Repair shops say they’re being sent to collections for total loss, rental car fees

By onBusiness Practices | Collision Repair | Insurance

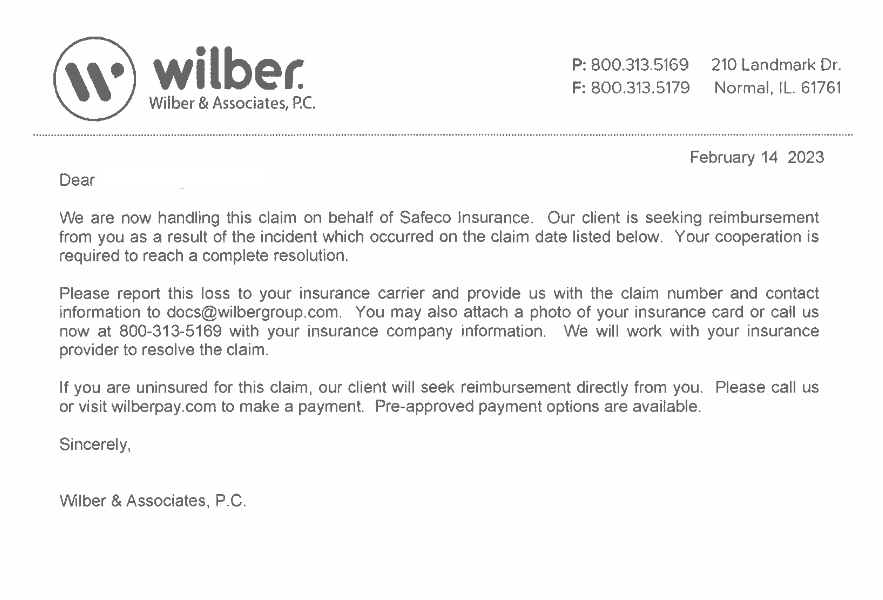

A number of repair shops have come forward with accounts of how insurance companies are using a collections agency to “intimidate” them into paying for things like rental car fees and total loss charges.

Repairer Driven News spoke to three shops who received collection notices from Wilber Group, a third-party claims administration company, that were sent on behalf of Liberty Mutual or an affiliate company. A fourth repair shop is facing a similar situation with a separate insurer and collections agency.

Liberty Mutual declined to participate in an interview, telling RDN it “does not publicly comment on our business dealings with vendors.”  Sean Gillette, director of collision repair operations at Rickenbaugh Cadillac Company in Colorado, said his shop has on multiple occasions received collection notices for total loss charges after the claim was thought to be settled.

Sean Gillette, director of collision repair operations at Rickenbaugh Cadillac Company in Colorado, said his shop has on multiple occasions received collection notices for total loss charges after the claim was thought to be settled.

“Total loss charges are explained, agreed to, paid, and the vehicle is picked up,” Gillette told RDN. “It’s generally two to four weeks later that we get the letter from the collection agency claiming we have been ‘sent to collections’ for the charges.”

All the notices sent to the shop were related to Liberty Mutual/Safeco claims, Gillette said, adding the collection notices came from Wilber.

Gillette said he’s grateful for insurers’ place in the industry and strives to work with them to ensure charges are fair for everyone. However, he added that there are issues that must be addressed about how insurance giants are working with repair shops.

“The biggest players on the insurance side have been extremely resistant in acknowledging OEM repair practices preventing the industry from moving forward in a more positive direction for the primary stakeholder — the owner of the vehicle, and that of their safety,” he said.

After receiving the most recent collection notice, Gillette said he called Wilber and through questioning determined their claim against him was not legitimate. He said he then threw the letter away.

“Until the laws are followed, I have little capacity for what amounts to extortion,” he said. “I know all of my state laws and the steps that have to be taken before a collection process can legitimately proceed.”

Gillette encouraged other shops that receive such letters to be familiar with their state and local laws, charge accurately for their work, make sure labor rates are visible, and check their charges.

“Doing so leaves you on solid ground in the event of a legitimate court proceeding,” he said.

“As always, activities like this target the most at risk, those that are hanging on by a thread and may not fully understand their state and local laws and why this may be happening,” Gillette added. “They may be sufficiently scared enough to pay based on the wording and scare tactics employed by the collection agency.”

Ben Bowman of Keeler Motor Car Company in New York recounted a similar situation where, after a vehicle was declared a total loss, he received a collection notice from Wilber, on behalf of Safeco, asking him to return about $4,000 he had been paid for things like storage and blueprint fees.

In this case, Bowman said that although it was clear that the vehicle would be deemed a total loss, it took Safeco two months to settle the matter.

“The entire time, I made them aware that there are resource charges,” he said. “A few months later we got this letter that we owe some of the money back.”

When Bowman called Wilber to inquire, he said he was told the notice was sent because Safeco claimed it was “under duress” when it paid his shop’s fees. Since he recorded his conversations with insurers, he replayed them to see whether there were any signs of discord during the calls.

“It wasn’t at all combative,” he said. “We were obviously firm. When they were asking for discounts, we said, ‘Unfortunately, we can’t do that.’ There was no indication this would get escalated in any way or forwarded on.”

Bowman said he informed Wilber that his shop’s charges were fair and that they weren’t going to settle the collection notice, and added he’s now waiting to see whether he hears anything else from the agency.

Separately, Barsotti’s Body and Fender Service in San Rafael, California said it received a collection notice this month for a vehicle that is still undergoing repair at the shop.

Amber Alley, shop manager, said the shop received the letter from Afni Collections regarding a claim Barsotti’s is handling with San Francisco-based startup Metromile Insurance.

She said the shop had been working to verify repair procedures on a Toyota and later determined the job was three times the size initially estimated, prompting them to suggest deeming the vehicle a total loss.

“They refused to acknowledge that,” Alley told RDN. “The outside adjuster or appraiser agreed with us and forwarded all the supporting documentation to them. It took months for them to review; they just kept coming back, saying they needed more information. In the end, they decided the car was still repairable.”

At that point, she said Barsotti’s went ahead and ordered parts and also received the collection notice seeking reimbursement for the vehicle owner’s rental coverage.

“I have not received anything like that before,” Alley said. “I had my file handler call to figure out what it was. He was told that it was for renting a car [because] the insurance had decided that we were at fault for that portion of the rental bill. He told them that was laughable and so far, that is the last we’ve heard from them.”

Metromile did not respond to a RDN query sent to its parent company, Lemonade.

On another occasion, the owner of a New York collision shop, who asked not to be identified out of concern for repercussions, said he received a collection notice, again sent from Wilber on behalf of Liberty Mutual, after working on a Model S that was declared a total loss after he wrote a $60,000 repair plan.

In that case, the owner said he initially received a call from the vehicle’s owner after the Tesla was taken away by Copart. The customer told him that his settlement had been reduced because the shop had not returned the Tesla’s parts to Copart.

“I got a call from my customer saying, ‘Hey, Liberty Mutual has decreased my settlement by the amount of your charges at the collision center that they deemed were unnecessary, including the charges for the parts because they said you still have them.’”

The shop owner then used the vehicle’s VIN to look it up and found it listed at an auction with the alleged missing parts. He shared photos from the auction listing with the car owner to prove he sent the car away with the parts, he said.

“We provided all of this information to the customer and he quickly came back around to our side,” he said. “After [we refused to] return any of the money to Liberty Mutual, they turned us into collections.”

He said the matter appears to have been dropped after several emails were exchanged, including some his attorneys were copied on.

He advised other shops facing similar situations to become familiar with their rights.

“Just make sure you understand the local state laws of where your place of business is,” he said. “People can send you a collection letter but that doesn’t necessarily mean anything until they file a claim with the court and you’re served.”

Images

Main image: iStock/BrianAJackson

Wilber letters courtesy of RDN sources