If an insurance company decides that they don’t want to handle the claim or settle with a body shop, they’re abandoning vehicles. The investigation of claims is just really taken a back seat to really trying to take care of the insured or the claimants.

“When we’re talking about the sophistication in these vehicles nowadays it is a matter of life and death, not only for the person driving that vehicle, that’s been improperly repaired but for the other people that are driving that have to watch that vehicle coming towards it.”

Photo estimating

As part of a survey by the Washington Independent Collision Repairer’s Association, 30 independent repair shop respondents said they see nearly 1,300 photo estimates every month and they’re only accurate 2% of the time. Eighty percent of respondents said the photo estimates they receive are never accurate.

The association presented the results of the survey during the Washington OIC workshop.

Small damages have the highest percentage of accuracy at 28% followed by moderate damages at 18.5%, and major damages at 14%, according to the survey. And every month, on average, 319 customers drive vehicles in for repairs that shops deem unsafe to operate. “Unsafe” in this context means damage to the vehicle structure, frame, wheels, suspension, and/or collision energy management system and/or air bag or seat belt pre-tensioner deployment.

Respondents said 93.4% of claims on vehicles at their shops are settled solely based on carrier review of photos. More than 63% of shops said they are routinely told by insurers that they can’t see in the photos the damage that’s listed on repair invoices. And around the same percentage of shops said insurers regularly deny their repair plans.

NWIC didn’t deny the accuracy of photo estimates.

“Many insurers have turned to the use of estimating apps that allow the claimant to take and submit photos of auto damage and file their claims online but as noted in the OIC report, estimating apps are new and may have limited ability to accurately estimate needed pairs because the photos submitted by claimants may not reveal the full extent of damage,” Brine said.

In contrast, APCIA’s Sektnan said “an estimate is just that — an estimate of the cost of repair based on what the estimator can see at the time of the inspection.”

“There seems to be heightened scrutiny of virtual estimating tools and other forms of technology that are used to speed up the inspection process,” he said. “Some blame the increase in use of these tools for the increase in supplements… No estimator, whether the inspection is done using video or photos, or in person, is going to be able to detect hidden damage that can only be found when the vehicle is disassembled or torn down prior to repair.

“One member company said that the percentage of partial loss claims payment captured on an original estimate was about 75% three years ago. But now, that number is closer to 60. This is not due to increased use of photo estimates. Rather, it is driven by an increase in the complexity of vehicle repairs.”

Consumers, including shop owners, that spoke during public comment about their dealings with auto insurers told OIC they think individual appraisals should be looked at to better gauge how insurance appraisers are undervaluing damaged vehicles and repair costs; the office is ignoring bad faith actions by insurers and not carrying out its enforcement rights under state law, and that carriers should be investigated for the “mind-boggling things they’ve done” in handling claims and moving through litigated claims.

Written public comments will be accepted by OIC online until Aug. 15.

Images

Featured image credit: rarrarorro/iStock