Fraudulent auto insurance claims highlight need for in-person inspections

By onInsurance

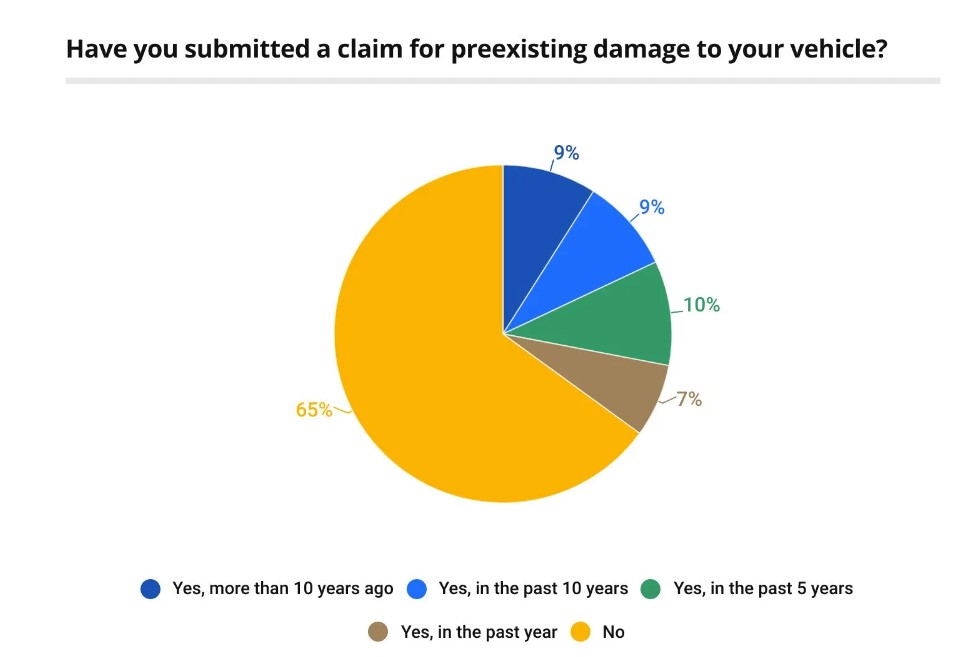

A newly released survey is shedding light on insurance fraud, reporting that 35% of auto policyholders have submitted claims for preexisting damage.

ValuePenguin’s survey of nearly 1,950 consumers found 60% of Millennials have filed insurance reports for preexisting damage to their vehicles; 27% of Generation Xers and 14% of baby boomers have done the same.

Divya Sangameshwar, a ValuePenguin insurance expert, said such fraudulent claims speak to the importance of insurers conducting thorough, in-person vehicle inspections.

“In addition to giving insurers a complete picture of the status of the vehicle, regular in-person inspections can also prevent claims padding, or omissions on insurance applications,” Sangameshwar told Repairer Driven News. “Insurers can also use in-person inspectors to communicate the importance of being truthful on insurance applications, and the consequences for lying — especially to their younger policyholders.”

Repairers have previously spoken of the need for conducting in-person inspections rather than making photo-based estimates. They’ve said that damage detectable by in-person appraisers can be overlooked in photos.

Another solution to combat fraud, Sangameshwar said, is for consumers to ensure they’re working with reputable and Automated Service Excellence (ASE)-certified repair shops to avoid being misled or scammed.

“Though the majority of collision repair shops operate by the book and utilize honorable business practices, there are a few shops that exploit and manipulate unsuspecting customers and defraud insurers,” Sangameshwar said. “In many cases, policyholders are lulled into thinking it’s not their problem – when in fact they too will face significant repair bills if their claim is identified as fraudulent and denied.”

Overall, the ValuePenguin survey found that 21% of auto policyholders have misled their insurers to save money.

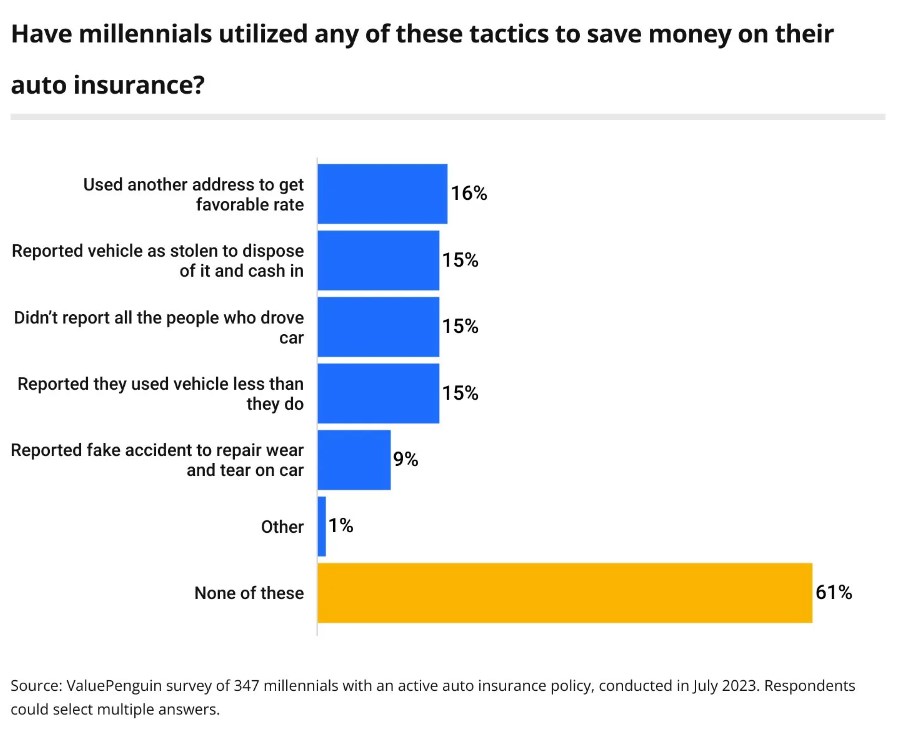

Younger Americans were more likely to be dishonest with auto insurers, with 39% of Millennials admitting to using “deceptive tactics” to save money, ValuePenguin said. Among the Generation X demographic, 16% admitted to stretching the truth; just 3% of baby boomers said they shared false information.

Lies among Millennials ranged from giving the wrong home address to reporting a car stolen so they could cash in on a vehicle that was no longer wanted. Others failed to list all of the car’s drivers, while others claimed to use the car less than they actually did.

About 15% of Millennials reported a fake accident to have wear and tear on their vehicles repaired at their insurer’s expense, the survey found.

Among young drivers, such falsehoods could come down to a lack of awareness, Sangameshwar said.

“Younger people are less likely to understand what insurance fraud is and the consequences of it,” she said. “As they get older and hear about their peers facing consequences for misleading their insurers, their tolerance for insurance fraud will decrease.”

Across all auto policyholders, ValuePenguin said that:

-

- “9% have used another address to get a better rate;

- “8% didn’t report all the people who drive their car;

- “8% have reported their vehicle as stolen to dispose of it and cash in;

- “8% have reported they use their vehicle less than they do;” and

- “4% have reported a fake accident to repair wear and tear on their car.”

ValuePenguin noted that 79% of survey respondents said they haven’t told any of the lies above to save money. However, the data it collected appears to conflict with that figure.

Some people might not realize they’re committing fraud by sharing inaccurate information with their insurers, ValuePenguin said, adding that just 9% of auto policyholders admitted to committing insurance fraud.

Among the Generation Z crowd, 26% said they didn’t consider insurance fraud a crime. It seemed Baby Boomers were more in tune with reality, as just 6% didn’t realize lying to their insurer was illegal.

Whether they know it or not, being dishonest about policies and making false claims can have consequences.

The study found that 58% of Americans believe fraud makes it more difficult to apply for insurance policies, while 27% said it could lead to less market competition. Conversely, 25% of those from Generation Z said they didn’t believe insurance fraud impacted them.

Sangameshwar said those who believe insurance fraud leads to less competition are correct.

“Insurance fraud leads to higher costs for insurers, which they pass on to consumers in the form of higher premiums,” she said. “It can also lead to a scenario where insurers may decide to stop underwriting policies altogether in an area where they feel there’s a high incidence of fraud, leading to less competition and higher rates for consumers.”

A separate ValuePenguin analysis found that omitting a driver on an insurance policy costs insurers $10.3 billion annually while underestimating the number of miles driven costs $5.4 billion annually. Lying about an address causes insurers to lose nearly $3 billion each year, it said.

Among those surveyed for its latest analysis. 51% said they believe those who commit insurance fraud receive fines. On top of that:

-

- 45% said they would lose coverage;

- 43% said it would lead to felony charges;

- 40% said fraudsters would be jailed;

- 32% said premiums would rise;

- 28% said lying would lead to a misdemeanor charge; and

- 25% said inaccurate insurance submissions would lead to premium penalties.

Sangameshwar said any of the above consequences are possible.

“Insurance fraud is a form of stealing, and it’s illegal in every state,” she says. “Most insurance fraud is categorized as hard or soft fraud. Hard fraud occurs when a person purposely destroys property in an attempt to collect on the insurance policy, and it often involves very large sums of money. This is a very serious crime that leads to felony charges, hefty fines, and even jail time.”

Images

Main image: asbe/iStock

Secondary graphics courtesy of ValuePenguin