S&P: In-vehicle subscription trial offers hook consumers, nearly third not aware of features

By onTechnology

Results of a March survey by S&P Global Mobility, released last week, show that nearly 8,000 global motorists found that once consumers subscribe to in-vehicle subscriptions, they’re hooked.

General Motors and BMW have recently sparked controversy by announcing efforts to grow subscription-based products and services in future vehicles, and negative backlash from consumers grappled social media and news reports but not as badly as some perceived, according to S&P.

In GM’s case, they touted the benefits of their new infotainment system, to be found in its next generation of electric vehicles (EVs). The tradeoff? Eliminating Apple CarPlay and Android Auto user interfaces — both offered standard on nearly every new vehicle on the market, S&P said.

“Consumers are welcoming to the idea of subscriptions because it gives them exposure to features or technology that they may not have had in the past,” said Yanina Mills, senior technical research analyst at S&P Global Mobility.

Fanni Li, connected car services research lead at S&P Global Mobility, added, “GM cannot get consumers’ usage data from the infotainment system if users only connect via third-party apps like Apple CarPlay and Android Auto. Having this data on their own will become one of the competitive advantages for OEMs.”

In a subset of about 4,500 respondents who had experienced a free trial or an existing subscription on a model year 2016 vehicle or newer, 82% said they would definitely or probably consider purchasing subscription-based services on a future new vehicle purchase.

Chris Ripley, a partner with IBM company, Dialexa, told Repairer Driven News in May that for OEMs to catch the attention, and the revenue, from customers the connected services have to stand out.

According to Ripley, “bad bets” on vehicle subscriptions include:

-

- BMW’s rollback in 2019 of its $80 per year Apple CarPlay subscription;

- BMW’s rollback in 2022 of its $18 per month subscription for heated seats;

- GM’s rollback of its $1,500 per three-year OnStar subscription as a standard item; and

- As of May, only two automotive manufacturers in the U.S. promote an all-inclusive car subscription platform: Care by Volvo and Porsche Drive

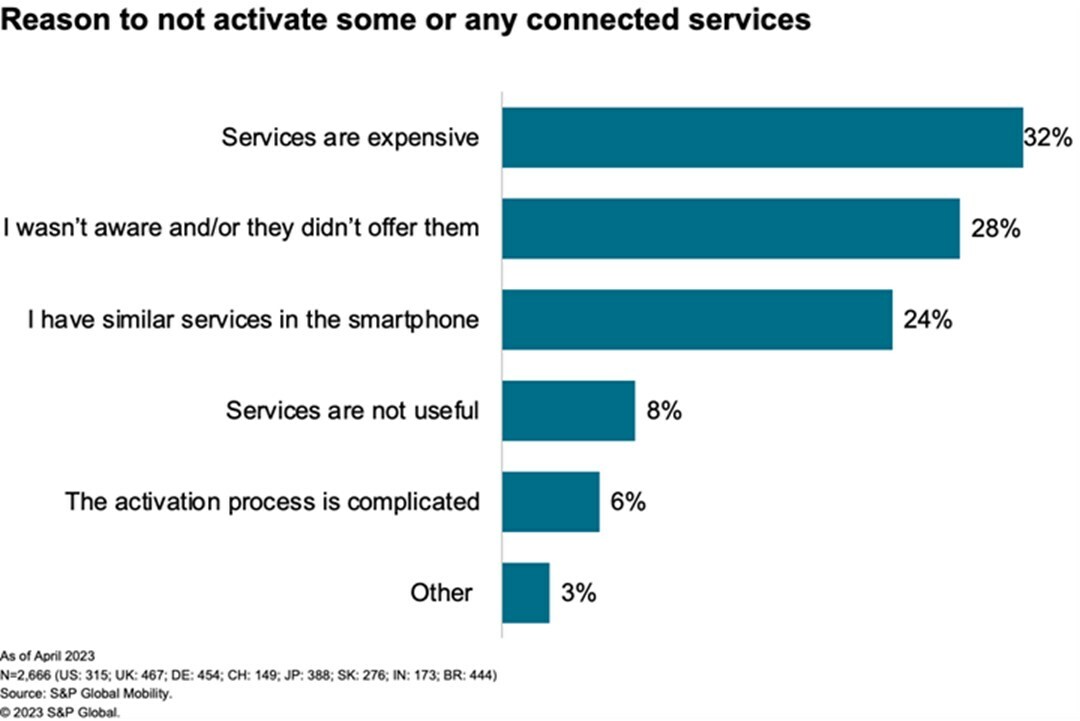

Based on its survey, S&P notes that 28% of respondents said they didn’t know that connected services were available when they bought their vehicle, or that the dealer didn’t offer them as add-ons.

“Improving education at point-of-sale is essential for category growth,” S&P said. “In-vehicle exposure is even better than education for growing demand and fostering satisfaction and retention with these services and brands. Forty-five percent of respondents had the service activated at the dealership, typically as part of a free trial period.”

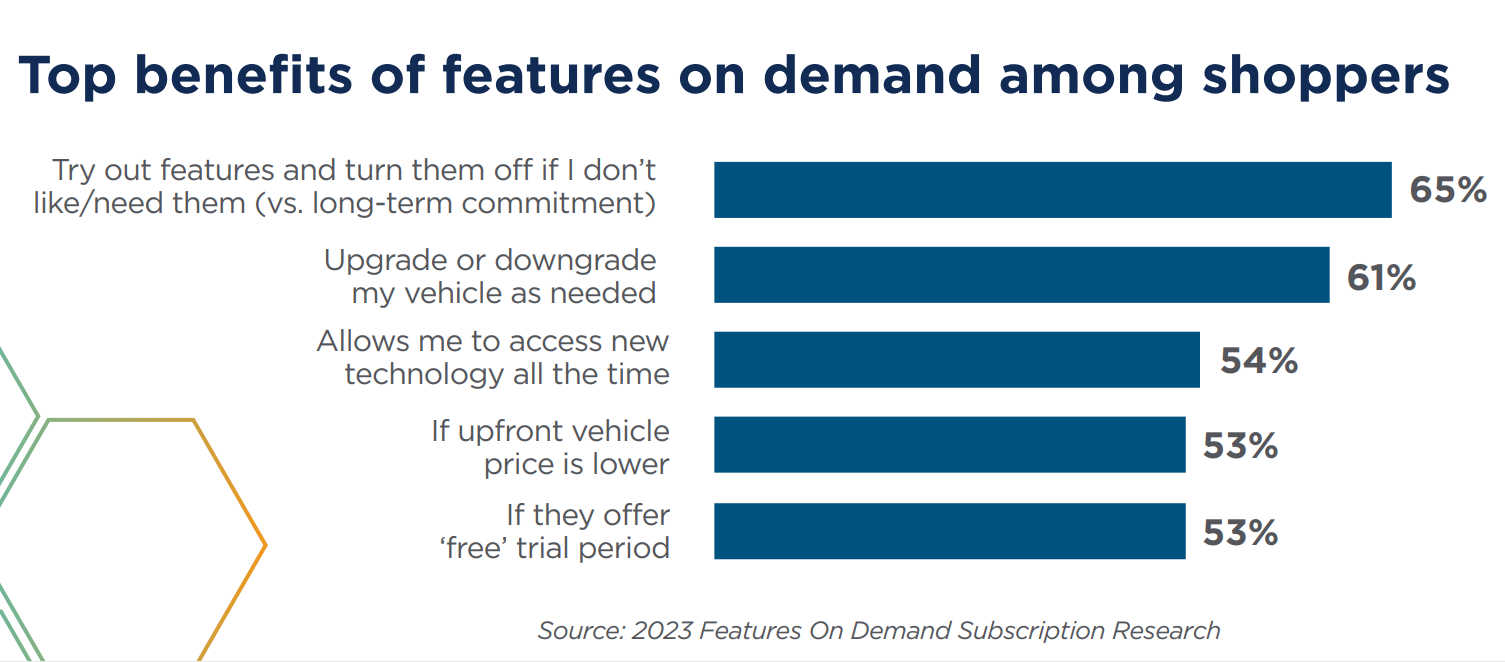

Cox Automotive and Dialexa research, released in May, also found that consumer awareness is low. It found that only 21% of in-market shoppers were familiar with the concept. However, 41% said they are interested in Features on Demand (FoD) — another term for in-vehicle subscriptions. The majority said they see some benefit in the features, especially the opportunity to try out the tech and upgrade their vehicles without a long-term commitment.

Satisfaction is high as well. Eighty-five percent of respondents said they’d recommend the service they used to a friend. Among individual brands, Audi Connect and BMW ConnectedDrive consistently perform well, scoring high in most global markets for the third survey year in a row, S&P reports.

“Marketing is everything,” Mills said. “Implementation is everything.”

Paid functional upgrades have been available in the market for only about three years. Even so, more than half of respondents said they want such an upgrade in their next vehicles, S&P’s survey found.

Enhanced navigation and advanced driver assistance system (ADAS) functionality top the list.

“For a lot of those features, when you buy them in full at the dealership, the initial investment is overwhelming,” Mills said.

Paid upgrade safety features, such as high-beam assist and driving video recorder, earned the highest satisfaction (89%) of all connected services. Likewise, navigation and safety/security features were the most desired in respondents’ next vehicles, S&P found.

Less expensive comfort features, such as heated seats and heated steering wheels, prove less popular for subscriptions. S&P says the less expensive options are perceived to be of lesser value as a subscription, especially because they’ve long been standard on upper trim models.

“When everything becomes a subscription, it becomes overkill,” Mills said.

S&P surmises that BMW may have crossed that line with its expansion of subscription-based connected services to include heated seats that were already installed in its cars.

Fewer than 30% of survey respondents are willing to pay for heated seats or a heated steering wheel by monthly subscription, according to S&P.

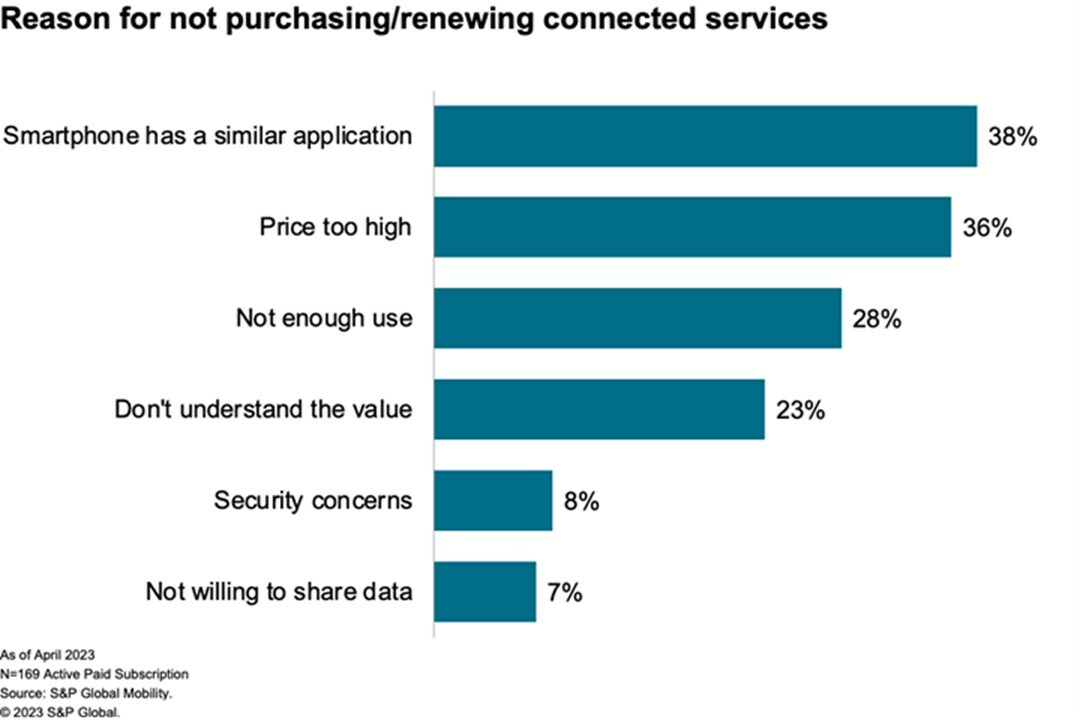

“The frequency of usage is an important factor,” Mills said. “If you have a feature that you only use once or twice, you’re not going to renew that feature.”

As consumers pare down their subscriptions, features that are redundant between vehicles and phones likely are the first to go with phones almost always take precedence. S&P Mobility found that Gen Z and Millennial respondents are most likely to drop connected services subscriptions because of similar services on their phones.

S&P concludes that the best way to win over consumers is to give them something for free. Seventy-four percent of respondents are willing to share data in exchange for free services, with Gen Z and Millennials being the most (80%) likely.

“It’s a delicate balance for automakers,” Mills said of vehicle data usage.

While accessing consumer data also improves features like EV-specific routing and range estimates, consumers are concerned about data privacy. Thirty-seven of respondents said they worry about security issues while 32% said they don’t understand the value that a connected service would provide from the shared data.

OEMs are the most trusted, with 31% of respondents feeling comfortable sharing data with them. As for the companies, 23% said they would trust them with their data.

S&P notes that the difference in trust likely stems from how much data is available to each entity, with automakers not having access to as much.

“That amount of data is limited,” Mills said. “It doesn’t go to the depth of where your personal devices go.”

Images

Featured image credit: Capuski/iStock

“Top benefits of features on demand among shoppers” graph provided by Cox Automotive