Allstate agrees to $90M settlement with shareholders over fraud allegations

By onInsurance | Legal

Pending approval from an Illinois District Court, a $90 million settlement has been reached between Allstate and a class of shareholders that allegedly lost money because of the company’s concealed lax underwriting practices, primarily in auto insurance.

The consolidated class action lawsuit was filed in March 2017 and brought on behalf of all purchasers of common stock between Oct. 29, 2014 and Aug. 3, 2015 and suffered damages, according to the complaint. The plaintiffs are Carpenters Pension Trust Fund for Northern California, Carpenters Annuity Trust Fund for Northern California, and named the City of Providence on behalf of themselves and all other members of the Class.

CEO Tom Wilson and Matthew E. Winter, former personal lines president, are also named as defendants.

Plaintiffs argue that Allstate violated the anti-fraud and defrauding portions of the Securities and Exchange Act of 1934 by making material

misstatements and omissions about the cause behind a large spike in auto claims frequency.

“Confidential witnesses confirm that starting in 2013, the Company greatly reduced its underwriting standards to make it far easier for agents to write new business,” the complaint states. “Another confidential witness confirms that the Company paid independent agents to roll over customers from competitor policies to Allstate policies, effectively ignoring the risk profile of the insured driver.

“According to this confidential witness, Allstate was ‘looking to build up their volume rather than look at the risk implications of the drivers that they were taking on.'”

As a result, the plaintiffs contend that the frequency of claims paid by Allstate increased significantly during Q3 2014 and continued until Q3 2015 “by which time the Company had reversed course and instituted stricter underwriting standards.”

“For example, during an earnings call on October 30, 2014… in response to an analyst’s question concerning claims frequency, Defendant Winter misleadingly responded, ‘Our frequency so far has been extremely favorable to prior year’ and ‘frequency trends have been good’ without disclosing that Allstate management had already identified a significant spike in claims frequency proximately caused by its reduced underwriting guidelines.”

According to the earnings call transcript Winter went on to say, “It is within our historical ranges. It is broad geographically, so our frequency trends have been good. We stay on top of them, as Tom says.”

Investor Relations Vice President Pat Macellaro (at that time) said, “The Allstate brand auto underlying margin trends… show that earned premium continued to increase in the quarter, up 1.7% from the prior-year quarter,” according to the transcript. “Premium increases have been approved in 35 states so far in 2014, reflecting an organizational focus on maintaining margins by making frequent adjustments based on actual results.

“The underlying losses and expenses per policy increased slightly in the third quarter by 0.1% compared with the third quarter of 2013. This resulted from a lower frequency of claims and expected increase in severity of losses along with the benefit from a lower expense ratio.”

Allstate’s motion to dismiss for failure to state a claim was denied. The company denies “all allegations of wrongdoing or liability and deny that Class Members were damaged, the sole reason for entering into the Settlement is to eliminate the burden and expense of continued litigation,” according to the proposed settlement notice.

“Securities ‘fraud’ is a claim of deceit that amounts to an accusation that a defendant lied or at least exhibited such reckless disregard for the truth that his conduct amounted to deception,” Allstate’s memorandum in support of the motion to dismiss states. “Nothing in plaintiffs’ amended complaint bears even a passing resemblance to such conduct.”

“Plaintiffs contend that defendants must have known that the increase in claims frequency resulted from Allstate’s earlier, well-publicized decision to grow its auto insurance business, announced in early 2013, instead of external factors such as the improving economy – even though claims frequency declined for the six quarters after the early 2013 announcement.”

Plaintiffs note in their complaint that, in November 2014, CEO Tom Wilson sold $33 million worth of his Allstate stock, more than 85% of his shares, while the stock was trading at artificially inflated prices near all-time highs, according to the complaint.

It wasn’t until Aug. 3, 2015 that Allstate told investors that the purportedly temporary increase in claims frequency persisted for a third consecutive quarter and that “the increase was proximately caused by the Company’s aggressive growth, which was based on Defendants greatly reducing its underwriting standards,” the complaint states.

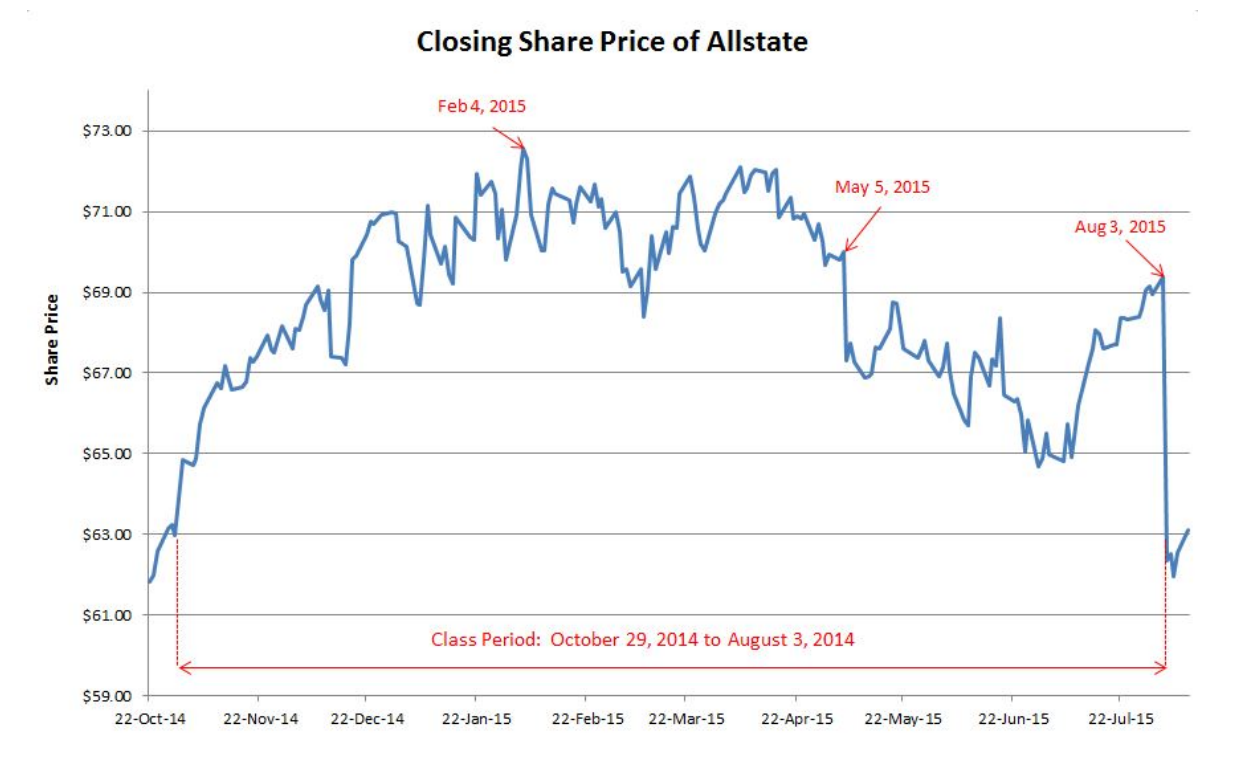

“In response, Allstate’s stock price plummeted more than 10% in a single day. The below chart shows the relevant declines in Allstate’s stock price, which erased billions of dollars in market capitalization.”

Source: Chart from Case No. 1:16-cv-10510 complaint against Allstate. Editor’s note: the class period date range is incorrectly stated. It ends on Aug. 3, 2015.

The settlement notice, filed in court on Aug. 14, states that each class member will receive an estimated the class will receive 46 cents per damaged share. A settlement hearing has been proposed to the court to be held in November.

Images

Featured image: March 20, 2022 — Allstate office building in Irving, Texas. (Credit: JHVEPhoto/iStock)

More information

Allstate reports $14B in earnings, says auto premiums will continue rising