Allstate reports $14B in earnings, says auto premiums will continue rising

By onInsurance

Allstate said it remains focused on improving profitability and will continue raising auto premiums as it reported nearly $14 billion in earnings during its Q2 earnings call.

The earnings represent a 14% year-over-year jump from Q2 2022, although net losses also increased, reaching $1.4 billion compared to $1 billion during the same timeframe last year.

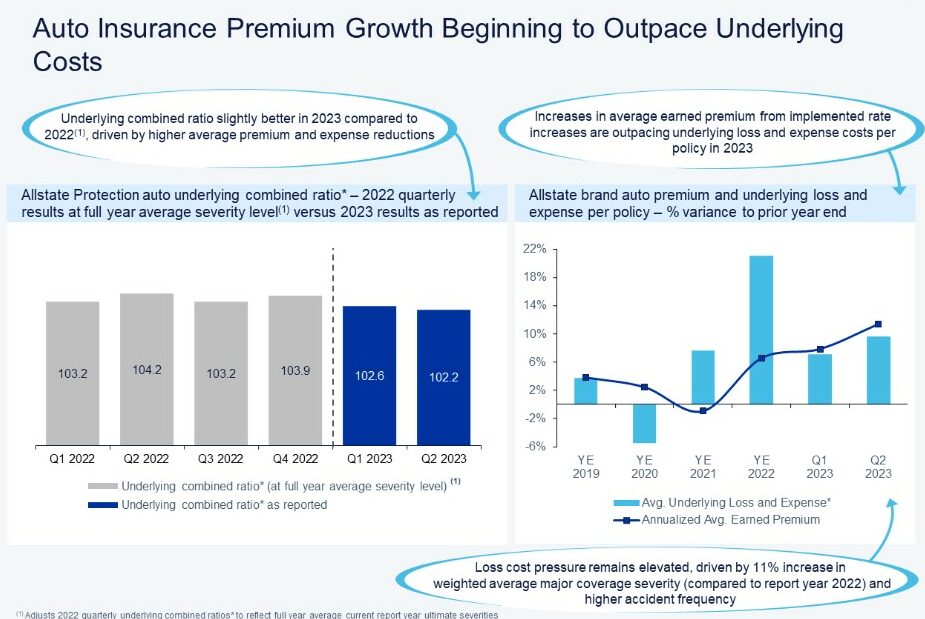

Separately, its executives said Wednesday during a Q2 conference call that it will continue to implement auto rate increases throughout the year to improve profitability, and that premium growth is beginning to outpace underlying costs.

Allstate implemented auto rate increases at 34 locations during Q2 averaging 10%. Nationwide, its premiums have increased by 7.5% during the first six months of 2023. That’s on top of the 16.9% increase the insurer implemented last year.

The company added that its National General Insurance arm implemented increases in 27 locations during Q2 averaging about 14% resulting in a total premium increase of 3.6% during the timeframe and up 5.5% so far this year.

Mario Rizzo, Allstate’s president of property-liability, noted that Q2’s auto insurance combined ratio of 108.3 was 0.4 points higher year-over-year, reflecting higher catastrophe losses coupled with increased accident frequency and severity.

He said those losses were largely offset by higher premium expense reduction and lower adverse non-catastrophe, prior year reserve reestimates.

“We continue to raise rates, reduce expenses, restrict growth and enhance claim processes as part of our comprehensive plan to improve auto insurance margins,” Rizzo told investors.

He went on to share an update on the execution of Allstate’s “comprehensive approach to increase returns in auto insurance.”

This includes four focus areas: raising rates, reducing expenses, implementing underwriting actions and enhancing claims practices, Rizzo said.

“Reducing operating expenses is core to transformative growth, and we’ve also temporarily reduced advertising to reflect a lower appetite for new business,” he said. “We continue to have more restrictive underwriting actions on new business in locations and risk segments where we have not yet achieved adequate prices for the risks, but are beginning to selectively remove these restrictions in states and segments that are achieving target margins.”

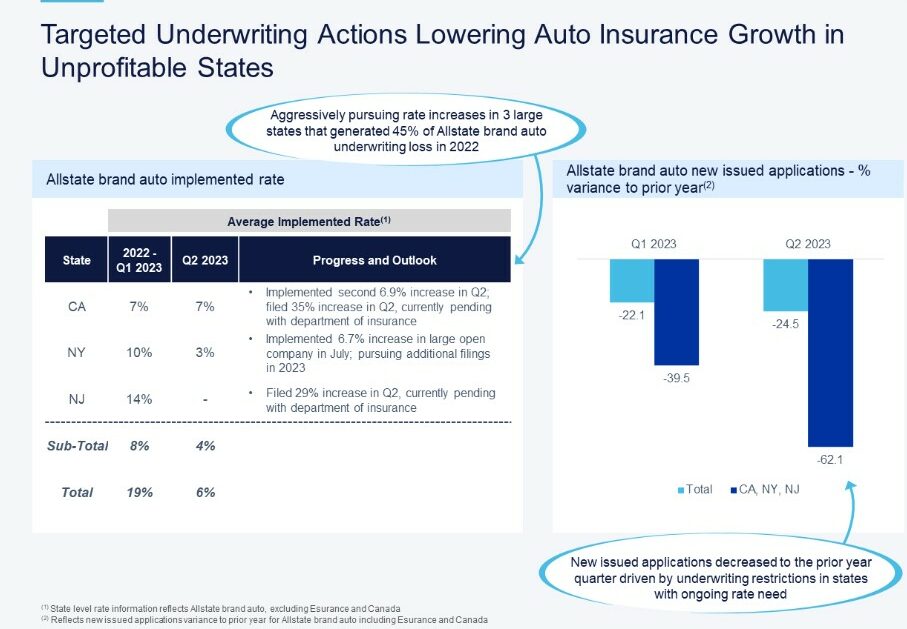

Rizzo then pointed to three states with a “disproportionate impact on profitability” where it was prompted to seek additional rate increases during Q2.

-

- In California, Allstate implemented a second 7% rate increase, on top of the 7% in case made during Q1. It has since filed a request to increase its rates by an additional 35%, and that ask is now being reviewed by state regulators.

- In New York, which saw a 10% increase in Q1 followed by a 3% increase during Q2, Allstate is “pursuing additional filings” this year.

- In New Jersey, Allstate filed a 29% increase during Q2, which is pending review. It raised rates in the state by 14% during Q1.

Rizzo also touched on how Allstate is committed to “delivering customer value, particularly in this high inflation environment,” in part by modifying claims processes as well as physical damage and injury damages.

“[We’ll do so] by doing things like increasing resources, expanding reinspections and accelerating the settlement of injury claims to mitigate the risk of continued loss development,” he said. “We’re also negotiating improved vendor service and parts agreements to offset some of the inflation associated with repairing vehicles.”

During the question segment of the earnings call, Gregory Peters, managing director of insurance at Raymond James, asked how many more rate adjustments would be needed to bring Allstate’s combined ratio figure down to the desired level.

Allstate’s CEO Tom Wilson said it’s hard to predict what’s going to happen during the second half of the year, especially since it’s not known whether claims severity will rise.

The insurer revealed ahead of the call that it implemented 11.6% rate increases across 12 locations in June to help offset more than $1 billion in catastrophe losses during the same month. While reporting single-month losses of $1.01 billion, or $799 million after tax, it attributed the majority of its misfortunes to wind and hail events but said its bottom line was bolstered by “favorable reserve reestimates for prior events.”

Allstate previously said it sustained another $885 million in catastrophe losses in May, representing nearly $700 million after tax and that it implemented auto rate increases that month averaging 9.3% across 15 locations.

Meanwhile, a new mid-report from Insurify indicated that, overall, personal auto insurance prices have increased an average of 17% in the U.S within the past six months. The report projects another 4% increase before 2023’s close. Overall, Insurance Thought Leadership (ITL) says the auto insurance industry is in a state of “existential crisis.”

Images

Featured images: iStock/JHVEPhoto

Secondary images courtesy of Allstate