As IRA deadline approaches, SCRS invites businesses to consider its multiple employer plan

By onAnnouncements

The Society of Collision Repair Specialists (SCRS) is reminding businesses that a deadline is approaching for those that offer a certain type of Individual Retirement Account (IRA) plan.

Businesses who provide a Savings Incentive Match Plan for Employees (SIMPLE) IRA, a calendar-year retirement savings plan, are required to notify their workers each year by Oct. 31 if they intend to offer the plan. It cannot be changed mid-year.

With the deadline approaching, SCRS said this is a good opportunity for businesses to consider the SCRS Multiple Employer Plan (MEP) prior to making their 2024 elections. The plans offer benefits that a SIMPLE IRA does not, such as:

-

- The ability for employees to make Roth 401K contributions;

- Increased savings limits for both business owners and employees;

- A wide range of employer match options, including the ability to add a vesting schedule; and

- Automatic enrollment for employees, which provides owners with a $500 tax credit.

SCRS’ MEP was launched on April 1, 2019, to “help participating businesses and employees save expenses relevant to their 401k balances, reduce administrative responsibilities for companies, and provide fiduciary support.”

It also gives businesses the ability to customize their own plan features, offers administrative support to help businesses with the transition, and requires one audit for the entire plan saving companies that do their own audits both money and time.

Visit www.scrs.com/401k to contact the advisory team and fill out a basic request for more information.

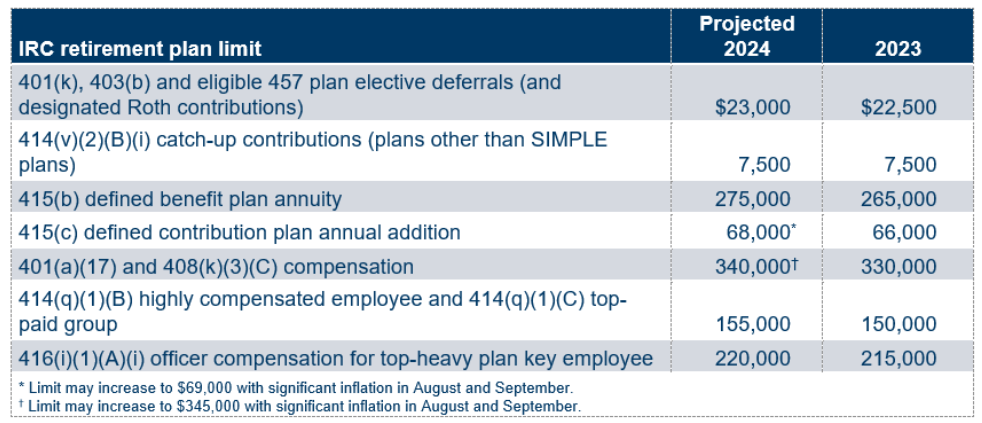

Meanwhile, a recent report from financial services company, Mercer, said that nearly every key Internal Revenue Code (IRC) limit for qualified retirement plans will rise from this year to next.

“The 2024 limits will reflect increases in the Consumer Price Index for All Urban Consumers (CPI-U) from the third quarter of 2022 to the third quarter of 2023,” Mercer’s report said. “Only the catch-up contribution limit, which has a relatively large rounding value, is expected to stay the same next year.”

It added that its estimates are based on the tax code’s cost-of-living adjustment and rounding methods, from CPI-U through July and estimated CPI-U values for August and September.

Official figures aren’t finalized until September CPI-U values are published in December, with the IRS normally announcing official limits for the coming year by early November.

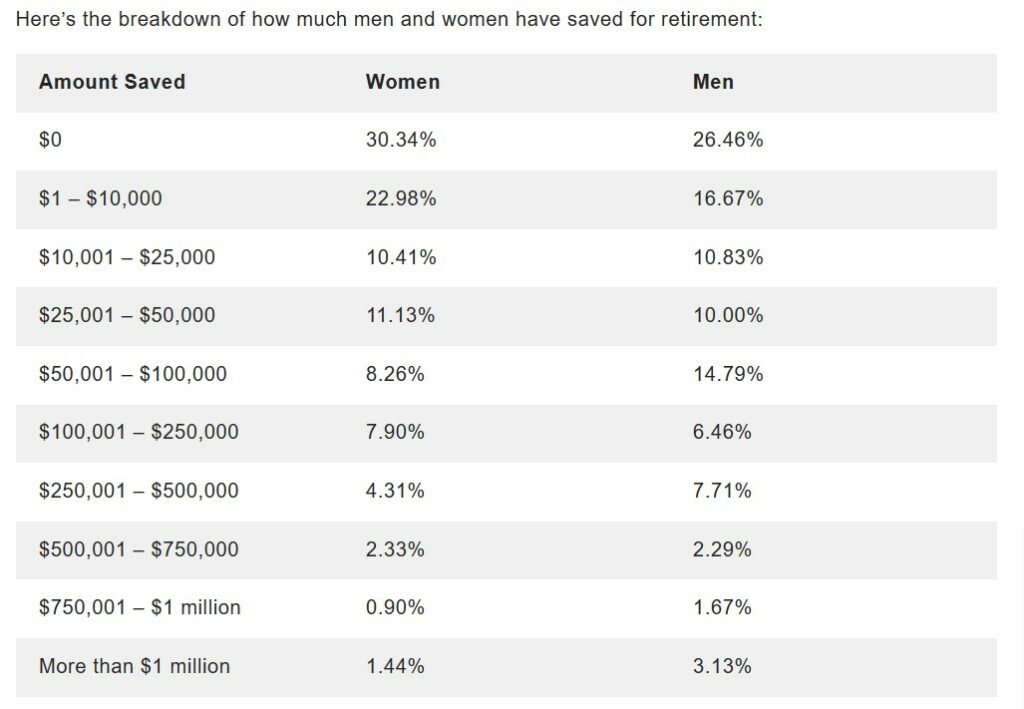

Separately, a newly released survey by personal finance site, GOBankingRates, found that 30% of women and 26% of men have not saved anything for retirement. It also found that less than 20% of women were financially confident about their retirement prospects, compared to 28% of men who felt the same way.

The survey found that, on average, 36% of Americans aren’t confident that they’ll be able to retire comfortably.

“Retirement savings is important but more and more people don’t have enough,” GOBankingRates said. “With the rise in inflation and life just getting more expensive every year, confidence in retirement happening at all is wavering. Overall, women are worse off financially than men and have less confidence that they will be prepared for retirement.”

Those interested in learning more about the SCRS plan who are also planning to attend SEMA can drop by the SCRS booth during the show to speak with Scott Broaddus, an Irongate Capital Advisors partners. Those who aren’t attending the show can reach out to Broaddus via email, at Scott.Broaddus@Irongate-Capital.com.

Images

Featured image courtesy of c-George/iStock

Secondary images courtesy of Mercer, GOBankingRates